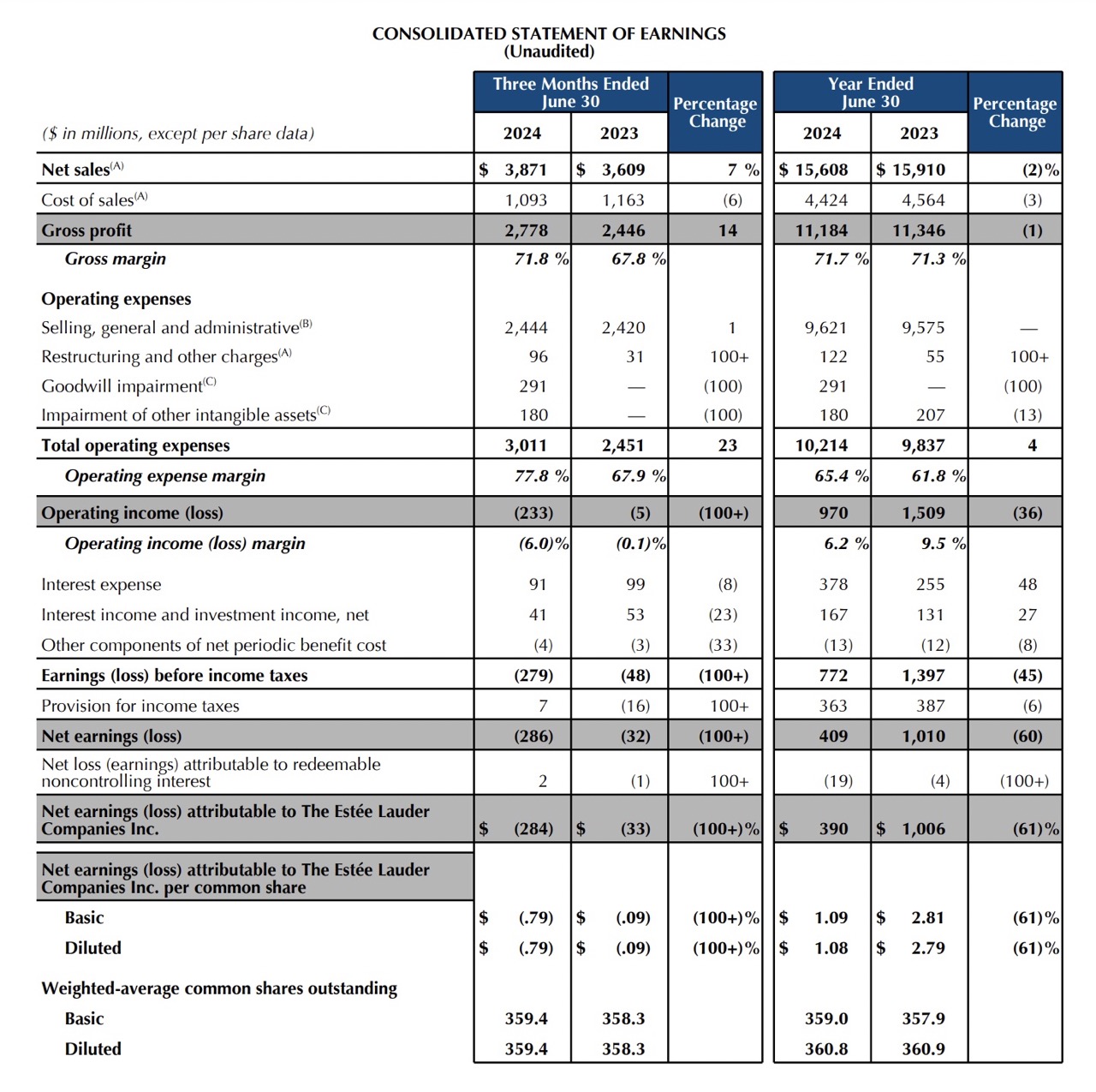

The Estée Lauder Companies today posted a -2% year-on-year decline in organic net sales to US$15.61 billion for its fiscal year ended 30 June.

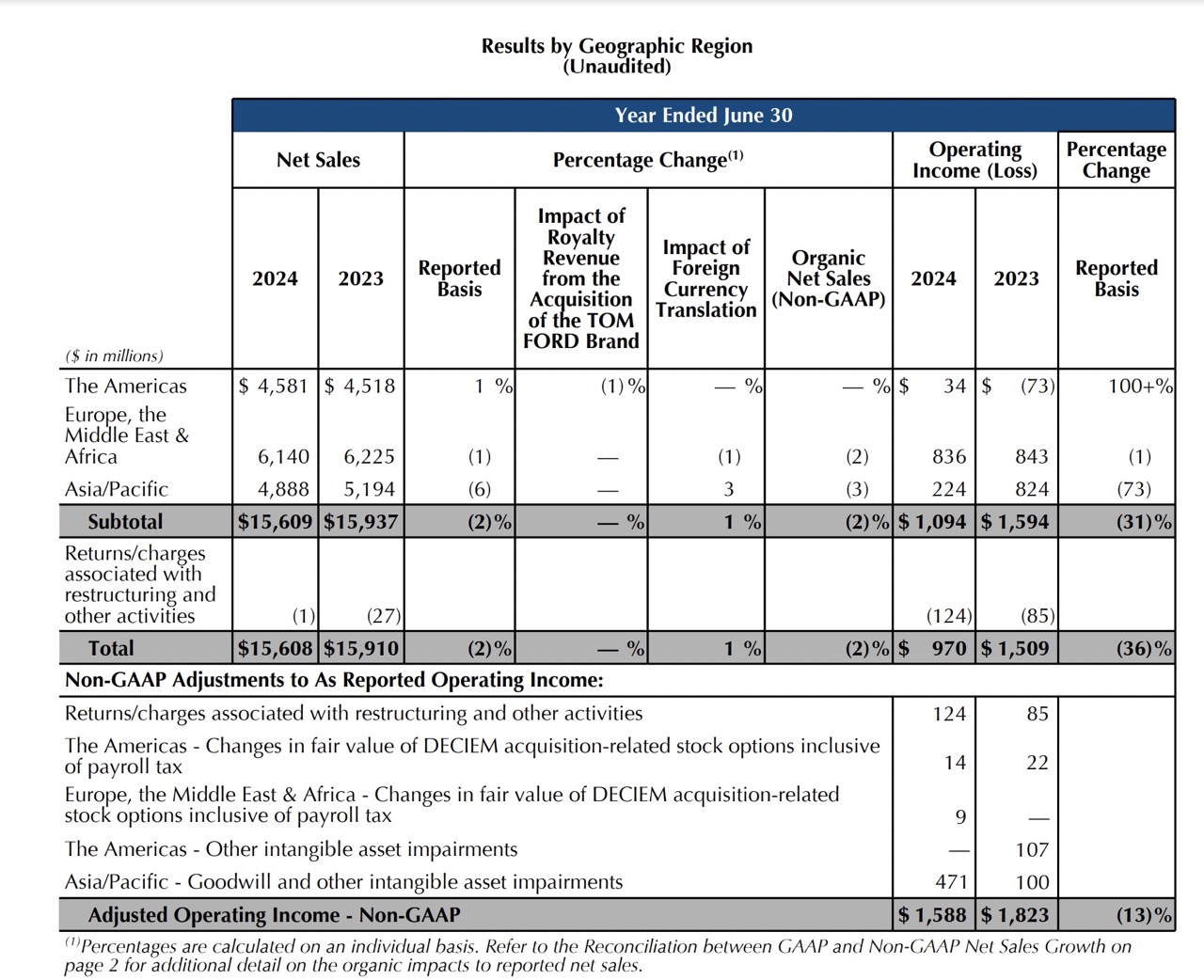

The decrease primarily reflected ongoing softness in overall prestige beauty in Mainland China and a decline in Asia travel retail.

The latter was driven by a decrease in the first half of fiscal 2024, which reflected actions taken by the group and its retailers to reset inventory levels [mainly in Hainan -Ed] as well as lower conversion.

Those declines were partially offset by growth in Hong Kong SAR, Europe, the Middle East & Africa, Japan and Latin America.

The group reported net earnings of US$0.39 billion, down -61.4% year-on-year.

For Q4, net sales rose +7% to US$3.87 billion.

President and CEO Fabrizio Freda, whose departure at the end of fiscal 2025 was also announced today, said: “In fiscal 2024’s fourth quarter, we achieved our organic sales outlook and exceeded expectations for profitability, closing a difficult year. Organic sales and adjusted EPS returned to growth in the second half.

“For fiscal 2025, we anticipate continued declines in the prestige beauty segment in China, mainly reflecting persistent weak sentiment among Chinese consumers.

“We intend to drive share gains in a market that continues to hold strong long-term promise. In the rest of our business, we are planning to deliver improved performance across both developed and emerging markets.

“To fuel this, our priorities are reigniting skincare, capitalising on the multiple growth drivers of high-end fragrance, moving faster in leveraging winning channels, launching accretive innovation inclusive of new, big opportunities, and enhancing our precision marketing capabilities.

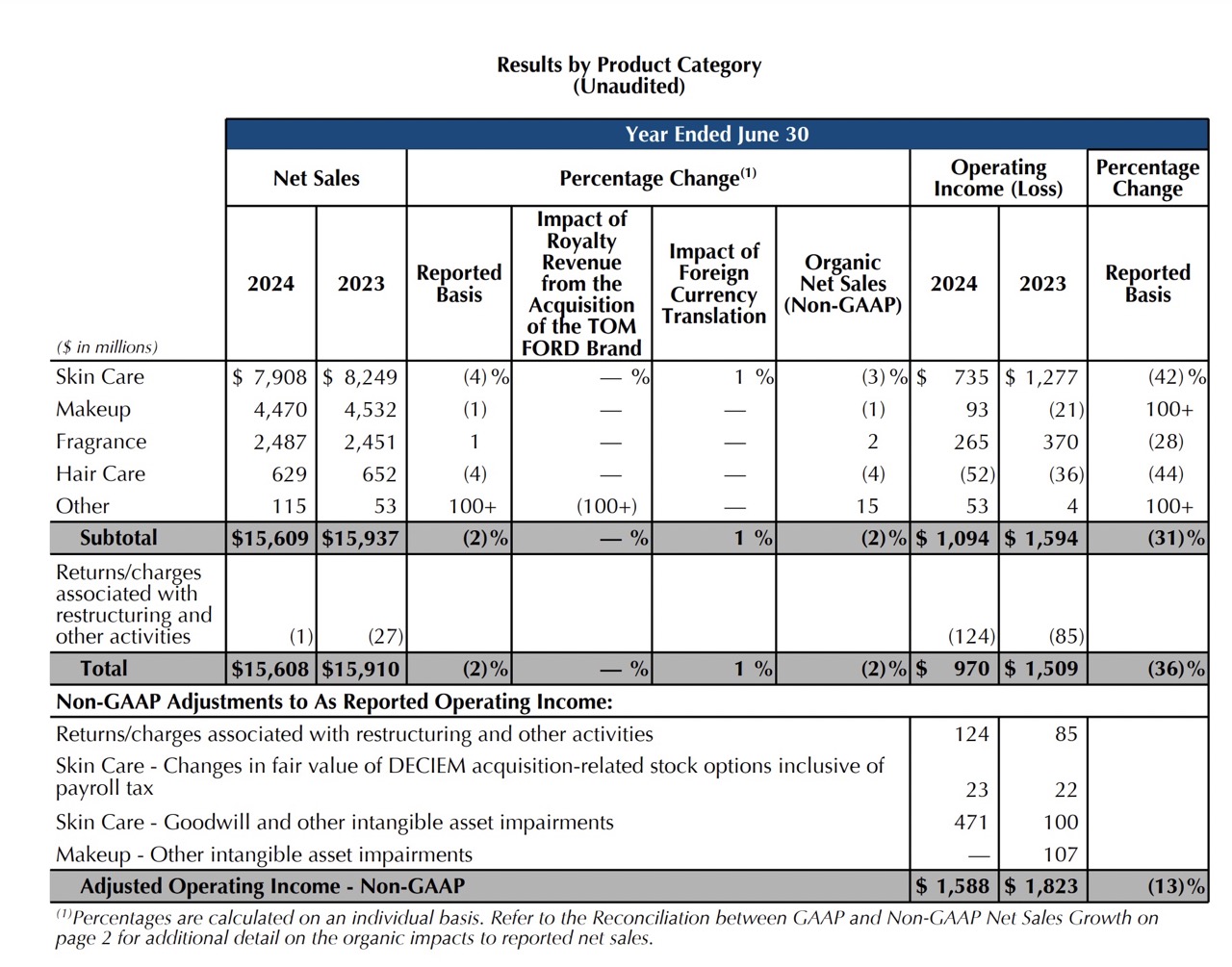

Travel retail reset takes a tollSkincare net sales declined in Asia travel retail driven by the decrease in the first half of fiscal 2024, reflecting actions taken by the company and its retailers to reset inventory levels. This was in part in response to changes in government policies that began in the second half of fiscal 2023, as well as lower conversion. Net sales from Estée Lauder, Clinique and Dr.Jart+ declined, primarily due to continued challenges in Mainland China and Asia travel retail. Makeup net sales decreased -1%, primarily driven by the company’s global travel retail business and a benefit in the prior year as a result of changes to M·A·C’s take-back loyalty programme. Net sales from La Mer declined, reflecting the impact of rationalising product assortment in the company’s global travel retail business. Estée Lauder’s net sales declined, partly reflecting pressure in the Asia travel retail business that led to lower shipments for replenishment orders. |

“From La Mer’s entry into night-specific consumption, to The Ordinary’s expansion into new markets and more brands debuting in new channels, like on Amazon’s US Premium Beauty store, we have a rich slate of initiatives to drive new consumer acquisition and continue to leverage our strength in retention.

“Alongside this work, we are realising initial benefits of the Profit Recovery and Growth Plan as we right size our cost structure and simplify the organisation to be more agile and faster to market.

“For fiscal 2025, the Profit Recovery and Growth Plan enables us to offset the pressure to profitability driven by the prestige beauty segment’s ongoing softness in China, yielding a more moderate pace of operating margin expansion than we’d previously expected.

“While our sales and profit outlook for fiscal 2025 is disappointing, this year we will make important strides, as we implement our strategy reset to continue rebalancing regional growth, deliver improved annual profitability, and strengthen go-to-market and innovation capabilities to elevate our execution in response to a more competitive market.

“These efforts, coupled with the strengths of our brands, product portfolio, and talented teams around the world, will position us to both outperform prestige beauty in fiscal 2026 and accelerate profitability expansion.”

We will bring you further details and comment after today’s earnings call. ✈

As reported, Freda has informed the Board of Directors of his intention to retire at the end of fiscal year 2025.

The Board said it is well advanced in its long-established CEO succession planning process, through which it has considered many highly qualified internal and external candidates.

Until his successor is appointed, Freda will continue to lead and oversee the group’s strategic, financial and investment priorities, including the Profit Recovery and Growth Plan and its efforts to reignite profitability and growth.