ASIA. Vietnam has become a must-visit destination for many travellers in Asia, with international capacity almost doubling in the past three years, according to analyst OAG.

“An influx of tourists with money in their pockets want to see one of the world’s last few unexplored destinations,” wrote OAG’s Deirdre Fulton. She noted World Tourism Organization figures which show that some 84% of Vietnam’s tourists use air travel to arrive in the country.

International capacity has risen from 24 million seats in 2015 to 42 million in 2018, outpacing the growth rate of neighbouring Thailand, Fulton pointed out.

Additionally, there were more airline seats on international routes than domestic ones for the first time in 2018.

OAG’s statistics show that Vietnam’s tourism sector is booming, as are the number of travellers using its airports. The soaring numbers offer great potential for the travel retail industry.

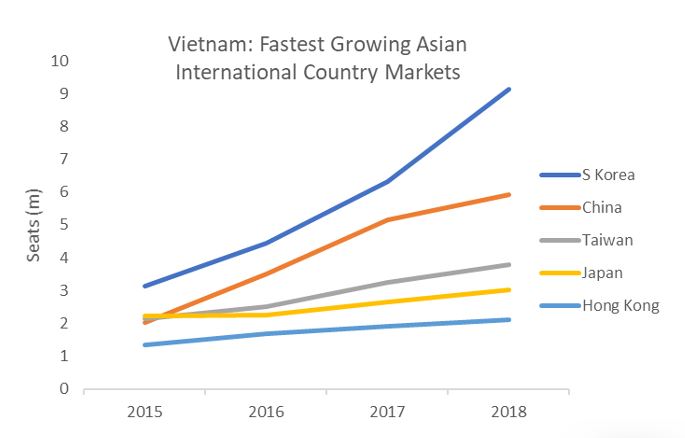

Over 90% of Vietnam’s international capacity currently operates to other destinations in Asia. In 2018, nearly two thirds of seats operated to countries in North East Asia, which are also the fastest growing country markets, Fulton pointed out.

South Korea is by far the biggest inbound market, and the fastest growing, with 110 flights per day between the two countries. Seat capacity was three times bigger in 2018 than it was three years earlier and airlines have grown the number of routes from eight to 19 over the same time period.

Capacity from China has also seen strong growth, with airlines adding 49 new routes in the last three years to reach a total of 93 in 2018. “However, there is a lot of churn in the tail-end of routes with 24 being dropped and 30 being introduced between 2017 and 2018,” wrote Fulton.

“There were 17 airlines that operated routes between China and Vietnam in 2018, of which China Southern and Vietnam Airlines were the largest with almost a third of capacity each,” explained Fulton. “The last few years have seen the share of capacity operated by Chinese carriers increase, and is currently just over 60%, as smaller Chinese airlines enter the market and provide services from a range of Tier 2 cities in China.”

There are also some pockets of high growth in Europe and the Middle East. Capacity from Qatar has almost tripled in size over three years, whilst Russia has seen growth increase substantially between 2017 and 2018.

The UAE has also seen a strong shift in capacity. “Looking behind some of these numbers highlights that these countries are acting as hubs for some key European markets which do not currently have enough direct capacity to service demand for travel to Vietnam,” wrote Fulton.

The scale of the indirect markets indicates there is scope for new direct services, according to Fulton. In the 12 months to September 2018, over 275,000 passengers travelled to Vietnam indirectly from Germany, for example, while 236,000 passengers did so from France.