|

Monarq is advancing its strategy of broadening its brand portfolio by taking on a premium portfolio of Bacardi brands.

From 1 July Monarq embarked on a regional partnership with Bacardi Caribbean/Atlantic to manage domestic and duty free distribution and marketing execution on most Caribbean islands of a premium portfolio of Bacardi brands.

|

“We are currently in the midst of the transition, getting ready for the high season in the Caribbean, and the feedback from our distribution partners has been very positive.“ |

Robert de Monchy Managing Director Monarq |

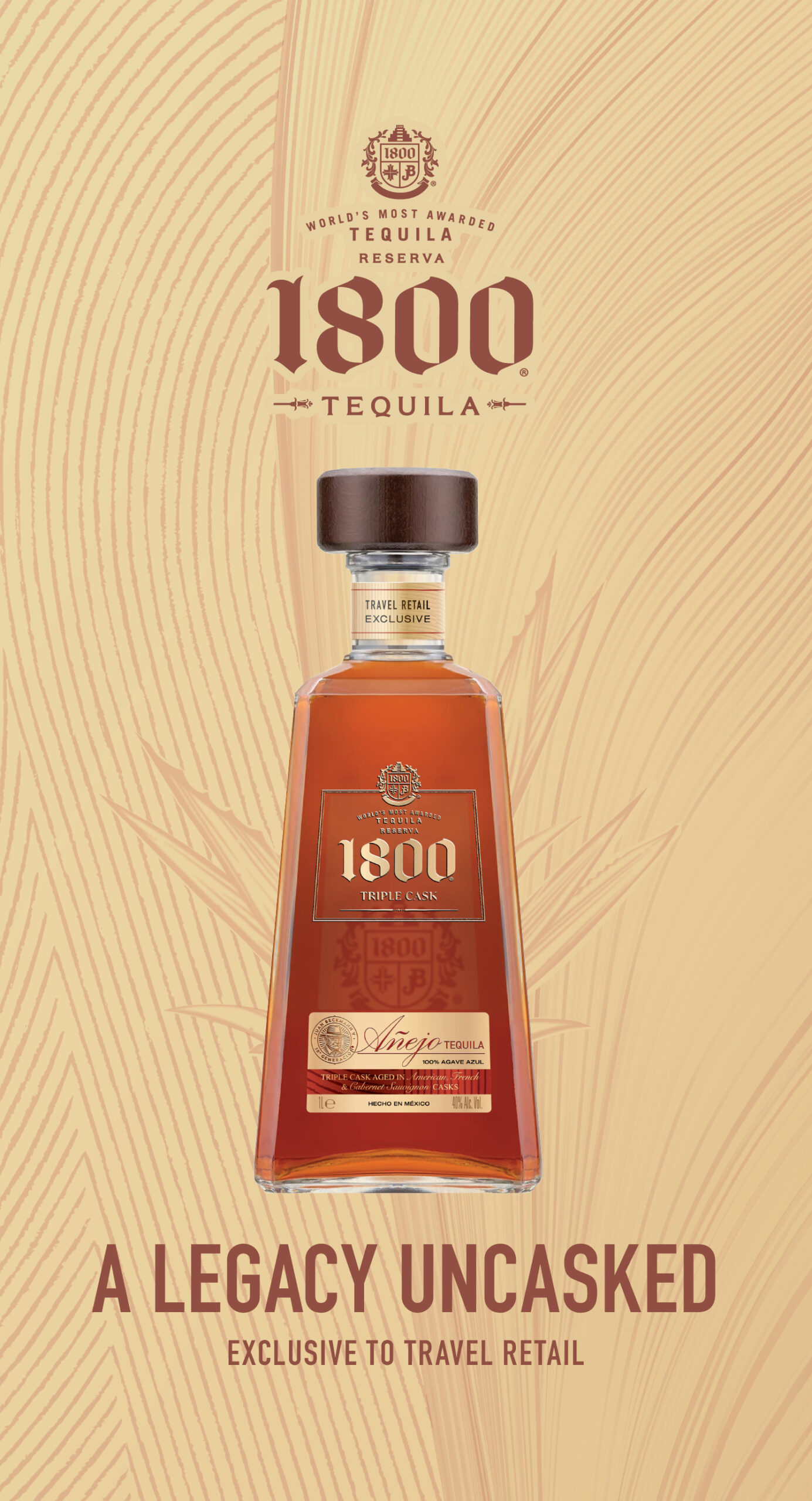

Those include Baron Otard Cognac, B&B and Benedictine, Cazadores Tequila, Eristoff Vodka, Noilly Prat Vermouth and Oxley Gin.

“We are currently in the midst of the transition, getting ready for the high season in the Caribbean, and the feedback from our distribution partners has been very positive,” Monarq’s Managing Director Robert de Monchy told The Moodie Report.

“The distribution agreement with Bacardi is in line with our strategy and the portfolio – which is only a part of Bacardi’s portfolio – fits like a glove.

“Brands such as DOM Benedictine and B&B are unique in itself, while others like Oxley Gin, Baron Otard Cognac and Cazadores Tequila fill a gap in our portfolio.”

Monarq has added a sales & marketing coordinator to its Miami office to service the brand additions.

As reported, Monarq has built its portfolio strongly in the past year with additions like Teeling Whiskey, Ole Smoky Moonshine and Richland Rum.

“Our strategy is a wide but not deep portfolio,” de Monchy explained. “We aim to have a leading brand in each of the relevant alcoholic beverage categories.

“Besides, we are always open to look at true innovations, such as Ole Smoky moonshine, Crystal Head Vodka or Frutta Winespirit.”

De Monchy underlined the need to meet increasing demand for innovative products, travel retail exclusives and destination products – a global trend but one that applies especially to Caribbean cruise ship passengers.

“Our portfolio is skewed towards this type of unique item. Travel retail is not all about price – it’s about the right proposition at the right moment.”

Powered by its strengthened portfolio, Monarq foresees continued growth in the Caribbean as well as Latin American, despite a possible slowdown in the Mercosur region, especially Brazil.

“The unfavourable exchange rate trend and economic slowdown have impacted duty free sales in Brazil and its borders,” de Monchy noted.