SPAIN. World Duty Free Group (WDFG) is challenging the terms of its “˜Lot 1′ duty free retail concession at Adolfo Suárez Madrid-Barajas Airport in the wake of a heavy passenger traffic decline in 2013 and a big increase in rental costs, The Moodie Report can confirm.

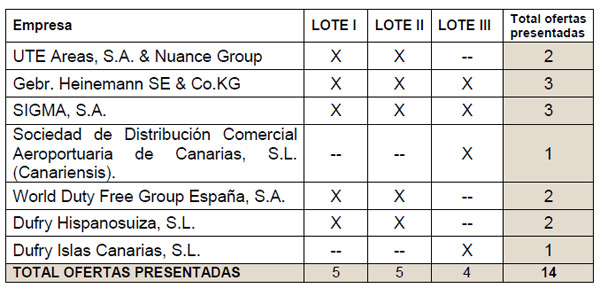

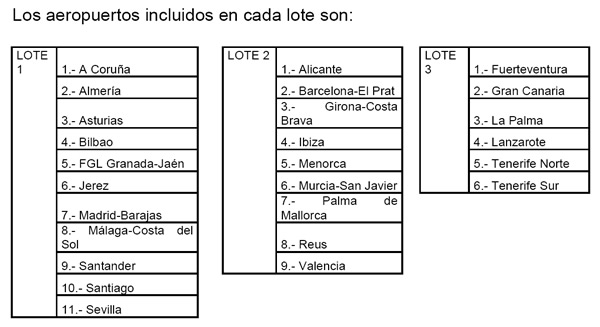

WDFG won the Lot 1 concession (containing 11 airports’ duty free operations) in 2012 ahead of competition from Dufry, LS travel retail entity SIGMA and Gebr Heinemann.

Madrid represented the largest of the airport concessions on offer. WDFG offered €753.1 million over the period to 31 October 2020 for Lot 1 (see charts). It also won Lots 2 and 3.

|

This key chart shows the rising cost of the Spanish airports minimum annual guarantee; Source: World Duty Free Group |

But as reported, the retailer ran into heavy weather in 2013 as the combination of significantly increased rent & royalty costs and a heavy -12.1% decline in 2013 traffic at Adolfo Suarez Madrid Barajas Airport (representing some 5.4 million passengers), took a heavy toll on profitability. “The concession was awarded in 2012 expecting growth from 2013 onwards but growth did not start until November 2013,” WDFG said in a statement earlier this month (see passenger traffic chart below).

|

“It is not a Spanish problem, it is a Madrid problem.” Here are WDFG’s minimum guarantees year-by-year to 2020 for Lot 1 (Note: The figures are adjusted to reflect future payments at late 2012 values and hence do not add up to the €753.1 million offered). Source: AENA |

In a presentation to analysts on 2 October, WDFG laid bare its Spanish problems, leading to a protracted slump in the retailer’s share price from €8.925 to a 52-week low of €6.05 by mid-October. Shares rallied +5.06% on Friday to €6.65.

|

Combine lower than expected Spanish passenger numbers, including a critical -12.1% decline at Adolfo Suarez Madrid Barajas Airport in 2013, with increased rents and the source of the retailer’s concern is clear; Source: World Duty Free Group |

|

More positively, core category sales growth continues to easily outstrip a welcome increase in passengers. Note the strong third quarter of 2014; Source: World Duty Free Group |

An online article in Spanish business news media El Confidencial yesterday, headed “˜Aldeasa declara la guerra a Aena’ (“˜Aldeasa declares war on Aena’), claimed that WDFG has threated to close its Spanish headquarters in Madrid and change local employment conditions if the airport authority will not modify the terms of the Lot 1 contract.

However, The Moodie Report has learned that WDFG will shut its Madrid headquarters whatever the outcome of negotiations and use London as its base. “Two headquarters is a nonsense,” a source said.

|

El Confidencial: “˜Aldeasa declara la guerra a Aena’ (“˜Aldeasa declares war on Aena’), |

The company is adamant that AENA’s passenger traffic projections for Madrid were misleading and much higher than those offered soon afterward when the airport operator tendered the food & beverage concessions at the airport (where Ãreas, formerly a joint venture partner with AENA, swept the board to capture all four packages). We are seeking AENA response to those claims.

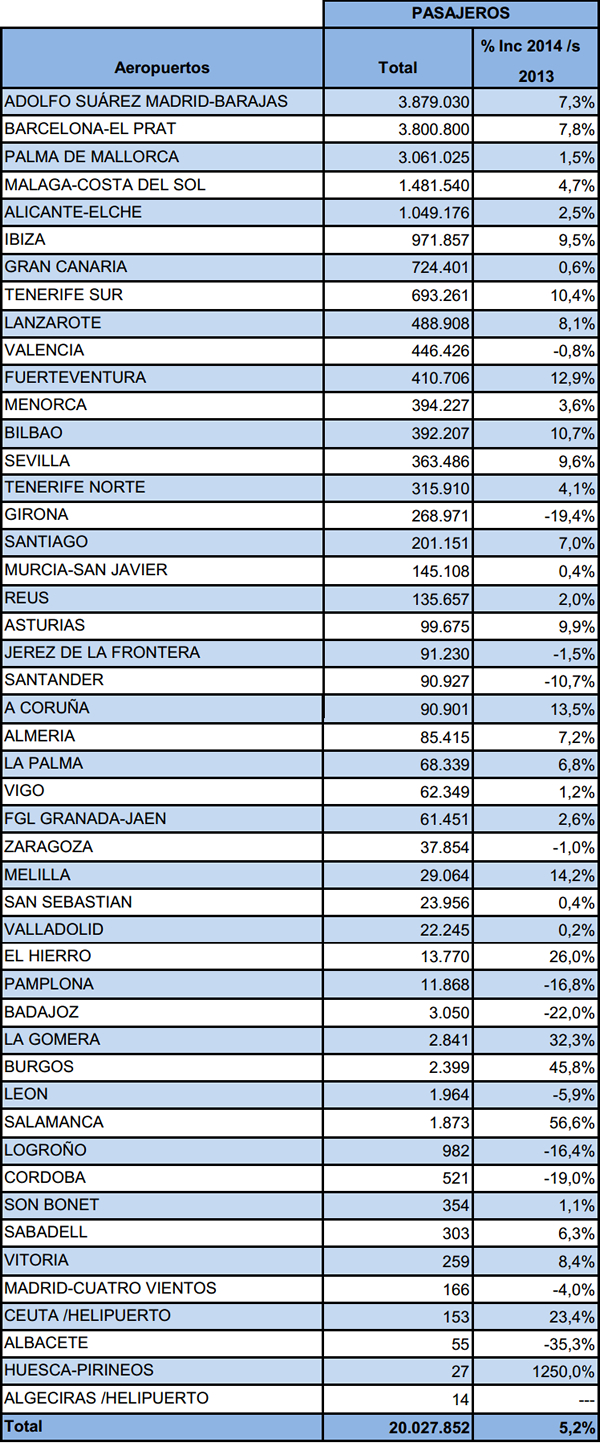

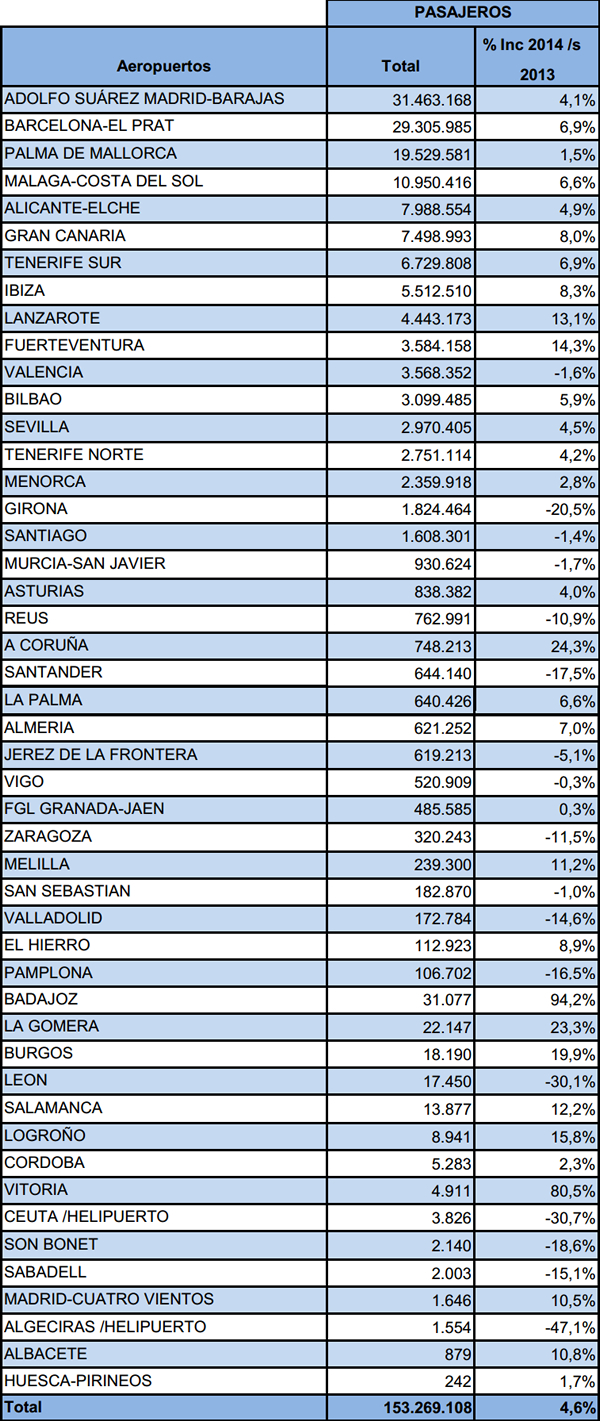

In its defence the airport operator will certainly point to the recent recovery in traffic at Madrid. For the first nine months of 2014, the airport handled 31,463,168 passengers, up +4.1%. It’s the international passenger component that matters in this context and according to ACI that sector, too, rose + 4.4% in the first six months to 13.8 million.

|

Figures for September (above) and the first nine months of 2014 (below) show a steady improvement in passenger traffic across the AENA estate, including Adolfo Suárez Madrid-Barajas Airport |

|

Source: AENA |

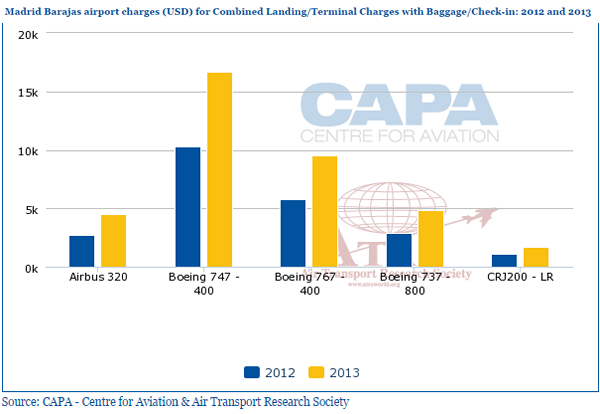

WDFG also claims that AENA’s decision to increase airline landing fees had contributed to the 2013 passenger decrease (since then AENA has introduced an airport charge discounting scheme as an incentive to airlines). Aviation analyst CAPA noted in a late 2013 report that there was a “clear link” between the increased charges and the falling traffic. Data from CAPA’s Airport Charges Database (supplied by Air Transport Research Society) showed that combined landing and terminal charges across a range of aircraft types at Spain’s largest airport increased by some +60% or more in 2013 versus 2012.

|

Madrid Barajas airport charges (USD) for Combined Landing/Terminal Charges with Baggage/Check-in: 2012 and 2013; Source: CAPA |

An informed source told The Moodie Report that AENA had to be “flexible” over the Lot 1 package or else WDFG would react strongly. “It is not a Spanish problem, it is a Madrid problem,” the source said. “Yes, we are ready to go to war. It is a major problem and we won’t let it go.”

The source said that if negotiations failed, WDFG is prepared to sue the authority or exit, possibly both.

We’ll bring you AENA reaction as soon as possible.

|

World Duty Free Group executives were euphoric when they won the Spanish airport contracts in late 2012 but things have soured since |

|

AENA commercial management and bidders in Madrid on a dramatic day in duty free |

|

|

|

World Duty Free Group has invested heavily in its new shops at Barcelona El Prat, Palma de Mallorca and Adolfo Suárez Madrid-Barajas airports, but believes the latter’s contractual terms are not sustainable |

|

AENA split the concessions into three lots, including debut duty free stores for the airports of A Coruña, Asturias, Federico García Lorca Granada-Jaén, Murcia-San Javier and Santander |