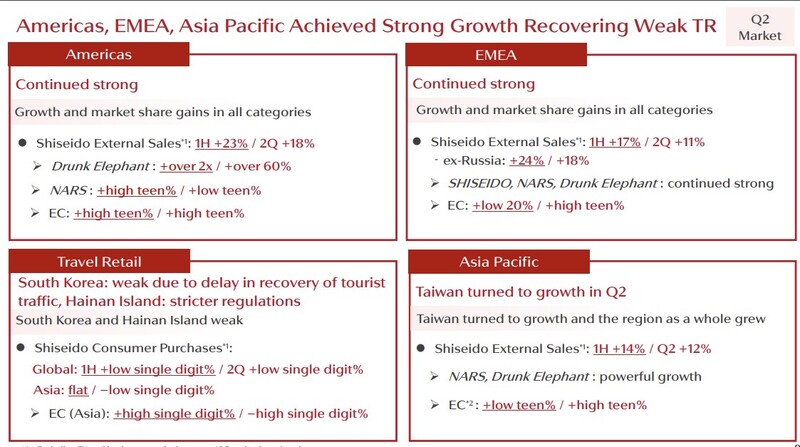

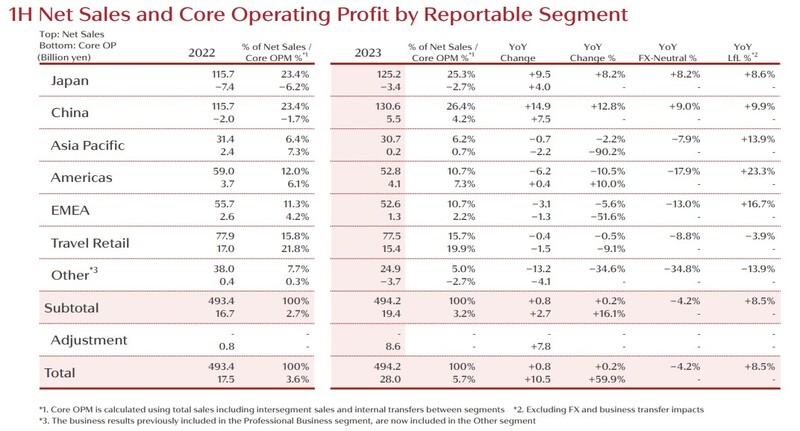

Japanese beauty house Shiseido posted a -3.9% decline in travel retail sales (like-for-like) to ¥77.5 billion (US$106.3 million) for the first half ended 30 June, with the channel – as with the group’s peers – affected by “retailer inventory adjustments linked to tighter regulations”.

That’s a reference to two key northeast Asian travel retail markets, South Korea – historically the world’s number one sector for the channel – and Hainan, China. Both have been affected by a slump in daigou-related sales driven by Korean Customs Service pressure and the Hainan authorities, respectively (see comment below).

H1 core operating profit from travel retail fell -9.1% year-on-year to ¥15.4 billion (US$106.3 million) due to lower gross profit related to the sales decline. However, at 19.9% travel retail’s core operating margin remained the best among all divisions.

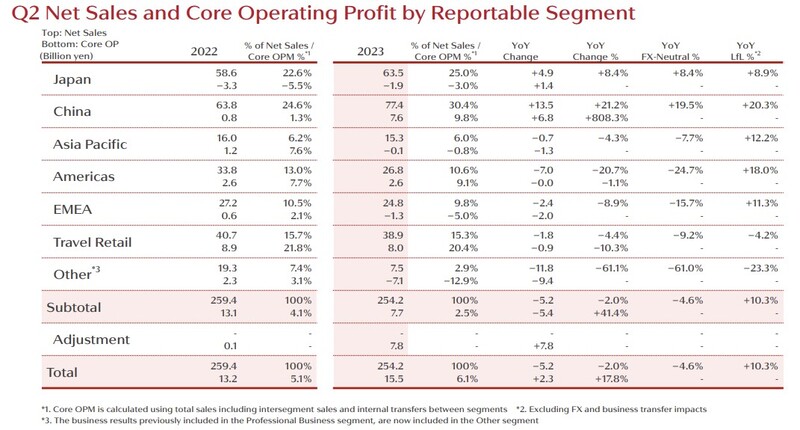

In Q2, travel retail net sales reached ¥38.9 billion (US$268.5 million), down -4.2% like-for-like year-on-year. Core operating profit for the division decreased -10.3% to ¥8.0 billion (US$55.2 million).

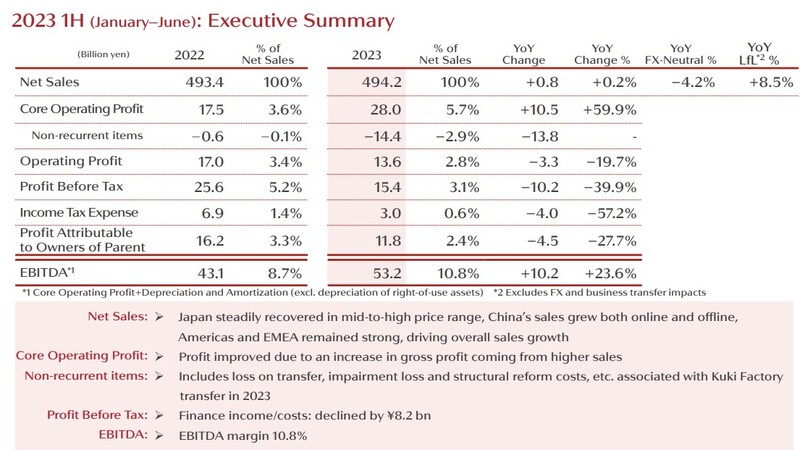

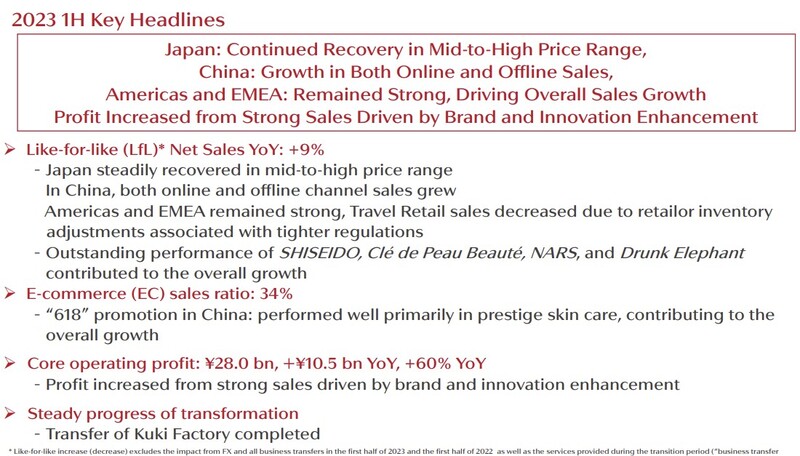

Overall, the group posted an +8.5% like-for-like sales increase year-on-year to ¥494.2 billion (US$3.4 billion) with a steady recovery in the mid-to-high price range in Japan; online and offline growth in the China local market; and continued strength in the Americas and Europe, Middle East & Africa.

Core operating profit groupwide rose +59.9% to ¥28.0 billion (US$193.2 million).

The “outstanding” performance of Shiseido, Clé de Peau Beauté, Nars and Drunk Elephant contributed to the overall growth, the group said.

Shiseido revealed a planned company restructure from January 2024, designed to “break silos to create a simple, flat and agile organisation” and actively promote and develop “next-generation leaders”.

‘Weak’ Korean and Hainan markets hit travel retail

Travel retail sales fell -4% in both Q1 and Q2 (see table) but remained +14% above pre-pandemic H1 2019. The channel accounted for 15.7% of net sales in H1, behind only China (26.4%) and Japan (25.3%).

Shiseido described the South Korean and Hainan markets as “weak” due to the delay in the recovery of tourist traffic in the former and stricter regulations [daigou-related -Ed] in the latter. Outside Asia, the channel delivered low single-digit growth in both H1 and Q2.

During a post-results earnings call, Chief Financial Officer Takayuki Yokota said, “The travel retail business remained sluggish due to the continued adjustment to distribution inventories in response to the return of a traveller-centric business model and the slow recovery of Chinese tourists and South Korea, as well as tightening regulations in Hainan island. We were also affected by these factors resulting in negative growth for the company as a whole.”

He noted that Shiseido and Clé de Peau Beauté grew in all regions except travel retail with Elixir and Anessa also posting declines in the channel. Other brands also saw travel retail sales decreases.

Yokota added, “Global trends in Chinese consumption, particularly in China and travel retail, are changing dynamically, and it is of utmost importance to respond with a sense of speed.”

Responding to a question about travel retail’s performance compared to the original forecast, Yokota said, “Travel Retail was minus -4% in Q1 and minus -4% in Q2… our original assumption was flat and therefore, the majority of this comes from the [longer] delay in recovery of Chinese travellers to South Korea than expected.”

He said stronger restrictions in Hainan meant the offshore duty market had “decelerated”, adding, “Therefore, the downside risks will still remain in regards to these areas. In any case, our first aim was +20% growth in travel retail. So the numbers for travel retail have now become really tough.”

Such pressures are being offset by good business in the Americas and Europe and also China travel retail [i.e. non-Hainan, international departures sales -Ed], Yokota added.

Pushed further about the particular pressures in Hainan and South Korea going forward, he responded: “For South Korea and Hainan island sell-out, Q2 and first half, the gap is about ten points, sell-in and sell-out at the same level behind. So in the second half, for South Korea, we believe it will continue for another two to three months.”

Hainan optimism

Shiseido began to feel the impact of the Hainan changes in June, which resulted in a “high-teen” percentage decline in sell-out. “So there’s been some inventory adjustments. How would that proceed? Will that be over the next three months? Or will it be prolonged a bit longer than that? That’s something that we’re not sure at the moment, but we need to watch cautiously,” Yokota commented.

But he remained upbeat about Hainan’s prospects when asked whether travel retail could return to double-digit growth as previously in the face of such structural restrictions.

Year-to-date, air passenger numbers to the island province are up by around +100% over 2023, Yokota noted. “The high-end retailers are investing significantly, and it is becoming a place for domestic travel for the people. So I believe that in the mid- to longer term, I’m quite optimistic in terms of the business opportunities in Hainan Island.” ✈