UK. Global travel retailer WH Smith PLC (WHSmith) today announced the successful completion of a £200 million (US$258 million) issue of US Private Placement (USPP) notes and a bank term loan of £120 million (US$155 million).

WHSmith Group Chief Financial Officer Max Izzard commented: “We are pleased to have successfully completed our refinancing, which includes our first US Private Placement and a new bank term loan.

“The refinancing strengthens our balance sheet, extends our debt maturity profile, and diversifies our capital structure. It also gives the Group access to a new debt investor base in the future, and we are pleased to have the continuing support of our banking partners.”

The announcement comes precisely two months after the leading convenience and essentials retailer confirmed it is exploring a sale of its High Street division.

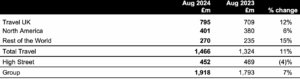

At the time the company said, “Over the past decade, WHSmith has become a focused global travel retailer. The Group’s Travel business has over 1,200 stores across 32 countries, and three-quarters of the Group’s revenue and 85% of its trading profit comes from the travel business.”

The USPP notes, which represent WHSmith’s debut issue in the USPP market, have a maturity of seven, ten and twelve years and have been issued on investment grade terms.

Simultaneously, WHSmith has agreed a £120 million three-year bank term loan with two uncommitted extension options of one year each. These would, subject to lender approval, extend the tenor of the new bank loan to four and five years, if exercised.

The additional bank loan is provided by a syndicate of existing lending banks comprising Fifth Third Bank National Association, HSBC UK Bank, Banco Santander, London and Skandinaviska Enskilda Banken.

The Group’s existing £400 million (US$516 million) revolving credit facility is retained and matures in June 2029. The RCF (Revolving Credit Facility) has one remaining uncommitted extension option of one year, which would, subject to lender approval, extend the maturity date to June 2030, if exercised.

WHSmith said this refinancing will diversify the Group’s sources of debt financing and extends its debt maturity profile in advance of the convertible bond maturing on 7 May 2026.

The income statement cost of the convertible bond is circa 4.6% including the non-cash debt accretion charge. The income statement cost of the replacement financing will be circa 6.3%. ✈