The decision by LVMH Moët Hennessy Louis Vuitton to up its bid for high-end jeweller Tiffany from US$120 a share to $135 to seal the deal showed just how much the global luxury giant coveted the iconic US house.

The original bid at the end of October came at a time when Tiffany stock was trading at below US$100. The offer pushed the stock up to around US$125 where it has hovered throughout this month. Upping the bid by 15 cents over the weekend was a significant extra outlay for LVMH but did the trick in pushing the deal over the line.

And what of travel retail, an increasingly key channel for the French luxury goods powerhouse in recent years? Where once brands such as Louis Vuitton barely played in the market, now the glitterati of the LVMH luxury portfolio are to the fore in numerous airport and downtown duty free locations.

The market thought it was a good buy nonetheless – LVMH’s share price on Monday broke through the €400 barrier having started the year at €253.30.

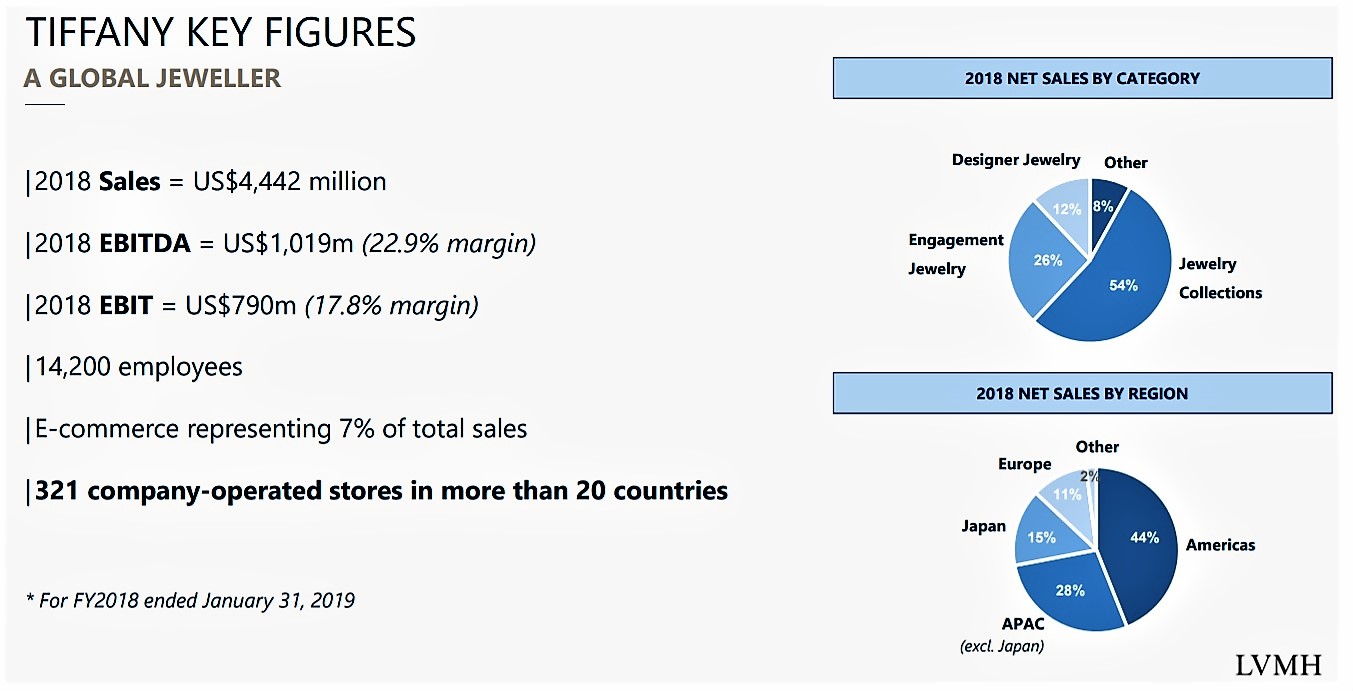

LVMH Chairman and CEO Bernard Arnault talked yesterday about “ensuring that Tiffany continues to thrive for centuries to come”. But well before that, once the deal closes in mid-2020, LVMH’s top line will start to get the direct benefit of Tiffany’s US$4.4 billion annual revenue pouring into its Watches & Jewelry division.

Into the ‘hard’ luxury big league

In 2018, that division – which includes high-end brands such as Bvlgari, Fred, Hublot, Tag Heuer and Zenith – generated the equivalent of US$4.7 billion (see Statista chart above) in sales. The arrival of Tiffany effectively doubles the division’s revenue and puts LVMH in the ‘hard’ luxury big league of watches and jewellery players – and up against houses like Richemont and, to some degree, Swatch Group.

Richemont – whose portfolio includes Cartier, IWC, Jaeger-LeCoultre, Panerai and Van Cleef & Arpels – generated watches and jewellery sales of around €10 billion (US$11 billion) in FY2019. Swatch posted sales of CHF8.2 billion (US$8.2 billion) in 2018. The company does not break down its volume and high-end sales but it noted that “the strongest growth was realised by the prestige and luxury range, particularly by the brands Blancpain, Omega and Longines”.

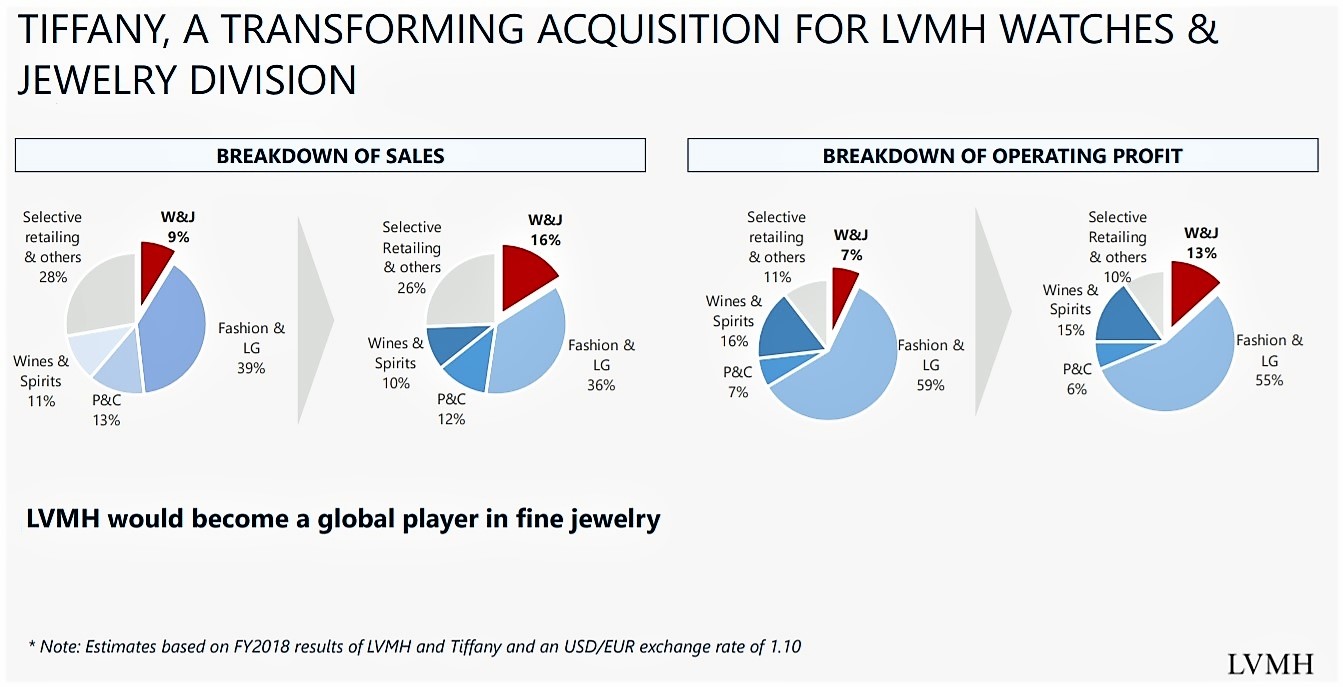

LVMH already has a powerful position in the ‘soft’ luxury segments of leathergoods, fashion and accessories with global brands such as Christian Dior, Fendi, Louis Vuitton and Marc Jacobs. Bolstering its previously smallest division of jewellery and watches with Tiffany will create a more balanced portfolio.

Fashion and leathergoods will drop from a 39% to 36% share, while watches and jewellery will climb from 9% to 16% (see chart below). This rebalancing also means that watches and jewellery will leapfrog both the beauty and wine and spirits businesses of LVMH.

The French conglomerate can also take comfort from being less exposed to fashion and leathergoods from a profit perspective. The division accounts for almost 60% of LVMH’s operating profit, but with Tiffany onboard that will drop to 55% while watches and jewellery will increase from 7% to 13%.

A win in the Americas

Geographically, LVMH will also gain. The lion’s share of Tiffany’s sales are in the Americas (44%), and another 28% in Asia Pacific (excluding Japan) where foreign tourists and wholesale (reseller) travel retail sales in Korea led strong growth of +13% last year. Japan added another 15%.

Meanwhile, LVMH generated just 24% of sales in the US in 2018, 29% in Asia Pacific (excluding Japan) and 7% in Japan. Tiffany therefore bulks up LVMH significantly in both the US market and Japan while Tiffany may get better access to European markets, where LVMH has historical strength.

And what of travel retail, an increasingly key channel for the French luxury goods powerhouse in recent years? Where once brands such as Louis Vuitton barely played in the market, now the glitterati of the LVMH luxury portfolio are to the fore in numerous airport and downtown duty free locations. Louis Vuitton just opened in the domestic zone in the new Beijing Daxing International Airport, while it will soon also open at Hong Kong International Airport to complement other airport stores at Changi, Heathrow, Incheon, Istanbul and Paris Charles de Gaulle.

Tiffany enjoys a strong presence in travel retail both as a stand-alone brand and through retailers such as the LVMH-led DFS Group. That presence seems sure to be strengthened as LVMH builds its strength in a channel earmarked at the highest level internally as a priority for the future.

Going strong on Globuy

As a lead business partner of The Moodie Davitt Report, Tiffany’s story will also appear in coming days in Chinese and with a consumer voice on fast-growing Chinese B2C WeChat social media account Globuy [玩转全球免税], as part of a new collaboration between Globuy owner Extra-Aile Media in Shanghai and The Moodie Davitt Report. Globuy aims to become “the KOL of Chinese travel retail” and already has 400,000 followers and a monthly audience of 1 million views for its WeChat social media platform promoting new launches, product availability, promotions and special offers. Underlining the strong affinity and complementary nature of the two companies’ work, Globuy has dubbed The Moodie Davitt Report “the KOL of travel retail B2B media” Under the agreement, selected stories from The Moodie Davitt Report.com’s lead brand partners in beauty, fashion, luxury, confectionery and premium spirits are also published by Globuy in Chinese. These include product reviews by the Globuy team. Globuy is promoting The Moodie Davitt Report’s platform to China’s travel retail sector and to its own consumer audience in China. The Moodie Davitt Report subsequently also publishes a curated selection of Chinese consumer feedback on the chosen stories and will reveal the results of regular consumer surveys conducted in association with Globuy. |