Prologue: During a near 25-year career with French beauty products powerhouse L’Oréal, Emmanuel Goulin has come to understand and deeply appreciate the value and vagaries of the travel retail channel, a sector he first entered in 2005 as an Area Sales Manager for Biotherm.

His career has taken in stints in London, Paris, Hong Kong, Tokyo and Milan, helping him develop an international perspective he considers crucial to the global leadership role he assumed as L’Oréal Travel Retail President and a member of the Group’s Executive Committee in January.

In his first interview since assuming the role, Goulin chatted with The Moodie Davitt Report Founder & Chairman Martin Moodie at L’Oréal Travel Retail headquarters in Paris recently.

What follows is a refreshingly candid view of how current challenges within travel retail must be addressed and the opportunities that lie ahead if the industry is brave enough to reinvent itself {note this abbreviated version is a preview of the full interview, which will appear in The Moodie Davitt Magazine, to be published in print and digital format in coming days to coincide with TFWA World Exhibition in Cannes}.

When he took over as President of L’Oréal Travel Retail on 1 January, Emmanuel Goulin was returning to a channel at once familiar and yet profoundly changed from August 2021 when he departed his leadership of the company’s Asia Pacific travel retail business for a senior role (ultimately President) at L’Oréal Italy.

The pandemic is long since over but so – courtesy of official crackdowns in South Korea and Hainan – is the daigou-fuelled trading bonanza that characterised both key markets throughout the darkness of the COVID period.

The Chinese domestic market is soft as is Chinese travel-related spending at home (Hainan, Macau, Hong Kong) and abroad. To many, and certainly to this commentator, it feels like a watershed moment in travel retail’s long, complex and sometimes rollercoaster history.

But rollercoasters are there to be ridden and challenges to be met head-on and Goulin says he is enjoying every aspect of his new role. That sentiment is helped, he says, by the inherent closeness of what amounts to a vastly spread geographic community all bound by a single channel.

“Right away, when you step into this industry, it feels like home and like family,” he says as we chat over coffee at the L’Oréal Travel Retail Seine 62 headquarters.

“There are great vibes in this industry. Even when times are tough like now, you can feel it. So, it wasn’t difficult for me to return to this big TR family. For the first few months since my return I’ve been trying to assess the new post-COVID reality because when I left in 2021, we thought most of COVID was behind us in Asia, but it wasn’t.”

A clear wake-up call

“So, I’ve been to Asia three times in the first half of the year. I’ve also been to North America, South America, the Middle East, and travelled around Europe. It’s been an opportunity to see my teams, meet retailers and stakeholders, and try to get a fair assessment of the market reality after these years of being in Italy. The market has changed for sure. I’ve seen that while traffic has returned to pre-COVID levels, the market hasn’t fully recovered in value compared to pre-COVID.

“I’ve noticed a world split into two different realities: a booming Western world, especially Europe, and a struggling Asian world. Travellers have changed radically as well – becoming more gender-balanced and much younger. About 37% of travellers are Gen Z or Millennials, and they have very different expectations. I’ve observed the change of paradigm in Asia, with Korea’s decline and Hainan’s rise, and I’ve seen – for the first time – a decorrelation between traffic and business. For me, this is a clear wake-up call for the industry that it needs to change something.

“Historically, the business followed traffic trends, and then there was the COVID downturn. But now, despite traffic picking up, the business is struggling to catch up. This indicates that the industry needs to reboot the system and see things differently.”

Goulin’s point echoes that of Dubai Duty Free Managing Director Ramesh Cidambi in an interview earlier this year with me, who said that while 2024 passenger growth is highly impressive the gap with sales growth is widening. With its combination of scale – the world’s largest single airport duty-free operation – and diverse passenger profile, the fortunes of the acclaimed Middle East travel retailer therefore serve as a bellwether for the wider travel retail channel.

Cidambi’s message was clear. With the generational shift and widespread softness of consumer sentiment, a change of approach is needed or thechannel will fall further behind. “Totally. I agree. I went to see Ramesh because Dubai is an interesting case study and we had this discussion. I think we’re fully aligned,” Goulin responds.

“Yes, there’s this decorrelation between traffic and business, and there is a conversion issue. But, in a way, it’s good because it’s forcing everyone to talk about conversion rate. I’ve spent many years in this industry, and conversion used to be a taboo topic. Even getting data on real conversion rates and penetration – which are basic KPIs in any other industry – wasn’t really dealt with in travel retail.

“When we look at the data for beauty, we estimate the penetration to be around 25%, meaning the number of people entering the shop versus the total number of passengers in an airport. The conversion rate, which is the number of people buying out of the total 100% of passengers, is around 11% to 12%.

“So, there are two ways to look at it – the glass half-full or half-empty. We see that penetration is slightly increasing, which is good because it shows there are more walk-throughs and more efforts in terms of data to bring people in.

“But conversion is stable or slightly declining. If conversion is only 11% to 12%, it means 9 out of 10 people are not buying beauty products in an airport. So, there’s still a fantastic opportunity to grow the business if we can make our offer more attractive and capture people’s attention.”

Goulin is clearly a glass half-full man. So does he see his job as topping up the glass? “No, no. You’d be surprised,” he responds. “L’Oréal is the undisputed beauty leader worldwide, and we want to make our products available where consumers are in a way that is relevant for them.

“If tomorrow the industry is unable to upturn the situation and unable to turn the airport into a destination rather than just a walkthrough, where it becomes a place you rush through quickly to board your plane without buying or spending time, L’Oréal will always find other means to serve its consumers best.”

It’s a welcomingly candid reply, which he explains with a broader context. “My job is to create value for our consumers, therefore for the group. If it’s not done in travel retail, it will be done in other channels, and that’s fine. We had a discussion with my CEO and the Executive Committee two weeks ago precisely about that.

“I’m strongly convinced there is still a very bright future for the travel retail industry because all the fundamentals are there. By fundamentals, I mean two key things: the appetite for travel, which is here to stay, and the growth of international traffic. When you look at the number of passports being issued in some countries where it’s still very low – only 7% in India have a passport today – and the growth projections from aircraft makers and plans for construction and expansion of new airports, all of it is materialising towards the doubling of international traffic in the next 15 to 20 years.

“So, I see a fantastic opportunity for L’Oréal to showcase our brand and create a physical touchpoint in an environment that remains exceptional.

“That’s why I prefer to see the glass half-full because I believe there’s still a way to turn airports into destinations that are exciting for travellers, to the point that if we do things well, they will even anticipate their trip and plan to arrive at the airport early to enjoy everything it offers. That’s the glass half-full. I strongly believe that travel retail offers a fantastic opportunity.”

So what’s the glass half-empty scenario look like? “That’s where technology and smoother passenger experiences, like what you see in some airports with biometric recognition and luggage scanning, allow you to get through the airport in two minutes without stress. But there is nothing striking. You can head to the gate, wait for your plane with free wifi, and order on your app from your local market. That’s the glass half-empty.

“But I’m convinced that with so much being invested in the industry and with the traffic growth to come, it’s in everyone’s interest to work better together to create value. That’s the way I look at it, so I’m very confident.”

Managing the China dynamic

Key to L’Oréal’s ability to manage the much talked about reset of the North Asia travel retail market over the past couple of years has been the group’s approach to China. The appointment of Goulin’s well-regarded predecessor Vincent Boinay to President, L’Oreal North Asia and China CEO suggests a more holistic approach to the Chinese consumer, whether they are in China buying locally or cross-border; in duty-free within the Mainland, Hainan or abroad. So the Chinese consumer is viewed as one consumer rather than a channel-obsessed view.

“Absolutely, and I’ll give you two examples to illustrate that,” Goulin replies. “One, we created the CCCT [Chinese Consumption Conquest Team], a few years ago. This initiative was developed together with the head of China at the time when Vincent was still leading travel retail, and I was heading travel retail in Asia Pacific.

“The purpose was to monitor Chinese consumption as a whole, enabling us to make the right choices around the same table to create value – first and foremost for the consumer, and then for our group. This was innovative at the time and helped us a lot in making the right decisions and ensuring we create value within the Chinese ecosystem.

“The result is that our brands and group have never been stronger in China than they are today. For example, when you look at our market share in China, we’re now above 33% in luxury, which shows how we’ve reinforced our leadership through these difficult years.”

Another example is through data collaboration. L’Oréal Travel Retail and its local market equivalent initiated a partnership with China Duty Free Group in Hainan to collect consumer data from travelling shoppers.

“We then reuse this data in the China local market to retarget these consumers, providing them with a seamless, consolidated, and consistent experience wherever they shop,” Goulin explains.

“Today, we’re able to do this within the Chinese ecosystem, with Hainan being fully integrated into China, making it easier. This is a concrete example of how we’ve been working with Vincent and the China team.”

How does he view the fundamental shift in the structure of North Asia travel retail, one that has seen a rapid-fire lurch from an overwhelmingly daigou-driven Korean market and a heavily daigou-influenced Hainan one to a more normalised scenario driven by legislation?

“I think the whole idea of creating the CCCT a few years ago was to ensure we had a unified approach in tackling the Chinese ecosystem, creating synergies wherever possible,” Goulin replies. “After all, where do the products bought by the daigou end up? They end up in the secondary market in China.

“These platforms competed fiercely, offering high levels of promotions, which is now raising questions. For example, the results of the 6/18 event in China were not very good, indicating there’s a limit to how much recruitment you can achieve through price promotions.

“It’s a question for the entire Chinese ecosystem to consider: How do we maintain control and continue creating value in a market that still holds immense potential? The number of Chinese consumers who don’t yet have access to our brands is still huge, so there’s significant long-term growth potential.”

That is a discussion Goulin consistently has with retailers, one that goes beyond price, which he sees as only one component of the ecosystem. “The problem in the travel retail industry today, in my opinion, is that we remain very transactional,” he observes. “In many local markets, if retailers don’t reinvent their business models, they collapse because online pure players enter the market and disrupt everything.

“So, reinvention is crucial, and I believe we are at that point in travel retail, especially given the decorrelation we’ve discussed. This is the moment not to rely solely on price,” he says with heavy emphasis.

Leaving a legacy

Goulin is in full and fascinating flow, describing how he sees these moments as a time of great opportunity and responsibility for travel retail leaders. “I’m obsessed with what people will say in 10 or 15 years about how this generation of leaders tackled this opportunity – or didn’t,” he comments. “For me, this is both a responsibility and a challenge, and that’s what excites me about taking this role.”

He’s right of course. For there surely exists an opportunity to reinvent an industry that was created in 1947 and grew essentially through the ‘60s to the ‘80s on one main proposition – price. One that was about beating the taxman, and which benefitted from huge disparities between local and duty-free channels, allowing companies such as DFS to thrive due to the enormous savings for passengers (in that case from Japan).

Time for the Trinity to become a Pentarchy

But the industry and its contextual landscape have since transformed. Even when The Moodie Report (as it was then) was launched in 2002, the internet was still in its infancy. Price transparency as a result was opaque and therefore relatively hard for the travelling consumer to establish.

Today, the sight of consumers – particularly Chinese travellers – price comparing on their mobile phones while viewing products in-store has become ubiquitous. That might be good news from a consumer perspective but when a travel retailer is obliged to price below a certain number of airports – as is the case with Changi Airport, for example – and pay high rents, profitability is put under extreme pressure. Structurally, it seems something has to change, I suggest.

“I couldn’t agree more, Martin,” Goulin comments. “I think the solution lies in what the industry calls the pentarchy, which includes five key players: airlines, retailers, airports, brands, and what I would call the digital ecosystem that surrounds the industry.

“The capacity of this ecosystem to reimagine things and see how we can create value through data and reinventing outdated terms is crucial. This collaboration is key to reinventing and rebooting the travel retail industry to create value for the future. As you mentioned, we need to ensure that operators can not only make money in an airport but also invest what is needed to make the experience differentiating and exciting enough. For me, that’s the key.

“Because if we don’t do that, forget about turning the airport into a destination. We risk the airport becoming just a walkthrough or a museum, and that’s problematic. That’s why I’ve met with a lot of airports and airlines; I’m trying to understand the ecosystem because we need to first agree on the assessments we’re making.

“The numbers speak for themselves, and we need to see how we can reinvent a new future and new rules of the game. My role goes beyond just leading a group of brands. This is what’s at stake – the airport becoming a destination or a walkthrough.

“If it becomes a destination, the whole industry can create value. If it remains a walkthrough, retailers and brands might do experiential pop-ups, but the retailers will lose business, the airport will lose non-aeronautical revenues, the airlines will miss opportunities for a holistic travel experience, and the digital ecosystem won’t leverage the opportunities to create a more personalised and complete travel experience.

“So, maybe we need to rethink The Trinity Forum and rename it Pentarchy because I believe the carriers and the digital ecosystem also have a crucial role to play.”

There are, of course, other models in play. Joint ventures – as with Extime in Paris Extime (Lagardère Travel Retail and Groupe ADP); Frankfurt Airport Retail (Fraport and Gebr. Heinemann); and Lima Airport Retail (Lagardère Travel Retail and Lima Airport Partners) – represent one example. Dubai Duty Free, government-owned, another. Then there’s Qatar Duty Free, part of a different kind of Trinity with airport, retailer and airline all under common ownership (i.e. Qatar Airways).

From a brand perspective, does Goulin see a different result with such alternative models? Are such retailers more prepared to invest in consumer experience than those which must meet very strict guarantees and retail pricing demands from their landlords?

“Many of the examples you’re giving are recent, so we need a bit more time to assess them fully,” says Goulin. “However, the first few months are very promising, and I’m confident this will prove to be the right approach. For example, if you discussed Charles de Gaulle Terminal 1 with Dag [Rasmussen, Chairman and CEO of Lagardère Travel Retail – also interviewed in The Moodie Davitt Report Magazine], what they’ve done with Groupe ADP and Extime is very promising and interesting. The passenger traffic into the store in this terminal suggests that the model is working. The fact that they’ve been able to implement this in Paris shows that it’s feasible, even in a mature market.

“Another striking example is Kansai Airport, where they’ve broken the traditional mould, created a walkthrough, and mixed in interesting experiences, particularly with their food offerings. We’ll have to see if this delivers the desired results, but from what I hear, it’s promising.

“Is it due to the weak Yen or other factors? Time will tell. What they are doing in the Middle East, particularly in Qatar, is also very interesting. They’ve gone quite far in enhancing the experience. But being transit hubs also allows Dubai and Qatar to cater to people who have more time. Qatar offers exclusive food options, spas and services that take the experience to another level.”

The art of creating desire

A creative renaissance is required in travel retail, Goulin says, adding: “What we’ve identified as a way to grow the industry in the coming years is to provide experiences and products that create desire.

“Take travel retail-exclusive sets, for example. This is the most boring commercial offer I have ever seen. They’ve been the same for the last 20 years, not very giftable – they are transactional. We need to rethink the offer so that it’s more giftable, unique and differentiated, so the desirability is there and not just triggered by savings on the second product.

“For me, the model starts with rethinking the assortment we’re offering – the product offer, bringing in differentiation in terms of format, product, look and feel, storytelling. Then there’s the experience around it. We can leverage technology, like the new skin diagnosis tool by Kiehl’s that we presented at VivaTech, to help consumers in an environment that is dehydrating and where they need to take care of themselves. If you don’t drink enough or use the right products, the jetlag can be much worse.

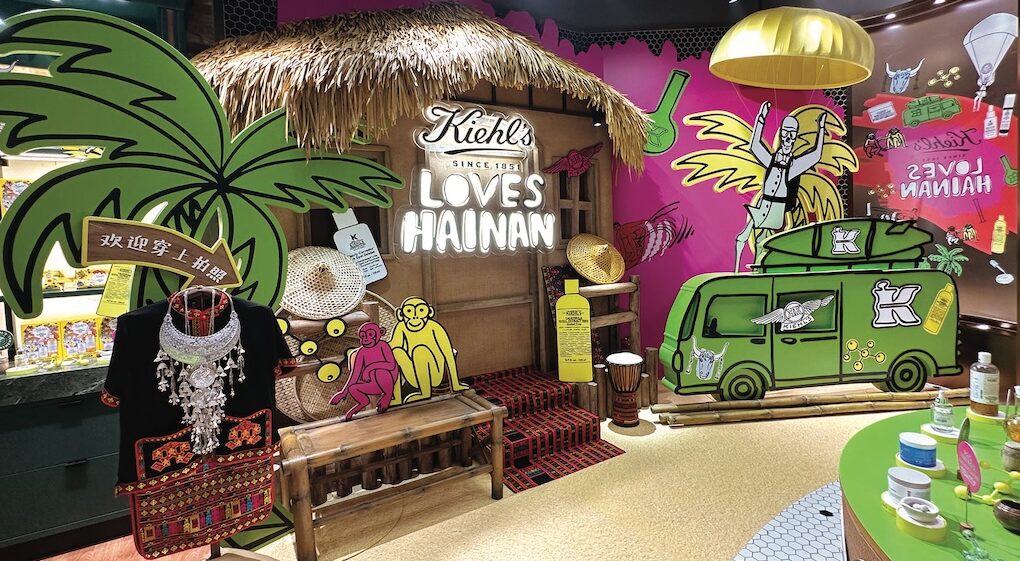

“After customs, the first thing people look for is a bottle of water. There’s a social need, and we need to explain and be more deductive to leverage technology to better serve those needs and bring unique experiences. We have many examples, like the modular [Maison Margiela] pop-up in Hainan that you covered, which was innovative and unique. The whole experience, from discovering the fragrance to the modular café, went beyond just the product.

“We need to work on the product offer, the technology, and the experience to improve the desirability of the beauty industry. It’s a collective effort. The more attractive my competitors are, the better, because we want to create value for the beauty industry overall.

“I’m confident that with the right portfolio of brands, we can draw people to our products. But it’s an industry-wide topic, and that’s why I use the travel retail set as an example. It’s a collective effort. After leaving travel retail and coming back, I realised that nothing had changed, and that’s something we need to address.”

Captive but not always captivated

“I think the industry used to assume we had control over consumers because they were coming to the airport, and since they were stuck, they would end up buying something. But that’s no longer true,” Goulin observes.

“Consumers today are younger, more connected, and more open to different offers. We need to convince them that the desirability of beauty products is strong in travel retail. When I returned to the industry, I initially thought the travel retail sector was lagging behind in digital advancements, especially compared to how local markets had accelerated. My initial reaction was to think about what we could do in terms of pre-ordering because, since the Koreans invented it 10 or 15 years ago, nothing much has changed.

“However, I now think differently. I believe the strength of our channel lies precisely in a world that is becoming more digital, where consumers are buying more of their beauty products online. In China, 60% of L’Oréal’s business is conducted online, and in some categories, like mass market, it’s even 80%. That’s the reality. In the USA, the level of digitalisation is also quite high.

“Therefore, I think travel retail offers a fantastic opportunity for brands to reconnect physically with consumers. We’re in a business where touch, feel, scent and conversation are essential, and there are limits to what online shopping can offer.

“For example, we still haven’t cracked the best online shopping experience for fragrances because it’s difficult to smell a fragrance through your computer screen. Travel retail, then, becomes an opportunity to go back to the fundamentals – offering physical experiences at the point-of-sale to consumers who might not get those in their local markets, where everything has gone digital. So, for me, it’s part of the reboot, bringing retail to the forefront again with a focus on good service and exciting experiences.”

Some of the fantastic activations that L’Oréal has created in Hainan are prime examples of such thinking at work. For decades, brands have talked about the ‘shop window’ role travel retail plays. But pre the digital era that shop window was only visible to the people who were passing through the airport. Now, thanks to digital amplification – and particularly livestreaming – the channel’s reach is often astounding, reaching millions of consumers in some cases.

Goulin concurs, noting that the group’s CCCT introduced a few years back was not only about pricing control but also about amplifying brand presence through giant pop-ups in Hainan, working with influencers, and generally amplifying its efforts in China.

“Digital technology is not in opposition to physical retail, it’s a business enabler. It helps us amplify what we do in-store,” he says. “For instance, AI tools such as Beauty Genius – the first AI all-in-one personal assistant that our CEO presented at CIS in Las Vegas – can complement the great retail experience we provide physically in travel retail.

“These tools can make our offerings relevant and personalised for every traveller, regardless of their. culture or nationality, and then we leverage digital tools to amplify that experience. This creates something unique and interesting for brands, retailers, and airports alike. It makes the airport a destination in itself, where something exciting is always happening, encouraging travellers to arrive earlier next time.”

Reinventing the future of travel retail

“Over the last decade, the focus has been a lot on Chinese shoppers in downtown areas, and we’ve lost sight of the fact that travel retail is fundamentally about the airport experience. I believe airports will regain a larger share of the business, unlike downtown areas which may face more challenges. So, we need to think about how to make the most of the airport environment, turning it into a place where travellers can have exciting and emotional experiences.

“It’s about going back to the fundamentals while also rebooting the system and challenging the status quo. There’s great energy in this industry, which you can feel when we all come together at events like Cannes. There’s a family spirit, and everyone is genuinely passionate. But are we addressing the right topics during these forums? Not really. We need to tackle the issues that matter and bring people together to reinvent the future of travel retail. It’s also about convincing our teams that just because COVID is over, we can’t go back to the pre-COVID way of working.

“We’ve been working on engaging our team with the concept of ‘creating beauty beyond boundaries’ for each traveller – encouraging them to stay open-minded, challenge the status quo, and think differently about the travel experience. We need to consider new markets such as India, which will be a huge growth opportunity given the rising middle class with an appetite for travel. New technologies will also change how people travel, from the aircraft they fly on to the airports they pass through.

“Our challenge is to bring all our creative ideas together to make the industry more attractive and to look beyond the next quarter. That’s why I’ve been talking not only to airports and airlines but also to leaders in other categories. We all recognise that while traffic is picking up, business is still struggling, so we need to differentiate ourselves.

“Why not explore cross-category partnerships, like selling a lipstick with a bottle of Champagne in a joint promotion? It’s time to redefine the boundaries of travel retail and think creatively. Let’s redefine the rules.”

It’s a bold message. And a refreshing one from a public company that has to deliver quarterly results.

“I have the luxury of being part of a group that gives me the freedom to think this way because the group is performing well,” Goulin notes. “It’s also essential to talk to airports, which are planning 10, 15, even 20 years ahead, and to aircraft manufacturers who are working on long-term projects. It shows that the fundamentals of the industry are strong, and now it’s up to us to bring the level of experience to where it needs to be.

“I’ve noticed that the food & beverage offerings at airports have improved significantly over the last decade, which is important because it directly affects how travellers choose to spend their time and money at the airport.

“Despite the challenges, they’ve managed to elevate the quality of their offerings, which is something we can learn from. Some industries have been more creative than the beauty industry in reinventing themselves – confectionery and alcohol, for example, have adapted to regulatory challenges and headwinds in inspiring ways. The beauty industry has done well, but perhaps we’ve wasted some time. However, it’s never too late to start, and I believe L’Oréal is in a unique position to lead the way in this.”

Leaving a legacy

Goulin is clearly very much relishing such challenges. Asked how he is enjoying being back in travel retail, he responds: “Very much. I love it. I like the energy of the channel. I like the fact that this moment is interesting and somehow unprecedented.

So, I feel thrilled and lucky to come into such a role at such a moment, where I consider the current situation is forcing us to act, to make bold decisions, to revisit the way we work – and for the benefit of all.

“I foresee a bright future for this industry, provided we can work well together. So, I find it extremely exciting, challenging and energising. I think making a difference is what is exciting as a leader – trying to see how you can leave your mark in a way that creates a clear before-and-after. That’s the way we look at it at L’Oréal. We’ve been in this industry for more than 40 years, and we plan to remain for many years to come and to keep growing with this industry.

“As one of the undisputed leaders of travel retail, we believe we have a role to play. The future of this industry is in our hands, and we must play our role. We do not do it alone. The challenge now is to ensure we can work collaboratively with all the key stakeholders, moving beyond basic transactional discussions to invent together a brighter future for the industry.

“Not many jobs offer this opportunity. So, yes, I feel blessed and thrilled to be back in this industry I love at a time when we can reinvent things. It’s fantastic. And it confirms that you never get bored in this industry. There’s always something happening.”

Gouline continues: “Let’s face it – the last four years have been difficult for the entire industry. It’s important to look forward and see how we can make a difference, invent a new future, and leave our mark on this industry.

“So that when people celebrate the 100th anniversary of the industry, they will look back at the year 2024 and say, ‘You know, these people, this company, made a difference. They made the right choices, and what they did left an important mark in the history of this industry.’ That’s what gets me excited when I come to the office in the morning.

“I couldn’t do a job sitting in front of a computer, not talking to anybody. I would be very sad, or not very good at it because I would get bored easily. I’ve had the chance to move between travel retail and other sectors in my career. All the people in this industry share a curiosity, and that’s also my point – how do we leverage this fundamental strength of the people in this industry to reinvent a new way of working, to harness this curiosity or emotion for the benefit of the business?

“If we do that, I think we can achieve great things. I’m convinced we will. But anyway, we will have fun trying. If we fail, we’ll learn from it. But what would be unacceptable is not to try.” ✈

Don’t miss it: Coming up in the extended Moodie Davitt Report Magazine interview

- Getting the balance right: “The group’s business has become even more balanced and stronger after COVID than before. This gives me the luxury to speak about the future without being too worried about the present.”

- Experience, sense of place, differentiation: “Yes, price is important, and we need to have a fair price, but not necessarily the best price. Experience, sense of place, differentiation – these are the areas where we need to make a difference, including in the Chinese ecosystem.”

- From transactional to experiential: “What really reassures me is that in every conversation I’ve had with stakeholders – whether they are retailers, airports or airlines – they’ve been focused on passenger needs and how to elevate the experience.“This focus on the consumer is the right direction because in every local market where businesses have reinvented themselves by centring on the consumer, it has always created value.”Has the Korean golden goose laid its final egg? “In recent years, the conversation in Korea has been dominated by daigou commissions and travel agencies, rather than on how to better serve travellers. First and foremost, I hope the focus will now shift back to the consumer and how to serve them better.“They saw a shortcut in Korea and took it, but now they realise it’s a dead end. They need to walk back and do what they knew how to do very well – bring back their capacity for innovation because the talent, energy and entrepreneurial spirit are all still there in Korea.”

- Turning transactions into emotions and experiences: “When people travel, they go through a rollercoaster of emotions – stress before customs, relief after, and then a sense of anticipation as they see their gate. That’s when they become ready to indulge themselves, and we need to offer them experiences that resonate emotionally.”

- On his leadership style: “I say what I do, and I do what I say. I also do things with my heart, with my convictions, staying true to myself and the values of our group.”

- Who has most inspired Emmanuel Goulin? That is a good question, Martin. I don’t have one specific person – I take inspiration wherever I can. It could be in sports, for instance. I like tennis, so I enjoy watching…” {look out for The Moodie Davitt Magazine to discover the answer} ✈