|

“We stand ready to acquire, if the right opportunity is available, companies with a strong balance sheet that are cash-generative“ |

Julián Diaz Chief Executive Officer Dufry Group |

INTERNATIONAL. Dufry is planning to open around 10,000sq m of new store space in 2011 amid the continuing expansion of the business. That’s according to CEO Julián Díaz, speaking to analysts and media after yesterday’s annual results announcement.

As reported, Dufry revealed a +9.7% rise in turnover to CHF2,610.2 million (US$2,867 million) in 2010 (up +15.0% based on constant rates), while EBITDA grew by +19.2% (at constant exchange rates).

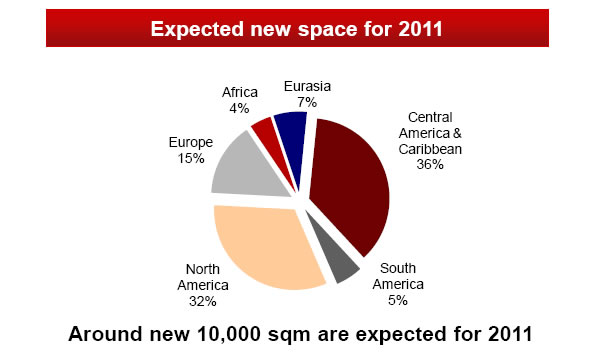

Díaz said: “We have signed contracts to open a further 10,000sq m of space in 2011. In Europe this will be in Italy’s rail network and we also won a tender in Martinique (in the French West Indies). In Africa we have won a tender in Rabat, and in Eurasia we will open new stores in Russia, Serbia and Cambodia. In Central America the development will include new openings in Aruba, St. Kitt’s, Dominican Republic and Jamaica, and in Brazil in South America.

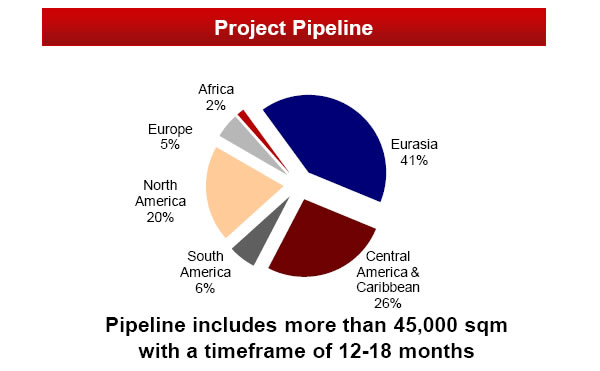

“In North America we won a significant tender for 20 stores at Los Angeles Airport, with other openings due in Chicago, Boston and many other locations, both in the US and Canada. And in the pipeline over the next 12-18 months we have a further 45,000sq m under negotiation across all of our regions.”

Of the new space planned for 2011, 36% is set to open in Central America/Caribbean, 32% in North America and 15% in Europe.

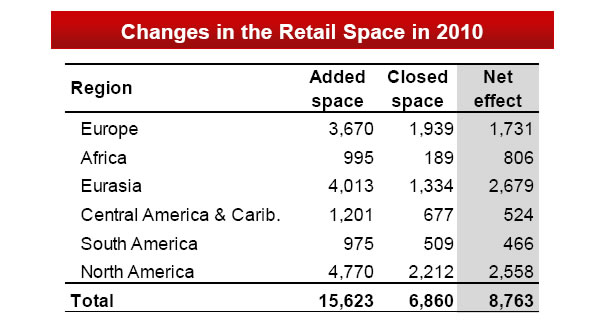

In 2010 the company opened a net 8,763sq m of new space (store openings and closures combined).

|

Díaz said: “The big openings in Europe were at Nice Airport, where we opened a number of new boutiques, plus we strengthened our position at railway stations in Italy. In Region 2, Africa, the most important development was at Borg El Arab, near Alexandria, a new operation, and two new airports in Morocco. In Eurasia the big development was our new openings in Shanghai, and in Central America/Caribbean it was in Dominican Republic, Barbados, Aruba and Mexico.”

|

In 2011, he added, the company will pursue growth around three key themes.

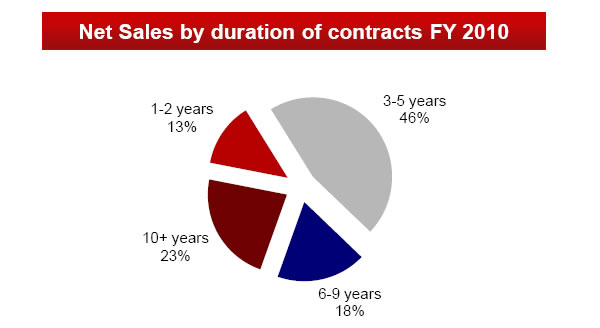

“First, we will push ahead with our plans to improve our operational execution and management, on top of passenger growth, to continue with our target of achieving +6% to +9% organic growth in the year. We have also targeted a growth of 100 basis points in gross profit margin improvement, with tighter control of our costs and better cash management.

|

“Second, we intend to be very active in expanding through new concessions and acquisitions, trying to maintain our net expansion of space (store openings and closures combined) at +6% a year, as we have done in previous years. As before, we will focus on emerging markets, tourist destinations and non-developed travel retail markets. And we stand ready to acquire, if the right opportunity is available, companies with a strong balance sheet that are cash-generative.”

Díaz also noted that any acquisitions would be in emerging markets and would be in the duty free rather than duty paid sectors. He also emphasized that the targets would be “˜mid-sized’ with sales of between US$100-200 million and with double-digit EBITDA.

He added: “The third point is that we are living in a period of short-term volatility. But our business model has shown its resilience due to our diversification. In the short term the volatility might increase but in the long term the outlook is positive.”

Díaz also commented on the performance in the first three months of 2011, when parts of the business were hit by weather-related problems (in North America) and political unrest (in North Africa).

He said: “In the US and Canada we saw more than 20,000 flights cancelled due to the heavy snow storms, with collateral effects on the Caribbean. In Tunisia, Egypt and Ivory Coast, there was the impact of political disruption with collateral impacts on Russia and Italy. Charter flights from Russia and Italy were especially affected.

“But there was mitigation in that many passengers were also diverted to Morocco in North Africa, or in the US and Canada, to the Dominican Republic or the British Caribbean, where we also have operations. This shows the importance of our regional diversification strategy. We evaluate the impact of these events on our business at around 4% of sales in 2011 to date, but with the weather-related problems over in North America and the political situation stabilising in North Africa, things are improving.

“The fastest improvement has taken place at Sharm el Sheikh, while in Tunisia and Ivory Coast we expect the situation to remain weak for two or three more months. We also expect that by May 2011, Russian charter flights will be back to normal.

“In the year to date, from January to this week, we have seen double-digit growth in Europe and in South America (at constant exchange rates). The other regions have shown single-digit growth, apart from Africa, which is down by around -10% due to the impact of the political situation in Tunisia and Egypt.”

|