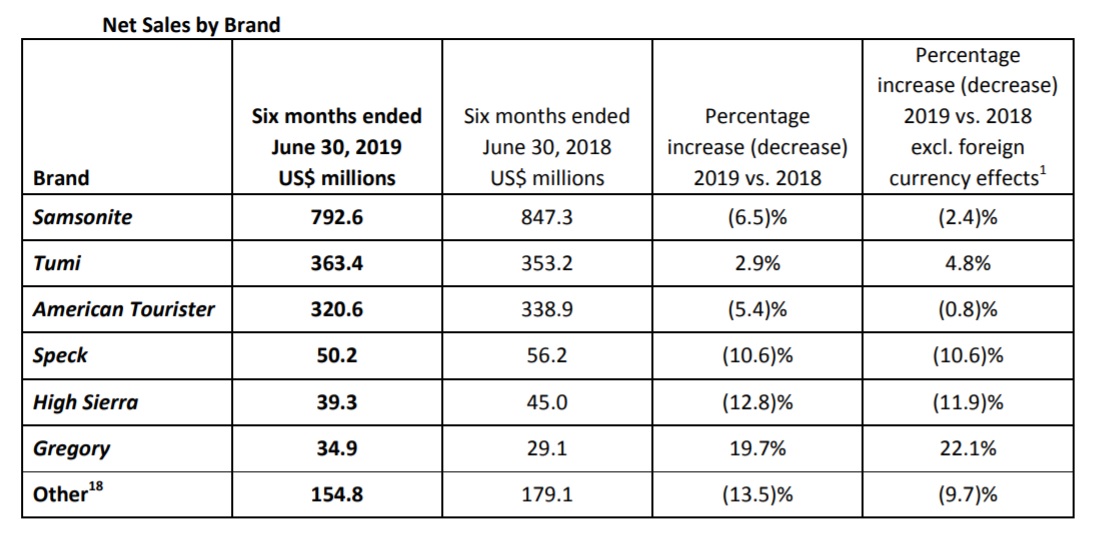

Tumi – a widely distributed prestige luggage brand in travel retail – was the only high-turnover label in the Samsonite International portfolio to grow in the half-year to June 2019. At constant currency, sales rose +4.8% to US$363.4 million.

The performance lifted Tumi’s share of the group’s first half net sales to 20.7% compared to 19.1% in the same period in 2018.

Other major brands from the world’s largest travel luggage company fared less well. Samsonite slipped -2.4%* to sales of US$792.6 million and American Tourister was down by -0.8% to US$320.6 million in the half year.

Among the group’s smaller bag labels Speck and High Sierra had double-digit declines, but Gregory powered ahead with +22.1% growth (see table). The ‘Other’ segment of the business – which includes names such as Kamiliant, Lipault, Hartmann, eBags, Saxoline, Xtrem and Secret, as well as third-party brands sold through the Rolling Luggage and Chic Accent retail stores and the eBags ecommerce website – fell by -9.7% to US$154.8 million.

Group net sales fell by -1.5% to US$1,755.7 million though there was an improvement in the second quarter versus the first quarter: -0.7% and -2.4% respectively.

Tumi excels in Asia and Europe

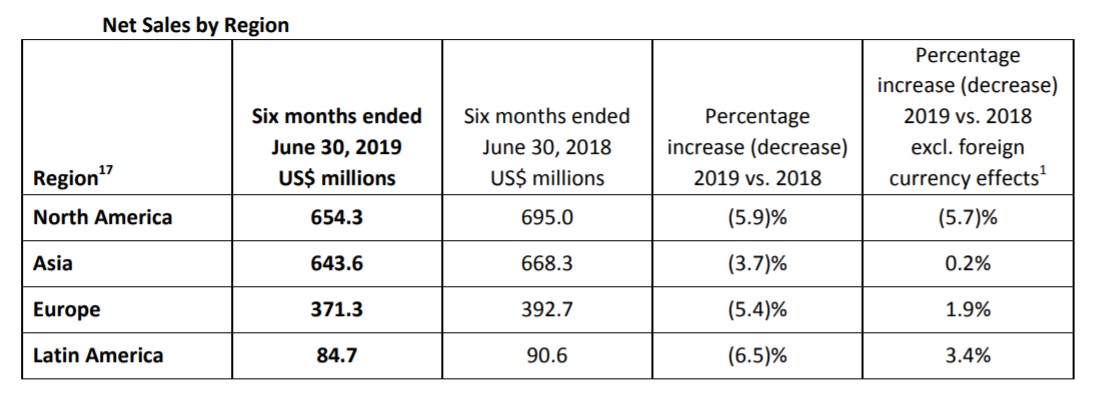

Tumi’s performance was aided by strong net sales growth in two major markets: +11.9% in Asia, and +20.4% in Europe. Though much smaller, Latin America had an impressive +178.2% increase. However in North America, the biggest market for the group, Tumi’s net sales decreased by -2.9% year-on-year.

Hong Kong-listed Samsonite International said one reason for the North American decline was the company’s “successful efforts to identify and stop sales to shippers who were selling Tumi products to unauthorised distributors in Asia, and from reduced tourist-traffic gateway cities in the US”.

Across the whole group a -5.7% decline in North American sales to US$654.3 million allowed Asia to catch it up. While barely growing (at just +0.2%), sales of US$643.6 million mean that the region could overtake North America by the end of the year.

However this is not guaranteed as the group saw declines in B2B sales in China and continued weakness in South Korea. Helping to offset those were healthy gains in Japan (+4.8%) and India (+9.2%).

Samsonite International CEO Kyle Gendreau said: “In the first half of 2019 we continued to reposition the business for long-term growth and profitability. At the same time, we remain focused on navigating the macro-economic headwinds impacting our performance in certain markets including the US which was affected by increased tariffs on products sourced from China and lower foreign tourist traffic.”

He added: “The global outlook remains uncertain (and) we intend to temporarily reduce advertising spend for the second half of 2019 to help offset the pressure on our profitability. We plan to execute this reduction in a targeted manner to ensure continued support for our growth initiatives, including the Tumi brand’s further international expansion, our direct-to-consumer e-commerce growth strategy and planned new product introductions.”

* All percentage growth figures are on a constant currency basis unless stated.