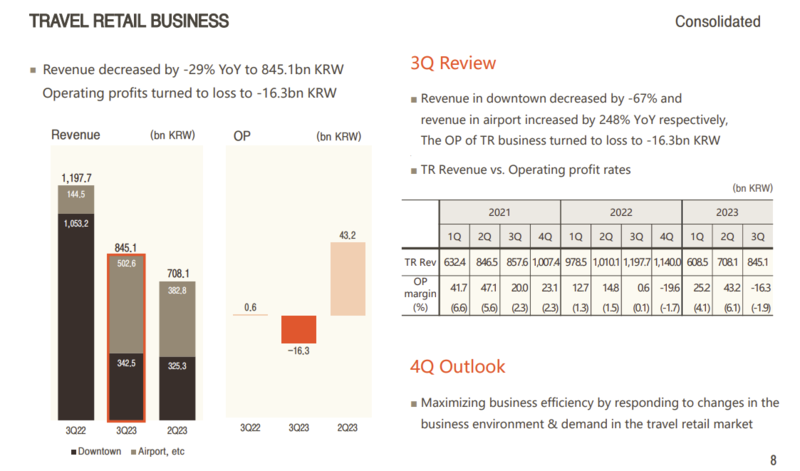

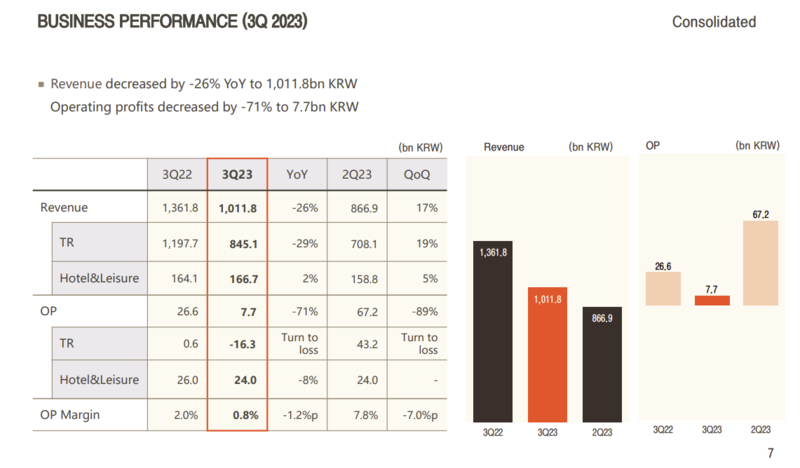

SOUTH KOREA. Hotel Shilla’s third-quarter travel retail revenues fell by -29% year-on-year to KRW845.1 billion (US$625.3 million) while operating profit plunged into a KRW16.3 billion (US$12.1 million) loss.

The news, announced late Friday, hit The Shilla Duty Free parent’s share price hard with the stock falling by -11.24% today to KRW60,800 by late afternoon.

Hana Securities Researcher Seo Hyun-jeong told online media Naver that structural problems in the duty free sector had driven the disappointing results.

Seo highlighted softening Chinese consumption at home; a decline in the daigou business that has long driven Korean travel retail; a declining preference for duty free shopping; and the strengthened competitiveness of local Chinese brands.

Naver reported that Korea Investment & Securities had lowered its target price for Hotel Shilla from KRW110,000 to KRW100,000. Researcher Kim Myeong-ju told the title, “The duty free sector was sluggish due to the [slow] processing of physical inventory.

“The rise in the Won-Dollar exchange rate damaged the cost ratio, and the increase in labour costs also had a negative impact on the duty free business.” ✈