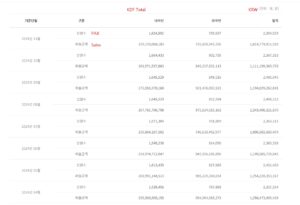

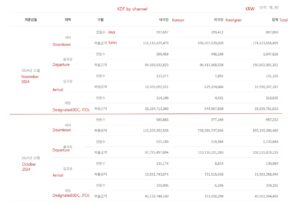

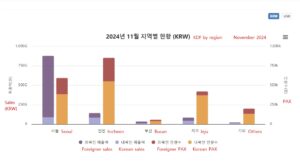

SOUTH KOREA. Total duty-free retail sales (excluding inflight) fell -8.7% month-on-month in November and -12.2% year-on-year to KRW1,014,779,011,519 (US$690.4 million), according to latest Korea Duty Free Association figures.

This was partly driven by a -6.7% decline in customer numbers compared with October to 2,394,529. However, year-on-year customer numbers rose by +12.9%, underlining the current softness of the market in spending terms.

Sales to foreigners (74.5% of the total market) slumped -11.02% over October and -13.1% year-on-year to KRW755,608,943,336 (US$514,100,155) on a -15.8% month-on-month fall in customer numbers to 759,937.

On a year-on-year basis, though, foreigner customer numbers rose +17.6%, indicating how structural changes in the market related to daigou buying have dampened average and overall spend.

Spending by Koreans eased just -1.06% compared with October to KRW259,170,068,183 (US$176.3 million). Year-on-year that tally was up +10.7%. Korean customer numbers slipped -1.9% month-on-month but rose +10.8% year-on-year to 1,634,592.

“Overall foreigner sales kept decreasing due to the sagging demand from China and the changed daigou policy of the retailers,” a senior Korean travel retail executive told The Moodie Davitt Report.

“In December we will see a much greater decline in sales due to the political unrest while the plane crash [of Jeju Air at Muan International Airport on 29 December -Ed] will have an ongoing impact on the number of inbound and outbound travellers. All this is on top of the ongoing adverse market evironment.”

Downtown duty-free sales, historically crucial in terms of the Chinese business, fell +8.9% month-on-month and -9.4% year-on-year to KRW774,123,658,499 (US$526.7 million). Customer numbers at the downtown stores fell -6.3% over October (but rose +32.8% year-on-year) to 897,069.

Downtown duty-free sales, historically crucial in terms of the Chinese business, fell +8.9% month-on-month and -9.4% year-on-year to KRW774,123,658,499 (US$526.7 million). Customer numbers at the downtown stores fell -6.3% over October (but rose +32.8% year-on-year) to 897,069.

Airport departure sales declined -8.5% month-on-month but rose +23.7% year-on-year to KRW190,802,501,351 (US$129.8 million).

Sales to Koreans downtown actually rose +2.57% month-on-month (+24.2% year-on-year) to KRW116,116,629,479 (US$79 million). “This may be because of strong marketing on online liquor,” noted an informed source.

But airports were a different story with Korean spending off by -3.5% to KRW94,389,632,823 (US$64.2 million).

Note: For a comprehensive evaluation of the reseller business entited ‘The past, present and future of the South Korean duty-free industry’, click here. ✈

Note: For a comprehensive evaluation of the reseller business entited ‘The past, present and future of the South Korean duty-free industry’, click here. ✈