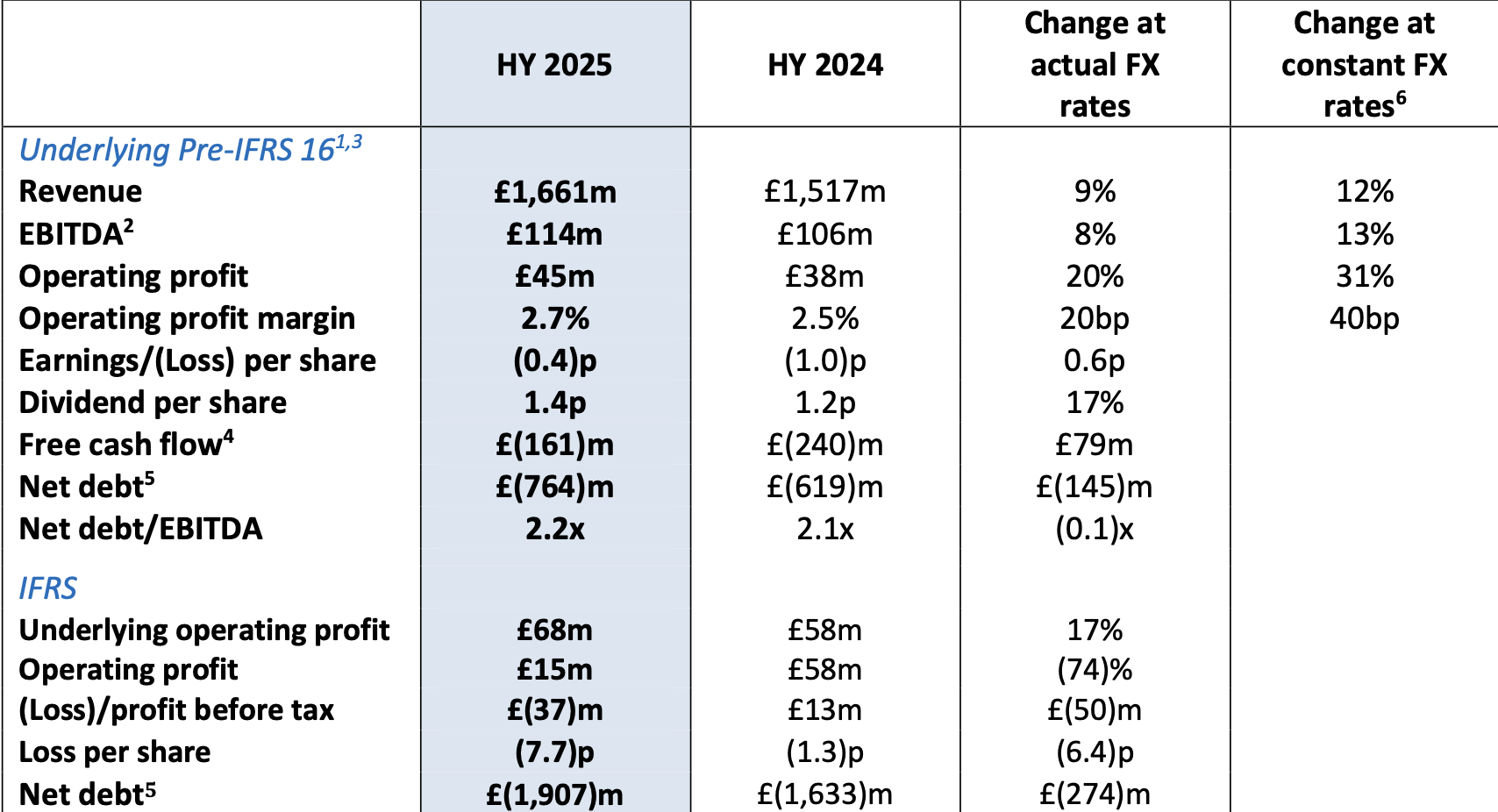

UK. SSP Group today reported first-half results to 31 March, with revenue climbing by +9% year-on-year (+12% on a constant current basis) to £1,661 million (US$2,221 million). Like-for-like sales grew by +5%.

EBITDA of £114 million (US$152 million) rose by +8% year-on-year at actual exchange rates and +13% at constant rates.

Under IFRS accounting standards, statutory operating profit was £15 million (US$20.06 million), down by -74% compared to the prior year primarily due to non-cash IT transformation costs as well as recognition of impairments in France and Italy.

On the same basis, SSP also posted a pre-tax loss of £37 million (£13 million profit a year earlier).

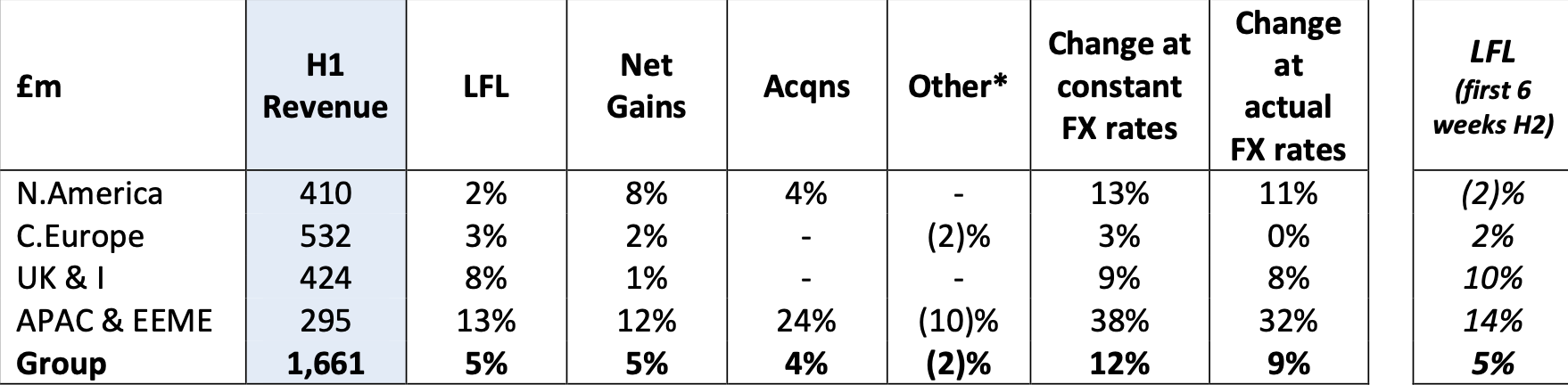

By division, North America sales climbed by +13% year-on-year, reflecting a strong contribution from net gains and acquisitions of 11%. Operating margin fell 90 basis points, but improved year-on-year after adjusting for the release of COVID provisions a year earlier.

In the UK, sales climbed by +9% including strong like-for-like sales growth of +8%, which drove an operating profit margin enhancement of 120 basis points.

In Continental Europe, sales rose +3% with operating margin enhancement of 80 basis points year-on-year.

SSP highlighted a “significant change programme” now under way in France and Germany to improve profitability. The company has reaffirmed its plan to build operating margin from 1.5% of sales in FY24 to around 3% this year and 5% in the medium term.

In APAC & EEME, sales jumped +38%, including like-for-like sales growth of 13% and a 24% contribution from acquisitions.

Operating margin was strong at 11.8%, but down 210 basis points principally due to the deconsolidation of the Adani Airport Holdings Limited (AAHL) joint venture in India. The latter relates to SSP joint venture Travel Food Services creating an updated joint venture with AAHL, in which TFS will hold around a 25% share. The alliance will manage restaurant and lounge operations at Mumbai International Airport, and has secured contracts in other AAHL-operated airports, namely Ahmedabad, Guwahati, Jaipur, Lucknow and Trivandrum. The new deal builds on a previous JV with AAHL in Mumbai, in which TFS held a 44% share (compared to 25% now).

Main story continues after the panel below.

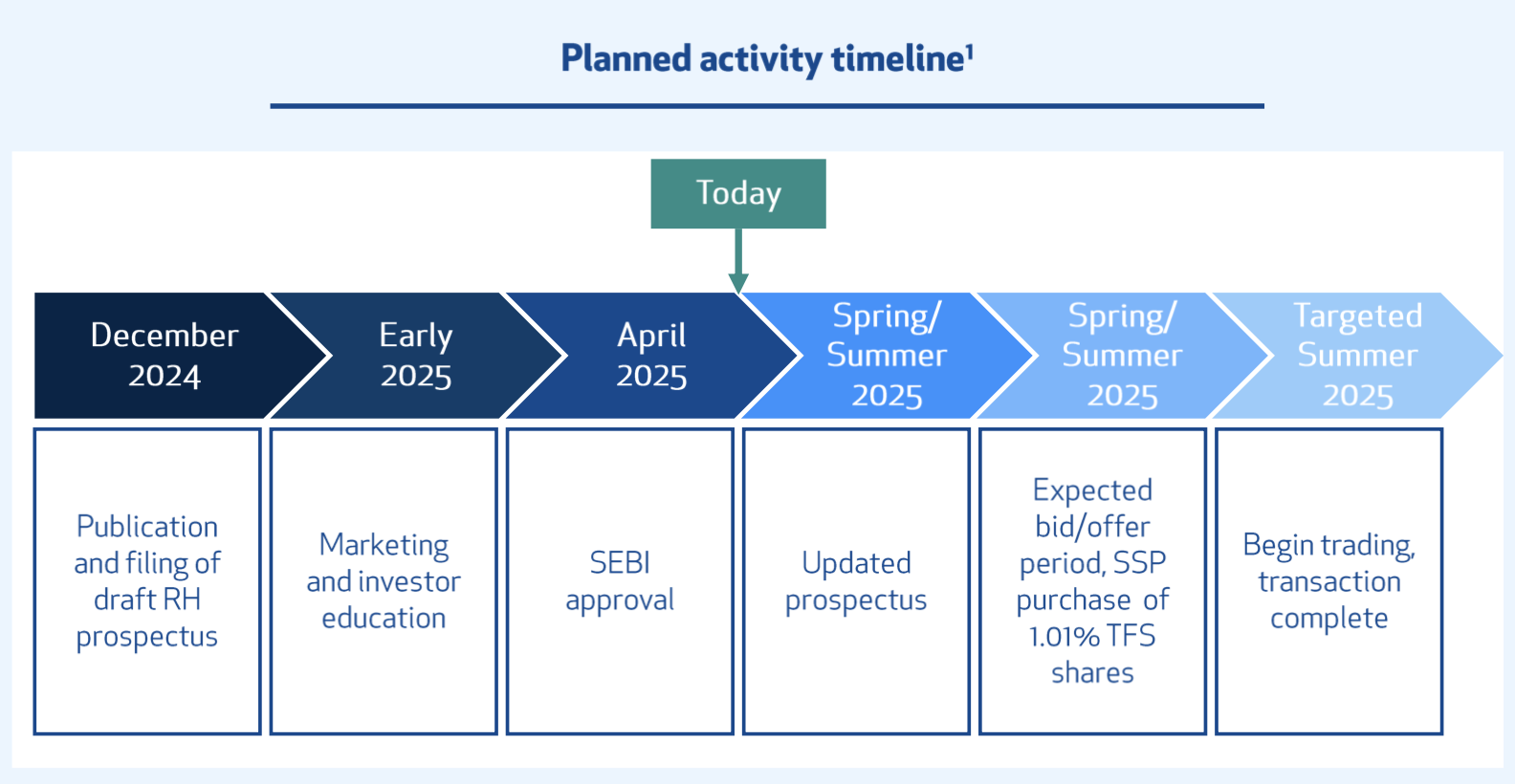

Travel Food Services IPO draws closer with regulatory approvalDuring today’s results announcement, SSP Group revealed that the company has received ‘in principle’ clearance from SEBI, the Indian market regulator, to proceed with a planned initial public offering (IPO) for Travel Food Services (TFS) in its home market of India. On 10 December 2024, SSP and Indian joint-venture partner K Hospitality Corp, first announced plans for the IPO. TFS is the leading player in the fast-growing airport quick service restaurant and lounge sectors in that market. Since that date, a period of market and investor education “has progressed well”, said SSP.  SSP acquired an initial stake in TFS in 2016 and currently holds 49% (which it consolidates) for which it paid net consideration of £57.9 million (US$73.9 million). Prior to the transaction, SSP said it expects to purchase additional shares in TFS (representing 1.01% of TFS’ issued share capital) at a value referenced to the IPO price; following completion of the purchase, SSP expects to indirectly hold 50.01% of TFS’ issued share capital and TFS will continue to be consolidated in SSP’s reported financial results. The Kapur Family Trust, which is the shareholding entity of K Hospitality Corp, will be the selling shareholder in the planned IPO.  Speaking to The Moodie Davitt Report about the India market, SSP CEO Patrick Coveney said today: “This is a brilliant business with high growth and high margins and we are very positive on aviation and travel F&B in the short to medium term. “We are also positive about the lounges story, not only here but in how we can bring that format to other parts of Asia Pacific and Middle East. TFS is our lounge format platform for other markets.” He added that the recent rebound in the Indian stock market, and strong investor interest, gave him confidence that the timing of an IPO in summer 2025 would be appropriate. |

Group like-for-like sales during the first six weeks of the second half of the year (from 1 April to 11 May) grew by +5% on a constant currency basis, including a benefit from the later timing of Easter.

In APAC & EEME, like-for-like sales of +14% in the period reflected good passenger growth. In the UK, like-for-like sales in the period were +10% including a modest impact in M&S units as a result of systems issues.

In Continental Europe, like-for-like sales grew by +2%, while in North America like-for-like sales fell by -2% following recent geopolitical events and an impact on passenger numbers.

SSP has maintained its full-year guidance though it noted a “a greater level of macroeconomic uncertainty”. Its planning scenarios remain for revenues of £3.7-3.8 billion, operating profit of £230-260 million and earnings per share of 11.5-13.5p on a constant currency basis.

The company said it is accelerating a programme to drive profitability, capital discipline and returns.

This includes turning around profitability in Continental Europe, generating cost efficiencies, accelerating returns from investments and increasing cash generation.

A major programme of cost reduction will be delivered through the second half, accompanied by a tightening of capital expenditure.

SSP is now planning for capital spend in FY25 of less than £230 million, while maintaining underlying net gains target of around 4%; planning for capex spend in FY26 of less than £200 million, driven by a lower level of renewals and growth capex consistent with its medium-term guidance for net gains of 2-4%.

It said a strong cash generation anticipated in the second half “would leave us on track to consider a share buyback programme towards the end of the calendar year”.

Elaborating on its planning assumptions, SSP said in a statement: “Recent geopolitical events have led to a heightened level of uncertainty across some of our travel markets, in particular in North America.

“While we believe that our geographically-diversified business model means that SSP is more resilient to fluctuations in travel and consumer spending than other consumer sectors, both in terms of our operational flexibility and traveller behaviour, we believe it is prudent to plan for a degree of ongoing uncertainty of demand through the second half.”

SSP Group Chief Executive Patrick Coveney said: “We recognise the importance of driving enhanced performance and we are executing against our agenda to achieve this.

“Our accelerated actions include a decisive turnaround plan for our Continental European business, a programme to deliver the full benefits of recent strategic and capital investments and a further step up in initiatives to deliver cost efficiencies. As a result, notwithstanding the higher level of macroeconomic uncertainty, we are maintaining our full-year guidance.

“Given the resilience of our business and the strong foundations that we have built in growing food travel markets across the world, we continue to see significant opportunities for SSP to drive compounding growth and to build margins and returns in the medium and long term.”

UPDATE

Speaking to The Moodie Davitt Report after the results announcement, Coveney said the US market slowdown came principally from airports serving international travellers, with the short-term weakness to mid-May coinciding with a period of tension and uncertainty around US tariffs.

“We have had a period of strong net gains in the US, and have gone from 51 airports last year to 57 today. Despite some short-term weakness, North America remains a market into which we will continue to allocate capital, alongside Asia Pacific and Middle East.”

Elaborating on the turnaround plan in some European markets, Coveney noted that many of the challenges had come in rail and motorways (around half of the regional business), with air more robust.

“We have also had some airports that we entered post-Covid where numbers or flows have not been what we expected and that represent big investments. These require remedies and we are engaging on these today.”

Commenting on the UK business, Coveney highlighted a +10% leap in year-on-year sales in the first six weeks of the second half. “The trajectory of the UK business remains strong. We have seen great feedback on our new experiential concepts such as Shelby & Co at Birmingham Airport. Every business should perform well in its home market, which brings many benefits and we are doing that in the UK.”

Note: The Moodie Davitt Report publishes the FAB Newsletter, which features highlights of openings, events and campaigns from around the world of airport and travel dining.

Please email Kristyn@MoodieDavittReport.com for your complimentary subscription.