SOUTH KOREA. Hotel Shilla, parent company of The Shilla Duty Free, has turned in an outstanding second quarter financial performance.

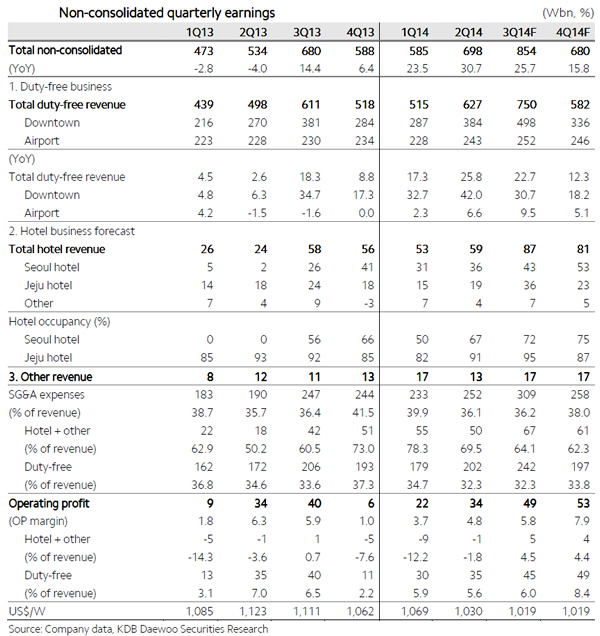

In its results, announced Friday, the Korean hotelier-to-retailer outperformed market consensus; driving a strong improvement in gross margin; and, critically, seeing its airport shops resume growth with sales up +6.6%.

Overall revenue and duty free shop revenue both hit record highs, while operating profit beat the consensus (KW25.9 billion) by +29.2%.

Non-consolidated duty free revenue (that earned inside of Korea) increased by +25.8% year-on-year and +21.8% quarter-on-quarter to KW626.9 billion (US$610.8 million), helped primarily by the continuing surge in Chinese inbound travellers and spending.

Seoul-based KDB Daewoo Securities Equity Analyst (Textile & Apparel, Hotel & Leisure) Regina Hahm told The Moodie Report: “If such gross margin improvement and better hotel/airport performance continue, we might see the best profitability level in many years in 2H14, especially from the duty free business, as the long-awaited operating leverage effect at Incheon Airport could become fully effective.”

Hotel Shilla posted preliminary revenue of KW698.4 billion (US$681.3 million, up +30.7% year-on-year) and operating profit of KW33.5 billion (US$32.7 million, down by -0.6% with an operating profit margin of 4.8%), respectively.

|

In a note, Hahm said: “We view the latest 2Q14 results as a genuine earnings surprise. The Seoul hotel’s occupancy rate picked up faster than expected (67% in 2Q from 50% in 1Q), and underlying margins improved thanks to higher cost efficiency at the duty free shop business.”

|

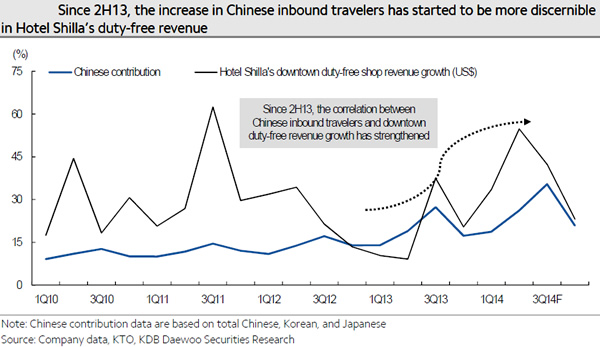

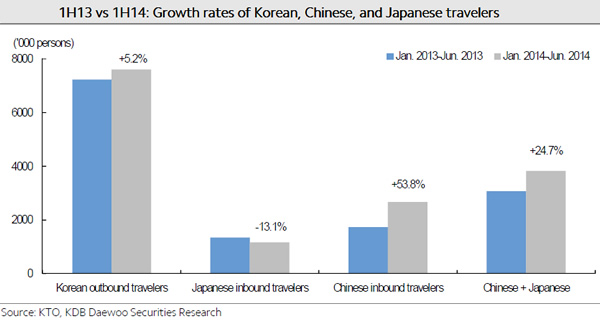

Hahm commented: “It should be noted that the Korean duty free market growth was very weak until 1H13 since the previous year’s base was very small for Chinese travellers while the relative contribution from Japanese was higher. The growth gradually resumed from 3Q13 led by the downtown shops but the overall level of growth was relatively weak throughout 2013.

“2014 will be the first of many years to come that we could see the Chinese contribution to the duty free business become fully effective.”

|

These just-published tourism arrivals figures for the first six months of 2014 emphasise the key dynamic underpinning South Korea’s travel retail market; Source: Korea Tourism Organization |

|

|

THREE POSITIVE EXPECTATIONS REALISED

KDB Daewoo Securities’ report said that the results had confirmed three positive expectations.

Firstly, The Shilla Duty Free had resumed growth at Incheon International Airport after six quarters of sluggishness. In 2013, the Incheon operation posted its weakest growth ever, mainly due to its heavy reliance on Japanese and Korean travellers.

|

(Above and below) These pictures, taken on Saturday, illustrate the strong business that The Shilla Duty Free is capturing at Incheon International Airport’s Airstar Avenue retail zone |

|

|

|

Louis Vuitton’s first airport store, opened in association with The Shilla Duty Free in 2011, has proven a particular lure for Chinese shoppers |

In 2Q14, airport shop revenue grew +6.6%, better than KDB Daewoo’s projection (+5.4%), driven by a larger contribution from Chinese travellers [the Chinese have traditionally had a bigger impact on downtown duty free sales than at the airport -Ed]. “The resumed growth of airport shop revenue should strengthen the operating leverage effect we expect to see in 2H,” noted Hahm.

|

The Shilla Duty Free was the world’s eighth leading travel retailer (duty free and duty paid) by turnover in 2013 according to The Moodie Report’s just-published ranking of the world’s top 25 travel retailers |

“Second, the high growth of Chinese travellers is beginning to fully contribute to downtown duty free shop revenue.

|

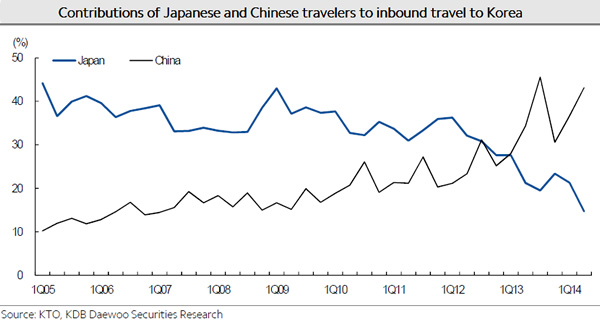

“In 1H13, Japanese travellers still accounted for a high proportion of overall inbound tourists (24% vs. 31% for Chinese).

“As a result, the sharp decline in Japanese travellers at the time largely offset the positive impact from the fast growth of Chinese travellers.

“However, in 1H14, the proportion of Chinese travellers expanded to 40% (vs. 18% for Japanese), allowing the sharp growth of the Chinese to be highlighted in earnings.

“Downtown duty free shop revenue jumped +42% year-on-year in 2Q and is expected to rise +30.7% year-on-year, despite a relatively high base of comparison.”

Thirdly, Hahm said, earnings at Shilla’s flagship hotel in Seoul was “getting back on track”. Most luxury hotels in Seoul have countered the plunge in Japanese travellers with aggressive price discounts whereas Hotel Shilla has responded to market changes more proactively since 2Q14 and is now seeing the effects of its efforts.

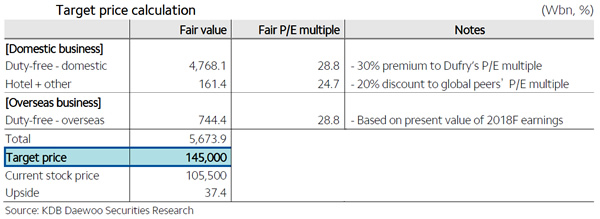

KDB Daewoo Securities maintain its ‘Buy’ on Hotel Shilla stock and raised its target price by +5.8% to KW145,000 (mid-afternoon Seoul time the stock was up +3.79% to KW109,500.00)

|

KDB Daewoo Securities sees plenty of upside in Hotel Shilla stock |

|

If current favourable trends continue, Hotel Shilla is set for a banner year |

|

(Above and below) These charts from KDB Daewoo Securities capture the dramatic contrast in fortunes between the Japanese and Chinese inbound travel markets to South Korea since 2005 and over the past year |

|