UK/INTERNATIONAL. Leading travel restaurateur SSP Group today announced a strong set of full-year results for the 12 months ended 30 September. It also revealed a deal to acquire 14 outlets from hospitality company Red Rock at Perth and Melbourne airports in Australia (see below).

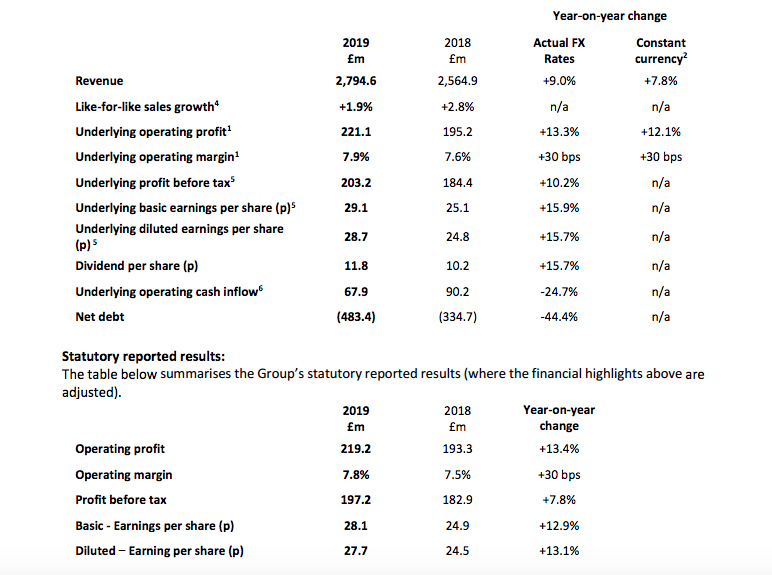

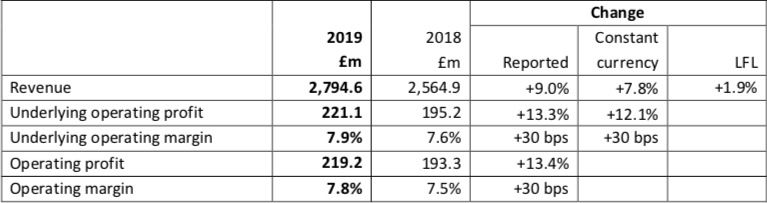

Group revenue hit £2,794.6 million, a rise of +7.8% year-on-year on a constant currency basis, comprising like-for-like sales growth of +1.9%, net contract gains of +5.6%, and a further +0.3% from acquisitions. At actual exchange rates, total revenue grew by +9.0%.

Underlying operating profit of £221.1 million was up +12.1% at constant currency and +13.3% at actual exchange rates. Reported profit before tax climbed by +7.8% to £197.2 million.

The company noted an “encouraging pipeline” of new business. Recently agreed contracts include entry into three new markets in 2020 – Bahrain, Bermuda and Malaysia – and new business in North America at New York LaGuardia, San Jose and Ottawa airports. In the Rest of the World region new business will open at Brisbane, Shenzhen and Hongqiao airports.

SSP also announced a share buyback of up to £100 million, which it said “underpins our confidence in the business and our commitment to maintain an efficient balance sheet”.

CEO Simon Smith said: “SSP has delivered another strong performance in 2019. Operating profit was up +12% at constant currency, driven by solid like-for-like sales growth despite some external headwinds, significant new contract openings and further operational improvements.

“We continue to grow our business in North America, and have made good progress expanding in Continental Europe. In the Rest of the World, we have grown in India and the Philippines, and have entered Brazil, a new market for us, with further market entries planned in Bermuda, Bahrain and Malaysia.

“The new business pipeline is strong across all our geographies both this year and next, and we’ve announced a £100 million share buyback which further demonstrates our confidence in the future of the business.

“The new financial year has started in line with our expectations and, while a degree of uncertainty always exists around passenger numbers in the short-term, we continue to be well placed to benefit from the structural growth opportunities in our markets and to create value for our shareholders.”

Robust revenue growth

The growth in the air channel was again stronger than in rail, driven by increasing passenger numbers in most major markets, noted SSP. On the outlook, said the company, “with the prospect of ongoing political uncertainty and the expectation of airline capacity cuts, we continue to plan cautiously, anticipating full year like-for-like sales at a similar level to 2019 of just below +2%”.

SSP posted strong performances from North America with net gains of +13.0%, including new openings in Seattle, Los Angeles, Oakland and LaGuardia airports, and Continental Europe where the “unusually strong” net gains of +6.6% were driven by new contracts at Charleroi Airport in Belgium, Montparnasse Railway Station in Paris, 22 new motorway service areas in Germany and a new contract for 29 Starbucks units in railway stations in the Netherlands.

The overall foreign currency impact against the UK Pound (principally from the Euro, US Dollar, Indian Rupee, Swedish Krona and Norwegian Krone) in 2019 compared to the 2018 average was 1.2%. If the current spot rates were to continue through 2020, SSP said it would expect a negative currency impact on revenue of around -2% compared to the average rates used for 2019.

Healthy profits rise

As noted above, underlying operating profit increased by +12.1% on a constant currency basis and by +13.3% at actual exchange rates. The underlying operating margin improved by 30bps, driven by progress on strategic initiatives, said the company.

Gross margin increased by 80 bps year-on-year on a constant currency basis. This reflected the ongoing roll-out of strategic initiatives to optimise gross margin, including ranging and mix management, food and drink procurement and waste and loss reduction, said SSP.

This was partially offset by an increase in the labour cost ratio of 20 bps year-on-year reflecting the scale and complexity of the new opening and rebranding programme, together with inflationary pressure on labour rates in the UK and North America. There was also an impact from several of the “headwinds” noted by the company during the year, particularly those relating to political protests in France and Hong Kong that resulted in sharp and unplanned falls in sales.

Concession fees rose by 60 bps during the year, in line with recent trends. These, said SSP, were affected “by the stronger like-for-like sales growth in the air sector, which typically has higher concession fees but also higher gross margins compared to rail”.

In 2020, the overall operating margin is expected to remain at a similar level to this year, with higher pre-opening and start-up costs associated with net contract gains, expansion into new territories and the proposed acquisition of the Red Rock operations, as well as a slight increase in the rate of depreciation, reflecting the timing of SSP’s investment programme.

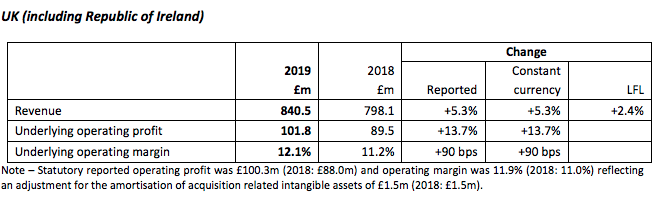

Performance by region: UK & Ireland

Revenue in UK/Ireland increased by +5.3% on a constant currency basis, comprising like-for-like sales growth of +2.4% and net contract gains of +2.9%. The like-for-like sales reflected solid growth in the air sector and a slightly stronger performance from the rail sector, which benefited from a lower level of disruption in the rail network during the summer.

Looking forward to 2020, with political and economic uncertainty and the expectation of airline capacity cuts, most notably from the failure of Thomas Cook, SSP said it was “cautious”, expecting like-for-like sales in the UK to be around +1%. The net contract gains included contributions from new M&S Simply Food units in two major London stations, as well as the three Jamie Oliver restaurants at Gatwick Airport which began operating in early summer.

Underlying operating profit for the UK increased by +13.7% on a constant currency basis, and underlying operating margin increased by 90 bps to 12.1%, driven by the stronger like-for-like sales growth and by the continued roll-out of operational efficiency initiatives.

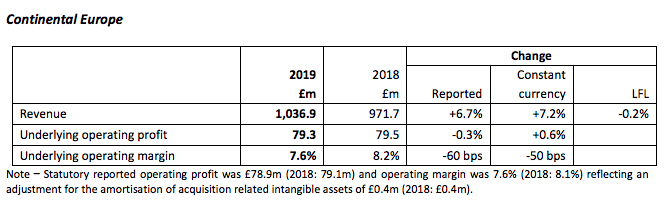

Continental Europe

Revenue increased by +7.2% on a constant currency basis, comprising a like-for-like sales decline of -0.2%, net contract gains of +6.6% and the impact of the acquisition of the Stockheim business in Germany of +0.8%.

The lower like-for-like sales reflected slower passenger growth across the Nordic countries and Spain, and the impact of major redevelopments in a number of airports, including Copenhagen, Malaga and Las Palmas. Like-for-like sales were also impacted by the ‘Gilets Jaunes’ protests in France during the first half of the year.

The 50 bps reduction in operating margin on a constant currency basis reflected the impact of the pre-opening costs relating to the new contracts, together with the disruption caused by the airport redevelopments in Denmark and Spain and the protests in France.

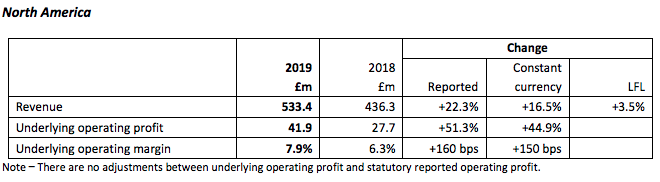

North America

North America had a strong year, said SSP, with revenue increasing by +16.5% on a constant currency basis, comprising like-for-like sales growth of +3.5% and net contract gains of +13.0%. Like-for-like growth was stronger during the first half year, benefiting from positive trends in airport passenger numbers in the North American market, with growth during the second half affected by the grounding of Boeing Max 737 aircraft, and by the transfer of passengers away from SSP terminals at some airports. Net gains included new openings in Seattle, Los Angeles, Oakland and LaGuardia airports.

Underlying operating profit increased to £41.9 million, an increase of +44.9% at constant currency. The underlying operating margin increased by 150 bps on a constant currency basis, largely reflecting this region’s increasing scale, operating efficiencies and a lower rate of depreciation. SSP said: “The strong results were particularly pleasing given the lower level of like-for-like sales growth in the second half, and the significant new opening programme”.

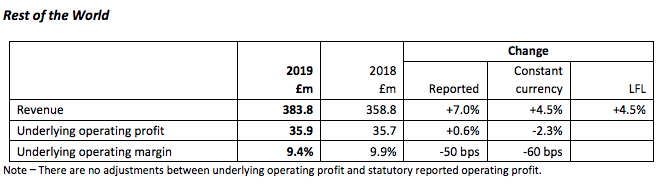

Rest of the World

Revenue increased by +4.5% on a constant currency basis, driven entirely by like-for-like sales growth. As in North America, this like-for-like growth was stronger during the first half year, driven by passenger growth in India, China and Egypt.

The softer growth during the second half year reflected external headwinds, including the cessation of operations at Jet Airways in India, weaker Chinese passenger numbers, which hit the wider Asia Pacific region, and more recently the protests in Hong Kong.

Contract gains came primarily from new units at airports in India and in the Philippines, but were offset by the closure of units in Hong Kong and Shanghai.

Underlying operating profit for the Rest of the World was down by -2.3% to £35.9 million on a constant currency basis. Underlying operating margin fell by 60bps, with the second half performance impacted by the lower LFL sales growth and the external headwinds noted above, as well as the closure of units in Hong Kong and Shanghai and the cost of entering new markets such as the Philippines and Brazil.

Cash flow and capex

SSP generated net cash flow from operating activities of £301.2 million, an increase of £21 million year-on-year, and free cash flow of £50.5 million.

Capital expenditure increased by £40.8 million to £185 million, the higher capex reflecting net contract gains in the year, as well as the investment in rebranding programmes at airports where new business was added in previous years, for example at Chicago Midway and LaGuardia.

Capital expenditure in 2020 is expected to be between £160 million and £170 million, excluding the proposed acquisition of the Red Rock outlets.

Acquisitions in the year used £25.8 million of cash flow, principally reflecting the £22.4 million paid for an additional 16% stake in the Travel Food Services business in India.

Future reporting

IFRS 16, the new financial reporting standard on accounting for leases, is effective for all accounting periods beginning on or after 1 January 2019. SSP’s first reported accounting period under IFRS 16 will be the 2019/20 financial year, from 1 October 2019.

Australian acquisition

In a major signal of SSP’s ambitions in Australia, the company has agreed to acquire 14 food & beverage units from Australian hospitality company Red Rock. SSP will take over full operations of Red Rock’s F&B business at Perth Airport, marking its entry into that location, and the majority of its F&B business at Melbourne Airport.

At Perth Airport, SSP will acquire seven units, including two Long Neck Public Houses, a bar brand located in the international and domestic areas of Terminal 1. The deal also includes Mediterranean brand Loco Poco, which can be found at Terminal 1 (International). The line-up also features two outlets from Italian-inspired brand Macchinetta and two Haymarket units, a marketplace of bars, cafés, bakeries, delis, juice bars and pizzerias. SSP also intends to acquire a further three new units at Perth – Common Bar + Kitchen, Pronto by Macchinetta and a new grab & go offer.

At Melbourne Airport, SSP will acquire four units. These include two ‘Two Johns Taphouse’ pubs. These are located at Terminal 4 domestic and Terminal 2 international. SSP will also operate casual dining outlet BÀXÃ Noodle Bar at Terminal 2 international. The fourth unit will be Able Baker Charlie, a modern Italian bakery, pizzeria and bar.

Simon Smith said: “The acquisition announced today is in line with our strategy to grow our geographic footprint and expand our operations in the Asia Pacific region. These new units will build on our newly established business at Melbourne Airport, and will mark our entry into Perth Airport. We’re excited to be adding new Australian brands to our portfolio and welcoming new colleagues into our SSP team, and we look forward to growing our business further in Australia.”

SSP began its operations in Australia in 2009, opening its first F&B outlets at Sydney Airport. The group now runs 23 food & beverage units at four key travel hubs – Sydney Airport, Melbourne Airport, Brisbane Airport and Hobart Airport. Most recently in Australia, SSP opened the new Food Collective food hall concept at Brisbane Airport earlier this month.