AUSTRALIA. Sydney Airport has attracted 11 responses to the company’s call for Expressions of Interest (EoI) in its duty free tender, announced earlier this month. The company reported “strong market interest” in the tender as it revealed its results to year-end 2013. Duty free incumbent Nuance’s contract expires in February 2015. The EoI process concluded on 18 February.

Sydney Airport retail revenue climbed by +2.3% year-on-year to A$242 million (US$218 million). Adjusted for the revenue impact of changes in the tobacco allowance, which has hit the duty free business hard, the rate of growth would have been +5.2%. Retail contributed 22% of revenues to the airport in the year.

In its results statement, the company said of the duty free tender: “The structure of the Expression of Interest and subsequent tender process has been designed such that the potential exists for a range of different concepts and/or operators. The initial interest in our concession indicates that it is a very sought after operation and that this will be a competitive tender process. We look forward to working with the successful operator or operators at the conclusion of the process.”

|

“Unprecedented interest”: With 11 responses to the EoI, the duty free opportunity at Australasia’s largest gateway is highly sought after, says Sydney Airport |

Speaking later to investors and media, CEO Kerrie Mather said: “The process has elicited 11 Expressions of Interest from most of the world’s best and largest operators. This is an unprecedented level of interest. A number of the major operators, including Nuance (as incumbent), Heinemann Asia Pacific, King Power Group (Hong Kong) and LS travel retail already operate speciality stores within the terminal.

“The bid structure allows for one or more operators, a factor which we think will elicit strong interest in the tender. The [option of] a multi-retailer scenario opens up a number of exciting opportunities for our duty free retail offer to passengers.”

As we reported previously, there is a variety of bid options. Companies will be required to bid on three of the following:

1.T1 Departures: Four locations – T1 Landside, Central Walk-Through; Express Pier B; Express Pier C

2.T1 Arrivals (two locations): Pier B Arrivals, Pier C Arrivals

3.Total Departures and Arrivals: The total of 1 and 2 above

4.T2: Studio store

In addition, there will be options to bid on “˜Luxury Products and Brands’ within the Retail Forum in the Central Lounge of T1, plus a “˜Visionary Bid’ option, which would aim to “push the boundaries” with a new creative approach to the business.

|

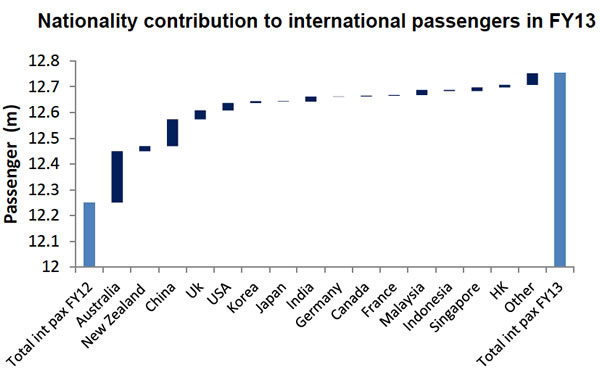

Of intense interest to bidders will be the burgeoning numbers of Chinese travellers to Sydney and Australia. These are now a major force in the market, as underlined by Sydney Airport in its results presentation (charts to follow).

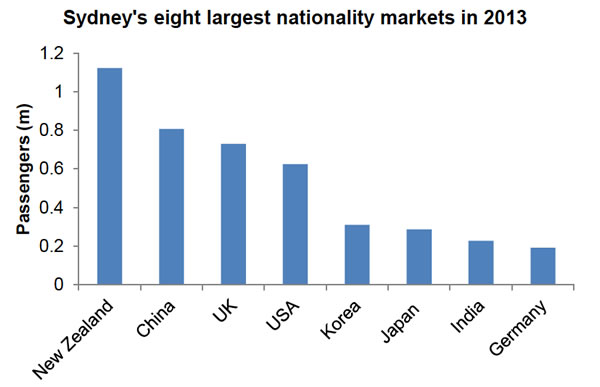

“Chinese nationality performance was the largest driver of passenger growth in 2013, increasing by +15% or 104,608 incremental passengers,” it said. China is now second only to New Zealand among the airport’s leading overseas passenger markets.

Sydney’s direct Mainland China airline seat capacity increased by +17.5% in 2013. Sydney has four carriers serving the Mainland China market non-stop and seven in total serving the Greater China market.

Mather told investors: “China’s market has now eclipsed the UK and is starting to get closer to New Zealand. We have seen nearly +11% compound annual growth in Chinese passengers over the last five years. And the potential for further increases is huge: China will overtake New Zealand as our largest inbound market in the next couple of years.

“Tourism Australia research shows that Australia ranks very highly as a destination of choice for Chinese travellers due to value for money, interest in wildlife, luxury accommodation and the ease of obtaining a visa.”

|

Driven by this performance (as well as strong growth from Malaysia, Singapore and India, among others), this was the first year since 2008 that international inbound growth (+4.8%) exceeded Australian outbound growth (+3.3%) at the airport.

Among other commercial highlights of 2013, the airport’s retail business added nearly 1,000sq m and 12 extra retail outlets across both terminals.

New concessions such as MoVida, Coopers Alehouse, Marcs and Oxford together with a refresh of other major branded stores have “transformed the dining and shopping experience” in Terminal 2, Sydney Airport said.

In Terminal 1, new stores such as National Geographic, Cerrone, A Little Something and La Perla “provide our international passengers with a unique offering at a range of different price points”, the company noted.

Property and car rental revenue grew strongly, up +10.8% for the year driven by market rent reviews, new leases and additional income from ancillary services.

|

The burgeoning Chinese business will excite bidders for the duty free contract |

|

|

Car parking and ground transport revenues were +10.9 % higher than a year earlier. This was driven, said the airport, by a +35% increase in car parking spaces, as well as “a clear value proposition, higher penetration, targeted advertising and tailored products”.

Online car park bookings continue to increase as a proportion of car parking revenues, and currently account for 20-25% of revenues.

Overall revenues for the year were A$1,115 million (US$1,005 million), up by +7.2% year-on-year, with EBITDA rising by +7.3% to A$910 million (US$820 million). Net profit for parent Southern Cross Airports Corp was A$5.3 million (US$4.7 million) compared to a loss of A$80.3 million a year earlier.

International passenger numbers rose by +4.1% to 12.8 million, with overall traffic up +2.7% to 36.9 million.

Capital expenditure was A$241 million for the year and is expected to be around A$1.2 billion for the next five years.

The airport also hailed the Australian Government’s approval of Sydney Airport’s 20-year Master Plan on 17 February. The master plan outlines Sydney Airport’s plan for the operation and development of the location for the period to 2033.

Forecast demand by then is 74 million passengers, a significant increase from the 38 million in 2013.

Mather said: “We have continued to deliver a strong set of operational and financial results in 2013. EBITDA grew by +7.3% on international passenger growth of +4.1%. Key drivers of EBITDA growth were international passengers, primarily from China and Asia, capital investment in aviation capacity and facility improvements, and commercial business initiatives.

“In particular, it has been pleasing to achieve revenue growth and yield improvement due to commercial expansion. Significant customer research and targeted products have translated into increased sales and market penetration.”

NOTE TO AIRPORT OPERATORS: The Moodie Report is the industry’s most popular channel for launching commercial offers and other airport bids. If you wish to promote an Expression of Interest, Request for Proposals or full tender process for any sector of airport revenues, simply e-mail Martin Moodie at Martin@TheMoodieReport.com

We have a variety of options that will ensure you reach the widest, most high-quality concessionaire/retailer/operator base in the industry – globally and immediately.

Similarly The Moodie Report is the only business intelligence service and industry media to cover all airport consumer services, revenue generating and otherwise. We embrace all airport non-aeronautical revenues, including property, passenger lounges, car parking, hotels, hospital and other medical facilities, the Internet, advertising and related revenue streams.

Please send relevant material, including images, to Martin@TheMoodieReport.com for instant, quality global coverage.