|

INTERNATIONAL. Dufry this morning announced it has signed an agreement to acquire the entire share capital of The Nuance Group – the biggest consolidation play in travel retail history.

[After breaking the news this morning, The Moodie Report will be bringing you further details, comment and reaction across the day via our Moodie Live rolling news service. Go to our home page or click here to access the live feed.]

The deal is valued at CHF1.55 billion (US$1.72 billion), on a debt- and cash-free basis. It will be financed with CHF1 billion (US$1.11 billion) in equity and CHF550 million (US$612 million) in new debt.

|

“The acquisition of The Nuance Group by Dufry is a transformational deal not only for Dufry but also for the travel retail industry“ |

Julián Díaz CEO Dufry |

The deal, which is subject to certain closing conditions, creates a new number one force in travel retail, bringing together the second and seventh biggest industry players by annual sales, based on The Moodie Report Research’s 2012 statistics (we will publish the 2013 numbers shortly).

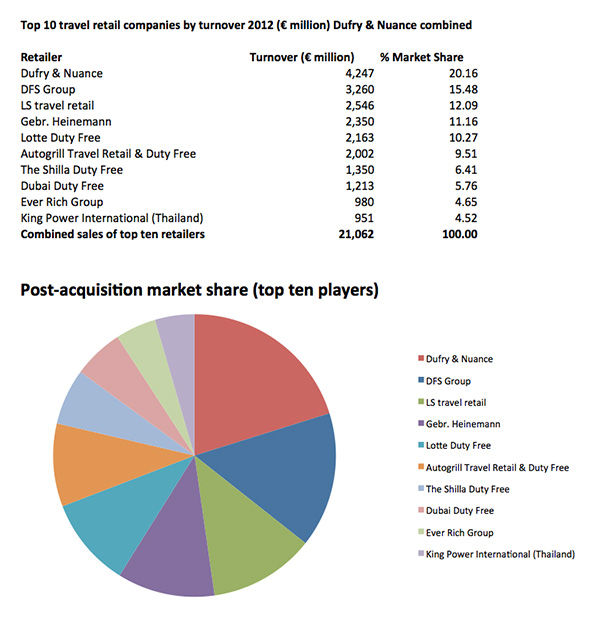

Based on those numbers, the new-look, restated entity commanded a €4.2 billion business, giving it a 20.16% share of the market held by the top ten travel retail industry players.

The Nuance Group stake is being sold by Noel International SA, the Luxemburg holding company, which owns 100% of the travel retailer.

Dufry CEO Julián Díaz commented: “The acquisition of The Nuance Group by Dufry is a transformational deal not only for Dufry but also for the travel retail industry. This acquisition is a continuation of the global diversification strategy which we have communicated and executed for many years and that is based on profitable growth through three main pillars: like-for-like growth, new concessions and acquisitions.”

Dufry will integrate Nuance into its organisation and expects to generate cost synergies starting in 2015, with the full impact of CHF70 million (US$78 million) pre-tax synergies per year at the Nuance level being reached by 2016.

Dufry said it expects an improvement in gross margin through increased purchasing power and the integration of Nuance’s purchasing into its supply chain and logistics platform. Dufry also expects that the combination of the global and regional organisations, as well as global support functions, will create “significant value”. The pre-tax integration expenses related to the acquisition are expected to be approximately CHF20 million (US$22 million) in 2014 and CHF10 million (US$11 million) in 2015.

In addition, Dufry said that the combination will be “beneficial for turnover growth, through the exchange of knowledge and the implementation of best practices from both companies”.

June 4 (Bloomberg) — Andreas Schneiter, chief financial officer of Dufry AG, discusses the company’s agreement to buy Nuance Group for about $1.7 billion, unifying the Swiss duty-free store operators and securing growth in the Mediterranean. He speaks from Zurich with Guy Johnson and Caroline Hyde on Bloomberg Television’s “The Pulse.” (Source: Bloomberg) |

|

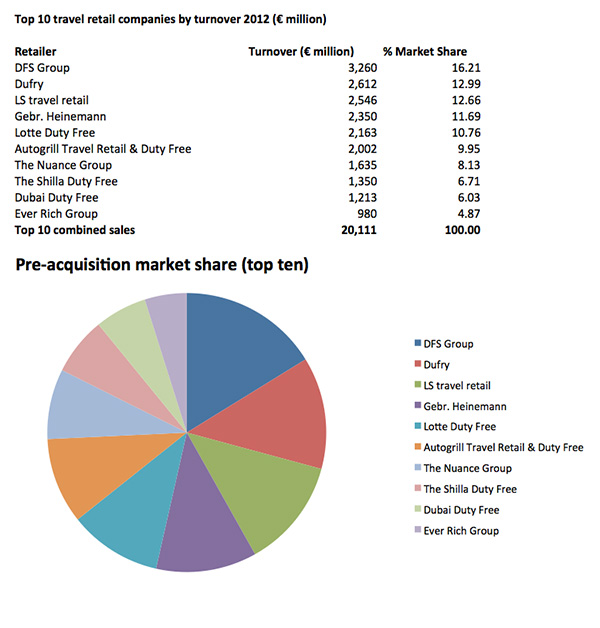

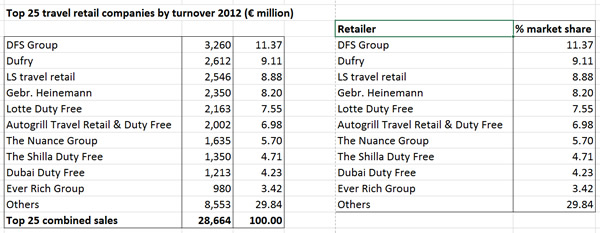

This chart, using 2012 sales figures, shows sales and market share among the top ten global travel retailers (Moodie Research figures), before the acquisition |

|

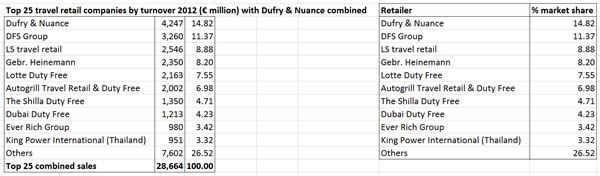

This chart, using re-stated 2012 Moodie Research figures, shows how market share among the top ten global travel retailers shifts with the acquisition |

Díaz added: “Dufry has been a key player in the consolidation of the fragmented travel retail industry and we have been delivering significant value through acquisitions. We have been consistently delivering synergies and diversified our concession portfolio worldwide step by step, thus avoiding concentration risk for any specific region or location. With this transformational transaction, we make another big step forward in this respect and bring our global scope to a new level. Also, the scale and breadth of our business will be changing the scope of the travel retail industry going forward.

“The combination of both organisations will further strengthen our current concession portfolio, adding new countries and operations that have a very strong fit with Dufry’s regional strategy. Nuance will reinforce our presence in Asia, Mediterranean, North and Central Europe and North America.

|

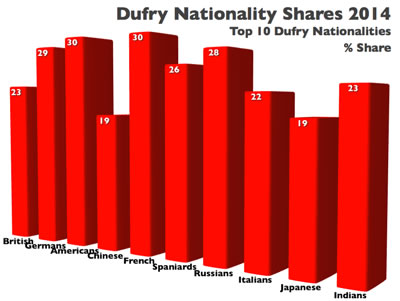

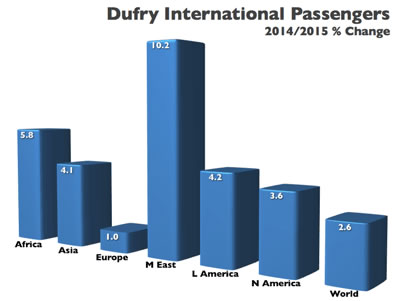

These charts from AIr4Casts, the respected London travel and travel retail research and analysis specialists that The Moodie Report works closely with show (above) the forecast increase in international passenger flows for the ‘new Dufry’ for 2015 over 2014 (Air4Casts has each retailer’s store locations on its databases). The second (below) shows the new Dufry’s top nationality mix for 2014 ( again combining Dufry and Nuance outlets). |

|

“We have identified substantial synergy potential in the acquired business mainly from gross profit margin improvements and cost synergies. Additionally, there is further synergy potential of the transaction for Dufry’s existing operations in terms of gross margin improvement and economies of scale in logistics.

“We have already prepared an integration plan with the core of this plan being the transition of Nuance’s operations into Dufry’s business model, and we will work closely with the local teams to ensure that we capture the best of the Nuance and Dufry worlds.

“We look very much forward to working with our more than 5,000 new colleagues to create an even better company. We are proud to welcome all of them and I am sure the complexity of this integration will be mitigated by the great professionalism of both organisations.

“Ultimately what we want to achieve is to develop a better company for our employees, customers, suppliers and landlords and a more valuable asset for our shareholders.”

|

This table, using 2012 figures, shows The Moodie Report’s Top 25 Travel Retailers list and market share among those top 25 leading players |

|

This table, using re-stated 2012 figures, shows how The Moodie Report’s Top 25 Travel Retailers list is reshaped by the Dufry acquisition of Nuance |

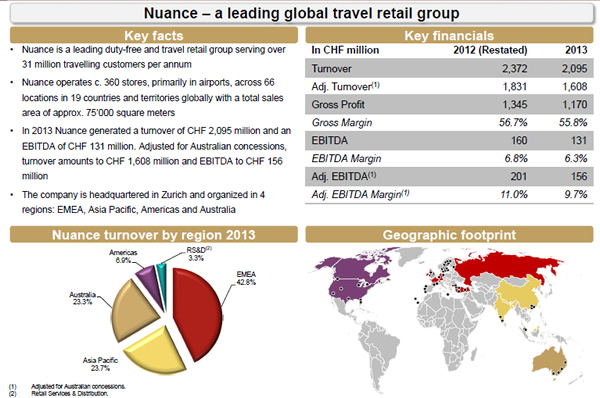

Nuance operates close to 75,000sq m of retail space in 66 locations across 19 countries in Europe, Asia and North America. In 2013, Nuance generated a turnover of CHF2.1 billion and an adjusted EBITDA of around CHF156 million.

Dufry said the deal would give it “a global and geographically diversified concession portfolio and strong positions in developed and emerging markets covering all continents”.

In 2013, the two businesses had a combined market share of close to 15% in the airport retail industry based on turnover, noted Dufry. It said: “The geographic presence of Nuance is complementary and strengthens Dufry’s positions in strategic key markets in the Mediterranean, North and Central Europe, Asia and the United States and Canada. As a result of the transaction, Dufry will emerge with a leading position in the Mediterranean in addition to its existing leadership positions in Latin America, Caribbean and North America. In addition, the acquisition will strengthen its diversified business in Asia with attractive locations that will provide a strong basis for further growth in the region.”

In the Mediterranean, Nuance’s operations in Turkey, Malta and Portugal will complement Dufry’s existing operations in the region, where Dufry has activities in eight countries, such as Italy, Greece, Spain, Morocco and Egypt.

In Eastern Europe, Dufry will have a strong market presence in Russia, and add activities in Bulgaria.

|

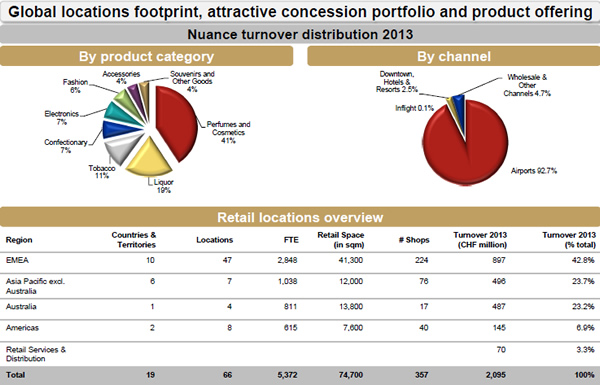

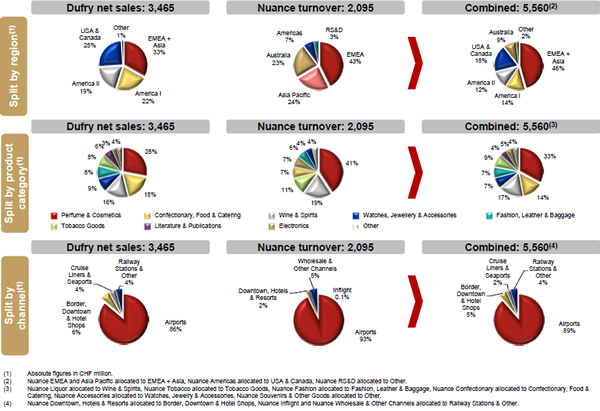

How the Nuance business shapes up (above and below) based on 2013 figures (from Dufry’s presentation on the deal to investors today) |

|

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

In North-west Europe, Dufry will become the preeminent travel retailer in Switzerland and have activities in Sweden as well as the UK, most notably at London Heathrow Airport.

In Asia, Dufry said Nuance’s concessions in Mainland China, Hong Kong and Macau will be complementary to Dufry’s operations in China, South Korea and Taiwan. In South-East Asia, the combined entity will have a presence in Cambodia, Indonesia, Sri Lanka and Nuance will add airport retail activities in India and Malaysia.

|

The acquisition bolsters Dufry’s presence in Russia, where Nuance opened its newest European operations early this year at St. Petersburg Pulkovo (above and below) |

|

In North America, Nuance operates mostly duty free formats and these locations will “fit well into Dufry’s existing retail network,” it said. “The acquisition reinforces Dufry’s position in the United States and Canada and will help Dufry to further gain market share in the duty free and duty paid segments.”

|

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

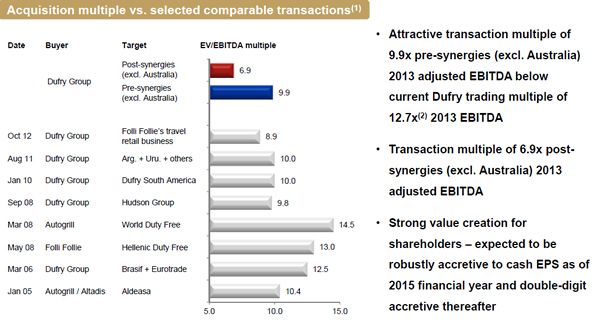

Dufry said that through synergies, the transaction is expected to create value to shareholders and is expected to be robustly accretive to cash EPS in 2015 and double-digit accretive thereafter. In terms of valuation, the consideration translates into a 6.9x EV/EBITDA multiple based on EBITDA adjusted for the Australian business and including synergies.

“Given the size and breadth of the combined platform, Dufry is well positioned to develop and expand its business further on a global scale. The combined group’s retail capabilities and logistics network offer a differentiated proposition when competing for concessions and provides a solid foothold to successfully realise renewals and win new contracts in key strategic areas.”

|

A partnership between Nuance and DFASS recently extended its Orlando Airport contract to 2022; the Nuance acquisition reinforces Dufry’s strong position in North American airports |

Financing the deal

The transaction-related funding is secured through a committed bridge financing, which will be refinanced by equity of CHF1 billion and accessing the debt capital markets for at least CHF 550 million, as noted above. Dufry is also planning to refinance its existing bank debt facilities and extend their maturity profile. A total financing package of CHF4 billion (US$4.45 billion) has been fully underwritten, it said.

As for the equity increase, Dufry intends to do a rights issue and will seek approval for an ordinary capital increase at an Extraordinary General Meeting. Dufry intends to also use its existing conditional capital authorisation as part of the contemplated equity financing.

Dufry’s reference shareholder group led by Travel Retail Investments, which holds 22.2% of Dufry’s share capital, has committed to vote in favour of the capital increase at the Extraordinary General Meeting and intends to participate in the equity increase pro-rata with its current holding, the group noted.

Dufry plans to hold the Extraordinary General Meeting on 26 June 2014. The first trading day of the new registered shares is expected to be on 9 July.

The transaction is expected to close in Q3 2014 and is subject to customary regulatory approvals and other customary closing conditions.

|

Dufry hails the acquisition multiple as compared to other industry deals; click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail) |

Reaction to the deal

Reaction is pouring in to The Moodie Report about this dramatic industry deal, and we’ll bring you updates from across the travel retail world throughout the day.

The acquisition has already prompted the first comments from the investment community.

Grupo Santander European Retail and Luxury analyst Rebecca McClellan had already written about the likelihood of a deal between Dufry and Nuance. She told The Moodie Report: “The writing was on the wall when Dufry requested a CHF1.5 billion raise at their AGM.”

That move was rejected because the shareholders wanted to know what Dufry was going to do with the raised debt, and the financing will now be cleared at the Extraordinary General Meeting to be held on 26 June (see above).

McClellan added: “Dufry has already bought Folli Follie at the lower end of the Top 25 travel retailers and if you look higher up the list there are some Middle Eastern retailers, a host of Asian companies and Nuance.

“Nuance is big but also vulnerable – it has lost two key locations [at Singapore Changi and Hong Kong International airports] which although not margin generating are important. The acquisition of its joint venture stakes in Asia [from former partner AS Watson] last week was housekeeping. Something had to happen.”

Here’s further reaction of a leading observer from the financial services sector who asked to remain anonymous: “Dufry has taken a major step in accelerating travel retail consolidation at airport locations globally. This is a fantastic transaction securing a high-quality company that will provide significant synergy potential to the combined group. The willingness to pay a full price has to be seen in the context of synergies and achieving an undisputed leadership position in the sector that brings further development potential in new and existing regions.”

How do investors view the impact of today’s deal on the other major listed players? Here’s the early response from Exane BNP Paribas this morning.

On WDFG, it says: “Expect negative market reaction – the stock trades on very high multiples also due to the ever-present speculative appeal. With Dufry purchasing Nuance, all speculative appeal of WDF is eliminated as clearly it will no longer be a takeover target for Dufry.”

On Lagardère Group, parent of LS travel retail, the same institution says: “Lagardère has said it is looking for a transformative acquisition in travel retail. Management argued that scale matters in that industry. Given its high EM exposure, TNG appeared as a suitable candidate. In our view, Lagardère is under more pressure to act now that its main competitor has moved.”

Throughout the day The Moodie Report will bring you reaction to and comment on this hugely significant development for the channel. Stay online for constant updates to this story here and via the Moodie Live rolling news service on our home page.

*Click here for further reaction and comment from Dufry CEO Julián Díaz as he addressed analysts after the announcement.