|

Fabrizio Freda: “Our make-up artist and luxury brands, and online and travel retail channels, delivered standout performances.” |

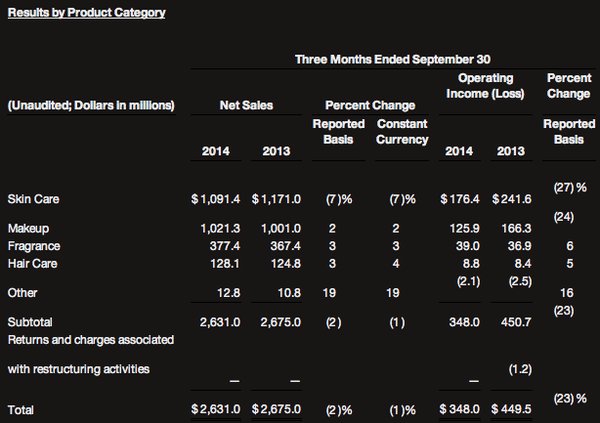

USA. The Estée Lauder Companies has reported net sales of US$2.63 billion for its first quarter ended 30 September, a -2% decrease compared with the US$2.68 billion in the prior-year quarter. Excluding the impact of foreign currency translation, net sales decreased -1%. Net earnings for the quarter were US$228.1 million, compared with US$300.7 million last year. Diluted net earnings per common share were US$.59, compared with US$.76 in the prior year.

In the fiscal 2014 fourth quarter, some retailers accelerated sales orders in advance of the group’s July 2014 implementation of its Strategic Modernization Initiative (SMI) in certain of its largest remaining locations of approximately US$178 million. These orders would have occurred in the group’s fiscal 2015 first quarter. This amounted to approximately US$127 million in operating income, equal to approximately US$.21 per diluted common share. Adjusting for the impact of the accelerated orders, net sales in constant currency and diluted earnings per share for the three months ended 30 September 2014 each would have increased +5%.

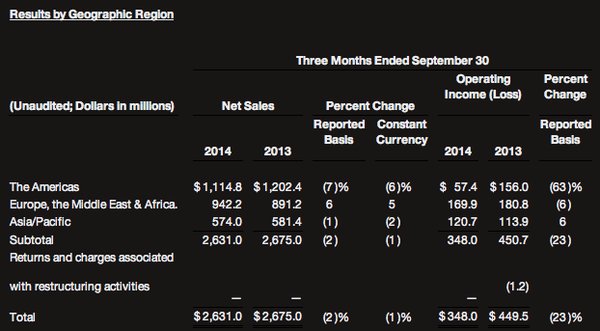

President and Chief Executive Officer Fabrizio Freda noted: “We entered the fiscal year on solid footing, with underlying strength in many parts of our business. Sales growth in the first fiscal quarter was in line with our expectations and earnings per share exceeded our forecast, due to strong results in several of our brands, as well as disciplined expense management. Our performance, after adjusting for the accelerated sales orders we reported in fiscal 2014, was highlighted by double-digit sales and operating income growth from our Europe, Middle East & Africa region, where we are building share and leveraging opportunities in both developed and emerging markets. In addition, our make-up artist and luxury brands, and online and travel retail channels delivered standout performances.”

He added: “Our well-diversified business allows us to accelerate what’s working and capture opportunities to further strengthen our leadership in prestige beauty. Some of our brands that were small have become sizeable and solid engines of growth and we believe the new small brands we added to our portfolio recently can become engines of the future.

“While our current business is solid, we recognise the recent challenges around the globe, including the strength of the US dollar, geopolitical tensions and soft retail environments in certain important markets, like Hong Kong. Reflecting the impact of these challenges, we are adjusting our full fiscal year net sales estimate to 5% to 6% in local currency and reducing our earnings per share estimate to US$3.03 to US$3.11 for the full fiscal year, excluding the effect of the accelerated retailer orders. Our forecast reflects solid programmes, our ability to leverage high growth opportunities and our intent to continue to sustain investments in areas of strong momentum and further build capabilities for the long term.”

|

In the Q1 Earnings Conference Call, Freda underlined the “solid financial performance” of the group, in spite of a difficult global backdrop.

“Like many companies, we operated against several macroeconomic and geopolitical issues, ranging from the foreign currency headwinds and slower growth in some of our markets to unrest in Hong Kong, the Middle East, and Ukraine,” he observed.

“We weren’t immune to the challenges, but many of our brands, countries, and channels were resilient and even vibrant. Our best-performing areas were our luxury and make-up brands; our online, travel retail, and freestanding store channel; as well as the European region, where we gained share.

“Our sales rose +5% in local currency, meeting our expectations and continuing a pattern on profitable quarterly growth. Earnings per share came in above our forecast. Prestige beauty overall remains healthy, as consumers are constantly drawn to innovative products and the hottest trends. Our creativity and ability to react quickly has enabled us to capitalise on many areas that we are winning.”

In terms of product, Freda hailed the success of the colour category, describing MAC – the group’s largest make-up brand – as a “true powerhouse with strong momentum globally”. “MAC’s next Viva Glam spokesmodel, Miley Cyrus, is certain to bring attention to the brand and to its AIDS-related philanthropic causes when the new lip products launch in January,” he explained.

Skincare remains Lauder’s largest category. Freda noted that the group was committed to creating products that appeal to multiple demographics and add incremental sales. In terms of launches, he singled out Clinique’s Smart Custom-Repair Serum, Clinique’s Sonic System Purifying Cleansing Brush, Estée Lauder’s new Englighten range and the high-end Re-Nutriv Ultimate Diamond Dual Infusion.

|

Regarding distribution channels, Freda declared: “Travel retail is one of our important engines, and we expect to return to retail growth ahead of traffic because of strong initiatives on the biggest brands, opening more doors and expanding distribution in high-growth mid-sized brands. In travel retail our net sales exceeded retail sell-through, because we needed to supply the new doors, and retailers were bullish ahead of Asian Golden Week holiday travel.”

He added: “We expect a rebalancing of trade inventories in the second quarter. Geopolitical issues are making global travel factors more volatile, which are reflected in our travel business.”

Outside travel retail, Lauder’s geographic strength was centred in Europe, the Middle East and Africa, which posted “excellent growth” despite the continued economic malaise in many European countries.

Freda noted: “Emerging markets are an important part of our growth story and continue to provide much of our fuel. Excluding China, sales in our emerging markets rose more than +30%, with superb results in many countries, including the Middle East, Brazil, Turkey and South Africa. This group is as large as China and continues to provide strong momentum, demonstrating the balance across our business and the scope of our geographic strength.”

He noted: “Balancing the softer-than-anticipated results in greater China was positive news out of other Asia-Pacific countries – namely Korea, Japan and Australia, where both net and retail sales generated strong growth. We have a strong turnaround in Korea, as our brands tapped into consumer preferences and leveraged local trends.”

Freda concluded: “We have the winning formula. More than two-thirds of our business is growing solidly, and we are disciplined in our management of expenses. We will continue investing in marketing programmes and capabilities that are necessary to maintain our long-term growth and remain committed to achieving our financial goals.”