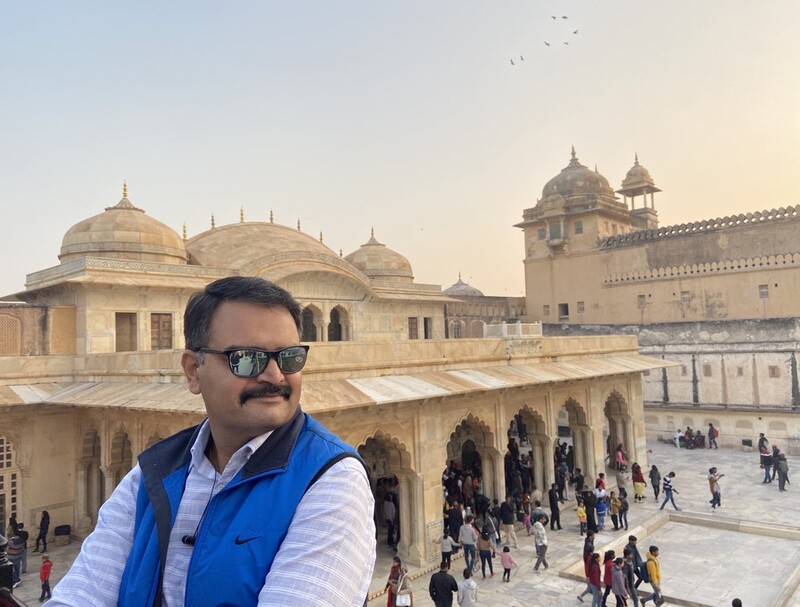

As reported, experienced travel retail and airport commercial executive S. Shriram has joined The Moodie Davitt Report in line with our desire to boost coverage of one of the world’s most exciting and fastest-growing aviation and travel retail markets. Here he reflects on the story of travel retail in the country over the past two decades, and assesses how the next chapters are set to unfold.

What surprises most Indians when we look (up) at many developed countries is the way India and its people have sprung back in less than two years from the deadly COVID-19 pandemic, writes S Shriram.

For the first time in history, civil aviation – along with many other public utilities and private services – came to a complete standstill on 27 March 2020. Everything and everyone was grounded, clueless about how the next 21 days would pass as our first-ever complete lockdown began.

When I look back, the way Indian air traffic has reemerged over the last 15 months is little short of fabulous. From wearing masks through a three-hour domestic flight to fearing dining at kiosks and cafés at airports, or being worried because of a coughing co-passenger, most Indians today travel worry-free through airports and on aircraft, thanks to double-vaccination and a general easing of the pandemic.

As of 31 December, India operates 153 airports – 29 international, 114 domestic and 10 customs (military). During her annual budget speech on 1 February, India’s Minister of Finance Nirmala Sitharaman announced plans to inaugurate an additional 50 airports and heliports (including water ports) during fiscal year 2023-24.

Of the current 153 airports, only 16 are run through JVs or Private Public Partnership (PPP) models. All the rest are directly controlled by state-owned Airports Authority of India (AAI).

Pioneered by the GMR Group with Delhi and Mumbai airports in 2006, the other private partners in Indian aviation currently include Canada’s Fairfax Investment Holdings which operates Bangalore International Airport and homegrown corporate giant Adani Group.

In terms of commercial partners across retail and food & beverage, there are several powerful international and Indian players.

HMSHost, part of international food services giant Autogrill (now merged with Dufry) entered the scene back in 2007 while Indian company Café Coffee Day and Nestlé (Nescafe coffee & Maggi Kiosks) were among the first tenants in the early 2000s at airports.

Mumbai-based F&B and lounge specialist Travel Food Services (TFS), launched by Sunil Kapur in 2009, has grown impressively to become the country’s largest player in the sector with a diverse portfolio across multiple airports and railway stations. It has been in a joint venture with international F&B powerhouse SSP since late 2016.

Shoppers Stop, India’s largest department store chain with over 86 stores across 40 cities entered travel retail in a joint venture with The Nuance Group in 2007 and commenced operations at the two new greenfield Airports at Bangalore and Hyderabad in 2008. Marks & Spencer, the British fashion retail chain pioneered its Indian travel retail journey at Delhi International Airport T3 in 2010. Other fashion brands have invested over time across the top 20 airports (by passenger volumes).

TATA Group’s Croma (consumer technology retail) entered airport retail with its first outlet in 2007 in the Domestic Terminal at Mumbai International Airport. Kiosks selling electronics & gadgets are a common feature even in Tier 2 and 3 airports in India today.

Starbucks Coffee entered India in 2011 in a joint venture with TATA Group. At airports it began its journey at Mumbai International Airport’s domestic arrivals zone in 2013. Today, the American coffee chain operates over 350 locations across India and is the largest café operator across a dozen airports and counting.

The duty free story has been just as fascinating over the past 20 years. Flemingo International was among the first homegrown duty free retailers in India, commencing operations in 2003. That followed a period in which India Tourism Development Corporation, a Government of India undertaking, operated duty free businesses at many airports.

The Nuance Group entered India in 2007 at Bangalore and Hyderabad airports, while Delhi Duty Free Limited was launched in 2010 as a JV between Aer Rianta International and the GMR Group, which operates Delhi International Airport. Adani Group, the largest private operator of Indian airports, purchasing a majority share in Flemingo/Mumbai Travel Retail in 2021 after it acquired the rights to operate Mumbai International Airport from the GVK Group in 2020.

The travel retail annual revenues at India’s major airports remain dwarfed by those at many others international hubs, but things are set to change as traffic builds back.

In 2019, India had aggregate domestic air traffic of 144 million, the highest figure ever. After reaching 63 million in 2020 and 84 million in 2021 – both years hit hard by Covid-19 – this figure reached 123 million in 2022.

With international traffic, things are yet to improve as much. However, the +89.5% increase in December 2022 to 5.55 million passengers is a strong positive signal.

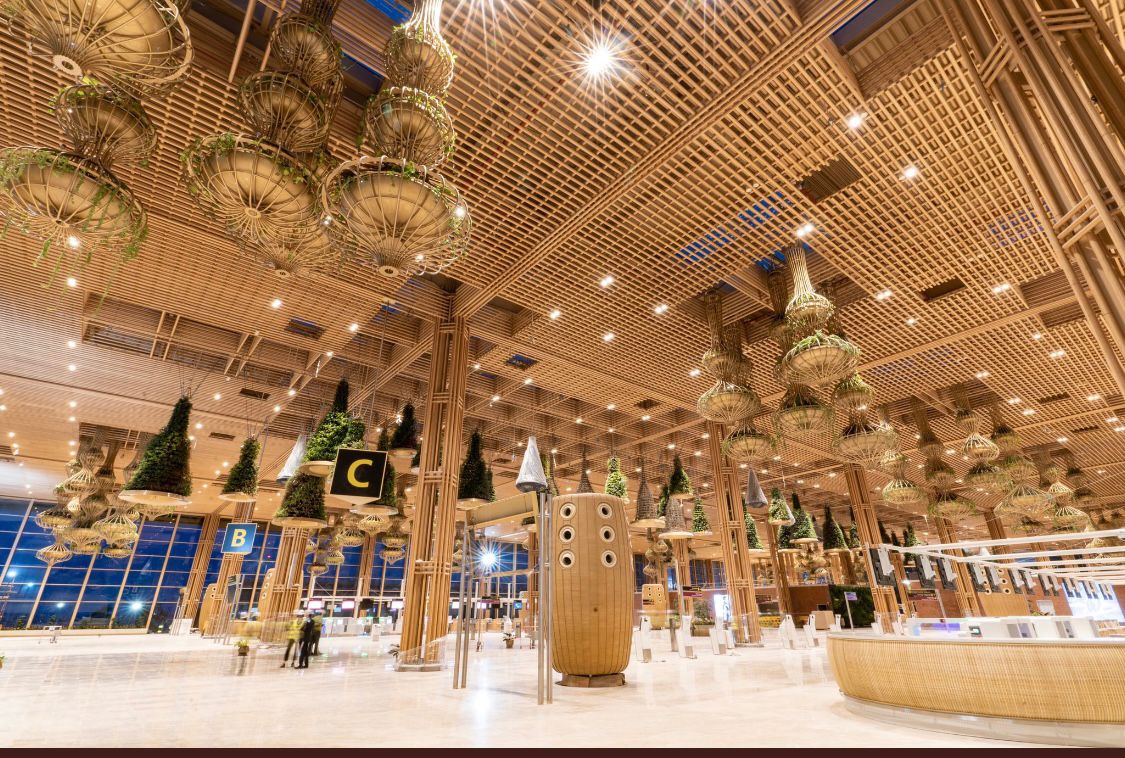

So, what’s in store for travel retail revenues across domestic retail, duty free, F&B, cafés, kiosks and other services? It promises to be a year of strong recovery and potentially record-breaking revenues as traffic roars back. That growth will be aided by recent big infrastructure developments including the opening of Bengaluru International T2 and a new greenfield airport in Goa.

Consumer services across the country’s airports are improving too, with many existing terminals being upgraded by AAI and by private operators.

Much of this remains centred around domestic terminal activity, which accounts for around 80% of the traffic. That remains a big commercial opportunity.

With better last mile connectivity to airports through public transportation such as Metro Rail and comfortable, cheaper taxi services, it is common to see visitors at the airport receiving or sending off their loved ones. That represents a relatively untapped landside travel retail opportunity.

With so much development, air travel rushing back and new consumer offers emerging, it is an exciting period for travel retail in India. In this new role with The Moodie Davitt Report I plan to capture what is happening on the ground, and to bring you details of the many plans and projects that will define the industry’s future. Here’s to new beginnings. ✈

Note: S Shriram can be contacted from Monday 13 February at Shri@MoodieDavittReport.com (before that at shri611@gmail.com). All stories on India are archived on our website under ‘India Newsroom’ on our regional dropdown menu.