Key take-outs as a new ¥100 billion net sales milestone is reached

[1] Excluding Travel Retail Japan [2] Foreign currency exchange rate applicable to income and expense accounting line items in the Company’s financial statement is JPY109.1/US$ for fiscal year 2019 |

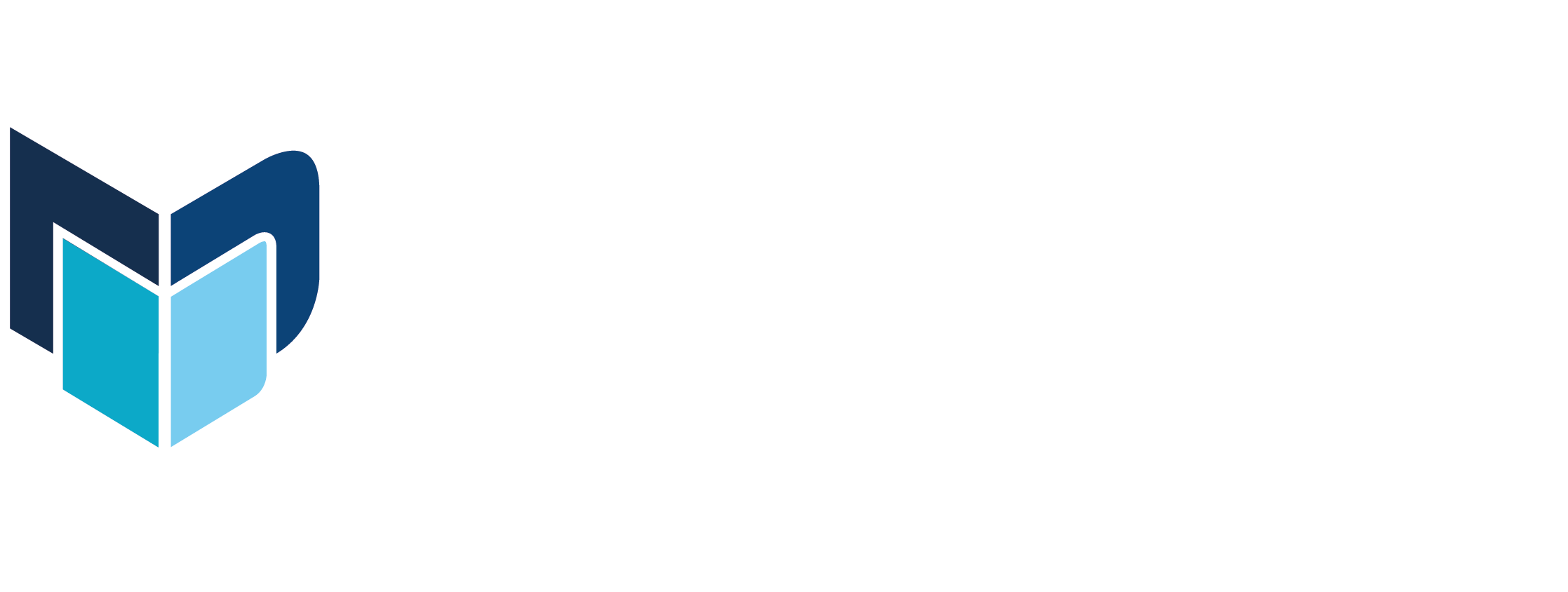

Travel retail was the star performer for Japanese beauty giant Shiseido last year as the division generated like-for-like growth of +19%* in 2019, propelling revenue past the ¥100 billion mark to ¥102.2 billion (US$930.4 million).

Shiseido Travel Retail remains the fastest-growing market within Shiseido Group and now represents 9% of the group’s global business (see table below).

Divisional operating profit increased by +25.5% year-on-year to ¥22.1 billion (US$201.2 million) – bigger than any other segment – boosted mainly by higher margins.

In the 12 months to December, travel retail was the fastest growing of Shiseido’s eight divisions, narrowly ahead of China which grew by +19.0% to ¥216.2 billion (US$1.97 billion).

Boom time for travel retail

Shiseido Travel Retail’s stellar performance in 2019 was helped by strong acceleration in Q4 of +24.5%. According to the company, this outpaced channel growth of almost +20% led by prestige skincare, although “fragrance remains challenging”.

The Asia travel retail market for Shiseido was particularly strong last year at over +35%, and over +45% in Q4.

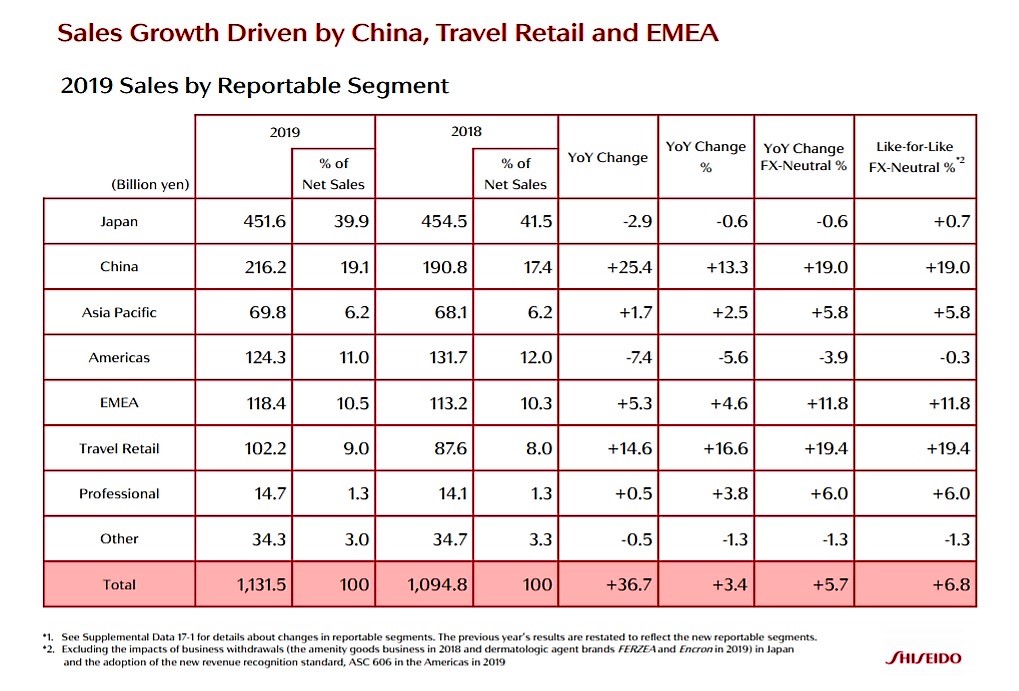

The company also revealed how the accelerating coronavirus outbreak has so far affected certain segments. The Chinese market grew by +47% year-on-year (for the four brands Shiseido, Clé de Peau Beauté, NARS and Elixir) between 1-23 January before seeing a sharp downturn of -55% from 24-30 January as the virus began to take an increased human and market toll.

Japan – Shiseido’s biggest market – had negative growth over the same periods of -3% and -16% respectively. Travel retail in Japan was resilient with year-on-year increases of +25% and +13%, although contraction began in early February (see chart below).

In response to the medical crisis, the company has suspended or postponed marketing activities for the next three months but says it will instead “strengthen marketing activities in the second half”. It is also putting extra emphasis on ecommerce and cross-border sales.

In response to the medical crisis, the company has suspended or postponed marketing activities for the next three months but says it will instead “strengthen marketing activities in the second half”. It is also putting extra emphasis on ecommerce and cross-border sales.

Strong CSR effort to help the battle against coronavirus

The company has also launched its Relay of Love Project to help support efforts to combat the outbreak (separate story to follow soon). Key elements include donating CNY10 million (US$1.43 million) for medical treatment and infection prevention in China and a contribution of 1% of sales (between February and July this year) from Asian markets.

Shiseido Chief Financial Officer Michael Coombs described Shiseido’s 2019 overall results – which included like-for-like, foreign exchange neutral sales growth of +6.8% and operating profit rising by over +5.1% (reported) – as a “resilient performance despite external challenges and increasing uncertainties”.

Travel retail investment pays off

In 2019, Shiseido Travel Retail stepped up promotions and advertising in airports globally. This helped drive continued strong growth for Shiseido, Clé de Peau Beauté, NARS, and Anessa, mainly in South Korea, China, Thailand, and other Asia markets. To accelerate growth, the division expanded the roll-outs of Ipsa and Elixir and strengthened strategic sales counters.

Shiseido Travel Retail President & CEO Philippe Lesné commented: “Through investments in brand exposure and partnerships, we enhanced our competitiveness and cemented our status as a (beauty) category growth engine. 2019 was a landmark year for us, with +19.4% growth in net sales to reach the milestone of ¥102.2 billion.

He added: “The year presented a challenging business environment in the shape of the global economic slowdown, continued market volatility and an increasingly diverse and highly competitive beauty sector. We have found strength and success in working closely with our key partners in travel retail in order to inspire travellers with our products, beauty consultants and experiences. We recognise the particularly strong performance of our brands in China and South Korea, which are not only our largest markets but were also among the fastest-growing last year.”

“As we enter 2020, our thoughts are with those affected by the coronavirus and, as a group, we remain focused on the health and safety of our employees, consumers and partners around the world. We are monitoring the situation very closely.”

Expectations for 2020

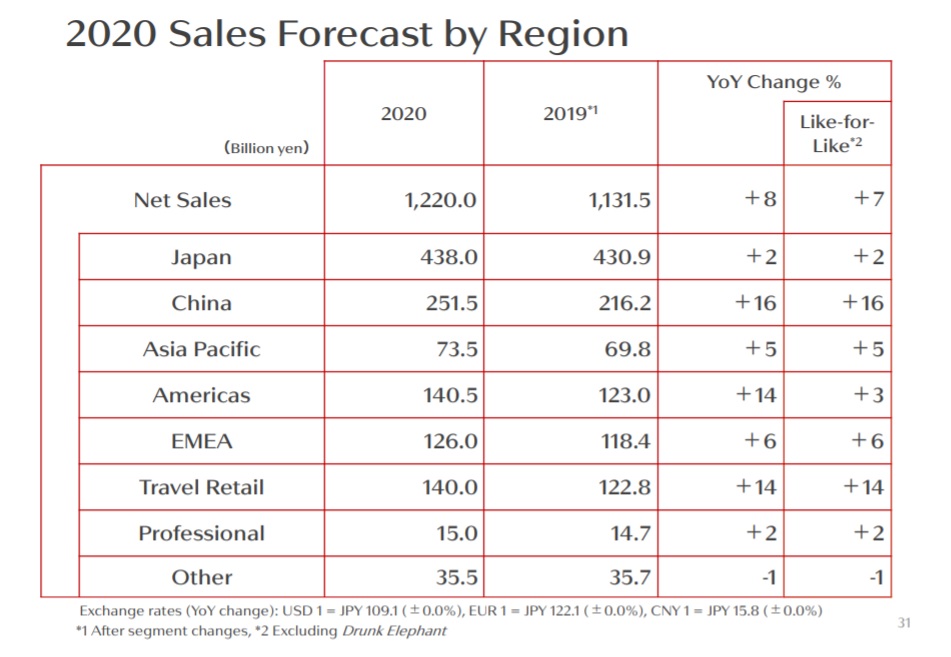

Excluding the unquantifiable impact of the Coronavirus epidemic, Shiseido CEO Masahiko Uotani expects like-for-like growth this year to hit +7% with travel retail forecast to grow at +14%.

Lesné said: “Shiseido Travel Retail retains a strong resolve to continue innovating to meet the evolving needs of travellers, developing even stronger retailer partnerships and pushing the boundaries of consumer experience, digital marketing and product development in beauty and travel retail.”

Overall full-year 2019 company results are shown below. * All percentages in the text above are at constant currency unless stated.

* All percentages in the text above are at constant currency unless stated.