INTERNATIONAL. The announcement of the Apple Watch in September 2014 has sparked a global interest in the smartwatch segment, with the highest levels of interest coming from consumers in the US, China and the UK, according to a report by research and market intelligence firm Digital Luxury Group (DLG).

In its latest Smartwatch Feature examining the impact of smartwatches on the luxury watch industry, DLG analysed over 107 million relevant online searches made for 18 brands in 20 markets from January 2014 to March 2015.

The study found that consumer interest for smartwatches spiked in September 2014 following the announcement of the Apple Watch. The highest number of searches were registered in the US, followed by China, the UK, Germany, Spain and Italy.

|

US, China and UK top consumer interest for smartwatches worldwide |

DLG has earmarked the Apple Watch as the leader that will establish the market for smartwatch brands. Interestingly, in the month of the Apple Watch announcement, the company noted that consumer interest increased not only for the Apple Watch but also for competing products such as the Pebble, Moto 360 and Samsung Gear. It suggested that consumers worldwide were searching for smartwatches from different brands, possibly looking to understand the alternatives available on the market.

Traditional Swiss watchmakers are also starting to offer alternatives to meet luxury consumers’ growing demand for smartwatches, DLG observed, the first of which was Montblanc with the launch of its E-strap in January 2015.

“Even before any luxury brand announced a smartwatch or other smart features, consumers worldwide were already researching this kind of product,” Digital Luxury Group Research Analyst Robin Hurni highlighted.

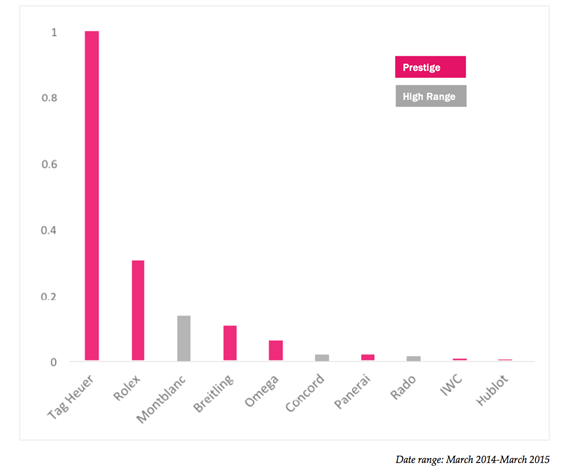

Of the 62 brands tracked in DLG’s WorldWatchReport 2015, Tag Heuer got the most searches related to the keyword “smartwatch”, followed by Rolex and Montblanc. Of the top 10 brands, seven belong to the ‘Prestige’ category* – these tend to be brands with a sports heritage – and three to the ‘High Range’ category. Brands in the ‘Haute Horlogerie’, ‘Watch & Jewelry’ and ‘Couture’ categories do not seem to have as strong an association with smartwatches in consumers’ minds, DLG noted.

|

‘Prestige’ and ‘High Range’ brands most associated with smartwatches |

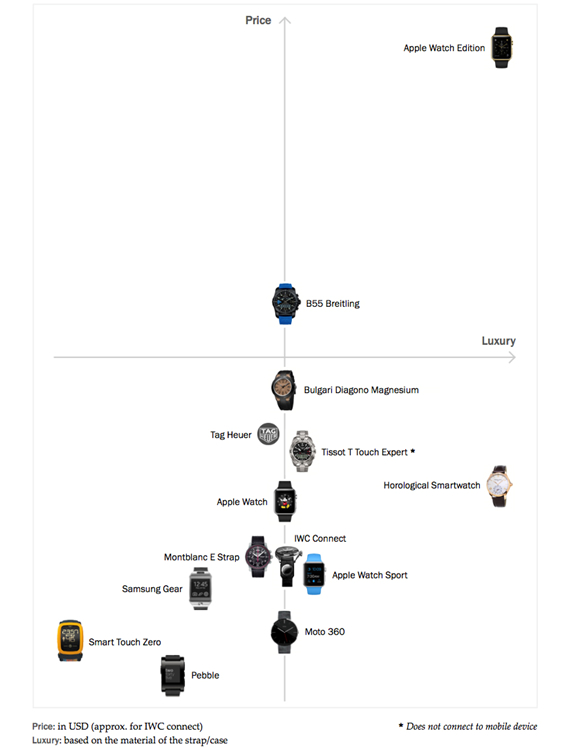

With a price tag of around US$14,000, the Apple Watch Edition is almost three times more expensive than alternatives offered by traditional luxury watchmakers, which are priced at around US$5,000.

Digital Luxury Group Founder & CEO David Sadigh said: “The Apple Watch Edition Collection (starting at US$10,000) is an attempt to convey the image of Apple as a true luxury brand but the business reality is different. We anticipate Apple to generate 80% of their sales with Apple Watches priced less than US$700, a segment that will have more impact on American and Japanese watchmakers than Swiss ones.”

While consumer interest for smartwatches will continue to have bearing on luxury brands, the disruption “is most likely at its infancy as strong product benefits are widely missing”, said DLG. This will gradually change as developments in software (rather than hardware) increase the functionality of smartwatches, the company concluded.

|

Apple Watch Edition is almost three times more expensive than available luxury options |

*WorldWatchReport’s featured 62 brands, grouped into five categories:

• Haute Horlogerie: A. Lange & Söhne, Audemars Piguet, Blancpain, Bovet, Breguet, De Bethune, Franck Muller, Girard-Perregaux, Glashütte Original, Greubel Forsey, Jaeger-LeCoultre, Jaquet Droz, Parmigiani, Patek Philippe, Richard Mille, Roger Dubuis, Ulysse Nardin, Vacheron Constantin

• Watch & Jewelry: Bulgari, Cartier, Chaumet, Chopard, Harry Winston, Jacob & Co., Piaget, Tiffany & Co., Van Cleef & Arpels

• Couture: Chanel, Dior, Hermès, Louis Vuitton, Ralph Lauren

• Prestige: Breitling, Corum, Hublot, IWC, Omega, Panerai, Rolex, Tag Heuer, Zenith

• High Range: Baume & Mercier, Bell & Ross, Bremont, Carl F. Bucherer, Concord, Ebel, Eberhard, Frédérique Constant, Graham, Longines, Louis Erard, Maurice Lacroix, Montblanc, Perrelet, Rado, Raymond Weil, Romain Jerome, Sinn, Technomarine, Tudor, Vulcain

DLG Founder & CEO David Sadigh and other CEOs of the watchmaking industry share their thoughts of the future of smartwatches with Swiss business magazine Bilan |