SINGAPORE. The Shilla Duty Free’s burgeoning reputation as an Asian travel retail powerhouse in beauty is being underscored at Changi Airport, where the company expects this year to start contributing a percentage of revenues rather than the Minimum Annual Guarantee (MAG) it has been paying until now – a sure-fire indicator of improved business.

“That means we have made a great improvement,” said Hotel Shilla President of Travel Retail Division Ingyu Han, talking to The Moodie Davitt Report at company headquarters in Seoul last month. Han said that Shilla has driven a much-improved passenger spend rate as well as implementing various operational improvements at its key Singaporean operation.

Shilla was awarded the Changi perfumes & cosmetics concession ahead of red-hot competition in late 2013. Although it got off to a difficult and heavy loss-making start, business has improved substantially since. The victory – and learnings – laid the platform for further international expansion in ensuing years.

That development included the beauty business at Macau International Airport in partnership with Sky Connection and, notably, the key beauty & accessories contract at Hong Kong International, which it won ahead of intense competition last year. Shilla will celebrate the Grand Opening of its multi-store network at Hong Kong International, where it trades as Beauty & You, on 28 June.

Shilla is also the dominant beauty retailer at Incheon International Airport T1 and T2.

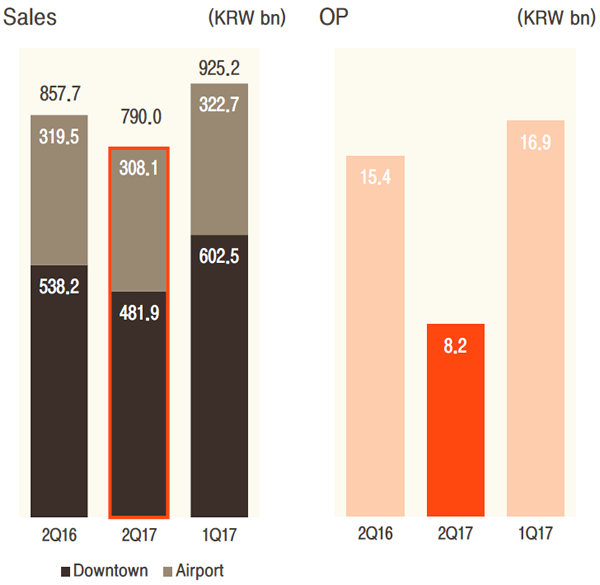

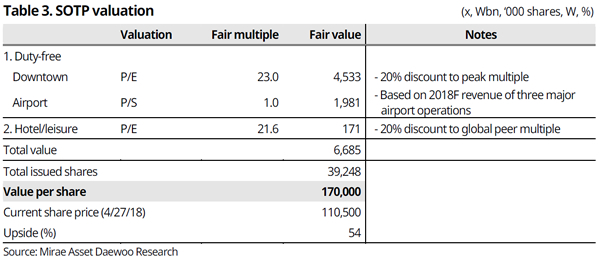

As reported, Shilla posted outstanding results for the first quarter. Hotel Shilla’s travel retail division posted a +30% surge in revenues for the first quarter of 2018, to KRW1,013.7 billion (US$950 million), while operating profit in the division surged by +182% year-on-year, hitting KRW47.6 billion (US$44.5 million).

The company’s airport duty free business delivered a +41% revenue rise, while in downtown duty free the increase was +22%.

Regina Hahm Equity Analyst (Cosmetics, Household goods, DFS) at Mirae Asset Daewoo Research Center said: “The overseas duty free business delivered a strong performance in terms of both growth and profitability. Revenue surged +76% YoY, bolstered by more meaningful sales from the Hong Kong International Airport operation. Operating loss declined to 42% of the 1Q17 level with the help of efficiency gains in the Singapore Changi Airport operation.”

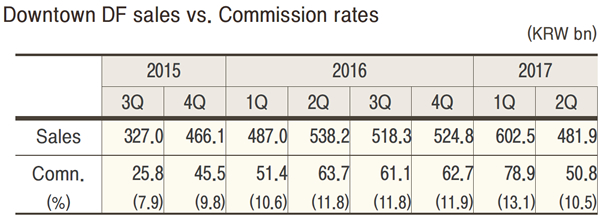

Commenting on the wider results, Ms Hahm said, “The stellar results were attributable to strong growth and margin improvements across all businesses. The domestic duty free business (key to profits) posted record revenue of W771.5bn (+19.6% YoY) and OP margin of 6.5%, the highest quarterly level since 3Q15. We believe the main drivers were: 1) the stabilization of travel agent commissions (which became unduly high due to intensified competition); and 2) cost efficiency gains resulting from the company’s enhanced merchandising capabilities.”