“The design of the new Dufry logo creates a symbiosis of Dufry’s Swiss heritage and the shopping basket as symbol for the Group’s key activity – to successfully operate travel retail shops – with the commitment to be WorldWide.WorldClass!” – Dufry

“The design of the new Dufry logo creates a symbiosis of Dufry’s Swiss heritage and the shopping basket as symbol for the Group’s key activity – to successfully operate travel retail shops – with the commitment to be WorldWide.WorldClass!” – Dufry

INTERNATIONAL. Travel retail’s most powerful player Dufry today unveiled a new corporate logo and brand identity, following the acquisitions of The Nuance Group and World Duty Free over the past two years.

The company made the announcement while presenting its nine-month results (see below).

It said: “The unique character of the acquisitions of Nuance and World Duty Free and their integration into Dufry has considerable implications at internal and external level. Three established corporate cultures and three well-recognised duty free brands need to be integrated and aligned.

“I am confident that with the new business operating model and new corporate identity we are ready to combine the best of the three companies and benefit from the incredible possibilities that it entails”Julián Díaz

“I am confident that with the new business operating model and new corporate identity we are ready to combine the best of the three companies and benefit from the incredible possibilities that it entails”Julián Díaz

Dufry CEO & Chairman of World Duty Free“Dufry’s new corporate logo and clearly structured branding strategy provide both a common starting point with respect to corporate culture and identity for all Group employees, and a consistent branding approach for the markets, allowing to maintain the powerful commercial brands at local level and to benefit from their recognition and positive image established with landlords and customers.”

It added: “The design of the new Dufry logo creates a symbiosis of Dufry’s Swiss heritage and the shopping basket as symbol for the Group’s key activity – to successfully operate travel retail shops – with the commitment to be WorldWide.WorldClass!”

Dufry said that the existing portfolio of brands which are successfully established in specific regions, such as Hellenic Duty Free in Greece for example, or which represent specific commercial concepts, such as Hudson for our travel convenience stores, will be continued and also implemented on a case-by-case basis going forward.

“The three main identities of the traditional duty free business, Dufry, Nuance and World Duty Free will also be continued and used according to their brand recognition at country or regional level.

“Going forward, Dufry will therefore assess in each situation which is the most suitable brand to be used for a specific project and implement it accordingly. This will allow to benefit from the positive local recognition of the existing commercial brands and to successfully drive global expansion. The implementation of the new logo will be executed on a step by step basis.”

CEO Julián Díaz said: “I am very proud to present our new corporate structure, the new branding and of course, the new logo: three essential and most relevant elements of Dufry’s further growth and value creation.

“During the many years of growth Dufry has always adapted its structure in smaller steps, but after the combination with Nuance and WDF, we needed to take a deep look at our foundations and rethink our entire company. I am confident that with the new business operating model and new corporate identity we are ready to combine the best of the three companies and benefit from the incredible possibilities that it entails.

“On the one hand, our new organization and the simplified processes will allow us to create new concepts and growth opportunities, while at the same time accelerate the speed of implementation and benefit from additional potential efficiencies.

“On the other hand, the new corporate identity symbolized with the new logo provides a new common starting point for all employees and unique set of values. This will allow us to accelerate the integration of the different cultures and to align our teams and ways of working along with the Group strategy.”

COMMENT: “I think you need to do something about your logo.” I’d like to think my comment to Julián Díaz over dinner after his stand-out presentation at this year’s Trinity Forum in Hong Kong had something to do with today’s change but as usual the Dufry CEO was way, way ahead of me. As is his want, he just smiled and said, “Let’s see what happens.”

A logo is far more than a badge of a company’s trading and brand identity. At best it is a deep-meaning symbol that captures the very essence – and even direction – of an organisation.

The old Dufry logo looked – and was – tired. It simply did not sit with the ever-evolving persona, sophistication and (most importantly) internationalism of a corporate giant – one that had transformed itself from bit-part player to industry colossus in just over a decade to an extraordinary position where it now generates approximately one in every four dollars of sales in airport travel retail.

As the company notes, the new logo encapsulates Dufry’s long-time Swiss heritage with its prime focus of selling to the international traveller (expressed via a chic shopping basket icon) ‘WorldClass, WorldWide’ neatly sums up both qualitative aspirations as well as trading reality. In today’s social media parlance, ‘Like’.  ACQUISITIONAL IMPACT DRIVES SALES & PROFITS GROWTH

ACQUISITIONAL IMPACT DRIVES SALES & PROFITS GROWTH

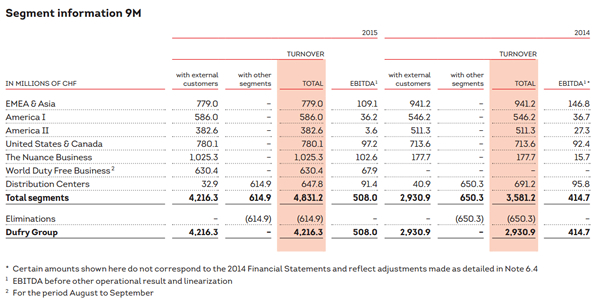

In the first nine months of 2015, Dufry posted what it described as “a good performance”. Turnover, driven by the acquisitional impact, grew by +43.9% in the year to September to CHF4,216.3 million but organic growth contributed a negative -4.9%. EBITDA grew by +22.5% to CHF508 million with an EBITDA margin of 12.0%.

Cash generation continues to be strong, Dufry said, with free cash flow of CHF327.1 million, +18.2% higher than in the first nine months of 2014. This performance includes the contribution of World Duty Free, which has been consolidated from August onwards.

Díaz said: “The performance shown by our company during the challenging period we have been facing due to the high volatility of several emerging market currencies, makes me confident in the resilience of our business model. Our strategy of diversification has prepared Dufry to mitigate temporary disturbances in specific markets, while benefiting from the positive long-term trend in travel retail. Our financial solidity is also a case in point that we have shaped the Group the right way.

“In the last quarter, we have worked on several initiatives to drive organic growth. The initiative launched to accelerate the refurbishment of shops has already shown results. So far, Dufry has refurbished 34,600sq m of retail space in the year. Among many shops, the refurbishments in Greece and Italy, where the revamp generated double-digit sales growth, are good examples of the impact that this initiative can have.

“Within the brand plan initiative, we have already agreed upon individual plans with seven major brands. On the cost side, the efficiency plans put in place in Brazil and Russia were fully implemented and will generate savings of CHF20 million in 2016. In terms of the integration of Nuance, most of the streams are completed and we can confirm that all synergies will be implemented by the end of 2015 and will be fully reflected by full-year 2016.

“Last but not least, we are well on schedule on the WDF acquisition, having already crossed the 95% threshold, with which the squeeze-out of the remaining minorities and the delisting of World Duty Free by mid-November will be only a formal step left to be made.”

The impact of The Nuance Group and World Duty Free Group acquisitions has been “transformational”Following the two “transformational” acquisitions of Nuance and World Duty Free, Dufry said it has adapted the Group organisation and operating business model to the “considerably increased footprint” and number of operations to benefit from further efficiencies going forward.

The impact of The Nuance Group and World Duty Free Group acquisitions has been “transformational”Following the two “transformational” acquisitions of Nuance and World Duty Free, Dufry said it has adapted the Group organisation and operating business model to the “considerably increased footprint” and number of operations to benefit from further efficiencies going forward.

As reported last week, operations have been restructured into five new divisions, directly managing their related countries, “thus being closer to customers and landlords”.

The negative organic growth of -4.9%, when adjusted for the impact from the troubled Russian and Brazilian markets, showed a positive performance of +4.7%.

Like-for-like growth of World Duty Free reached +5.0% in the first nine months. Net new concessions (adjusted) accounted for a marginal +0.7% uplift, to which gross new openings contributed +2.4%, mainly from shops opened and refurbished in Athens and Milan Malpensa airports.

Source: DufryREGIONAL RESULTS

Source: DufryREGIONAL RESULTS

Turnover in Region EMEA & Asia reached CHF779.0 million in the first nine months of 2015, down sharply from CHF 941.2 million a year earlier. In constant exchange rates (CER), turnover declined by -9.7%. Overall, European markets performed well, except for locations with high exposure to Russian passengers, Dufry said. In Greece, this impact has been partially mitigated by the record number of tourists visiting the country this year.

A “remarkably positive development” has been seen in Italy, due to recent refurbishments and expansions in Milan Malpensa and Bergamo airports. In Eastern Europe, Czech Republic and Serbia continued to post solid growth.

In Africa, Dufry’s existing business started to stabilise in Q3. The comparable basis of the region has been impacted by the exiting of travel retail operations in Tunisia. In Middle East and Asia, most of the operations posted good growth, including those in China, South Korea, Cambodia and Indonesia.

Turnover in grew by +7.3% to CHF586.0 million in the first nine months. When measured in local currencies, it grew by +9%. In Central America, Mexico was largely stable and the Caribbean continued to present a good performance, especially in Dominican Republic, Dufry said. In South America, Argentina continued to see a solid performance.

Region America II turnover stood at CHF382.6 million in the nine months of 2015 from CHF511.3 million one year earlier, another sharp fall. In local currency terms the development was nearly flat, Dufry pointed out.

The decline was caused by the devaluation of the Brazilian Real, which intensified in the third quarter (-56% in Q3 vs -29% in H1). The weakening of the local currency lowered the purchase power of Brazilians, the main consumer group in the region.

Dufry has continued to extend its footprint in Brazil by opening 19 new stores in the first nine months, implementing different duty free and duty paid retail concepts such as the Hudson travel convenience shops and branded stores, such as Apple shops.

Turnover in Region United States & Canada rose by +9.3% to CHF780.1 million. Measured in CER, turnover grew by +3%. Dufry’s operations in the region continue to follow the “resilient growth” in passenger numbers and to boost spend per passenger, mainly through productivity gains, the company said.

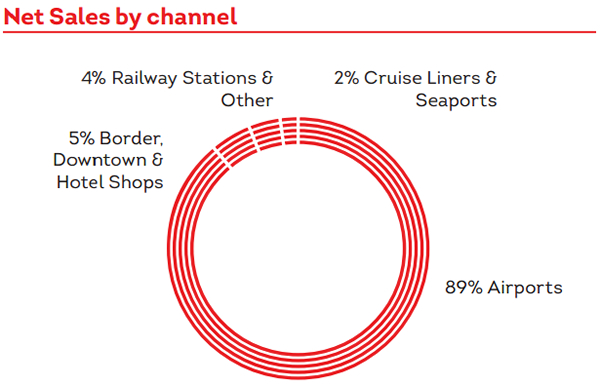

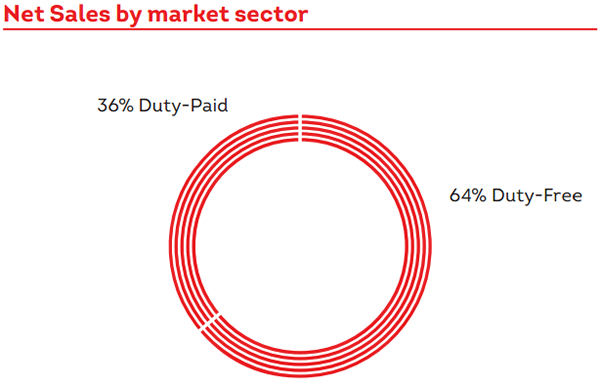

Net sales by region, category, channel and sector, respectively

Net sales by region, category, channel and sector, respectively

DETAILED FINANCIAL RESULTS

DETAILED FINANCIAL RESULTS

Acquisitions drove a +41.9% rise in gross profit to CHF2,449.5 million. Gross margin in the third quarter reached 58.3%, practically equalling the same performance level of the previous year, of 58.4%. Over the first nine months the gross profit margin was reduced from 58.9% in the previous year to 58.1% as a result of the consolidation of Nuance and World Duty Free.

Selling expenses reached CHF1,144.8 million in the year to September, versus CHF702.9 million a year earlier. As a percentage of turnover, selling expenses rose from 24.0% to 27.2 as an effect of the consolidation. For Dufry’s standalone business, selling expenses as a percentage of sales remained largely flat.

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail)

Click on the above to view the enlarged image (then hover over graphs with your cursor and click for full detail)

NEW GROUP STRUCTURE

NEW GROUP STRUCTURE

As reported, from 1 January 2016 Dufry will operate according to the new divisional and operational structure consisting of five divisions.

This represents “a well-balanced and diversified geographic split”, Dufry said. The new divisions are:

• Southern Europe and Africa

• UK, Central and Eastern Europe

• Asia, Middle East and Australia

• Latin America

• North America

The first division, Southern Europe and Africa, headquartered in Madrid, Spain, connects businesses from the three former Groups, such as Italy, Greece, Turkey and Spain, and thus consolidates Dufry’s leading position in the Mediterranean.

The second division, UK, Central and Eastern Europe, will be headquartered in London, UK, and will also include markets such as Switzerland, Sweden and Russia, among others. The division combines an attractive portfolio of markets with a well-balanced passenger mix from developed and emerging countries, Dufry said.

By creating the new division Asia, Middle East and Australia, headquartered in Hong Kong, Dufry said it is underlining its increased footprint in the region, “where the critical mass has now been reached”. For the Group this region represents an important growth area with the potential to drive expansion in new and existing markets.

The division Latin America, with headquarters in Miami, has been redefined with the integration of Brazilian and Bolivian operations as well as the WDF businesses in Peru and Chile. This will allow the division to generate additional synergies and efficiencies in a geographic area where Dufry has a long-lasting market know-how and an important footprint, the company said.

The North America division, based in New Jersey, USA, – even if geographically unchanged – will see an improved footprint and an increased diversification of its retail concept portfolio through the integration of the former Nuance and World Duty Free operations, Dufry noted.

The new geographic segmentation is also reflected in the Group Executive Committee – announced on 28 October – which has seen five new appointments and includes executives from all the three former Groups. It comprises the following executives:

Chief Executive Officer (CEO) Julián Díaz

Chief Financial Officer (CFO) Andreas Schneiter

Global Chief Operating Officer (GCOO) José Antonio Gea

Global Chief Corporate Officer (GCCO) Luis Marin

Global Resources Director Jordi Martin-Consuegra

General Counsel Pascal Duclos

CEO Southern Europe and Africa Pedro J. Castro Benitez

CEO UK, Northern and Eastern Europe Eugenio Andrades

CEO Asia, Middle East and Australia Andrea Belardini

CEO Latin America René Riedi

CEO North America Joseph DiDomizio

General Manager Brazil and Bolivia Gustavo Magalhães Fagundes