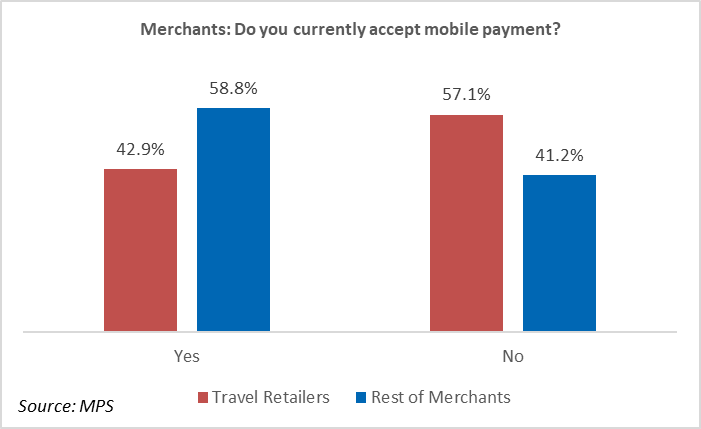

CHINA/INTERNATIONAL. Travel retailers have been slower to adopt mobile payment methods such as Alipay and WeChat Pay than other merchants, according to a new survey.

Mobile payments specialist Cancan and financial research authority Kapronasia also found that travel retailers register a smaller share of mobile payment transactions in their global sales (3%) compared to other merchants on average (15-25%).

The companies recently published a global study, 2017 Mobile Payment Survey: Chinese Consumers Abroad, covering the impact of Asian mobile payment solutions at point-of-sale worldwide, in which 14 travel retail companies were interviewed (of 65 total companies). It claimed that mobile payments will soon overtake cash and credit cards as the preferred payment choice for Chinese travellers shopping abroad.

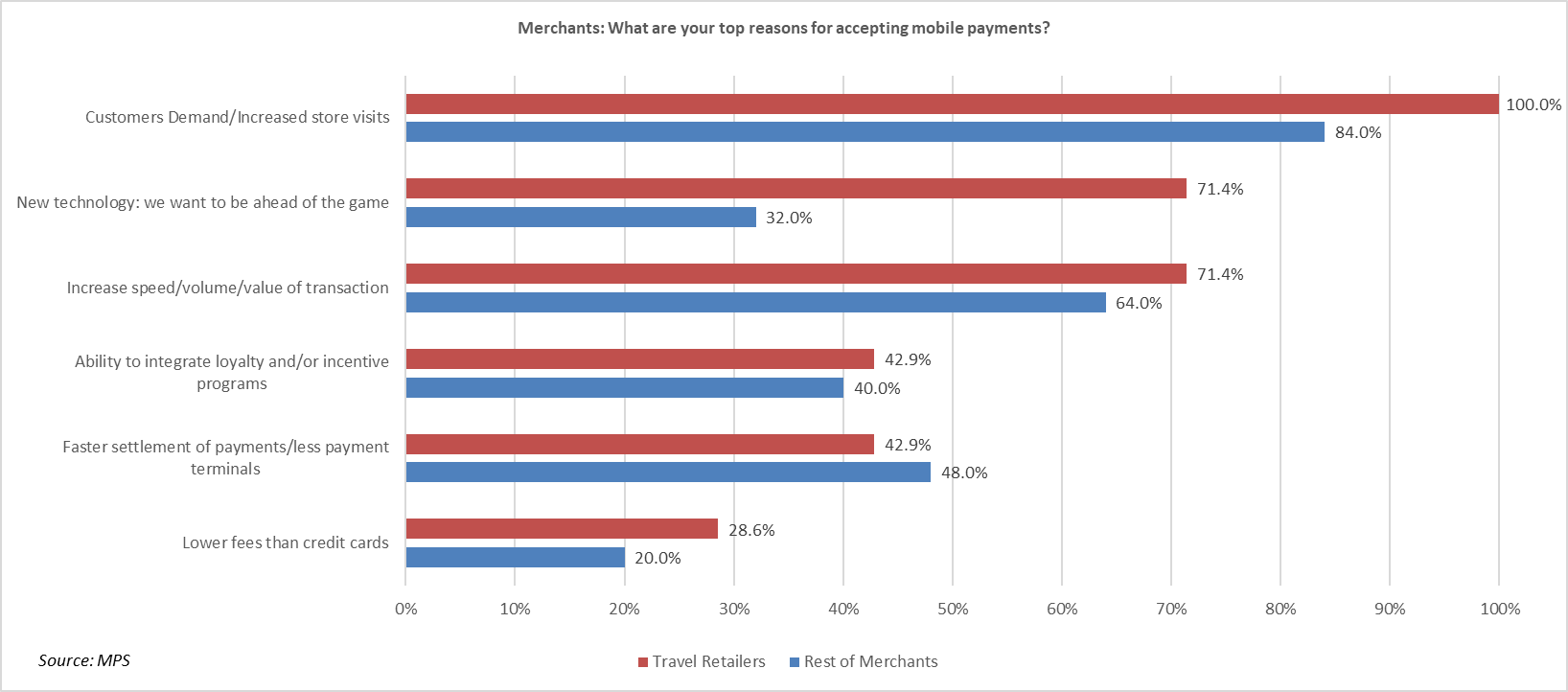

All travel retailers agreed that customer demand was the key driver in their decision to offer mobile payments. Of those who do not yet accept mobile payments, the cost of development, lack of internal resources, and existing hardware and/or software vendors were given as reasons for non-implementation.

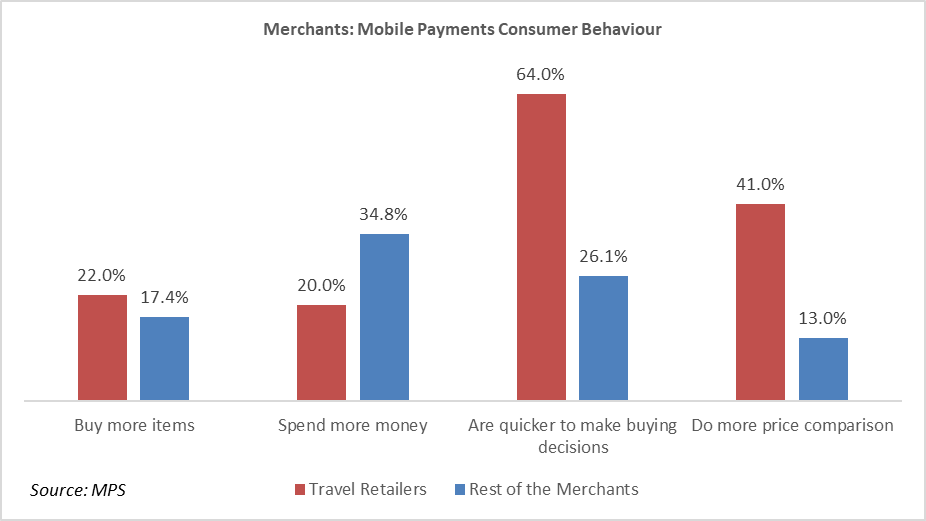

Travel retailers also said that their Chinese customers using mobile payments do more price comparisons and make quicker buying decisions, behaviours that are not as marked with non-travel retail merchants.

“What we have found from the survey is that Chinese customers tend to close the sale more quickly when they know that they can pay with mobile and that transaction times are extremely quick at under a minute, the perfect conditions for any travel retailer operating in an airport environment,” said Cancan Managing Director Candice Koo.

“So it seems logical that travel retailers should be ready to welcome Chinese travellers with mobile payments, yet nearly half of the surveyed group does not.

“The survey reveals that Mainland Chinese consumers expect to spend more with mobile payments such as Alipay and WeChat Pay this and next year than in 2016 when travelling abroad, greatly overriding their propensity to use cash or credit cards. Merchants need to answer their expectations to shop with mobile payments.

“Today that consumer is predominately Chinese, but in a year we could be looking at Koreans, Japanese, Indonesians, Indians, who are already all following the Chinese trajectory. Merchants who do not yet offer mobile payments need to act fast.”

More findings from the 2017 Mobile Payment Survey: Chinese Consumers Abroad can be viewed here.