INTERNATIONAL. SSP Group, which operates travel food & beverage outlets across 37 countries, has reported strong growth in its fourth quarter (ended 30 September).

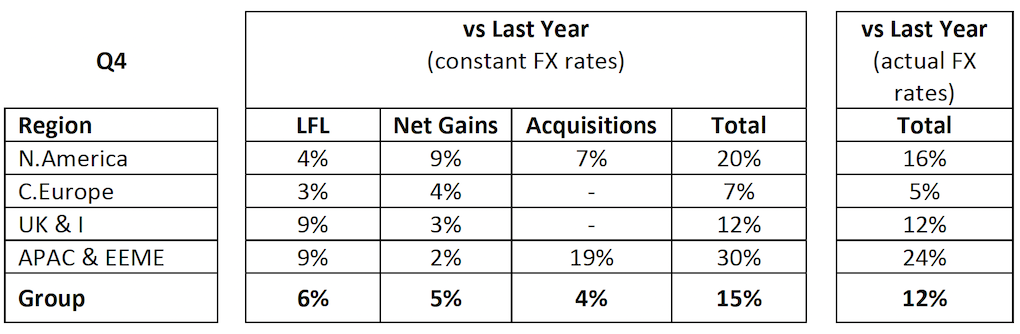

Revenue rose +15% year-on-year (on a constant currency basis), including like-for-like sales of +6%. There were net contract gains of +5% and a +4% contribution from acquisitions.

The performance lifted SSP to full-year revenues of circa £3.5 billion (US$4.59 billion), a +17% rise year-on-year (on a constant currency basis), with operating profit for the financial year expected to be in the region of £210-220 million (US$276-289 million), or around +30% year-on-year.

The FY revenue growth comprised like-for-like sales growth of +9%, net contract gains of +4% and a contribution from acquisitions of +4%.

SSP said it is expecting to see strong operating profit growth across the North America, APAC & EEME and UK regions.

On a constant currency basis, the company revealed it expects to deliver EBITDA in the range of £350-360 million (US$459-472 million) for the financial year.

Q4 regional performance

In North America, on a constant currency basis, SSP Group sales grew +20% year-on-year, including a +9% contribution from net gains. Acquisitions contributed +7% to sales, comprising the outlets at Denver International Airport, transferred under the Midfield Concessions Enterprise acquisition, and the acquisitions of Mack II in Atlanta and ECG in Western Canada.

In Continental Europe, sales growth of +7% was largely driven by the high level of unit openings. Like-for-like sales performance, at +3%, whilst strong in Spain and the other Mediterranean holiday destinations, was behind expectations, the company noted.

The perceived shortfall came primarily in France, where demand was negatively impacted by the Paris Olympics, and also in Germany, where the company saw weak trading in its motorway service business over the peak summer season.

SSP said it is taking action to improve the future profitability in Continental Europe. It will focus on driving returns from the investment programme, simplifying the leadership structure, reducing the cost base and exiting the German motorway services business (contractually agreed as of September 2024).

Further, SSP noted that it has recently appointed Satya Menard as the new Continental Europe CEO to lead this business.

In the UK, sales increased +12%, with like-for-like performance at +9%, driven by high demand in the air travel sector, a lower level of disruption in rail compared to last year and strong operational execution throughout the peak summer period.

In APAC & EEME, sales grew +30%, with strong like-for-like sales growth of +9%, driven mainly by Australia, Hong Kong and Egypt. The +19% contribution from acquisitions reflected the completion of the Airport Retail Enterprises deal in Australia earlier this year.

Full-year 2025 expectations

SSP said its performance in FY24 gives it confidence it “will see a year of good revenue and margin progression in FY25”. It noted those expectations are underpinned by the continued structural growth in travel, optimising the performance and returns from its extensive recent investment programme and the secured new contract pipeline, together with planned operating efficiencies.

Further progress, it added, will be supported by the aforementioned actions to drive returns in Continental Europe.

The company said it is planning for a lower level of capital expenditure in the year ahead as it concludes the backlog of renewals from the COVID period.

Furthermore, SSP noted that having executed a number of important infill acquisitions recently, to accelerate its growth in strategically important markets, its focus is now on integrating these operations and delivering the planned returns. Little, if any, further new infill M&A activity in the near term is anticipated, the company added.

Commenting on the performance, SSP Group CEO Patrick Coveney said: “There has been good trading momentum across our business throughout Q4. Our North America, Asia Pacific and EEME regions have continued to perform ahead of, or in line with, our plan and we have seen a material improvement in the performance of our UK business.

“We have had challenges in some parts of our Continental European business, which we are addressing through a series of actions that will build margins. Overall this year we expect the Group to deliver a significant increase in year-on-year profitability and margins.

“Our focus is now on optimising the performance of our business, building returns on the high level of recent investment, and the delivery of sustainable and compounding growth and returns in the years to come.”

Note: The Moodie Davitt Report publishes the FAB Newsletter, which features highlights of openings, events and campaigns from around the world of airport and travel dining.

Please email Kristyn@MoodieDavittReport.com for your complimentary subscription.