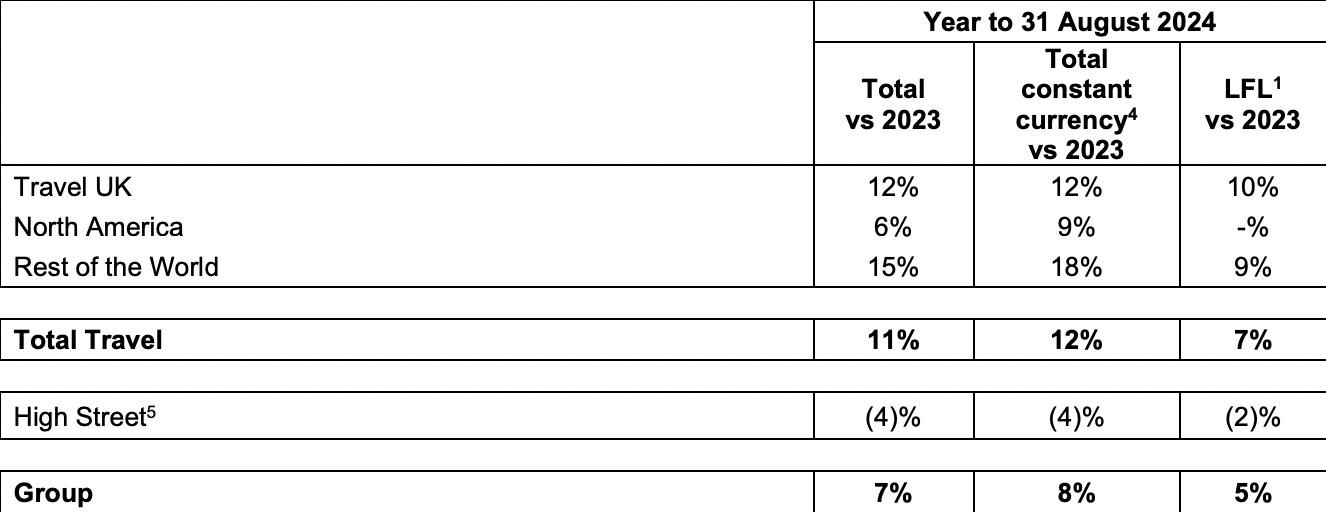

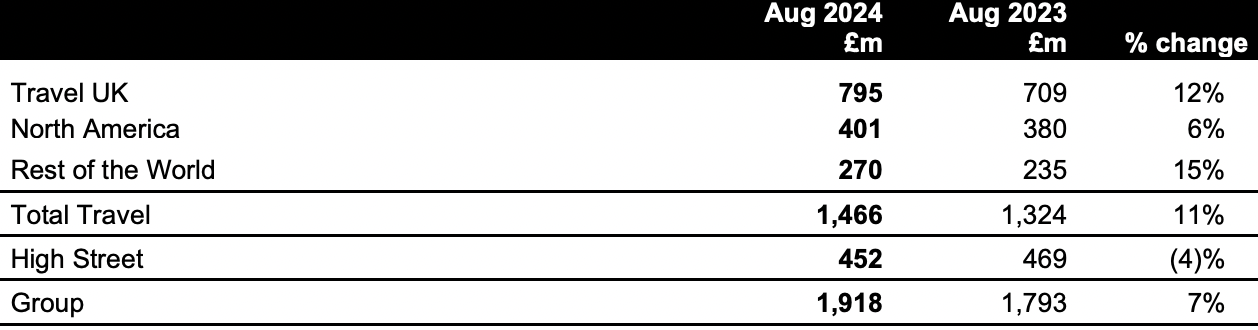

UK. Leading travel retailer WHSmith today posted preliminary results for the 12 months ending 31 August, with total revenue up +7% to £1,918 million (US$2.4 billion) and Travel division revenue climbing +11% to £1,466 million (US$1,860 million). Within this, Travel UK revenue rose +12%, North America +9% and Rest of the World (ROW) +18%.

On a like-for-like basis, Travel UK was up +10%, North America flat and ROW up +9%.

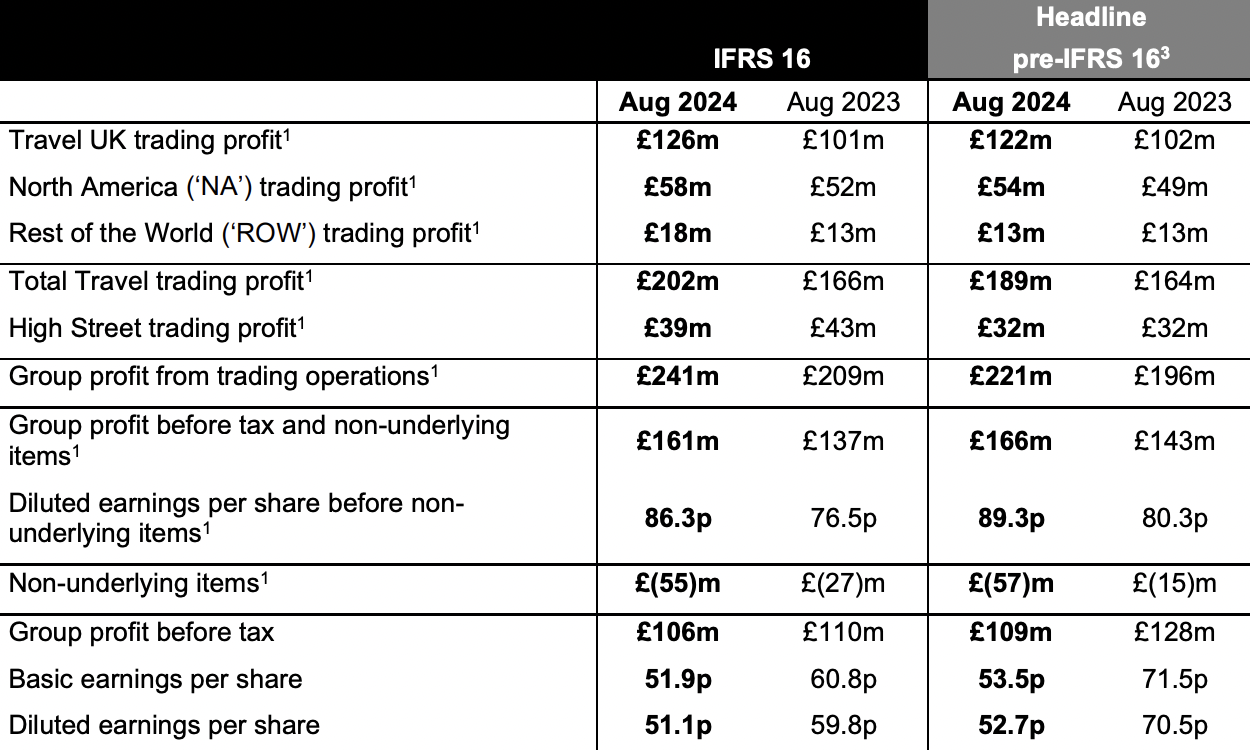

Group profit before tax and non-underlying items rose +16% to £166 million (US$211 million). Trading profit in Travel also rose sharply, led by a +20% leap in the UK business.

WHSmith also noted a strong pipeline of store openings, including over 90 won and yet to open in Travel, 60 of these in North America. The company said it expects to open net 40 stores this financial year across the Travel business.

Chief Executive Carl Cowling said: “The Group has delivered an excellent performance throughout the year, particularly over the key summer trading period.

“Our Travel divisions are trading well with a particularly strong performance from our UK Travel business, with trading profit up +20% to £122 million. We are making excellent progress in the UK as we continue to benefit from the roll-out of our one-stop-shop format which is creating significant opportunities to further grow profitability.

“Our most exciting opportunity for growth is in North America. We are very pleased to have recently won some significant new airport business, including wins at Dallas, Denver and Washington Dulles airports, and we are the preferred bidder for a further 15 stores across two major US airports. Our store opening programme is on track and we have a new store pipeline of around 60 stores already won.

“In addition to the £50 million share buyback announced in September, the Board is today proposing a final dividend of 22.6p, making a total of 33.6p for the year reflecting current trading and the significant medium and long-term prospects for our global travel business.

“The new financial year has started well. While there is some economic uncertainty, we are confident that 2025 will be another year of good progress.” ✈