The 2018/19 Airport Commercial Revenues Study is now available for purchase.

The 2018/19 Airport Commercial Revenues Study is now available for purchase.

The 2018/19 edition represents the 11th edition of the ACRS which was first launched in 1998 as a world-first, ground-breaking benchmarking analysis of the performance of airport retail programmes around the world.

The ACRS is therefore the oldest and still the leading publication that benchmarks airport commercial revenue performance. The ACRS covers all aspects of airport commercial revenue programmes including duty free, F&B, specialty retail, currency exchange, advertising, car parking and car rental.

The 2018/19 Edition was prepared for The Moodie Davitt Report by The Mercurius Group, a leading airport and infrastructure commercial planning consultancy. Mercurius Managing Director, Ivo Favotto, was the founder of the ACRS in 1998 and his return represents a return to the original style of the ACRS where we attempt not just to measure performance but to explain it.

At the same time, the ACRS has been modernised based on extensive research and customer feedback, with new sections including:

- Retail space per thousand passengers;

- Overviews of the duty free, F&B, Specialty and Currency Change sectors;

- Analysis of duty free sales by product category for each region and airport size type;

- Analysis of F&B by sub-segment (i.e. QSR v Food Court Outlets v Bars/Cafes/Casual Dining;

- Analysis of specialty retail by sub-segment (i.e. News/Gift, Beauty, watches & jewellery, fashion & accessories, souvenirs, packaged food, electronics and other);

- Analysis of goods-in, storage & waste-out management and practices;

- Analysis of other commercial income streams including car parking, car rental and advertising;

- Analysis of pricing and service obligations imposed on concessionaires; and

- Analysis of common terminal planning practices (i.e. gate provision, security lanes, lounges, common-user systems, call-to-gate systems, automated bag drop and fast track systems.

These new areas of analysis are in addition to all the usual features of the ACRS where commercial sales and rents are analysed on both a per-passenger and per-sqm basis and where yields by retail sector and sub-sector are determined.

For details on how to purchase the 2018/19 ACRS, please contact Jess Allerton at Jessica@MoodieDavittReport.com

Key Highlights

Three key highlights of the 2018/19 ACRS are provided below to give some insight into the quality of data and analysis provided:

- Retail space per thousand passengers;

- Duty Free sales per departing international passenger; and

- F&B Yield by Outlet type.

All the data presented in this article is indexed to global averages to demonstrate the type and quality of insights included in the ACRS. The actual data is provided within the ACRS.

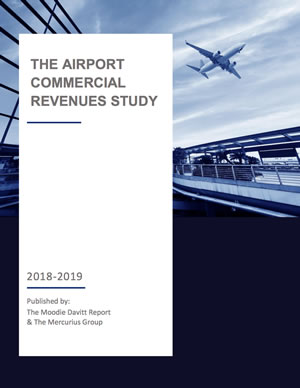

Retail Space per Thousand Passengers

One of the most sought after benchmarks in the ACRS in the amount of retail space provided per thousand passengers.

A key question faced by airports worldwide, particularly when contemplating terminal developments or expansions is – how much retail floor space can I sustain?

While the answer is of course very circumstantial to each individual airport, the ACRS’ benchmarks are the ideal starting point. Shown as an Index below but with the actual data in the ACRS, the Asia-Pacific region typically provides, on average, 32.7% more space per thousand passengers than the global average.

By contract, airports in the Americas only provide 67.3% of the retail space per thousand passengers compared to airports on average. Airports in Europe provide just about the same level of retail space per thousand passengers as the global average.

The ACRS goes into detailed analysis to explain the key factors behind these regional differences and the cycles individual airports go through over the course of typical terminal expansions as terminals grow over time in response to passenger growth.

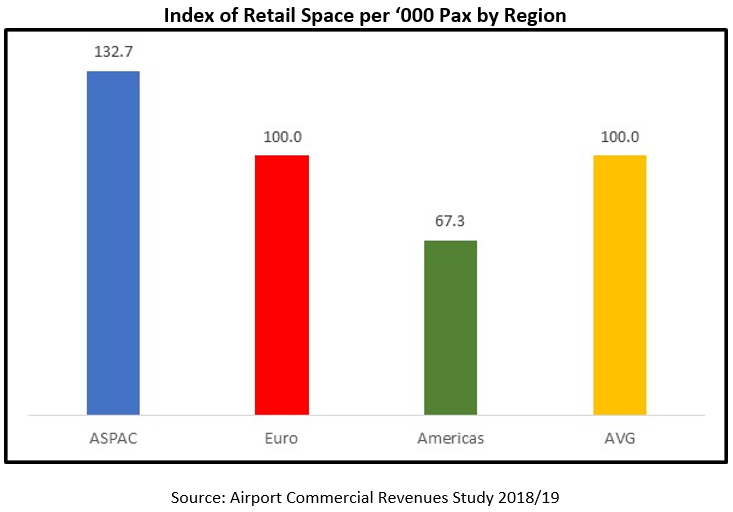

Duty Free Sales Per Departing International Passenger

Duty free remains the headline act of travel retail. Typically, duty free accounts for 8.5% of total retail space but 28% of sales and 48% of airport income.

The figure below provides an index of duty free sales per departing passenger performance for airports around the globe. Asia Pacific leads the way, with duty free sales per departing passenger 28.4% higher than the global average.

Interestingly, the small airport average (i.e. for airports with less than 10m total passengers per annum) is higher than global average. In the Americas, small airports perform particularly well and large airports particularly poorly, relative to the global average. In Europe, sluggish duty free sales (on average) in recent years have resulted performance below the global average for airports of all sizes.

F&B Yield by Outlet Type

F&B in increasingly becoming the growth engine of travel retail and increasingly where airports can bring a sense-of-place and downtown experiences to the airport.

Nevertheless, F&B outlets on average consume 75% of all retail space at airports but only 23% of airport income.

The ACRS provides very useful F&B performance benchmarks include sales per departing passenger, sales per square metre and yield. In addition however, the 2018/19 edition of the ACRS also provides – for the first time – analysis by outlet type. Benchmarks are segmented into three outlet types:

- Quick Service Restaurant (QSRs);

- Food Court outlets (FCOs); and

- Café/casual dining/bar (other).

The yield generated by these three different outlet types differs markedly. The figure below provides an index of yield by outlet type based off the global average. Note that actual yield percentages (rather than an index of yields) are provided in the ACRS.

Interestingly, QSRs generate only 56% of the global average F&B yield and yet are a common feature of many airport’s F&B program because of the volume of sales they can bring and the fact that they service a market at a price point. Similarly for FCOs.

Cafes/bars/casual dining outlets have the highest yield of all outlet types, generate 11.9% more than the global F&B average yield and they are by far the dominant outlet type in terms of contribution to number of outlets, share of space, share of sales and share of airport income.

Summary

The 2018/19 ACRS is typical of the ACRS’ evolutionary journey since its inception in 1998. The 2018/19 edition modernises airport retail benchmarking with new areas of analysis and greater degrees of granularity.

According to MrMartin Moodie, Founder and Chairman of The Moodie Davitt Report, “In developing and modernising the 2018/19 edition, we are responding to extensive airport and purchaser consultation.

“We get a lot of feedback asking us to revert to the ways of the original ACRS and provide individual airport data however, due to confidentiality considerations, we cannot do this. Maintaining the confidentiality of the data provided to us is the bedrock of the ongoing continuation of the ACRS as it provides airports with the comfort of providing us the data with which we generate the benchmarks. But at the same time, we found new benchmarks to provide. In providing data on retail space per thousand passengers, goods-in/storage/waste-out strategies and terminal planning considerations we are giving airports the data they have requested to help them plan and manage heir retail programs,” he said.