The Estée Lauder Companies today reported “outstanding results” for the quarter to 31 December, 2018, with travel retail a key contributor, notably in Europe, Middle East and Africa.

However, it warned that geopolitical and economic risks could affect performance in coming quarters. In its outlook for the period ahead, it noted the following risks:

*Future moderation of net sales growth in China and travel retail, “which we have not experienced to date, to reflect current geopolitical and economic risks”.

*Impact of the planned tariff increase in China in March.

*Announced closings of certain department store locations in the US and UK.

*Some costs associated with the upcoming anticipated Brexit in the UK.

STRONG Q2 PERFORMANCE

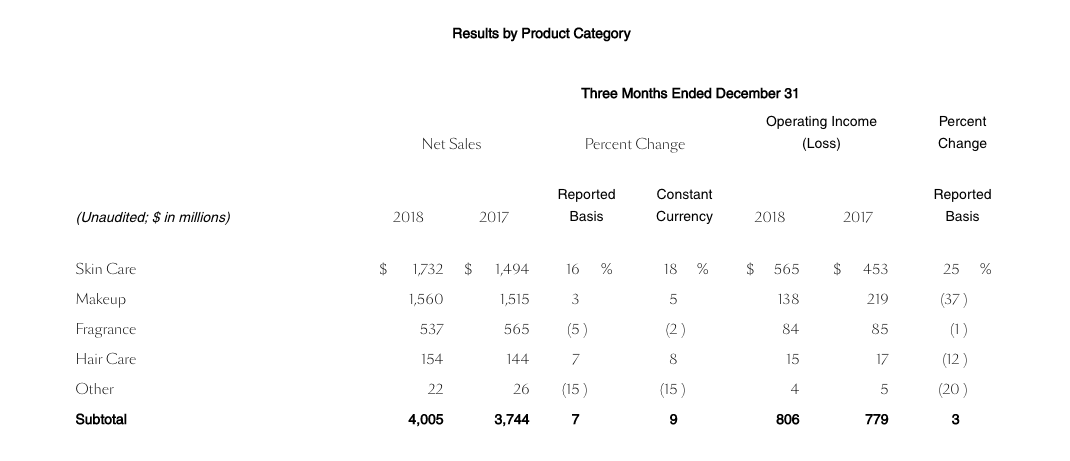

The company’s quarterly net sales exceeded US$4 billion for the first time and increased by 7% year-on-year. This included growth in nearly all product categories, geographic regions and channels. Excluding the impact of currency translation and the adoption of a new revenue recognition accounting standard (ASC 606), net sales increased by 11%.

President and Chief Executive Officer Fabrizio Freda said: “Our strongest growth engines this quarter included the skincare category globally, the Asia Pacific region, the online and travel retail channels, and most brands, including Estée Lauder, La Mer, M•A•C and our artisanal fragrance brands.”

By region, Estée Lauder singled out travel retail’s performance in Europe, Middle East and Africa. It noted: “In travel retail, strong double-digit net sales growth was broad-based across brands, led by Estée Lauder, La Mer, M•A•C, Tom Ford and Origins. Growth was also realised across many geographies and reflected increases in international passenger traffic, improved conversion, successful innovation and expanded targeted consumer reach.”

Within this region, the adoption of ASC 606 and unfavourable currency translation (related to the strong US Dollar) dragged on growth in net sales and operating income. Both however were boosted by travel retail, with operating income rising by double digits in the channel, though offset by lower results in the UK, which the company said was partly attributable to “consumer confidence ahead of Brexit”.

In Asia Pacific, the company delivered another quarter of strong double-digit net sales increases, both on a reported basis and in constant currency.

The growth was broad-based, with nearly half of the markets in the region growing double digits. China, Hong Kong and Japan continued to deliver strong growth, and Korea net sales accelerated. Prestige beauty in China accelerated and the company said that it continued to build share.

In the Americas, net sales declined 3%, excluding the impacts from the adoption of ASC 606 and currency translation. Against this, net sales grew double-digits in online and single digits in specialty-multi in North America.

Q2 PERFORMANCE BY CATEGORY

Skincare

*The adoption of ASC 606 reduced reported net sales growth by 3%, and reduced operating income growth by 7%.

*Skin care net sales grew across most geographies, channels and brands, particularly Estée Lauder, La Mer and Origins. Clinique’s skin care net sales also grew globally in constant currency.

*The Estée Lauder brand delivered net sales growth in every region and most channels. The double-digit increase reflected strength in its existing product franchises, supported by innovation such as Advanced Night Repair Eye Supercharged Complex.

*Double-digit growth at La Mer was also broad-based, with net sales increasing across regions and channels, driven by higher net sales of existing products. Additionally, incremental net sales from new product launches, including The Treatment Lotion Hydrating Mask and The Luminous Lifting Cushion Foundation also contributed.

*Operating income increased sharply, reflecting higher net sales, primarily at Estée Lauder and La Mer.

Makeup

*The adoption of ASC 606 reduced reported net sales growth by 1%, and reduced operating income growth by 8%.

*Growth in makeup was primarily driven by strong increases from Estée Lauder, M•A•C, Tom Ford Beauty and BECCA. These increases were partially offset by lower net sales from Clinique and Smashbox.

*Estée Lauder generated solid double-digit growth, driven by strength from its Double Wear line of products.

*M•A•C’s strong performance was led by double-digit growth across Asia/Pacific, the Middle East, including Turkey and Italy.

*Net sales from Tom Ford Beauty increased double-digits, primarily driven by its lip colour and eye shadow franchises.

*BECCA’s growth was largely driven by the BFF Collection and the Ultimate Lipstick Love new product launches.

*Makeup operating income declined, reflecting planned investments at Too Faced to support new and existing products, as well as international expansion. Lower makeup net sales from Clinique and Smashbox also contributed to the decline, as did US$38 million of goodwill and other intangible asset impairments related to Smashbox. This decline was partially offset by increases at Estée Lauder, Tom Ford Beauty and M•A•C, primarily due to higher net sales.

Fragrance

*The adoption of ASC 606 reduced reported net sales growth by 2%, and reduced operating income by 5%.

*The net sales decrease reflected a change in promotional strategy for the holidays by Estée Lauder and lower net sales of certain designer fragrances. The decreases were mostly offset by growth from luxury and artisanal fragrances, including Jo Malone London, Le Labo, Tom Ford Beauty and By Kilian.

*Jo Malone London’s net sales increase primarily reflected the launch of holiday collections and expanded targeted consumer reach.

*Increased net sales from Le Labo, Tom Ford Beauty and By Kilian reflected expanded targeted consumer reach and new product launches.

*Fragrance operating income declined in line with net sales.

Haircare

*Hair care net sales increased, primarily reflecting higher net sales from Aveda, due to continued growth from recent launches and online.

*Hair care operating income declined, as higher net sales from Aveda were offset by strategic advertising investments to support product launches, digital outreach and the brand’s innovative social media and digital campaign activity.

“Despite a volatile and challenging backdrop, we are optimistic about our company’s long-term outlook. We are very well-positioned to build share in global prestige beauty.”

Freda said: “This was our eighth consecutive quarter of impressive net sales growth that met or exceeded our long-term goal, all while navigating many global macro issues. Our sustained progress is the result of our multiple engines of growth strategy, and demonstrates our agility in moving resources to the best global opportunities.

“Our earnings per share in the second quarter grew more than twice the rate of net sales in constant currency, delivering an impressive first-half performance. With confidence in our continued ability to execute effectively and grow share in prestige beauty, while simultaneously making strategic investments in our business, we are raising our net sales and EPS guidance for the year.

He added: “Despite a volatile and challenging backdrop, we are optimistic about our company’s long-term outlook. We are very well-positioned to build share in global prestige beauty. Leveraging savings generated by our Leading Beauty Forward initiative, we plan to increase our investments during the next six months behind our successful innovations, high-quality products, compelling digital advertising and effective commercial execution, while also enhancing our capabilities to strengthen our industry leadership and deliver long-term profitable growth.”

For the six months ended 31 December 31, the company reported net sales of US$7.53 billion, a 7% increase compared year-on-year. Net earnings were US$1.07 billion, compared to US$550 million a year earlier.

The company said it continues to see “strong consumer demand” and expects to continue to deliver growth at the high end of its long-term net sales and earnings per share growth targets.

It noted: “We continue to expect global prestige beauty to grow 5% to 6% during the fiscal year. However, the company is mindful of risks related to social and political issues, including the government shutdown in the US, geopolitical tensions, regulatory matters, global security issues, currency volatility and economic challenges that could affect consumer spending in certain countries and travel corridors.”