In the heart of Switzerland, in the quiet and breathtakingly beautiful canton of Schwyz, discreet plans are afoot to make the biggest employer in the region – Victorinox – a global brand in the travel retail channel.

Just under three years ago, the company – famous for its iconic multi-tool, the Swiss Army knife – hired Thomas Bodenmann, the former Mondelēz World Travel Retail veteran of seven years as Director Global Travel Retail/Duty Free.

Since then Bodenmann has been honing his travel retail strategy and building a regional team, and he is ready to take the brand into the channel in a structured rather than opportunistic way.

In July 2018, Bodenmann also saw his remit widened, becoming Head of Global Travel Retail & Fragrance Sales.

At the company headquarters in Ibach, where Swiss Army knives are manufactured by both hand and machine, he told The Moodie Davitt Report: “We are now a small travel retail unit of five people covering sales and business development across three regions: Americas, Europe and Middle East, and Asia Pacific.”

Prior to Bodenmann’s arrival Victorinox’s share of sales from travel retail was about 1%.

“Now we are at around 2% and we want to double it again. In the next three to five years we should be at 5%,” he said. For reference, Victorinox’s annual revenue hit CHF480 million (US$487 million) in 2018.

“Obviously we want to be commercially successful in travel retail, but the channel offers a fantastic opportunity to really build Victorinox into a Swiss multi-category brand. This visibility will benefit our domestic markets as well,” added Bodenmann.

Every shop-in-shop that is opened adds substantial extra revenue and Bodenmann believes the business can grow quickly. “We are also looking to franchise,” he said.

European base, Asian opportunity

Victorinox’s current travel retail business is Europe-centric and the region remains a priority for further expansion. The company just reopened a 48sq m landside store at Zürich Airport with Dufry bringing its points of sale at the hub to 15.

“We also opened up Helsinki Airport last year which is important because of its routes to Asia and we would like to add strategic locations like London Heathrow,” Bodenmann said.

“But our biggest potential is in Asia because our main customers in Europe are Asians, particularly the Chinese. They buy our multi-tools as souvenirs and gifts – and not just one item but ten.”

The phenomenon is happening in both travel retail and in the Swiss market.

To date, Victorinox has two self-operated stores in Hong Kong International Airport (landside and airside) and a backwall at Singapore Changi Airport. But the brand wants bigger spaces at these locations and also in markets popular with the Chinese like South Korea and Thailand. In Latin America, Victorinox fragrances have also just gone into some travel retail beauty stores thanks to the brand’s popularity there.

“We want travel retail to be an important sales channel for Victorinox,” emphasised CEO Carl Elsener IV. “We want consumers to know that we are not just about the Swiss Army knife. We offer other categories as well.”

“Never leave the planet without one”

Victorinox can certainly claim global recognition for its Swiss Army knife, first made in 1897 after the company was founded by Karl Elsener I in 1884. It is a symbol of Switzerland and a recognised design icon. Every day the company makes 40,000 pocket knives and 90,000 household and professional knives – more than 30 million a year.

Uniquely, the brand’s reputation has gone beyond Earth. Every NASA space mission has included a Swiss Army knife as part of the packing list. In his book, An Astronaut’s Guide to Life, Canadian spaceman Chris Hadfield wrote: “Never leave the planet without one.” The value of such a testimonial is immeasurable.

Yet it was only relatively recently that Victorinox took an interest in nurturing its brand. Elsener said: “Over the past 25 years we have really begun to invest in, and understand the importance of, the brand. For many years we were just a manufacturer.”

For travel retailers, whose brand focus is laser-like, Victorinox has some obvious advantages: it has a world-recognised product but is yet to significantly break through in the channel.

One of its key strengths remains the Swiss-made claim, something that will not change any time soon. Elsener told The Moodie Davitt Report: “The Swiss Army knife is a symbol of Swiss quality and reliability. We will work hard to keep the production in Switzerland.”

That ‘made in Switzerland’ badge extends to all product categories under the Victorinox umbrella including fragrances. Today, Victorinox is moving in the direction of a lifestyle brand with knives, travel gear, watches and fragrances all in the mix, and all marketed in-house. This was a strategic decision under a plan called Horizon 2020. “The aim was to bring our product categories closer together, with one team and one voice,” explained Elsener.

But it has not been all plain sailing. The apparel business was discontinued in 2017 “because it didn’t fit… and we couldn’t find a sustainable path for the category” he admitted.

Travel retail versus domestic

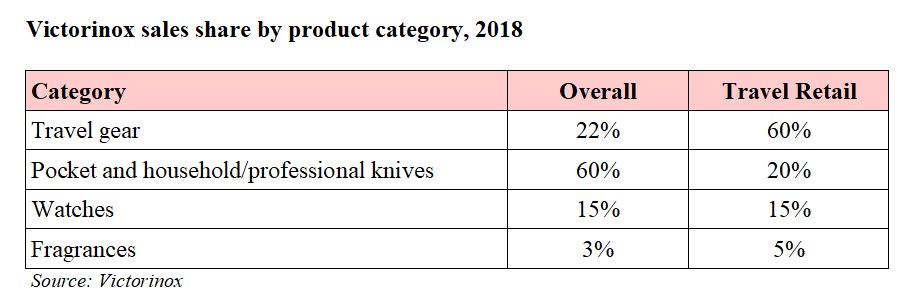

The revenue split between product categories varies greatly between the travel retail channel and the overall business. Victorinox’s signature pocket knives – together with the growing segment of household/professional knives – make up 60% of sales followed by travel gear at 22% for the company as a whole.

In travel retail, these shares flip: travel gear drives 60% of revenue, whereas multi-tools (knives) have just a 20% share – not surprising given the airport security concerns about these products.

Travel gear’s share of travel retail could become even greater thanks to the deployment of the rival Wenger brand, bought in 2005. Bodenmann explained: “We are focusing on Victorinox in travel retail but we see an opportunity for Wenger travel gear, especially in Europe, because the bags are more affordable. We are targeting electronic stores.”

Acquisitions and future development

Elsener is not prioritising more brand acquisitions, but he told us: “We are always open if it makes business sense. Our strategy is to focus on two growth segments: travel and the urban outdoors (with the knives, watches and travel gear); and the other is kitchen and cooking where our household/professional knives represent a very strong and growing pillar.”

That prompted Elsener to invest in US cutting board producer Epicurean and increase its stake to 80% over some years. The start-up makes its boards and kitchen tools from durable wood composites used to make ramps at skate parks. The brand could eventually be another option for travel retail.

Nearer to home, Victorinox is currently building a vast new CHF50 million (US$56 million) solar-powered European distribution centre close to its Ibach factory. The decision is a clear boost to the Schwyz canton, and to the family company’s continued commitment to remaining a Swiss brand at heart.