|

Xavier Rossinyol: “We are very pleased to have found a service provider in IFS that shares our focus on innovation and efficiency, with the flexibility to quickly adapt within the ever-changing world of the airline industry” |

EUROPE. gategroup has struck a deal to acquire 100% of leading Nordic travel retailer and distributor Inflight Service (IFS) for CHF130 million (US$126.6 million).

The move complements gategroup’s existing business and establishes a “leadership position in Buy on Board services” said the Swiss company. (See below for reaction from today’s investor presentation.)

gategroup makes the acquisition from funds advised by Triton, a private equity firm. The move will generate additional revenue for gategroup of more than CHF240 million (IFS’ annual sales) and EBITDA of CHF13.4 million.

Based in Sweden, IFS employs around 300 people across five countries. The company leads Buy on Board services in the Nordics, “providing versatile retail service solutions to airlines, ferry and cruise lines, and has a broad and diversified customer portfolio,” noted gategroup.

The transaction is subject to the approval of the Polish antitrust authorities, with closing expected in February 2016. The purchase price of SEK1,106 million (about CHF 130 million) reflects a post-synergies multiple of 6.5 times EBITDA.

The transaction is expected to be 12% accretive in cash earnings per share (EPS) in year one, and 16% in year two including run-rate synergies. The acquisition will be fully financed through drawing under gategroup’s existing facilities.

Targeted annual run-rate cost synergies of about CHF 6 million between gategroup and IFS are based on cost of goods sold (CoGS) efficiencies and integration of support functions. These synergies will be realised in the next 18 months during the post-acquisition integration phase, noted gategroup.

Synergies will include office, warehousing and transportation, with a shared service centre located in Stockholm using IFS’ central warehouse and its transport network.

Synergies on CoGS, according to gategroup, will come from:

*Combined purchasing power

*Optimisation of suppliers via development of strategic partnerships

|

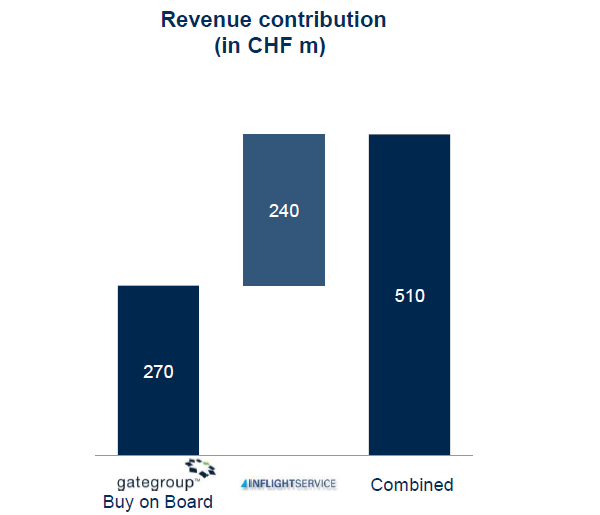

A glance at the new combined group’s inflight sales revenues |

Synergies on headquarters will come from:

*Elimination of duplicitation in support functions across finance, marketing and IT

*Dismissal of redundant senior management

*Implementation of gategroup Buy on Board ERP tool to further reduce head count in support functions.

|

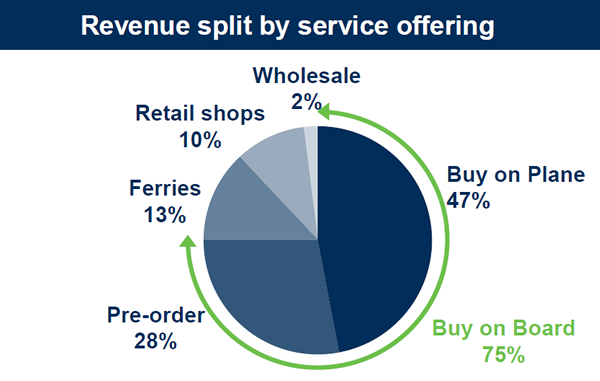

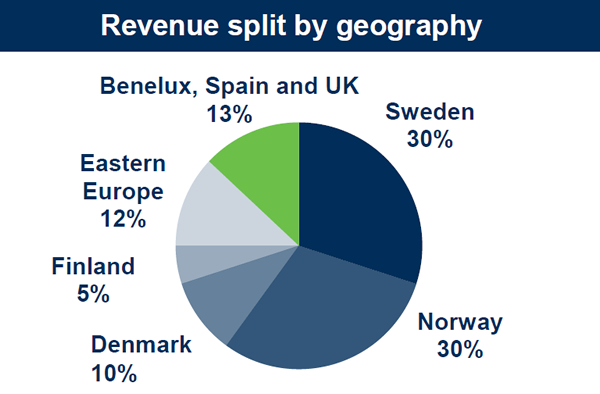

Inflight Service’s estimated 2015 revenue split by sales channel (above) and by region (below) |

|

The integration of the IFS business into gategroup will also drive commercial improvements, noted gategroup, which said it will now become the leader in Buy on Board services in terms of size, number of customers, business intelligence (with data comprising purchasing preferences of more than 175 million passengers worldwide) and onboard technology.

gategroup said: “This will also mean the acceleration of gategroup’s POPS, an automated and full-featured pre-order and pre-selection technology that enables airlines to implement and deliver a modern onboard shopping experience to passengers driving efficiencies and revenue opportunities. Buy on Board is a key segment, as already today about 50% of the short-haul traffic in Europe derives from low-cost carriers with no complimentary food service.”

“gategroup’s growth and the enhancement of our Buy on Board offering coupled with an on-track delivery of efficiency gains and cost savings are key pillars of our Gateway 2020 strategy,” said gategroup Chief Executive Officer Xavier Rossinyol. “We are pleased to have found a service provider in IFS that shares our focus on innovation and efficiency, with the flexibility to quickly adapt within the ever-changing world of the airline industry and with a common goal to provide the best possible offering to customers.

“This transaction, therefore, represents much more than an accretive acquisition: It is a clear step forward in creating the largest Buy on Board operator in the industry, leading commercial innovation, knowledge of customers and technology as well as to accelerate ancillary business generation for the airlines while significantly enhancing passenger satisfaction.

“We look forward to welcoming the IFS employees to our gategroup community and to jointly continuing to develop and deploy advancements in this important retail space, to modernise the passenger experience, and to create incremental value to our shareholders.”

|

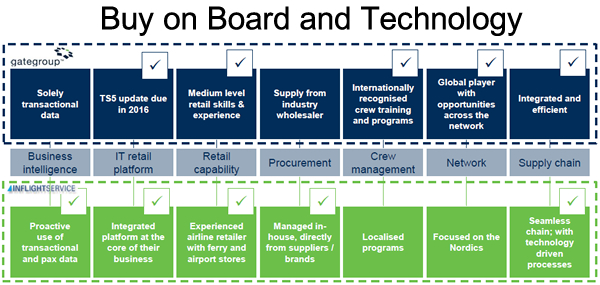

gategroup says it will become the market leader in Buy on Board worldwide and take a dominant position among LCCs and the charter business in Europe |

Headquartered in Stockholm, with a warehouse and packing facility located in Tibro, IFS is a Buy on Board specialist, catering to both charters and scheduled airlines. Its major expertise lies in the pre-order business, with around 700,000 orders a year from the Nordic and Baltic states. It also operates retail on nine ferry & cruise lines in the Baltic and North Seas and has several operations in airports in Estonia and Poland.

UPDATE: This afternoon gategroup updated investors on the transaction, with Xavier Rossinyol noting how Buy on Board had become a “very interesting channel” for gategroup.

“This reinforces our stated plan to extend our Buy on Board network on a worldwide scale with a particular presence on low-cost carriers and charters. IFS offers us a very attractive and complementary platform to do this,” he told analysts and media today. “Inflight Service is a leader in pre-order food and retail, and we will bring commercial innovation and new technology to this channel.”

Importantly, Rossinyol noted that the small airport retail business operated by IFS was “not contributing profitably” and was non-core and non-strategic”, opening the way for a likely divestment of its airport operations in Estonia and Poland. However, he said the group’s ferry business was “a complementary segment” to the airline business.

The joint company will now manage 9% of the CHF2.4 billion airline F&B market and 8% of the CHF2.6 billion inflight retail market, according to gategroup.

“Many airlines now seek combined food and retail solutions from a single provider,” said Rossinyol. “With LCCs, Buy on Board is becoming more important than ever. This also gives us entry to the very profitable charter market, where we have no presence today.”

He added: “You will hear us talk a lot more about diversification, and this helps gategroup to diversify. We will be onboard around 20 of the world’s leading LCCS and charters as we aim to serve the widest portfolio possible.”

That expansion will help the group generate a combined business intelligence database, he noted. “It will be key to have the right assortment and pricing policy, but to do that you need to know what the customer wants to buy.”

The new entity will be able to offer services to any operation in the world through new retail IT systems and draw on stronger procurement. “Until now there has been less focus on Buy on Board (including retail) procurement at gategroup; we’ll now benefit from a targeted approach with IFS,” said Rossinyol.

On synergies, the company said that gategroup’s three hub operations plus its logistics centre in the Nordics would provide one area of synergy. At HQ level, duplication in areas such as finance, marketing and IT would be eliminated, with senior management across the IFS and gategroup Nordic operations “aligned”.

Rossinyol added: “This is an excellent strategic fit for gategroup. We have a post-merger team already in place that includes IFS, gategroup Buy on Board plus external support.

“IFS has plans to expand but now it will have the logistics and warehousing support to help that process, as we take its concept from the Nordics to the rest of the world.”

|

How gategroup sees the combined strengths of each player |