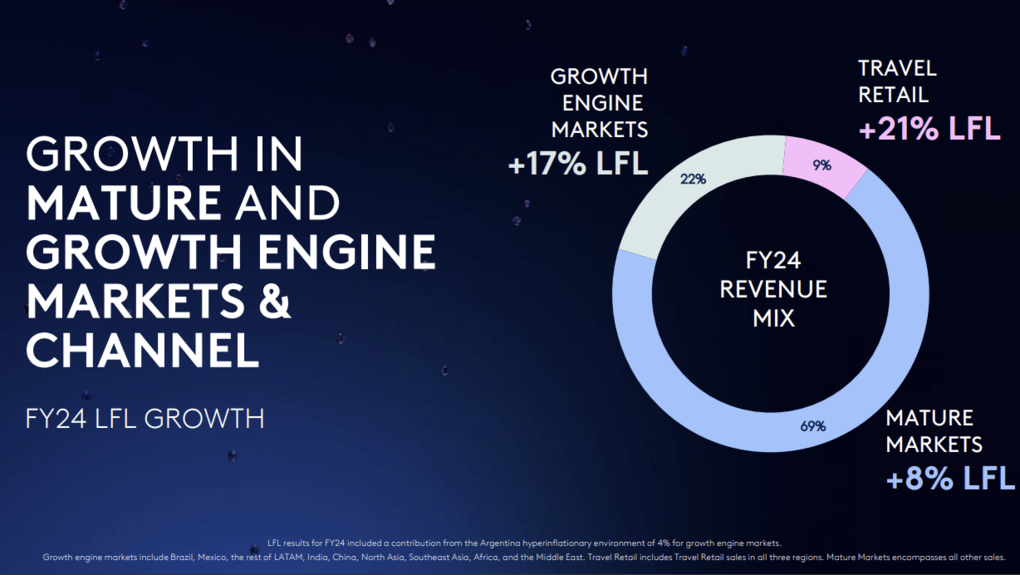

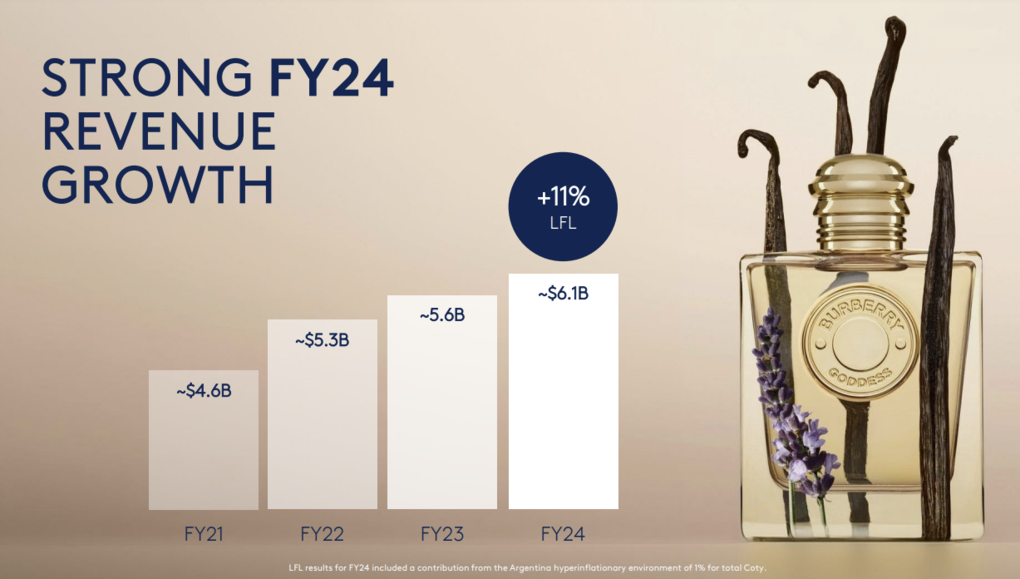

Travel retail (see panel below) played a starring role with revenue surging almost +21% as US beauty house Coty yesterday reported a +10% year-on-year rise (+11% like-for-like) in net revenues to US$6,118.0 million for its financial year ended 30 June.

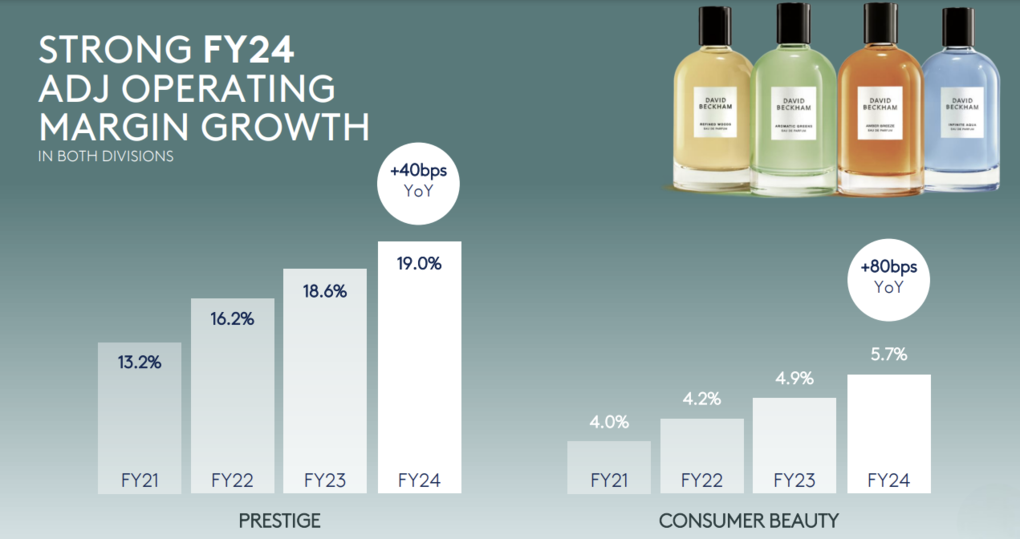

The groupwide results were driven by a strong +13% (+14% like-for-like) increase in Prestige.

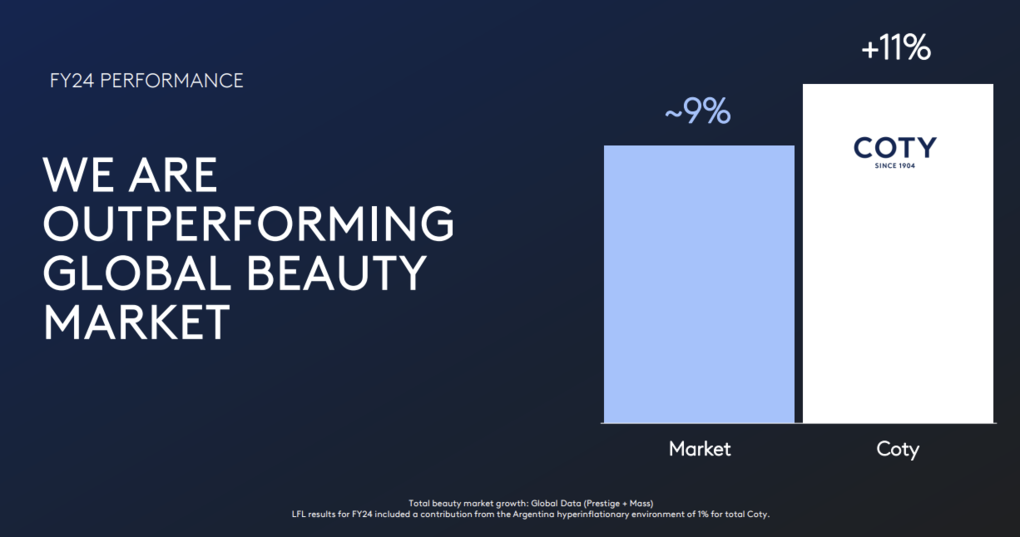

Reported operating income rose +1% to US$546.7 million, delivering an 8.9% operating margin. The group outperformed the global beauty market’s +9% like-for-like increase.

Coty CEO Sue Nabi said: “Our FY24 results set a new milestone in Coty’s sustained track record of top-notch execution and market outperformance.

“In a dynamic macroeconomic backdrop, beauty maintains its privileged position, being neither a consumer goods industry nor a luxury goods industry. Instead, beauty is at the sweet spot of desire, well-being, self-confidence, affordability, ritual, indulgence, and many new things that we and our consumers will invent.

“This is what fuels the strong global beauty growth that we continue to see to this day and which we expect to continue for the quarters and years to come.”

Travel retail to surge forwardIn prepared remarks for today’s earnings call, Coty CEO Sue Nabi said: “Our second high-growth channel [alongside ecommerce] remains travel retail, as we continue to benefit from our broad-based geographic footprint, our multi-category expansion and of course our collaborative partnerships with the key retailers. “Travel retail now accounts for approximately 9% of our sales and grew over +20% like-for-like in fiscal ’24, even as we lapped over +30% growth last year, with strong growth across all regions.”

Looking forward, Nabi said the company is targeting double-digit percentage revenue growth in fiscal ’25 across its “growth engine” markets, which include Brazil, LATAM, Mexico, Africa, Saudi Arabia and travel retail which cumulatively account for over 30% of the group’s business.

“Given these growth markets and the high-growth travel retail channel… we see double-digit growth in this part of the business for fiscal ’25 as quite reasonable, particularly as global travel trends remain robust and as we actively expand distribution of both our Prestige and Consumer Beauty brands in these growth engine markets.” |

She continued: “At Coty, having transformed our organisation and strategic path several years ago, we are now performing as a beauty leader and more and more as a beauty trendsetter, which we believe is an opening for a new era for Coty as a beauty powerhouse.

“Importantly, a key element of this outperformance has been our unwavering strong investment into our marketing, regardless of the macroeconomic volatility, because we believe that this is what will create value for our brands for the long term.”

Nabi highlighted four key achievements of FY24, beginning with the company’s performance having outstripped the beauty sector’s growth.

This was fuelled by Coty’s leadership in fragrances, a strengthened performance in the core cosmetics business, and “over-driving of the company’s growth channels, markets and categories, she said.

“In fact, in eight out of the last 12 quarters, we have delivered like-for-like growth which is ahead of the leading global beauty companies,” Nabi commented.

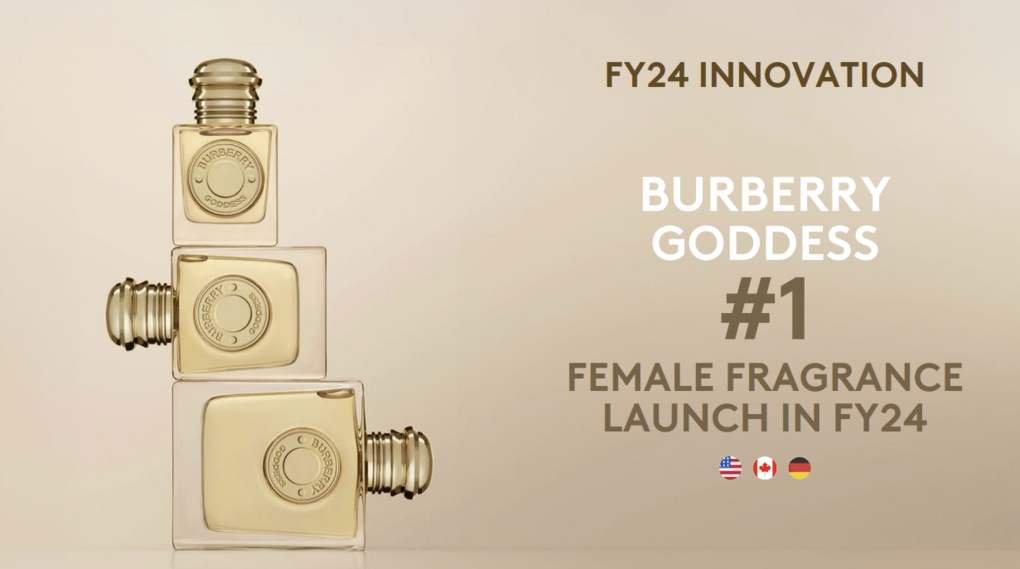

“Second, we are building unique and hopefully best-in-class expertise in each of our core categories. For example, our unrivalled expertise in fragrances was exemplified by the blockbuster launch of Burberry Goddess, which was not only the biggest fragrance launch in Coty’s history, but also the #1 female fragrance launch for the industry.”

Thirdly, Coty is becoming an advocacy-led company, reaching consumers through platforms where they discover newness and build connections with brands,” Nabi continued.

“With the earned media value for both Rimmel and CoverGirl over +400% higher than a year ago and closing the gap with leading peers, we are seeing the strong results from this transformation. The next step is co-creating the trends that will shape the global beauty industry in the coming quarters and years.”

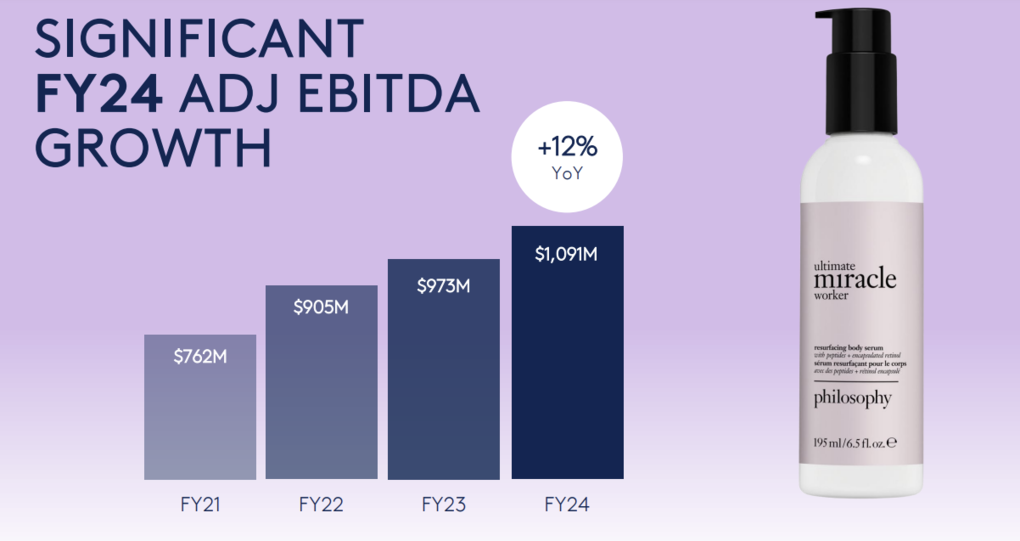

The fourth factor was that Coty had once again delivered double-digit growth in like-for-like sales and adjusted EPS – the third consecutive year of double digit growth in both metrics.”

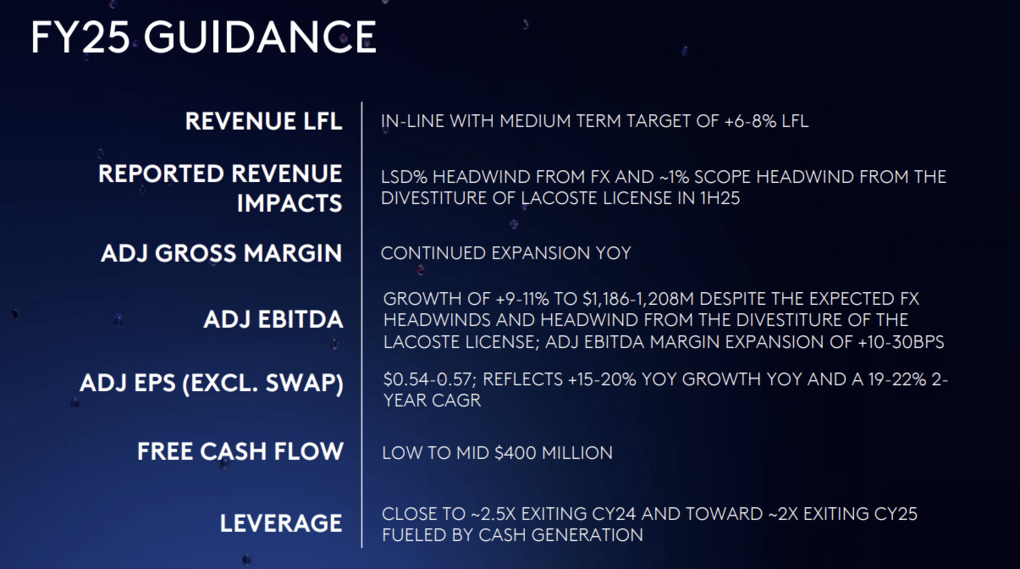

Nabi expressed confidence in the company’s FY25 outlook, highlight its innovation pipeline, including Burberry Goddess Intense, Chloe Signature Intense, Gucci Flora Gorgeous Orchid, Lancaster Golden Lift, CoverGirl Eye Enhancer 3D Mascara and adidas Vibes (the first mass fragrance line designed and scientifically proven to enhance one’s mood).

“In sum, we are confident in delivering another year of growth in line with our medium-term targets, steady margin expansion, cash flow improvement and deleveraging progress.

“As we strengthen our position as a global beauty powerhouse, acting with the agility of smaller brands but also creating the beauty trends of today and tomorrow, Coty remains one of, if not the most compelling investment opportunities in our industry.” ✈