AUSTRALIA/NEW ZEALAND. Ivo Favotto, a Sydney-based executive and company owner who has worked for all three stakeholders in the Trinity ecosystem, presents his latest commentary and figures on the gradual re-emergence of airport commercial activities in Australia and New Zealand.

Favotto owns and runs The Mercurius Group, a consultancy focused on industry research, consultancy and benchmarking studies, as well as operating his own destination merchandise supply business.

Here, Favotto – in the latest edition of his unique monthly report tracking the recovery of an initial 832 travel retail outlets across Australia and New Zealand – reports positive news from the two countries on border reopening and vaccination rates. The path ahead for travel retailers and F&B operators remains rocky though, as he explains.

Cautious optimism has replaced despair in travel retail circles down under as the hitherto COVID-hermit kingdoms of Australia and New Zealand have each announced a pathway back to reopening state and international borders.

This follows a remarkable turnaround in vaccination rates in both countries. Driven by outbreaks of the seemingly unstoppable Delta variant which has caused politicians to understand that they need to learn to live with COVID, double-dose vaccination rates have hit 77% in Australia and 75% in New Zealand.

In New South Wales (NSW), Australia’s most populous state, double-dose vaccination rates have reached 88% and are well on track to hit 95% over the coming months.

While the trans-Tasman travel bubble between Australia and New Zealand may reopen in the coming weeks to the COVID-free and fully vaccinated, New Zealand Prime Minister Jacinda Ardern announced that international borders are likely to be reopened in early 2022. This is, of course, good news but still months away.

“Some airports have steadfastly only provided rolling relief without committing to contractual reform or even a trigger for when minimum annual guarantees will be reintroduced. As optimism returns to the sector, fears remain that the return of MAGs will be faster than the return of passengers, creating another hurdle to travel retail’s recovery”

In the federation of states that is Australia however, the reopening remains patchy. The most populous states of NSW and Victoria have opened their international borders quarantine-free for the COVID-free and fully vaccinated travellers from 1 November, although initially only to repatriating citizens and essential workers.

Tourists, meanwhile, might be allowed back sometime in early 2022. Other states seem to be holding out for double vaccination rates to hit 90% before they will reopen international borders on a quarantine-free basis.

The reopening programme for Australian State borders remains an uncoordinated mess. It seems highly probable that the citizens of NSW and Victoria could travel overseas before they could travel to Western Australia, for example.

For travel retailers though, any news is good news, even if there is seemingly still a long way to go to get back to normal.

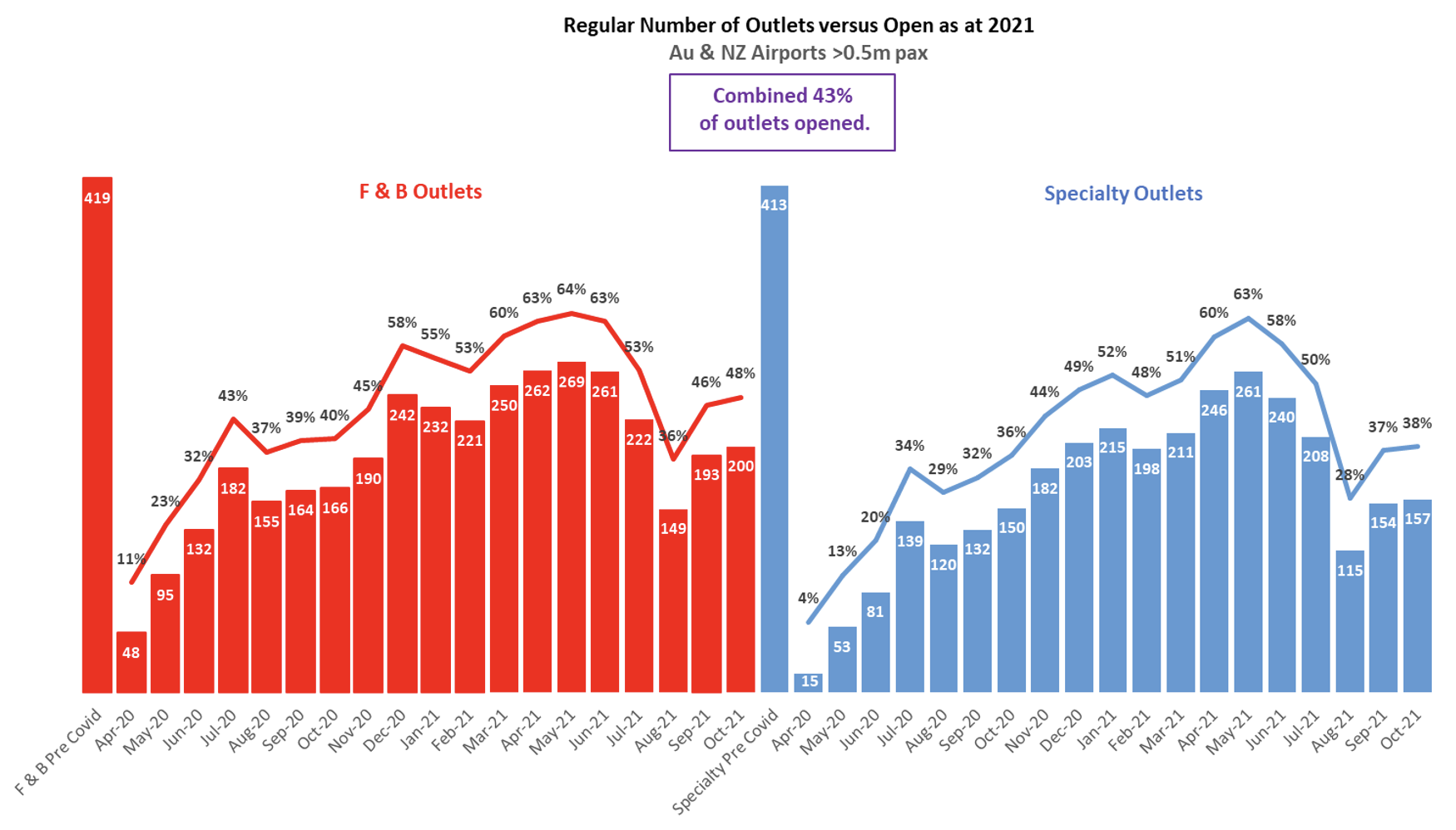

But the good news is yet to reflect in store reopenings. According to The Mercurius Group’s 18th monthly report tracking the recovery of travel retail in Australia and New Zealand from the COVID-19 pandemic, only 43% of travel retail stores were open in October 2021 compared to the number of stores open pre-pandemic in 2019. The figure is up marginally from 42% in September.

In terms of outlet type, October 2021 saw total F&B outlets open increase to 48% and total specialty outlets increase to 38%.

It is expected however that the November report will show a material uptick in reopenings as many travel retailers and airport restaurateurs start to dust down their stores and outlets ready for trading. Many will be looking around to see if their neighbouring retailers and F&B operators are also going to open and wondering how many passengers will be available between them.

The prospect of reopening stores also brings with it challenges of staffing and supply chain. Many travel retailers are still finding it difficult to find staff (migrants, overseas students and backpackers having been primary sources in years gone by that are no longer available). Meanwhile, supply chains are challenged by time delays and the soaring cost of container shipping is affecting the entire globe.

The next challenge for travel retailers will be around contractual terms. While all airports across Australia and New Zealand have provided rent relief to travel retailers as a result of the pandemic, some have renegotiated contracts to include passenger-drop clauses.

Other airports have steadfastly only provided rolling relief without committing to contractual reform or even a trigger for when minimum annual guarantees (MAGs) will be reintroduced. As optimism returns to the sector, fears remain that the return of MAGs will be faster than the return of passengers, creating another hurdle to travel retail’s recovery.

Case study: A Tale of Two Cities (continued)

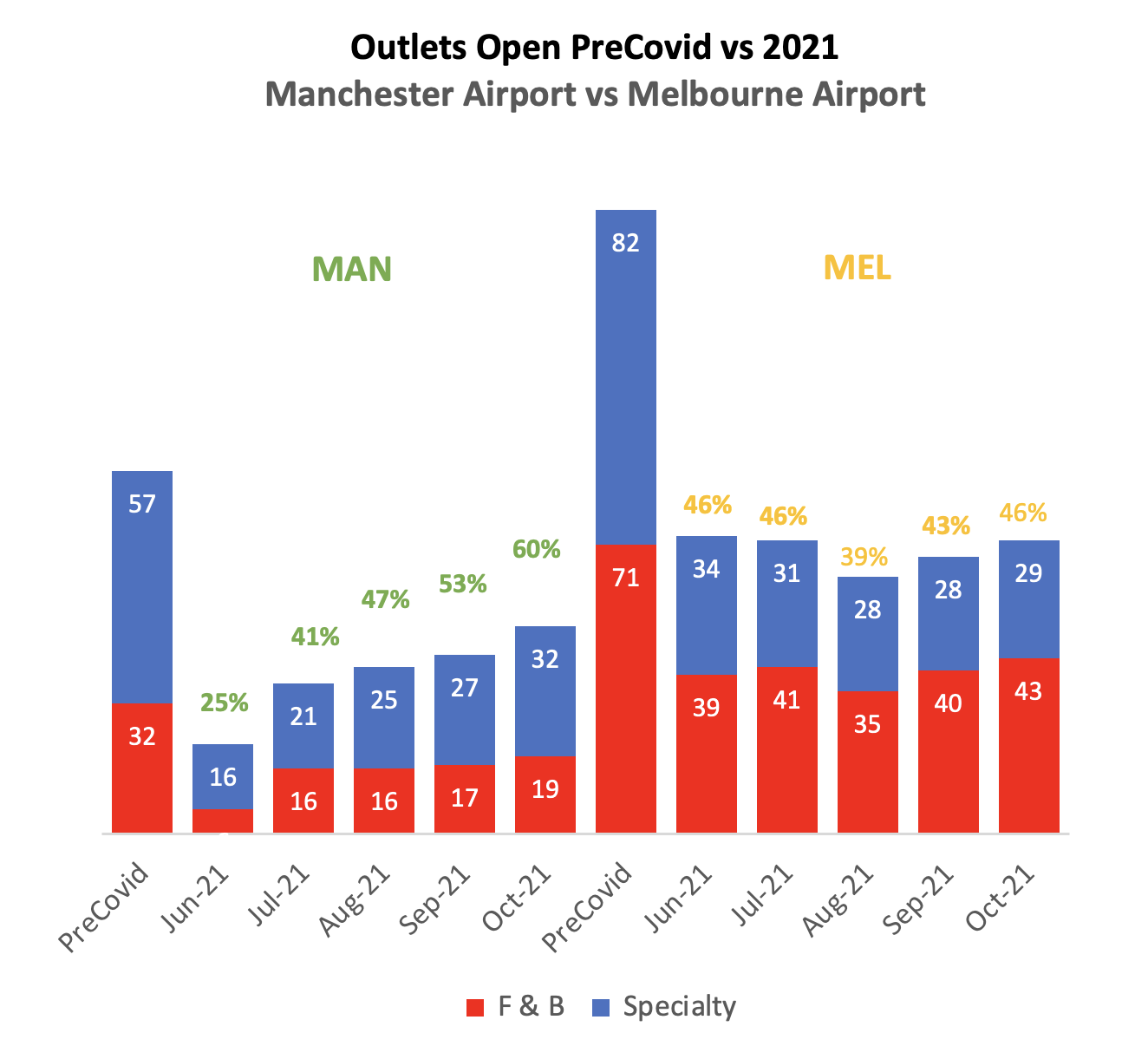

For five months, The Mercurius Group has been tracking the rate of travel retail’s recovery from COVID-19 in two airports of similar scale on two different sides of the planet – Melbourne Airport in Australia and Manchester Airport in England.

The differences in the approaches to travel retail recovery can be seen in the change in the contrasting commercial evolutions in Manchester and Melbourne airports since June 2021.

At the beginning of our analysis, Melbourne Airport had almost twice as many as retail outlets reopened versus their pre-pandemic level compared to Manchester Airport.

But as passenger traffic at the northern UK gateway started its slow recovery (passenger numbers in August 2021 were 33% of August 2019), the number of outlets opened has climbed from 25% to 60% in October 2021.

While 60% of outlets open on 33% of traffic returned hardly represents fantastic trading conditions for those retailers, it does show there is a sound and steady improvement.

Melbourne Airport has meanwhile languished for the past few months with 46% of outlets reopened in October 2021, a slight increase from the low of 39% in August.

That 46% have reopened is a minor miracle, given that in September 2021 the airport had just 1% of its pre-pandemic passengers. These outlets will, however, be trading on very restricted hours. It is likely that some are trading just to retain staff so that they can be ready for when travel reopens.

Footnote: The Mercurius Group, in partnership with The Moodie Davitt Report, has released the inaugural edition of the Airport Food & Beverage Study (AFABS).

The AFABS 2021 edition focuses on the Australian and New Zealand airport F&B markets, covering all 27 airports in Australia and New Zealand with annual passenger volumes exceeding 0.5 million.

The AFABS 2021 also features The Mercurius Group’s Top 12 F&B Operators League Table. These particular operators are responsible for 75% of the outlets within the region.

Other key features of AFABS Australia and New Zealand include:

- An estimate of overall airport F&B sales in the Australian and New Zealand market;

- F&B PSRs by country, terminal type and airport size;

- F&B PSRs by outlet type, outlet location and operator size;

- The number and type of F&B outlets in the market;

- A ranking of the Top 12 F&B operators by sales and a profile of their outlet portfolio; and

- A profile of the F&B programme for each airport (and for each terminal where applicable).

Other special features of the publication include a commentary on:

- How airports build an F&B programme; and

- The potential for F&B operator consolidation (mergers and acquisition activity) in the Australian and New Zealand airport F&B market.

To purchase a copy please contact The Mercurius Group:

Tel: +61 423 564 057;

Email: ifavotto@themercuriusgroup.com;

Website: www.themercuriusgroup.com