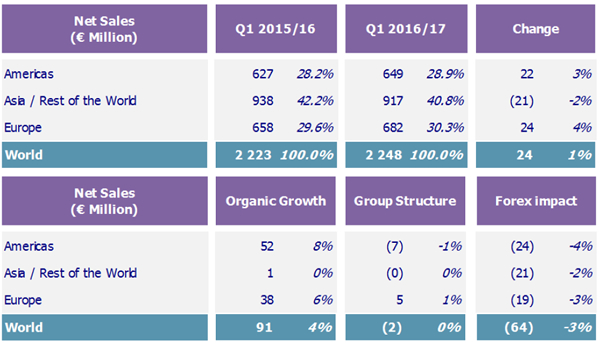

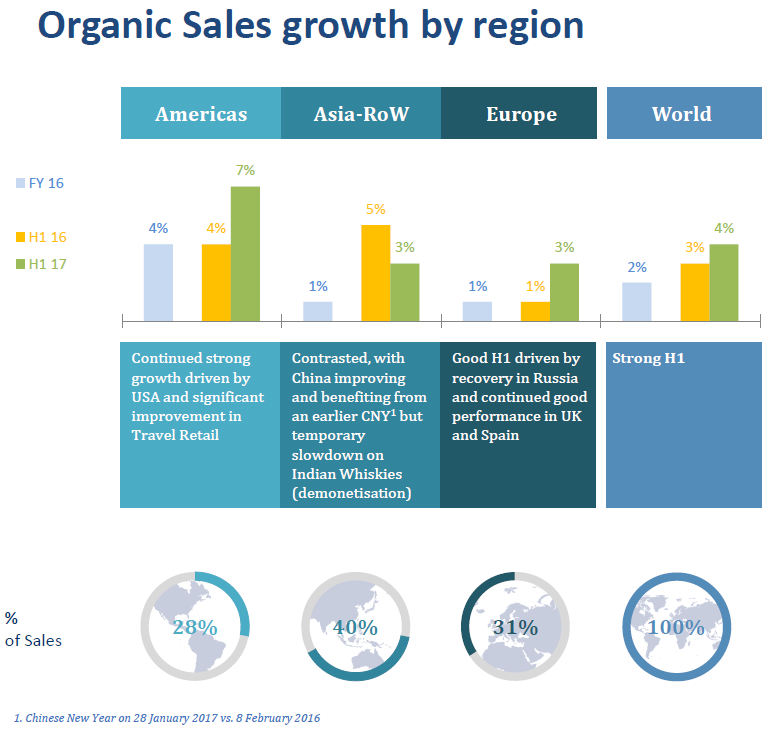

Travel retail turned in a mixed first-quarter performance at drinks giant Pernod Ricard, which today unveiled a +4% organic growth in sales for the period to € 2,248 million. Reported growth was +1%, affected by unfavourable foreign exchange impact.

Performance in the Americas was described as “dynamic”, with sales rising by +8% year-on-year, driven by continued strength in the USA. Travel Retail Americas showed a return to growth with better performance from duty free across the zone in terms of product mix and pricing.

Stability was noted for Asia-Rest of World with the key China market improving but Africa and the Middle East “getting tougher”.

Travel Retail Asia was impacted by a “difficult environment with Q1 impacted by tough commercial negotiations”, the company said. Korea duty free showed showed improvement.

Travel Retail Asia was impacted by a “difficult environment with Q1 impacted by tough commercial negotiations”, the company said. Korea duty free showed showed improvement.

Europe posted “solid” growth of +6% overall but travel retail declined, hit hard by a downturn in Eastern Europe.

The group’s Strategic International Brands (+3%) were a key driver of overall improvement. This was the result of Jameson’s continued strong momentum, good growth on Ballantine’s and improvement from Absolut and Martell, the company said.

The Strategic Local Brands grew +5% thanks to Indian whiskies and Seagram’s gin in Europe but were affected by difficulties for Imperial in South Korea. Strategic Wines were down -1%, mainly due to shipment phasing.

The Strategic Local Brands grew +5% thanks to Indian whiskies and Seagram’s gin in Europe but were affected by difficulties for Imperial in South Korea. Strategic Wines were down -1%, mainly due to shipment phasing.

Chairman and Chief Executive Officer Alexandre Ricard stated: “We have had a good start to the financial year, consistent with our full year guidance. Therefore, we confirm our FY17 guidance of organic growth in profit from recurring operations of between +2% and +4%.

Chairman and Chief Executive Officer Alexandre Ricard stated: “We have had a good start to the financial year, consistent with our full year guidance. Therefore, we confirm our FY17 guidance of organic growth in profit from recurring operations of between +2% and +4%.

“We will continue to implement our long-term growth strategy, focusing investments behind our priority brands, markets and innovations and remaining disciplined on pricing and costs.”