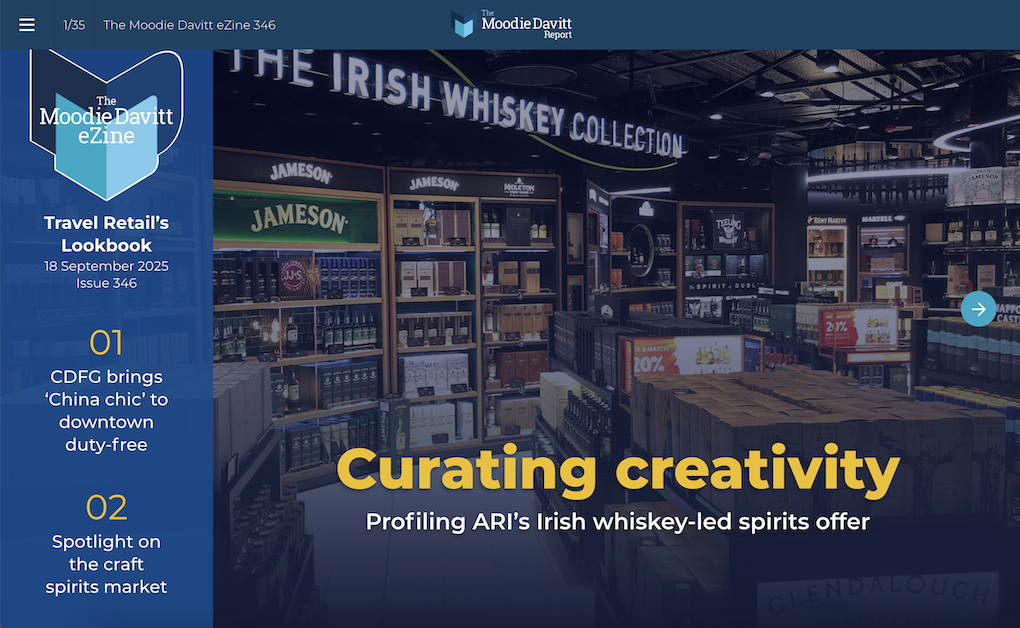

ASIA PACIFIC. TFWA Asia Pacific kicked off on Monday with the traditional opening conference, this year themed “˜Staying a step ahead’, at the Marina Bay Sands Expo & Convention Centre in Singapore.

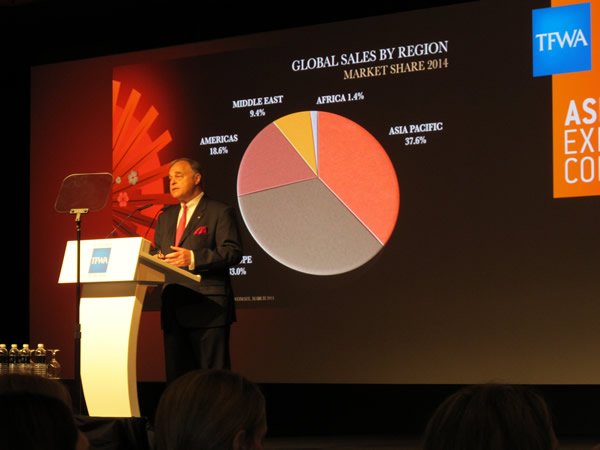

In his state-of-the-industry address, TFWA President Erik Juul-Mortensen presented the latest data on travel retail performance in Asia Pacific (courtesy of Generation Research). In 2014, the region received 521 million visitors and posted a modest +4.3% gain in duty free sales. Asia Pacific remains the largest market with a 37.6% share (Europe came in second at 33.0% followed by the Americas at 18.6%), up by +5.5%. The top-selling categories in the region were beauty (30.0%), fashion (19.2%) and wines & spirits (14.1%).

While growth in the region remains healthy, the rate of growth has slowed down. “We have reached a watershed point in Asia Pacific,” he declared, noting slow economic growth, political and social instability in certain countries, the evolution of consumer preferences from luxury goods to individual, bespoke and one-off experiences, and the online shopping boom.

He believes the increasing consolidation of the travel retail industry can add dynamism to the retail landscape. The future will be more challenging and competitive, requiring a period of adjustment, but there are still plenty of opportunities to exploit, Juul-Mortensen noted.

|

TFWA President Erik Juul-Mortensen: “We have reached a watershed point in Asia Pacific” |

|

Uncertainty over duty free allowances is a barrier to purchase at the airport and offers an opportunity for better communication, says APTRA President Jaya Singh |

Asia Pacific Travel Retail Association (APTRA) President Jaya Singh cited research that showed two-thirds of travellers do not purchase at the airport, many because they are unsure of their duty free allowances. Herein lies a challenge and opportunity for better communication – for example, the printing of destination-specific allowance information on boarding passes. More data-driven solutions like these will be shared at the APTRA Insights Seminar on Wednesday 13 May as part of APTRA’s endeavour to support development of the regional travel retail industry.

Success is not just about the bottom line, Singh underlined. Sustainability is key, as is a more pre-emptive and pro-active approach to identifying and addressing changing consumer needs.

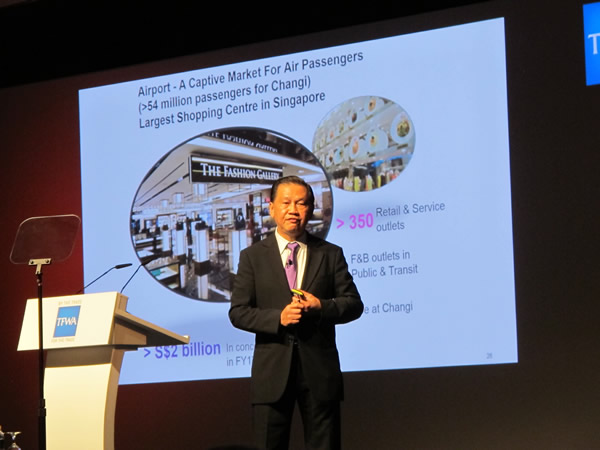

Changi Airport Group (CAG) Chairman and CapitaLand Group President and CEO Liew Mun Leong charted the development of Singapore Changi Airport into a “lifestyle entertainment centre” and the message behind its “˜The Changi Experience’ branding. Airports are no longer just air transportation facilities; they are now centres of shopping, dining and entertainment, he highlighted.

In 2014 Changi Airport handled 54.1 million passengers and delivered US$2 billion in concession sales. The numbers say it all: the airport sells on average 1.7 million bottles of perfume, 4.6 million boxes of chocolate and 5.6 million bottles of liquor per year. Several retail firsts, such as the new duplex stores for the liquor & tobacco (DFS) and perfumes & cosmetics (Shilla) categories, underscore the consumer-oriented and experience-focused approach underpinning The Changi Experience.

With the upcoming Terminal 4, Jewel Changi Airport, Changi East and Terminal 5 projects, Changi is set to become a mega airport, said Liew. The challenge is in maintaining efficiency – supporting the “˜hardware’ with five-star customer service.

|

Airports are no longer just air transportation facilities, says CAG Chairman Liew Mun Leong |

|

LVMH Group President Greater China Andrew Wu urges the travel retail industry to buckle up as China continues to evolve and change |

In his superbly insightful presentation entitled “˜Keeping up with China’s consumers’, LVMH Group President Greater China Andrew Wu documented the dizzying pace of change in China and the escalation of Chinese aspirations.

The past 25 years have seen a dramatic change in consumer attitudes, thanks to shifts in consumption; an unprecedented second-generation of wealthy Chinese and an emerging middle class creating “two Chinas”; digitalisation; and increased and differentiated travel.

Fasten your seat belt, Wu urged, because even though growth is slowing down, change is speeding up. This “˜new China’ comprises a broad spectrum of diverse consumer groups which require extensive study and understanding. “This is not a time to be complacent or arrogant,” he noted, adding that the industry must “try to understand, in order to prepare”.

Following the plenary session, delegates were offered a choice of four workshops, each focusing on a relevant topic.

Workshop A, “˜Enhancing the customer experience’, began with some words of wisdom from Changi Airport Group Assistant Vice President, Advertising & Promotions, Airside Concessions Nicole Foo: “Happy airports make more money.” Happy passengers spend 45% more than grumpy ones, Foo noted, and this finding reinforces Changi Airport’s service vision, titled “˜P.S. I Love Changi’ (P standing for “˜Personalised’, S for “˜Stress-free’ and together they make up “˜Positively Surprising’).

Foo emphasised an omni-channel experience, advocating engagement with customers beyond just retail. The customer experience at Changi encompasses four areas: retail (e.g. new duplex stores, foray into e-commerce through iShopChangi portal), marketing (“˜Be a Changi Millionaire’ anchor promotion and launch of The Social Tree), service (shopping concierge) and operations (revamped POS with integrated capabilities to simplify cashiering and support marketing communications).

To implement a successful omni-channel experience, airports have to begin with the desired experience design, taking into consideration all other airport partners. It is important to connect with customers emotionally, and not just on functional aspects, Foo concluded.

|

“Happy airports make more money” – a phrase that informs Changi Airport’s service vision, according to CAG Assistant VP Advertising & Promotions, Airside Concessions Nicole Foo |

|

Nestle International Travel Retail Global Head of Sales Alan Brennan urges the industry to “pick your battles” when competing with e-commerce and domestic markets |

|

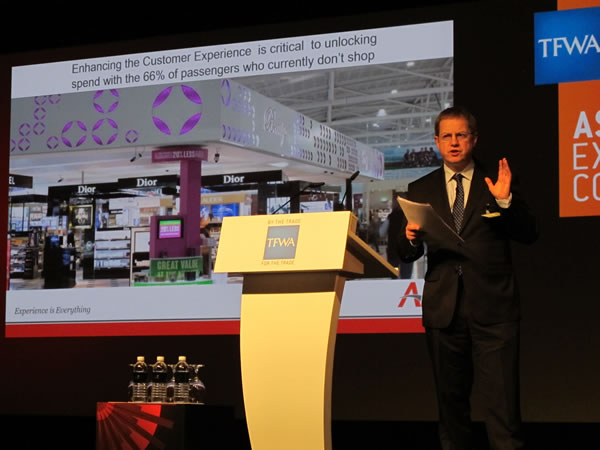

To enhance customer experience, retailers must understand their customers and deliver unique experiences, says Aer Rianta International CEO Jack MacGowan |

Next up was Nestle International Travel Retail (ITR) Global Head of Sales Alan Brennan, who said low footfall and low conversion remain the “˜Achilles heel’ of the travel retail industry. Three fundamental factors contribute to the consumer perception holding back purchase: retail proposition (replication of product offering, same stores everywhere), value proposition (price) and time pressure (inefficient processing procedures).

Travel retail cannot compete with online shopping and the domestic market on everything; we have to pick our battles, said Brennan. Customer experience is the great differentiator, and companies have to change their mindset from a transactional to an experiential one. They should also focus on enhancing the physical shopping environment, offering exclusives and limited editions, telling a compelling story and appealing to the customer’s senses.

Aer Rianta International (ARI) CEO Jack MacGowan said that enhancing the customer experience is critical to unlocking spend with the 66% of passengers who currently don’t shop. To do this, retailers must understand their customers (through consumer intelligence) and deliver unique and rewarding experiences (through retail theatre and concepts that tell stories).

However, enhancing the customer experience cannot be done by the retailer alone. The competing objectives of brand owners, retailers and airports make it a challenge which needs to be addressed, he stressed.

Workshop B, “˜Cruise Control’ examined the potential of the cruiseline business in Asia. According to the recent State of the Cruise Industry report by the Cruise Lines International Association, cruiseline operators are set to increase their Asian capacity by 20% in 2015. An increasing interest among Chinese consumers – and significant investment in infrastructure by destinations such as Hong Kong and Singapore – are among the key growth drivers.

Cruise Lines International Association (CLIA) Asia Secretary General David Goh began by delivering a useful overview of the size and composition of the Asian cruise market. Interestingly, he noted that more than four out of ten cruise passengers in Asia are under 40, with Generation Y becoming a key demographic. At present, short-duration cruises within Asia remain popular, although longer cruises to destinations further afield are forecast to grow significantly in the future.

Starboard Cruise Services Senior Vice President Luxury Cruise Retail & Asia Office David Goubert underlined how important the Asian region is considered by his company – and the cruise lines it partners with. For example, Royal Caribbean is targeting China with two key vessels, including its Legend of the Seas.

And while the Caribbean is still the leading cruise region globally, Asia is already number two – and still growing. Europe too is likely to benefit from an increase in Asian cruise passengers in the near future, Goubert added, as the clientele ventures further afield. Providing these discerning customers with unique experiences, and creating special connections and memories, is a key objective, Goubert noted. The right staff, brands, environment, retail theatre and media all play a role in this regard.

Kai Tak Cruise Plaza Managing Director Trevor Moore discussed the unique challenges of retailing in the world’s largest cruise terminal. “Nobody expects to see a travel retail store in a cruise terminal,” he observed, noting that raising awareness, and promoting what is available, was a key objective going forward.

And while Kai Tak Cruise Plaza is very much the new kid on the block, Moore insisted this was positive. “We are very young in an evolving market, and see an awful lot of potential globally, and especially in Asia,” he underlined. “With our retail offer we are trying to tap into the mind-set of the cruise passenger, while also being mindful that we are a destination in our own right,” Moore explained.

All three panellists agreed that there was much untapped potential in Asia for the cruise sector to exploit, although Goh expressed concerns about possible capacity issues. “It’s not easy to build a new ship in a year,” he observed. However, redeployment of existing vessels, emerging nationalities and new destinations will all help to drive future penetration.

A workshop focusing on “˜Asia’s rising stars’ covered the opportunities in some key emerging markets, and featured contributions from Bangalore International Airport Limited (BIAL) Vice President Commercial Sang Ahn, Haikou Meilan Airport Duty Free Shop Deputy General Manager Yong Sun and m1nd-set Global Marketing Intelligence & Solutions Founder and CEO Peter Mohn.

Mohn revealed the results of some dedicated research into Asia’s growth markets, with Ahn and Yong Sun offering insights into the commercial strategies at their locations.

Ahn said that among his priorities was to develop the airport as a shopping destination, to focus on dwell time and price management, and to understand consumer behaviour better. He noted plans to expand capacity with the new T2 in planning at Bengaluru International.

|

Sang Ahn: Focus on dwell time and price management at Bengaluru |

|

The panel was chaired by DFNI Editor Kapila Gohel (left) and featured contributions from (l-r) Haikou Meilan Airport Duty Free Shop Deputy General Manager Yong Sun, Bangalore International Airport Limited Vice President Commercial Sang Ahn and m1nd-set Founder and CEO Peter Mohn |

Yong Sun profiled the rapid rise of the Hainan Island offshore duty free business, citing the expansion in the number of categories available today. He also outlined the plans of Haikou Meilan Duty Free (with partner DFS) to grow from US$150 million last year to around US$244 million. The Hainan retailer was profiled in the latest issue of The Moodie Report Print Edition. Click here to access the issue (page 150).

In Workshop D, “˜Competing in e-commerce’, Counter Intelligence Retail Managing Director Garry Stasiulevicuis highlighted the fragmentation of the traveller’s digital experience. He charted a typical traveller’s digital journey, illustrating the various touch points at which their journey is interrupted digitally. The example, supported by useful statistics on digital usage, proves that it is possible to harness e-commerce and digital marketing in airport retailing.

Technology is omnipresent during a traveller’s journey, but engagement needs to be practical, Stasiulevicuis concluded. In the future, technology should help the booking to boarding (and shopping) experience become seamless.

In his presentation LS travel retail Pacific General Manager Ivo Favotto discussed further on how the industry can harness the power of e-commerce, which he considers another form of pre-order. LS travel retail’s wide-ranging e-commerce activities include a fully transactional website, weekly electronic direct mailers, data mining, members-only offers, Facebook, Instagram, and call centre with live chat functionality. “Technology is a freight train coming towards us,” Favotto declared. “We can’t stop it. So how do we convert it to kerching in the till?”

Traditionally, e-commerce was thought to be good for marketing but bad in terms of in-store experience, domestic competition and price transparency. But it is possible to turn these “˜bad’ aspects into opportunities, for example by using the internet to link consumers to the in-store offering. Favotto also believes that domestic competition can motivate the industry to keep on improving.

|

Counter Intelligence Retail Managing Director Garry Stasiulevicuis highlights the fragmentation of the traveller’s digital experience |

|

LS travel retail Pacific General Manager Ivo Favotto believes it is possible for the travel retail industry to harness e-commerce to compete more effectively with other retail channels |

|

AVA Online Group Founder and CEO Oliver Segovia explains how e-commerce is changing the way fashion is being created, particularly in the Philippines |

AVA Online Group Founder and CEO Oliver Segovia offered some real-world lessons in building an online fashion brand in the Philippines. The global e-commerce market is worth US$1.5 trillion – yet seven out of ten retailers do not have an online presence, he observed. 40% of purchases happen outside shopping mall opening hours of 10am-9pm, and credit cards and PayPal account for almost 80% of orders.

E-commerce is changing how fashion is created, Segovia said. Designers, brands and manufacturers can now reach a bigger market, faster and cheaper. Manufacturers can now create their own brands and go direct-to-consumer, with an increasing number of brands getting started online before expanding to brick-and-mortar stores. This enables brands to provide an omni-channel retail offer – allowing customers to “˜buy online, collect offline’.

Now is the ideal time for travel retail to embrace e-commerce, Segovia believes, as it can capitalise on the experience of the trailblazers – and learn from the mistakes of the early adopters.

The closing plenary was delivered by International Institute for Management Development (IMD) Professor Stéphane Garelli, who offered an entertaining macro perspective of today’s global economy. He injected some humour into an otherwise sobering topic of our increasingly fragmented and volatile economy, characterised by weaker growth and price instability.

Garelli illustrated that competitiveness in this new world will continue to be shaped by several factors: new players (such as family-owned companies) and new brands from emerging economies; new markets such as Africa (forecasted to hit 2.2 billion in population numbers in 2050), new business segments (the “˜emerging less poor’ living on between US$2-10 a day), new conditions such as the cost of energy and labour, new rules in corporate governance and compliance, and new consumer attitudes (shift from needs-based to wants-based).

|

IMD Professor Stéphane Garelli offers a candid view of today’s increasingly fragmented and volatile economy, characterised by weaker growth and price instability |