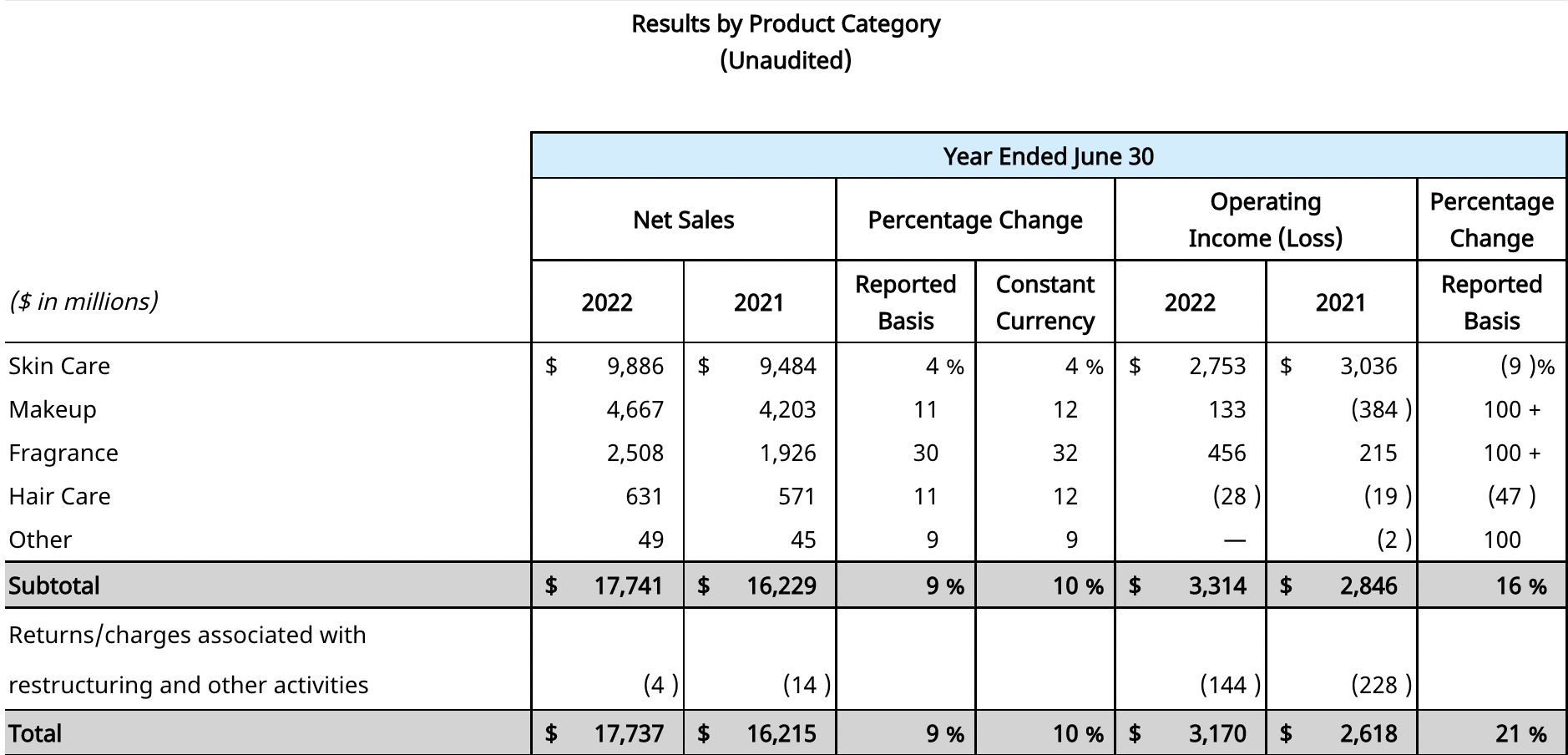

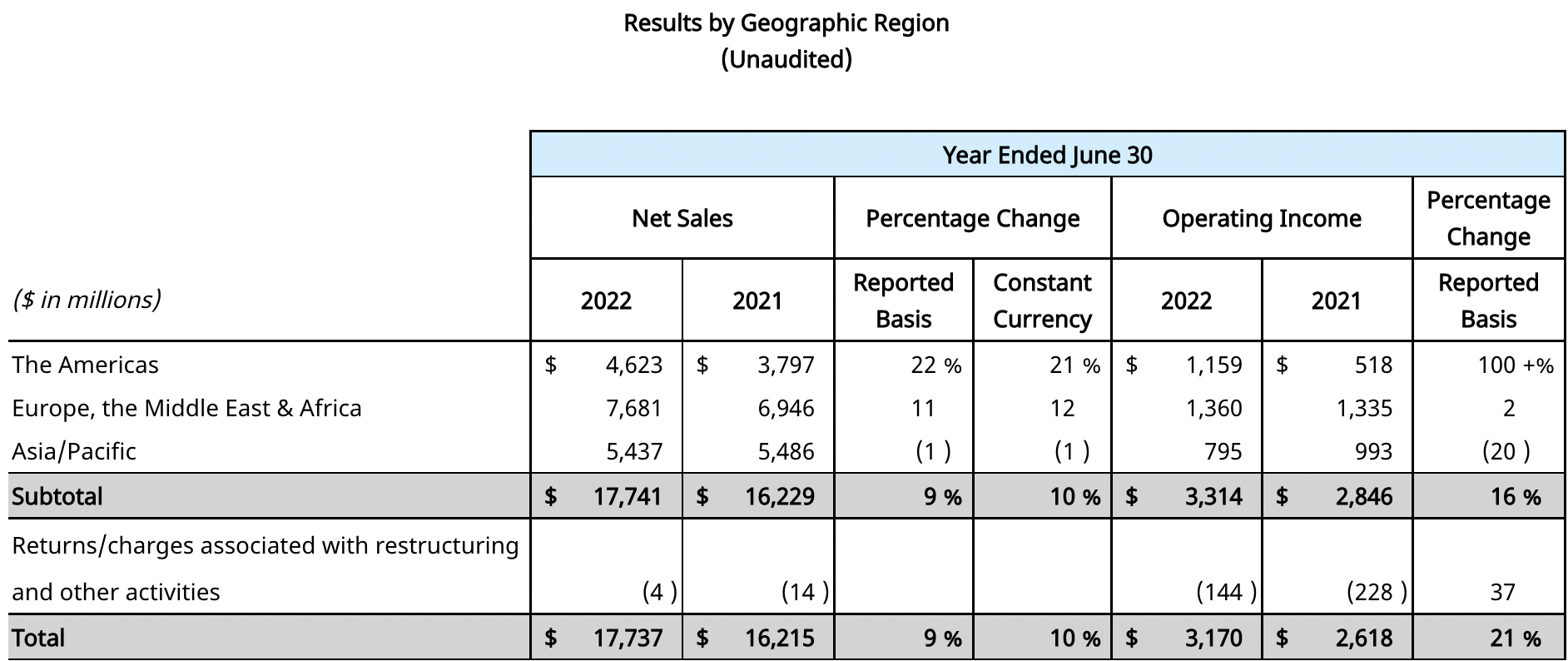

The Estée Lauder Companies (ELC) today reported a +9% year-on-year rise in net sales to US$17.74 billion for the year ended 30 June. Organic net sales increased by +8%, driven by double-digit growth in the Americas and Europe, the Middle East & Africa (EMEA) regions.

The performance was dampened by a -10% decrease in Q4 net sales (see below), with business in early Q1 2023 also down year-on-year, partly related to recent COVID-19 restrictions in China.

Global travel retail net sales for the 12 months to 30 June increased (by an unspecified amount) year-on-year, reflecting continued growth from Asia Pacific despite increased travel restrictions from March 2022 that particularly affected the Hainan market. Travel retail net sales grew in EMEA and the Americas, driven by increased traffic as COVID-19 restrictions were lifted.

By category (across all channels), skincare net sales grew in the Americas, offset by a decline in the EMEA region. High single-digit growth in the first nine months of the fiscal year was offset by the negative impact from increased COVID-related restrictions in China in the fourth quarter.

This included the temporarily reduced capacity at the company’s distribution facilities in Shanghai, resulting in flat skincare growth for the fiscal year. By key brand, net sales growth from La Mer, Clinique and Bobbi Brown was set against a decline from Estée Lauder – the latter’s skincare business was particularly hit by the Q4 challenges in China.

Makeup net sales increased among most brands, reflecting continued recovery in western markets, increased usage occasions and easier comparisons to the previous year. The growth was led by increases from both MAC and Estée Lauder.

In fragrance, net sales grew across every region and every brand, led by Jo Malone London, Tom Ford Beauty and Le Labo.

Hair care net sales rose across every region, reflecting increases from both Aveda and Bumble and bumble as brick-and-mortar recovered from closures related to COVID-19.

Group reported operating income was US$3.17 billion, an increase from US$2.62 billion in the previous year, while net earnings were reduced to US$2.39 billion from $2.87 billion.

President and Chief Executive Officer Fabrizio Freda said, “We delivered excellent results in fiscal 2022, exceeding our expectations in the fourth quarter and achieving record revenue and profitability on an adjusted basis for the year. Our multiple engines of growth strategy proved invaluable amid pandemic and macro complexity, affording us the diversification to seize growth of the moment. The Americas and EMEA prospered, fragrance soared, and makeup realised the promise of its emerging renaissance.

“La Mer, MAC and Jo Malone London led the contribution of double-digit organic sales growth by nine brands, impressive on its own and especially so given the significant pressure from COVID-19 in Asia Pacific at the end of the year. Brick-and-mortar and Online each grew globally, as we capitalised on reopening, extended our consumer reach in high-growth channels, and amplified our omnichannel capabilities.”

Freda concluded, “We are very confident in the strength of our company and in the vibrant long-term growth opportunity of prestige beauty, but recognise the environment remains complex and uncertain at this point in time. For fiscal 2023, we expect to deliver strong organic sales growth, fuelled by our diversified growth engines and enticing innovation, and to take the opportunity in this volatile year to continue investing for our exciting future.”

China restrictions hit Q4 sales

For the three months ended 30 June 2022, the company reported net sales of US$3.56 billion, a -10% decrease compared with the same period a year ago. Organic net sales slid by -8% year-on-year.

Strong growth in the Americas across every category was more than offset by the negative impacts from increased COVID-related restrictions in China. These affected travel and retail traffic as well as temporarily reducing capacity at the group’s Shanghai distribution facilities. In addition, the company suspended commercial activities in Russia and Ukraine after the invasion of Ukraine. As a result, net sales declined in both Asia Pacific and EMEA in the quarter.

Outlook

On the months ahead, the company said that it enters the new fiscal year during “a volatile period”. It highlighted record inflation, supply chain disruptions, a strengthening US Dollar, the risk of a slowdown in many markets globally, and with a strong headwind from the August 2022 COVID-19 restrictions in Hainan.

Against this, it noted strong prospects for growth in global prestige beauty and its plans to invest amid the “difficult environment to support share gains and long-term growth”.

For Q1 2023, reported net sales are forecast to decrease between -8% and -10% year-on-year. This includes negative effects from the termination of the company’s licence agreements for the Donna Karan New York, DKNY, Michael Kors, Tommy Hilfiger and Ermenegildo Zegna product lines effective 30 June 2022. It also reflects the negative impact related to Russia and Ukraine, foreign currency translation as well as certain effects from foreign currency transactions in key international travel retail markets. Organic net sales are expected to slide by -4% to -6%.

For the full year ahead, reported net sales are forecast to increase between +3% and +5% versus FY2022. This range includes the negative impact of -1% from the termination of licensing agreements noted above. It also reflects an estimated negative impact of -1% related to Russia and Ukraine and a negative -3% due to foreign currency translation, plus -1% due to foreign currency transactions in key international travel retail markets.

Organic net sales are forecast to increase by between +7% and +9%.

The full year outlook reflects the following assumptions and expectations:

- More balanced growth across categories, regions and channels as the impacts of COVID-19 restrictions begin to abate.

- Targeted expanded distribution throughout the year to retailers that provide broader consumer reach.

- A continued gradual resumption of global international travel, including to Hainan.

- Inflationary pressures, including higher transportation and logistics costs, are negatively impacting both cost of sales and operating expenses in fiscal 2023. The company expects to mitigate most of the impact to its business and costs through strategic price increases, mix optimisation and cost savings in other areas.

- Incremental savings from the Post-COVID Business Acceleration Program and reinvestment in advertising and capabilities.

- Full-year effective tax rate of approximately 23%.

- Net cash flows provided by operating activities are forecast to be between US$3.1 billion and US$3.2 billion, assuming the company achieves the results above.