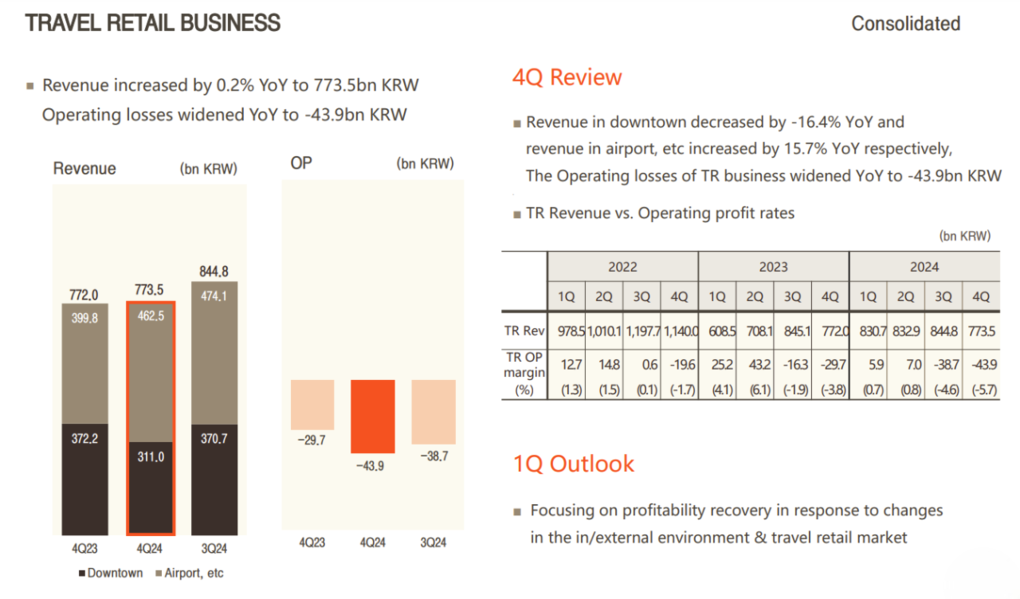

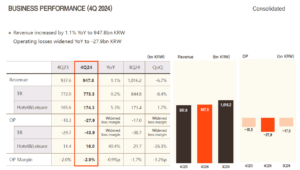

SOUTH KOREA. Hotel Shilla, parent company of The Shilla Duty Free posted a KRW43.9 billion (US$30.7 million) fourth-quarter travel retail operating loss as revenues edged ahead +0.2% year-on-year (down -8.4% quarter-on-quarter) to KRW773.5 billion (US$541 million).

The widening loss, up +47.8% year-on-year and +13.4% quarter-on-quarter, underlines the huge pressures facing The Shilla Duty Free and its Korean travel retail peers in the downtown sector.

There was a sharp contrast in performance by channel with downtown duty-free revenues decreasing -16.4% year-on-year

while airport sales increased +15.7%.

Looking ahead, Hotel Shilla maintained its 2024 mantra of focusing on profitability recovery to address the changes in the internal/external environment and travel retail market. ✈