AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity ecosystem, presents his latest commentary and figures on the gradual re-emergence of airport commercial activities in Australia and New Zealand.

Favotto owns and runs The Mercurius Group, a consultancy focused on industry research, consultancy and benchmarking studies, as well as operating his own destination merchandise supply business.

Favotto – in the latest edition of his unique monthly report tracking the recovery of an initial 832 travel retail outlets across Australia and New Zealand – says that the highly cautious strategy on border reopening and the pandemic in general from the two countries has backfired to some extent as the Delta COVID-19 variant breached lockdown defences.

He notes that a slow start to the vaccination rollout has prolonged the agony for retailers and F&B operators. Although 42% of stores have reopened and international traffic is set to resume in Australia later this year, passenger-starved travel retail operators remain under huge pressure, Favotto contends.

The term ‘hermit kingdom’ is used to refer to a country or society that wilfully walls itself off, either metaphorically or physically, from the rest of the world. Seems a pretty apt description of Australia and New Zealand’s current approach to COVID-19. International borders into and out of both countries have now effectively been closed for more than 18 pandemic-hit months.

This hermit kingdom COVID-19 strategy was initially hailed a success in late 2020/early 2021 as Australian and New Zealand citizens enjoyed the freedom to move around their respective countries (and even between countries for a while) while the rest of the world was still locked down with raging infection rates.

But the sense of security engendered by this early success and the global scramble for vaccine supply ensnared both Australia and New Zealand into a form of vaccine complacency resulting in some of the slowest vaccine rollout rates in the western world. And that slow roll-out has come back – big time – to bite both countries on the proverbial.

The emergence (through lax safety protocols) of the seemingly lockdown resistant Delta variant in Australia and (to a lesser extent) New Zealand has highlighted the folly of the hermit kingdom approach.

Australia in particular is now facing the dual onslaught of ongoing lockdowns of indeterminant length (Melbourne is now the most COVID-19 “lockdowned” city in the world apparently) and closed international and state borders – a situation that can otherwise be described as the worst of both worlds.

Meanwhile the economic cost continues to snowball with disproportionate effect on industries like travel retail.

But at the risk of mixing metaphors, I am reminded of the quote by English historian and theologian Thomas Fuller (1601-1661) “it is always darkest just before the day dawneth”. And so, with first dose vaccination rates in both countries approaching 80% and second dose rates rapidly catching up (56% Australia, 46% New Zealand), dawn seems to be appearing on the horizon with both countries preparing for a slow and cautious approach to reopening international borders over the next few months.

Let’s hope it’s not a false dawn. We’ve had those on this COVID-19 rollercoaster before. There remain many details to sort out. Vaccine passports, quarantine rules and which countries (not many to start with) are variables at this stage.

And let’s not mention the ongoing disaster that is Australian State versus Commonwealth border policy. It’s possible – probably likely – that fully vaccinated residents of the states of New South Wales and Victoria could be able to travel overseas before they can travel to other states within their own country.

Western Australia in particular has adopted the target of 90% double vaccinated before they will consider reopening their borders – a level unlikely to be reached there until well into 2022.

But it’s a start at least and offers some hope to a suffering travel retail industry.

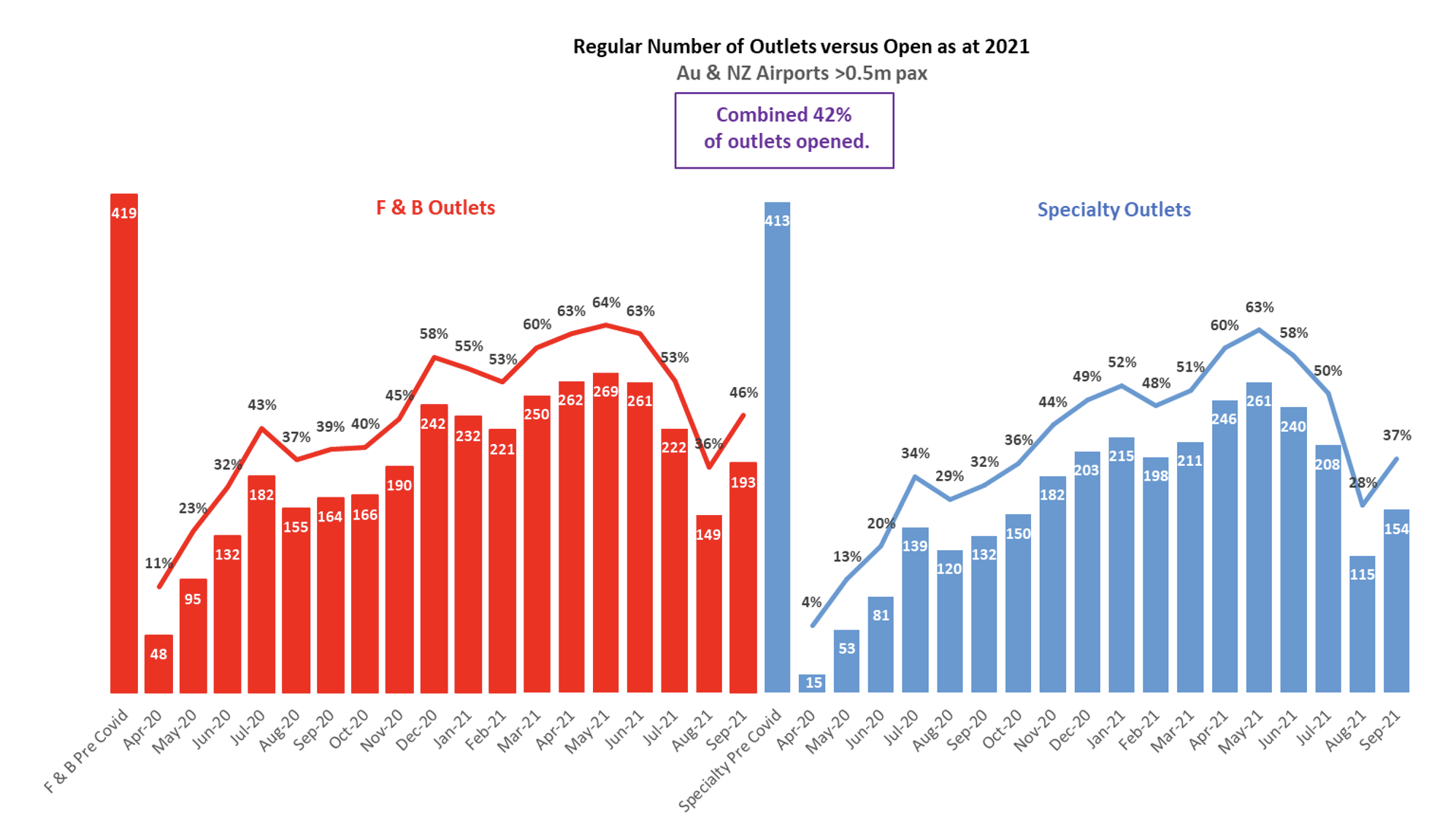

According to The Mercurius Group’s 17th monthly report tracking the recovery of travel retail in Australia and New Zealand from the COVID-19 pandemic, only 42% of travel retail stores were open in September 2021 compared to the number of stores open pre-pandemic in 2019.

While this an increase from 32% August 2021, it is primarily due to New Zealand partially reopening domestic travel, rather than any material recovery in Australia with New Zealand’s reopen rate at 52% compared to 39% in Australia.

In terms of outlet type, September 2021 saw total F&B outlets open increase to 46% and total specialty outlets increase to 37%.

So a bounce back of sorts from the depths of August 2021 when the majority of the Australia and New Zealand populations were in lockdown.

Case study: A Tale of Two Cities (continued)

For four months now, The Mercurius Group has been tracking the rate of travel retail’s recovery from COVID-19 in two airports of similar scale on two different sides of the planet – Melbourne Airport in Australia and Manchester Airport in England.

The differences in the approaches to travel retail recovery can be seen in the change in outlets open between our comparison on the recovery between Manchester Airport and Melbourne Airport over these four months.

In the beginning of our analysis in June 2021, Melbourne Airport had almost twice as many retail outlets reopened versus their pre-pandemic level compared to Manchester Airport.

But as passenger traffic at Manchester Airport has started its slow recovery (passenger numbers in August 2021 were 26% of August 2019), the number of outlets opened has climbed from 25% to 53% in September 2021.

While 53% of outlets open on just 26% of traffic returned is not fantastic trading conditions for those retailers, it suggests a sense of optimism that traffic has started its inexorable climb back to pre-pandemic levels.

Melbourne Airport has meanwhile languished for the past few months with 43% of outlets reopened in September 2021 compared to 46% in June 2021. That 43% of outlets at Melbourne Airport have reopened is a minor miracle, given that in August 2021, the airport had just 2% of its pre-pandemic passengers.

While there may be 43% of outlets open, they will be trading on very restricted hours. It is likely that some outlets are trading just to retain staff so that they can be ready for when travel reopens.

*Note: Ivo Favotto is a speaker at the Virtual Travel Retail Expo today (1500 Beijing, 0900 CET), in a session titled The APAC Dialogue, organised by The Moodie Davitt Report and the Asia Pacific Travel Retail Association (APTRA). He will examine the methodology behind – and question marks over – much travel retail industry research, both consumer and B2B. He will be joined by one of Australia’s foremost research providers, Neil Stollznow, Quantitative Director of StollzNow Research & Insights Advisory.

**Footnote: The Mercurius Group, in partnership with The Moodie Davitt Report, has released the inaugural edition of the Airport Food & Beverage Study (AFABS).

The AFABS 2021 edition focuses on the Australian and New Zealand airport F&B markets, covering all 27 airports in Australia and New Zealand with annual passenger volumes exceeding 0.5 million.

The AFABS 2021 also features The Mercurius Group’s Top 12 F&B Operators League Table. These particular operators are responsible for 75% of the outlets within the region.

Other key features of AFABS Australia and New Zealand include:

- An estimate of overall airport F&B sales in the Australian and New Zealand market;

- F&B PSRs by country, terminal type and airport size;

- F&B PSRs by outlet type, outlet location and operator size;

- The number and type of F&B outlets in the market;

- A ranking of the Top 12 F&B operators by sales and a profile of their outlet portfolio; and

- A profile of the F&B programme for each airport (and for each terminal where applicable).

Other special features of the publication include a commentary on:

- How airports build an F&B programme; and

- The potential for F&B operator consolidation (mergers and acquisition activity) in the Australian and New Zealand airport F&B market.

To purchase a copy please contact The Mercurius Group:

Tel: +61 423 564 057;

Email: ifavotto@themercuriusgroup.com;

Website: www.themercuriusgroup.com