INTERNATIONAL. Plotting a new path forward for travel retail in the post-COVID-19 era was a central theme of a compelling inaugural APAC Dialogue webinar, hosted on Wednesday by the Asia Pacific Travel Retail Association and The Moodie Davitt Report. It attracted well over 400 delegates and examined the airport retail consumer, commercial and contractual landscape in the wake of the pandemic.

The event featured two major elements:

- The opening keynote address ‘Emerging Stronger Together’ from Lim Peck Hoon, Executive Vice President, Commercial at Changi Airport Group.

- Discussion of some key findings of a new Trinity White Paper – ‘Travel Retail Wayfinding for the Post-Covid Era’ –co-authored by Mauro Anastasi of Bain & Company and Jack MacGowan of Castlepole Consulting in association with The Moodie Davitt Report.

Discussing the big picture themes were a powerful line-up of panellists comprising:

- Doug Bagley: Managing Director Asia Pacific, William Grant & Sons

- Dan Cappell: Chief Commercial Officer, Ontario International Airport Authority

- Lucy Thomas: Head of Retail, Auckland Airport

- Dag Rasmussen: Chairman & CEO, Lagardère Travel Retail

- Sunil Tuli: President APTRA, and Group CEO, King Power Group, Hong Kong

Click on the video to access the APAC Dialogue session.

Introducing the event on behalf of APTRA, Sunil Tuli said: “With the crisis continuing, we at APTRA felt it was even more important to maintain a dialogue, share ideas and face challenges together. Bringing members together is important and despite the current status quo, Asia Pacific remains the undisputed engine of the global travel retail industry.

“So we wanted to set up a platform to discuss progress, to challenge ideas, and to learn from innovation that has taken place.”

Changi Airport Group Executive Vice President, Commercial Lim Peck Hoon outlined how the Singapore hub had addressed the challenges of the pandemic, but also introduced a strong note of hope and optimism about the future. “2020 is over, we are still in the middle of the pandemic, but we remain deeply hopeful. We believe that the human desire to make face-to-face connections and the thirst for wanderlust remains strong and the demand for air travel will return.” Her full remarks can be found in a separate story at this link.

Mauro Anastasi and Jack MacGowan then outlined a stimulating and at times provocative view of the industry position, with a white paper featuring recommendations to follow.

Setting the scene,. MacGowan said: “It’s worth making the point that that the core benefits of the travel retail business are still very much there. There’s a deep need to connect, to explore, to travel, there’s the excitement of getting on a journey, the wow, when you walk into a great airport shop. And that excitement, those feelings have not gone away. And it is only a matter of time before we get back to doing what no other channel or no other retail can do, which is to deliver an emotional shopping experience, which is based on value, service and exclusivity.”

Anastasi highlighted the influences on the channel of demographic change (younger consumers, Generation X and Y, becoming dominant), the rise of online as a sales influencer, a reduced proportion of high spenders and the share of luxury sold within China to grow from around 30% pre-crisis to 50% post-crisis. “This has implications for brands but also for airports and retailers as it is a shift from travel retail to China local. So we will see different brands, different stores and different sales mixes.”

The overall impact, he noted, will be a compressed travel retail turnover in the next three to four years. This will also mean reduced profitability for the entire industry.

Bain & Company outlined its own view of potential industry recovery, with and uneven rebound, Asia intra-regional travel likely to return as soon as 2022, but most other regions likely to hit 2019 numbers in 2025/26. The likely delay in a return of large-scale long-haul travel until 2025/26 will also have a big impact on duty free & travel retail, based on quality of passengers flying. The projections also depend on how vaccine passports are rolled out, MacGowan noted, with mid-term recovery to depend on how this concept is introduced and accepted.

Anastasi also said that the shape of the airport business will change permanently, with even less aviation income and more from non-aviation sources in future, although he noted that profitability could still mirror pre-crisis levels with adjustment to the business model.

“There will be a need for a change in strategies at airports, embracing competition and marketing to establish strategic partnerships. In non-aviation, we’ll need to redesign and update footprints, develop a new category and brand mix, with more convenience -focused F&B, focus on omnichannel, CRM and the digital real estate.”

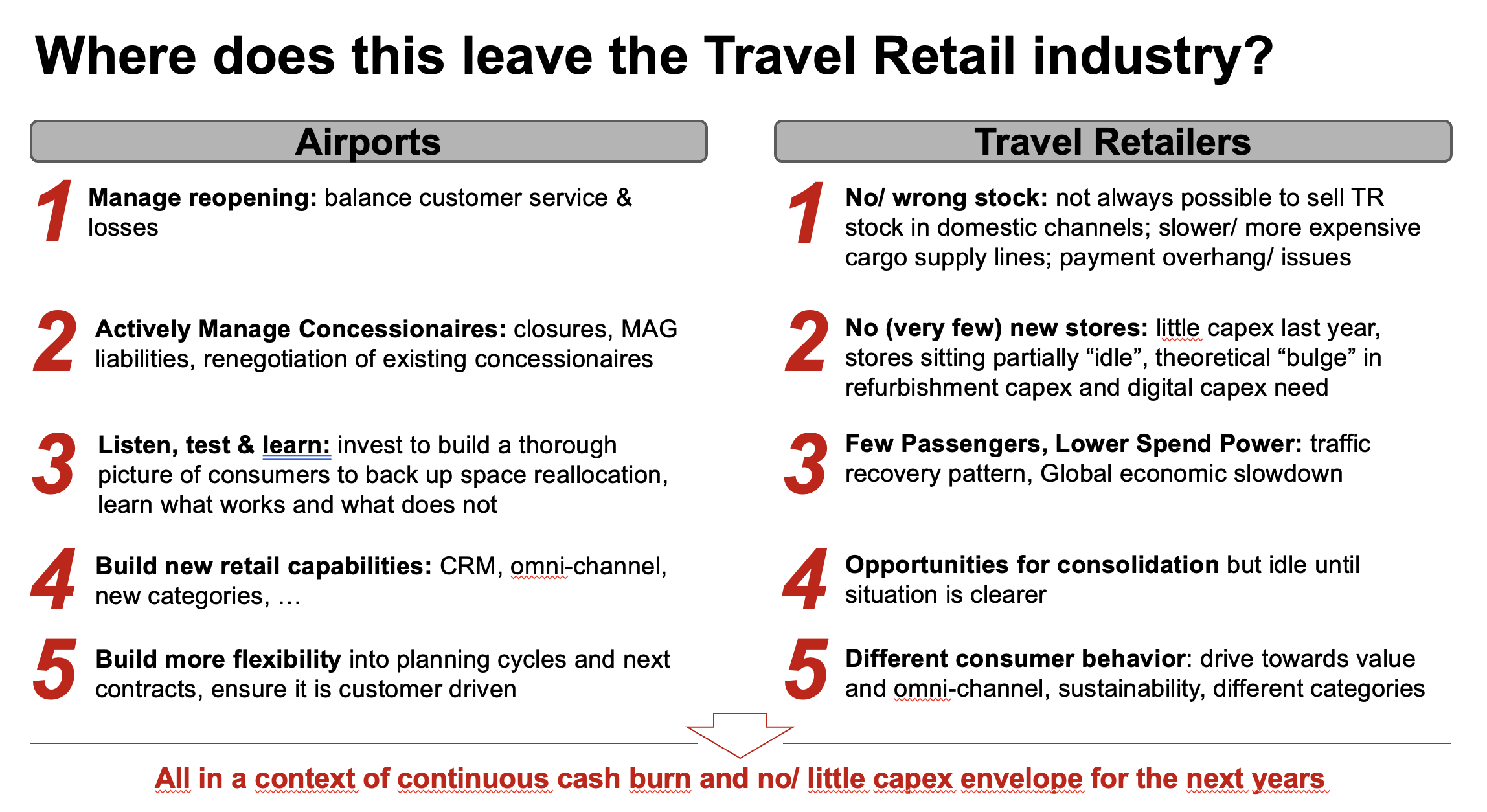

Further consequences of these dynamics will be balancing customer service and losses in the reopening phase; active management of concessions; listening, testing and learning for a new consumer; building new retail capabilities and having more flexibility in planning cycles and new contracts.

For travel retailers, this means overcoming issues of slow stock depletions; lower numbers of stores open and very few sales; a slowdown in passengers and the economy; facing new consumer behaviour and possibly eyeing opportunities for consolidation.

The calls to action for the industry should include:

*A focus on radically increased pax penetration, given what Bain & Co expects will be considerable vacant space in terminals, combined with low profitability. The industry target should go from 10-20% to over 30% where possible by location.

*Better understanding of the consumer, and fast adaptation to new consumers. “Airports are a long-term, real estate player but how the consumer changes the way they shop is unknown as yet, so speed of adaptability is fundamental. That has implications for how we plan our investments and allocate space.”

*Getting to a fully data-driven commercial strategy, with dynamic pricing that responds to the ecommerce challenge and optimises the range and promotional planning. “In domestic markets this is happening but for many in travel retail this is still to be done,” said Anastasi. “As a target we should have 90%+ of commercial decisions backed up by big data analytics.”

*Leveraging CRM better – bridging the gap between travel retail and downtown.

*Omnichannel tailored to travel retail – and a target of 25% of business driven by digital.

*A rethink of the contractual structure.

*Repurposing travel retail capex so that in the new era, 50% of capex should be dedicated to digital, not physical, real estate.

In discussion with moderator Martin Moodie, the panellists expanded on their own views of the COVID-19-enforced changes in the industry – and their strategic priorities.

Auckland Airport’s Lucy Thomas said: “Changes and priorities include the customer wanting information and the ability to shop using ecommerce or omnichannel. That was prevalent before, and now it is even more of a priority for us. Ecommerce is not competition, it’s part of our business.

“Also, if you don’t have travel, what are you as an airport? We can look to 2025 but am more worried about what I do now or next year as I have priorities for diversification.

“There is also a core customer base that we really must focus on in Kiwis and Aussies. We know them, we understand them. They are our lifetime customers and we need to be able to engage with them. They are our core.”

Offering the Ontario Airport view, Dan Cappell said: “The reduction in pax numbers is of course a concern but we are at around 50% of 2019 levels and have managed to keep most outlets open. We have to look at our mix, we have to raise our game in omnichannel but so do most airports and operators.

“Also, there’s the as yet unknown impact on business travel in the future. It’s a big driver for airline yield as they are for travel retail. If we do see LCC share increasing, it’s an issue for airline profitability and the speed of recovery.”

Lagardère Travel Retail’s Dag Rasmussen said: “Uncertainty is a key issue. We have to be open-minded and flexible. Also, the focus on digital is critical. Omnichannel is important but I think less relevant than it is for downtown. For us it’s incremental. We see why capex should be more digital but that also means the in-store experience, make the journey more seamless, how we speak to the customer. Then the other change is evolution of the model to greater value sharing.

“Priorities for us are to be more customer-centric, sharing data to know the customer better. Another is sustainability and we can use our stores to communicate how we care about the planet. The other is unlocking potential in the value chain through the business model.”

William Grant & Sons’ Doug Bagley said: “One important thing is to bring excitement to the traveller. We need to come together to deliver that in the shopping experience. If you look at ecommerce or department store luxury, how do we bring a shopping festival back to people once they return to airports?

“Price is another issue. I don’t think it’s the way to convince shoppers. There is room to improve penetration levels but usually we look at the customer in the store, not engaging with them through their journey. We have to be differentiated and surpasses other channels that compete with us.”

More contributions from all of the speakers feature in the video on this page, with further coverage of the key themes addressed in this webinar to follow.

As reported, The APAC Dialogue will feature a rolling set of one-day programmes every two months through 2021, each dedicated to a different theme, region or country.