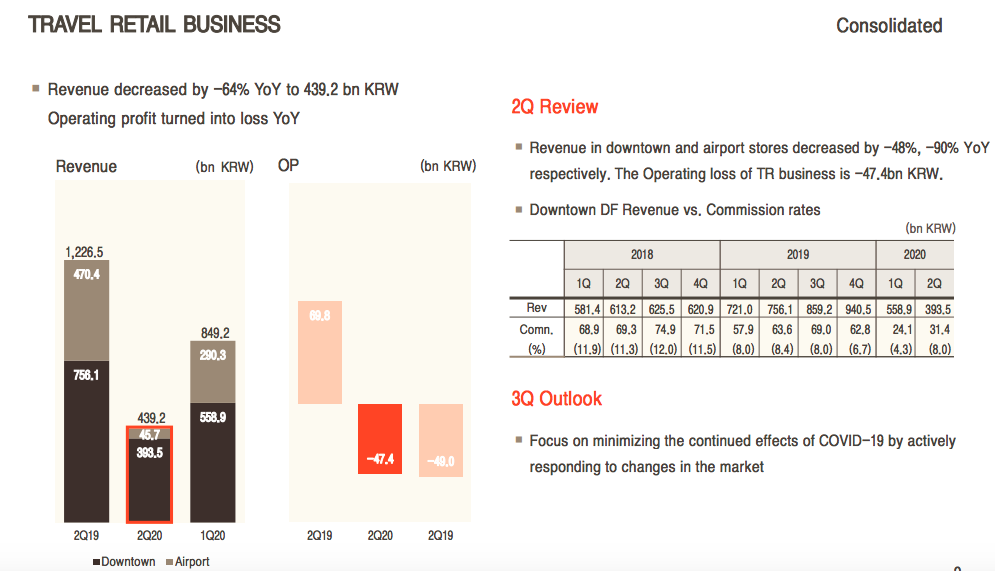

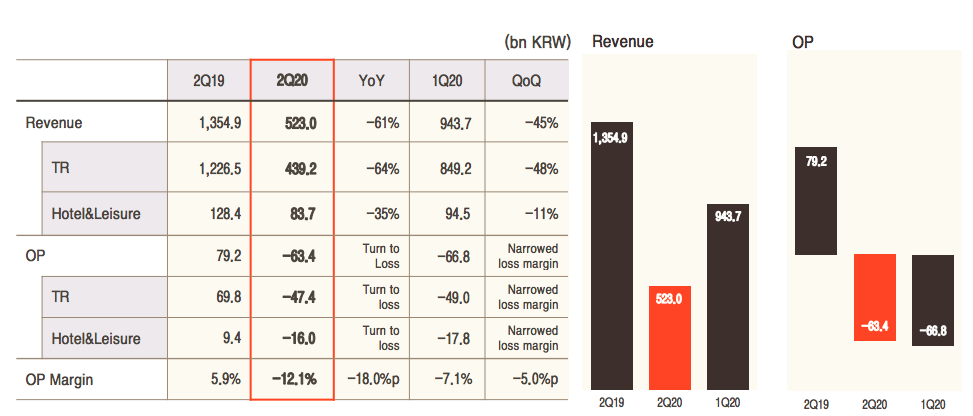

SOUTH KOREA. Hotel Shilla today reported second-quarter results, with consolidated revenue from its travel retail division falling by -64% year-on-year to KRW439.2 billion (US$368 million). Operating profit of KRW69.8 billion (US$58.5 million) in Q2 2019 turned to a loss of KRW47.4 billion (US$39.7 million) for the division in the period.

Revenue from The Shilla Duty Free’s downtown and airport stores fell by -48% and -90%, respectively. The airport figure mirrors the decline in passenger traffic. In downtown duty free, most of the business continues to be from large corporate daigou traders, but sales to such large reseller groups are much less profitable than to other customer sectors.

The company said it would “focus on minimising the continued effects of COVID-19 by actively responding to changes in the market” in Q3.

The Q2 figures track the downturn that began in Q1. Hotel Shilla posted its first quarterly loss in 20 years in the period from January to March, as group sales fell below the KRW1 trillion mark for the first time since breaking that threshold in Q1 2018. The travel retail business reported an operating loss for the first time since Q1 2000, as reported.

Like other Korean travel retailers, Shilla last month began selling off unused duty free inventory within alternative Korean channels as part of its crisis response. As reported, Korea Customs Service (KCS) announced on 29 April that it accepted the local duty free industry’s request to offload unsold stock (after paying import taxes) through a range of channels.

The Q2 performance underlines how hard the company has been hit by the COVID-19 crisis. Even during the height of the China-Korea political crisis over South Korea’s deployment of the anti-missile system THAAD in 2017, Hotel Shilla surprised by reporting positive profits.

In April, Hotel Shilla CEO Lee Boo-jin said that the company was “faced with great uncertainty from the beginning of the year – our main business travel retail is fighting desperately to survive”.