INTRODUCTION. South Korean travel retail sector newcomer Doota Duty Free is eyeing a sharp improvement in trading in 2017 as new brands come on stream, and insists it is here for the long run despite a difficult start.

Doota Duty Free – owned by the Doosan Group conglomerate – was a shock winner in the late 2015 contest for downtown duty free licences in Seoul – ahead of Lotte Duty Free World Tower.

The store opened on 20 May in Seoul’s Dongdaemun area, in the process becoming Korea’s first late-night duty free store (remaining open until 2am). Dongdaemun is a popular tourist destination – especially among Chinese visitors, who comprise about half of the 7 million foreigners who visit the area each year.

It may be an overnight store, but in South Korea’s ferociously competitive downtown duty free industry it is difficult to be an overnight success. And in that context it’s been a tough start for the retailer, which has reported total sales of US$43 million to the end of September – well below original projections. But things have been improving steadily, with September sales climbing to US$13.7 million.

It’s the P&L, though, that is the real issue, as it is for other Seoul start-ups Galleria 63 Duty Free and Shilla iPark Duty Free. With around 90% of its business coming from foreign shoppers, many of them Chinese group tourists, Doota is having to pay big commissions to tour agencies to bring travellers to the store. Combine that overhead with the heavy start-up and staffing costs (especially onerous given the late-night operation) and the burden for a start-up is obvious. The retailer’s other critical challenge is in attracting the key international luxury brands, which play such an important role in driving consumer choice of shopping location.

“I am the disruptor right now,” says Doota Duty Free Chief Creative Officer and Chief Strategy Officer Seowon ‘AP’ Park, speaking to The Moodie Davitt Report from his 22nd floor office high above Dongdaemun, offering magnificent views over east Seoul.

“A lot of people in the press and the business say ‘They’re crazy – they don’t know what they are doing.’ But we are looking at the site as a whole business model to be developed.”

The site in question is the nine-storey Doosan Tower Building in eastern Seoul, home already to a long-established shopping mall, which is highly popular with both Koreans and foreign tourists.“The Dongdaemun area in general, and the Doota Mall in particular, are quite well known to the Chinese consumer,” says Park. That offers a sound platform, he says, for developing the all-important FIT business. “We’re investing in the FIT customer,” he notes, emphasising that the high proportion of independent travellers offers the key to the future.

Park admits it hasn’t been an easy start. But, he says, the company has both a long-time perspective and a unique approach to the duty free busines that will eventually pay off.

He points to a healthy near 50:50 split of FIT vs group tour traffic, and believes the company’s commitment to creating a holistic tourist experience rather than simply an overtly commercial shopping approach is the right way forward.

Park is very different from any senior duty free executive I have met in 25 years of visiting the Korean market. Young, trendy, free-thinking and with a background from outside the retail sector, he’s determined to do things differently.

His career has embraced running his own design studio as well as heading Doosan’s advertising and communication business Or!com IMC Idea Group. His leadership roles within the conglomerate’s diverse portfolio have also included publishing (in 1996 Doosan Magazine launched the first fashion magazine in South Korea, Vogue, followed by other lifestyle titles such as GQ, Allure and W). That background manifests itself in Doota Duty Free’s vibrant pink branding and chic marketing, print and social media communication. A giant white model of a polar bear takes pride of place in his office, offsetting the constant splashes of pink.

Park believes the profile of the Chinese tourist will evolve quickly from the current shopping-obsessed stereotype. More travellers will be seeking content and culture from their Korean experience, he says, and Doota, will provide exactly that.

Park believes the profile of the Chinese tourist will evolve quickly from the current shopping-obsessed stereotype. More travellers will be seeking content and culture from their Korean experience, he says, and Doota, will provide exactly that.

He tells a spell-binding anecdote to illustrate the point. As an exercise he asked a group of executives to draw a butterfly and flower over a 30-minute period. The group spent much of the allotted time asking questions about the nature of the task before finally getting down to work over the final ten minutes. “When I ask kids to do the same thing, they just do it,” says Park with a smile.

And then the killer line. “One kid, aged about four, drew a flower but there was no butterfly. I asked ‘Why no butterfly?’ and she replied ‘Because the butterfly likes to fly free.’ I got goose bumps the whole day.”

The connection with Doota Duty Free, infant of the industry, is clear. “I think being young and naïve could actually drive something new,” Park says.

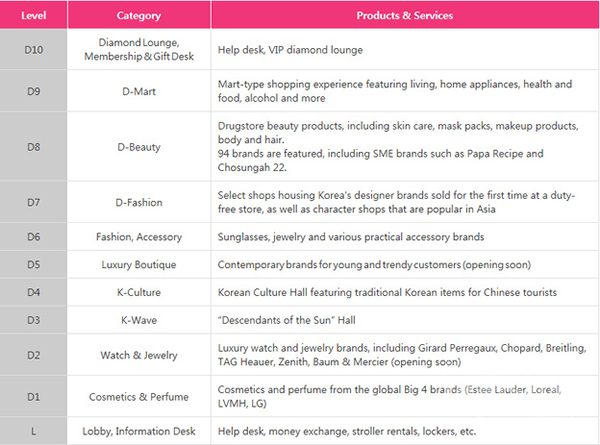

It will take time, he admits, and it will be tough for some time to come. The week before The Moodie Davitt Report’s visit the company finally opened all its floors (named D1 to D10), some on a temporary basis before they are redeveloped in coming months.

https://www.youtube.com/watch?v=wHLjIdVBL7c

“Our main goal is to get the top-tier brands, but it’s a big challenge. Our competitors all have relationships with them through their department stores.” To achieve this goal Doota needs time and retail space, he says. The latter is available through gradually taking over the different floors and converting them to duty free use.

“I think being young and naïve could actually drive something new”

Steadily, though, more and more brands are arriving. Kenzo is doing well, Versace and Moschino are in place, Longchamp and Michael Kors opened this month and Etro will be introduced in early 2017. Further leading international luxury and fashion names are in the pipeline. And in beauty, the impressive D-Beauty level offers a vast range of Korean skincare, while D1 features most of the key international brands (not Chanel) and the hottest Korean names.

Similarly the watch & jewellery floor features a strong array of blue-chip brands, including Panerai, Breitling, Jaeger-

(Below) Etro will open in early 2017

Park believes that Doota’s bolder, more edgy retail style will appeal to the younger consumers who are so vital to the future of all brands and retailers. Shoppers between 25 and 40 already generate the lion’s share of Doota revenue, he notes.

“We’re new, so we have to be strong, vibrant and different”

“The brands that are most interested in us are those that are going for image and creating an experience, and not just looking for revenue.” He cites the retailer’s temporary ‘culture floor’ on the third level, currently dedicated to interactive mock sets from popular Korean drama Descendants of the Sun, this year’s smash-hit television series starring Song Joong-ki. The zone enjoys excellent 7–8m ceiling heights (it was originally a showroom) and Park believes it can offer a tremendous showcase for a small number of selected brands that require greater space and impact.

Doota Duty Free announced in April that South Korean’s hottest Hallyu celebrity, Descendants of the Sun male lead Song Joong-ki, would star in the retailer’s new marketing campaign (see YouTube videos below).

The company’s goal is not to become the number one retailer in revenue terms, Park says, but to create an “absolute destination” that tourists simply will not want to miss. “We’re new, so we have to be strong, vibrant and different,” he comments.

They are three key words that have become a kind of internal mantra, and championing Korean products and culture is key to underlining them, Park says. He points out that the Doota Fashion Mall in the same building boasts 90% Korean content, while the 8th floor is entirely Korean beauty brands. “In duty free we have a much higher ratio of Korean brands than others,” he says. “Korean content is our main focus.”

Doota Duty Free may only be a newcomer, and its start-up may have been difficult (according to Yonhap News Agency it logged KRW16 billion/US$13.7 million in operating losses in the first half of this year), but no-one should underrate its determination, resilience or ability to see the long game. One suspects that Seowon ‘AP’ Park sees Doota, and himself, as that butterfly. Cocooned for a long time, it is now flying free.

Footnote: Look out for a more extended interview with Seowon ‘AP’ Park and a profile of Doota Duty Free in our special Korean report, part of The Moodie Davitt Report Print Edition January/February 2017.