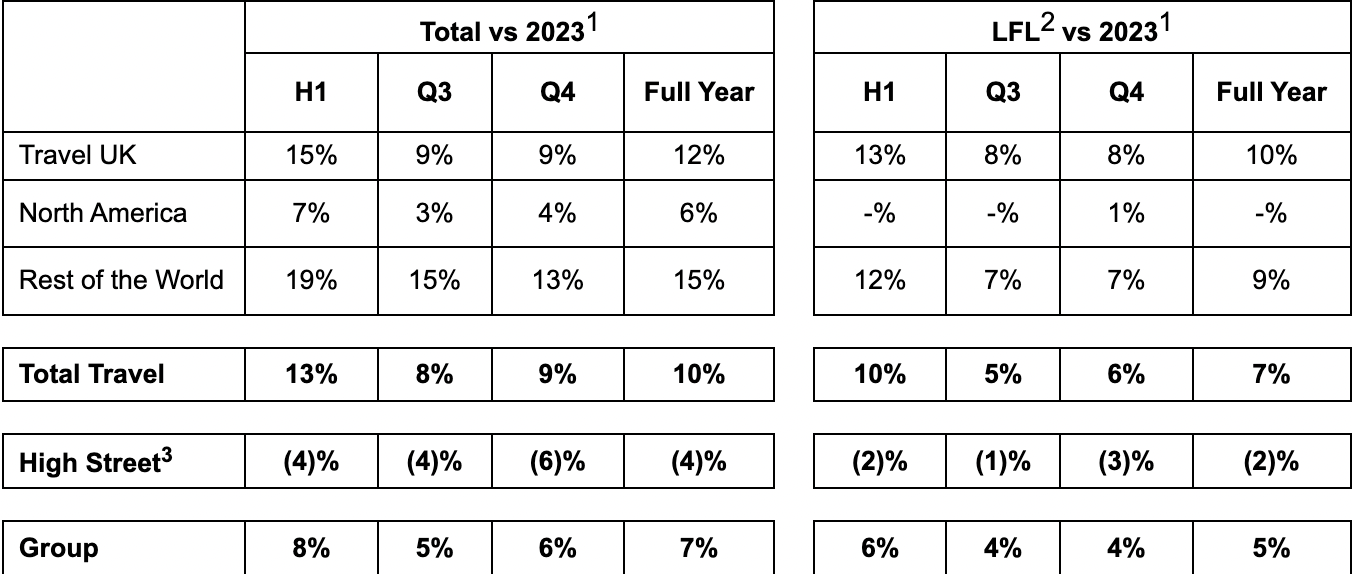

UK. Travel retailer WHSmith said that its Travel division posted +10% year-on-year revenue growth in the 12 months to 31 August, buoyed by a strong final quarter. The company offered a snapshot of its performance in a pre-close trading update.

WHSmith noted: “Travel performed well over its peak trading period in the second half, driven by our key initiatives and strong passenger numbers.”

Travel division growth outstripped group revenue growth of +7% and was driven by “the broadening of our categories and enhancing our ranges, most notably in food and drinks, health and beauty and technology,” said the company.

It added: “In the UK, our strategy to create a one-stop-shop for travel essentials is delivering strong results and our focus on category development continues. Ahead of the peak trading season, we launched a new food-to-go offer branded Smith’sFamily Kitchen which is performing ahead of expectations and, more recently, we opened our first own-brand Smith’sKitchen café at Princess Anne Hospital, Southampton.

“Our businesses in North America and the Rest of the World continued to show good momentum. In North America, our initiatives are starting to deliver an improvement in trading, and this positions us well for future growth. Our Rest of the World division is performing well as passenger numbers continue to improve across these markets.”

Group CEO Carl Cowling said: “We have ended the financial year in a strong position, delivering a performance in line with our expectations with good growth across our Travel businesses. Our UK division performed particularly well over the peak summer trading period.

“We are also announcing the launch of a £50 million share buyback, which reflects strong ongoing cash flow, the receipt of the pension fund buyout cash return, as well as the strength of our balance sheet, with leverage now within our target range.”