Strong double-digit travel retail sales growth contributed to a robust quarter ended 30 June for The Estée Lauder Companies, and to a healthy full-year performance for the US beauty house.

Strong double-digit travel retail sales growth contributed to a robust quarter ended 30 June for The Estée Lauder Companies, and to a healthy full-year performance for the US beauty house.

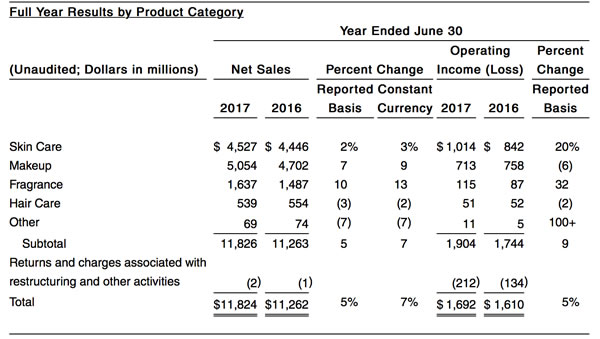

For the year, the company achieved net sales of US$11.82 billion, up +5% year-on-year. Net earnings for the same period were US$1.25 billion, a +12% increase.

For the three months ended 30 June 2017, the company reported net sales of US$2.89 billion, up +9% compared to the previous year, posting sales gains in all geographic regions and product categories, except haircare.

The company noted: “Fourth quarter sales benefitted from innovative new products and double-digit growth in several developed and emerging markets, particularly China. The company also generated double-digit gains in its travel retail, online and specialty-multi channels.” Net earnings for the quarter were US$229 million, compared with US$94 million last year.

President and CEO Fabrizio Freda said: “Throughout the fiscal year, our momentum accelerated, culminating in an outstanding fourth quarter performance that completed another year of strong net sales and earnings per share growth. These results reflect our success in pivoting our business to the fastest-growing areas of prestige beauty to align with consumers’ changing shopping preferences. With our leading brands, quality innovations and the acquisition of two make-up brands, we attracted new consumers globally.

“Our business accelerated in our online direct-to-consumer and retailer e-commerce sites, as well as in the travel retail and specialty-multi channels, and we built momentum in key geographies, like China and Italy, aided by enhanced digital and social media communications. Additionally, we began to further improve our organisational efficiency and effectiveness through our Leading Beauty Forward initiative. Importantly, we delivered this performance in the face of external global volatility and one of the biggest moments of change in our industry.”

Looking to the 2018 financial year, Freda added: “We expect the great momentum we built throughout the past year to continue in fiscal 2018. We are well-positioned to deliver strong profitable growth as we deploy our prestige brand portfolio to new consumers globally through our hero product franchises and robust new product pipeline, new digital-first marketing approach, and focused expansion for our smaller to mid-sized brands.

“In our 2018 fiscal year, we expect to see initial net benefits from our Leading Beauty Forward initiative and we will continue to focus on increasing the efficiency of our operations, eliminating non-value-added costs and generating sales leverage, while strategically reinvesting to support strong and sustainable growth. Our full-year outlook in constant currency reflects net sales growth of 7% to 8%, including incremental sales from our fiscal 2017 acquisitions, and 9% to 11% earnings per share growth. Looking out over the next three years, we continue to target constant currency net sales growth of 6% to 8% and double-digit EPS growth.”

Net sales and operating income in the each of the company’s product categories were impacted by the strength of the US Dollar in relation to most currencies.

Category performance

Skincare

• Net sales increased, with strong double-digit gains from La Mer, driven by the success of new and existing products, as well as targeted expanded consumer reach.

• The Estée Lauder brand delivered solid sales growth, primarily in travel retail and China, due, in part, to gains in the Advanced Night Repair and Revitalizing Supreme franchises. ‘Outstanding’ double-digit sales growth from GLAMGLOW reflected additional product assortments and targeted expanded consumer reach.

• Several other brands, including Bobbi Brown, Origins and Aveda, each posted solid gains. These increases were partially offset by lower skin care sales from Clinique.

• Operating income increased sharply, primarily from La Mer and Estée Lauder, reflecting higher sales. Estée Lauder also benefitted from a favourable comparison to higher spending behind launches in the prior-year period. Despite lower sales, Clinique had higher operating income, reflecting disciplined expense management.

Make-up

• Make-up sales increased, primarily driven by incremental sales from the company’s fiscal 2017 second quarter acquisitions of Too Faced and BECCA, ‘exceptionally’ strong double-digit increases from Tom Ford in every region, and double-digit gains from Smashbox, La Mer and Estée Lauder.

• The increased sales from Tom Ford were driven primarily by its lip colour franchises, including new product offerings, such as the Tom Ford Soleil Color Collection. Sales gains at Smashbox reflect the strength of the make-up category in specialty-multi. La Mer’s sales increase reflected the continued success of the SkinColor Collection. At Estée Lauder, higher sales were fueled by the Double Wear and Pure Color product lines.

• The overall increase in make-up sales also resulted from MAC growth internationally, as well as brands’ expansion in specialty-multi to reach new consumers.

• These increases were partially offset by lower make-up sales in the USA, primarily from Clinique and MAC, due to slow foot traffic in some US brick-and-mortar department and freestanding stores.

• Make-up operating income declined, due to transaction costs related to the company’s 2017 acquisitions. Strong growth from Tom Ford and Estée Lauder, primarily due to higher sales, were offset by declines from Clinique and MAC, mainly reflecting their lower sales in the USA.

Fragrance

• Net sales increased, primarily due to strong double-digit gains from luxury brands Jo Malone London, Tom Ford and Le Labo, and incremental sales from the recent acquisition of By Kilian.

• Jo Malone delivered ‘outstanding’ double-digit sales increases in every region, reflecting strong growth from existing fragrances, brand expansion and the recent launch of Basil & Neroli.

• Increased sales from Tom Ford partly reflected the continued success and growth of existing fragrances, as well as new product launches.

• Le Labo benefitted from growth in existing products and new launches and targeted expanded consumer reach.

• Fragrance operating income increased sharply, reflecting higher sales from Jo Malone, as well as disciplined expense management in certain designer fragrances.

Haircare

• Haircare sales decreased slightly, primarily due to a difficult comparison with several product launches in the prior year.

• Haircare operating income decreased slightly, reflecting the lower sales, partially offset by effective expense management.

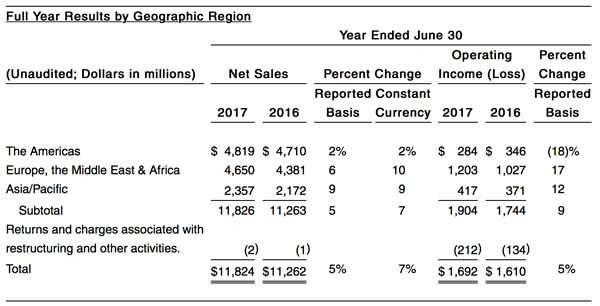

Performance by region

The Americas

• Sales in North America benefitted from incremental sales from the recent acquisitions of Too Faced, BECCA and By Kilian.

• Many of the company’s brands generated sales growth, led by double-digit gains from Tom Ford, Smashbox and Jo Malone, and strong gains from La Mer.

• Sales in the company’s online and specialty-multi channels grew strong double digits.

• The growth in these areas was partially offset by sales decreases, caused by the decline in retail traffic in some US brick-and-mortar department and freestanding stores. A decrease in tourist spending also adversely affected sales in certain US MAC stores.

• Sales in Canada were flat for the year, while sales in Latin America increased by double-digits.

• Operating income in the Americas decreased, reflecting lower sales of MAC. Partially offsetting this decrease was the favourable year-over-year net impact of the changes in fair value of contingent consideration and the impairment of goodwill and other intangible assets, as well as disciplined expense management in certain heritage brands.

Europe, the Middle East & Africa

• As reported, most markets recorded sales growth, with many posting double-digit increases, led by Russia, Italy, the Balkans, Israel and India.

• Foreign currency translation reduced reported sales by -4%, with the largest impact from the deterioration of the Pound Sterling.

• In constant currency, sales in the region grew solid double-digits, with virtually all countries generating sales gains. Double-digit growth was posted in several markets, including Italy, Russia, the Balkans, Central Europe, and India, as well as strong growth in the UK and Germany.

• In travel retail, ‘exceptionally’ strong double-digit sales growth was generated across most brands, led by Tom Ford, Jo Malone, La Mer, MAC, and strong gains from Estée Lauder. Growth in global airline passenger traffic, solid new launch initiatives, and targeted expanded consumer reach contributed sharply to the sales gains, said the company.

• In constant currency, lower sales were posted in the Middle East, driven by retailer inventory rebalancing, reflecting the impact of the macro-environment on consumer purchases.

• Operating income increased, led by strong double-digit operating results in travel retail and Switzerland and solid gains in the UK. The higher results were partially offset by lower results in the Middle East, France and Turkey.

Asia Pacific

• All markets recorded growth, except Hong Kong. On a reported basis and in constant currency, sales increased, led by strong double-digit growth in China.

• The higher sales in China reflected strong double-digit gains in most brands. Estée Lauder, La Mer and MAC contributed sharply to the sales growth. Sales benefitted from targeted expanded consumer reach and reflected double-digit online sales growth in every brand, including the launch of MAC on Tmall in China. Sales in department stores posted strong gains, while freestanding stores generated double-digit growth.

• Strong sales growth was generated in Japan, Korea and Taiwan. The company’s business in Hong Kong continues to stabilise and returned to growth in the fourth quarter.

• Sales in the region grew strong double-digits in Tom Ford, Jo Malone, La Mer and MAC.

• In Asia/Pacific, operating income increased, primarily due to higher results in China, Japan, Korea and Taiwan driven by higher sales. Operating results were lower in Hong Kong and Indonesia.