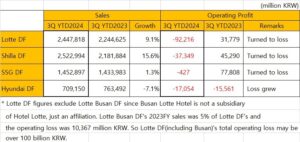

SOUTH KOREA. Lotte Duty Free has decided to cease the bulk sale (MG) daigou business that has been such a dominant element of its – and Korean travel retail’s – business over recent years.

The Moodie Davitt Report understands that brands have been informed of the policy change, which took effect on 1 January. The move is part of a multi-pronged response to a profitability crisis facing Lotte Duty Free and its peers, The Shilla Duty Free, Shinsegae Duty Free and Hyundai Duty Free.

Responding to our approach, the Korean number one travel retailer told The Moodie Davitt Report: “Lotte Duty Free plans to proactively respond to the rapidly changing business environment and focus on fundamental organisational improvements and profitability.

“We will avoid bulk sales and make every effort to attract more group tourists and individual customers.”

The elimination of MG daigou trading will affect around 50% of Lotte Duty Free’s sales, underlining the magnitude of the move. Though involving huge volumes in recent years, particularly post-pandemic, the heavy discount rates involved had placed increasingly big strains on profitability.

“Up to now most of the MG daigou trade has been transacted with discount rates under break-even level,” noted one sector expert.

As reported, Lotte Group is introducing a wide range of structural changes as it battles severe headwinds across multiple subsidiaries, including Lotte Duty Free.

New Lotte Duty Free CEO Kim Dong-ha, appointed on 1 January, is charged with restoring profitability via a programme that is likely to involve store closures or sell-offs abroad and possible contract exits.

We will bring you more reaction and analaysis in due course. ✈