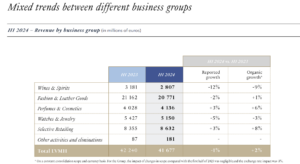

INTERNATIONAL. DFS Group performed strongly in Japan during the first half, driven by burgeoning tourist arrivals and a 34-year low Yen. But unflattering comparisons with H1 2023 in Macau and Hong Kong hit the travel retailer’s relative performance with overall sales down by -25% year-on-year.

Those were among the key takeaways from parent company LVMH Moët Hennessy Louis Vuitton’s (LVMH) post-H1 results earnings call yesterday (click here for our original report), which majored on how booming Yen-driven sales in Japan are affecting other Asian markets.

DFS is majority owned by LVMH with Co-Founder Robert Miller still retaining a 38.75% stake.

Noting DFS Group’s positive showing in Japan and at its US airport locations, Director of Financial Communications Rodolphe Ozun said: “DFS continued to be affected by the uneven recovery of global travel, including the very gradual return of tourists to Europe, Hong Kong and Macau, where revenue is still below 2019 levels.”

LVMH CFO Jean-Jacques Guiony commented: “Macau and Hong Kong were the only destinations open to Chinese travellers in the second quarter of last year, which created an abnormally challenging comparison basis in these markets. The good performance of DFS in Japan partially offsets this headwind, but not entirely.”

Asked about the scale of DFS’s decline, taking into account the tough comparatives in Hong Kong and Macau, Guiony replied: “The magnitude of the drop is significant – about a quarter, -25%, drop in the sales.”

Guiony noted DFS and LVMH as a whole were being affected by the Yen-driven propensity to spend in Japan as opposed to elsewhere.

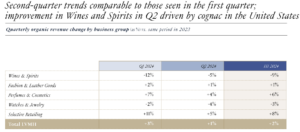

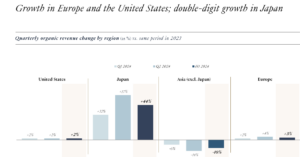

He noted (see image below) the high incidence of Chinese customer purchases abroad with a very positive impact on Japan – up +57% in Q2 – which remains one of the fastest-growing destinations for Chinese tourists. However, that dynamic’s corollary has been a negative impact on non-Japan Asia.

“The Japanese Yen currently stands at a 34-year low against the Euro, and Japan has become the most attractive shopping destination for Asian customers, which creates several challenges,” Guiony said.

“We really have a big shift of business from Asia into Japan. Bear in mind that Fukuoka, for instance, is only two hours by boat from the coast of China,” he said. “So it has a big impact. Not only do we have business at a lower price index compared to France, for instance, than is the case in China. But also we have lower margins… due to the cost structure.”

He added: “The magnitude and velocity of the Yen weakness make it difficult to offset the impact through price increases. Currencies fluctuate and this trend could reverse at any time, and we are reluctant to unduly penalise local demand in Japan. This means a significant portion of the growth is currently taking place at the lower price index.

“Second effect, it creates the equivalent of a deflationary situation in China. It’s a deflation in space instead of time, but the effect is the same. It creates an incentive for Asian customers to wait for the next trip to Japan, and in the meantime they are not buying at home.”

Later Guiony noted: “Analysing the Chinese customer is not the easiest thing in the world and we have a little bit of a hard time doing that from a pure macroeconomic viewpoint.

“When we look at our numbers, basically we look… at the global consumption of the Mainland Chinese cluster because it takes place partially inside China, partially outside China, and you have to look at it overall. As we’ve seen in the past, there could be some very important swings from one to the other.”

Further into the call, Guiony added: “We still see a lot of Chinese travellers, particularly into Japan, which basically says something about the appetite of Chinese customers, Mainlanders, for our brands, which shows no sign of fading away.”

However, he said, this “strange situation” of Japan attracting more than the company-wide growth is creating deflationary pressure in China – “because if you can’t buy at the Japanese price, you don’t buy and you wait till you go to Japan”.

He continued: “So these opportunistic purchases are probably more difficult to satisfy than was the case when Hong Kong and Macau were almost next door and [offered a] much easier opportunity to buy at a discount.” ✈