INTERNATIONAL. Flight analyst OAG has highlighted the early recovery of the Chinese aviation market as capacity returns and load factors increase. Details emerged during an OAG webinar that outlined the latest capacity reductions among the world’s airlines in recent days.

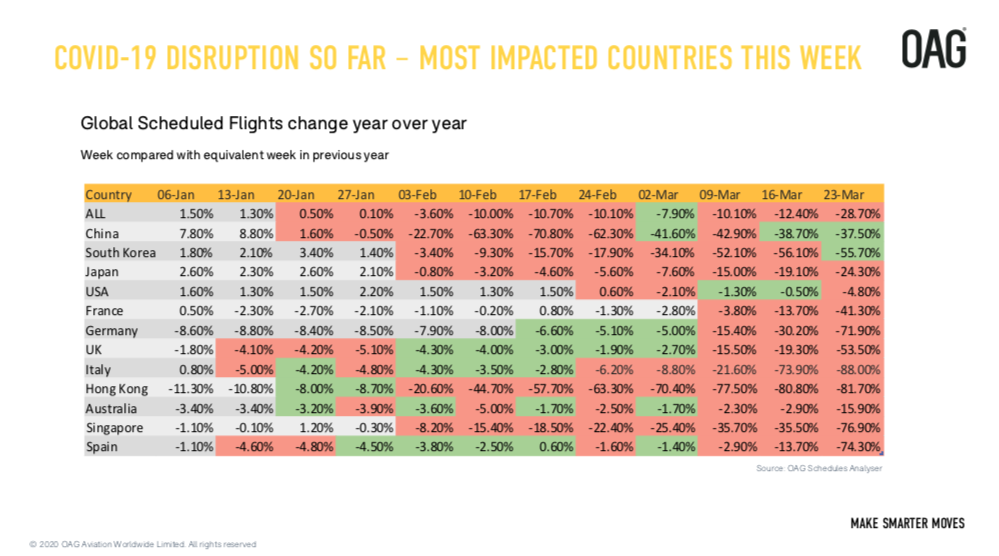

In the week beginning 23 March, European flight traffic fell by -60% week on week, or 92,000 flights. Middle East flight numbers fell -45% (led by network-wide cancellations among the big Gulf carriers), with Asia Pacific at -30% though this will change further once India domestic services are withdrawn from next week.

The global airline capacity figure was down -29% week on week. The major US airlines have yet to push through their schedule changes so the numbers will fall further still, said OAG.

Speaking about China, Institute for Aviation Research Professor Zheng Lei said: “The worst period was February. In that time most aircraft in China were grounded, but recently airline traffic has picked up. China Southern now has a 60% load factor on average so that is an improvement. The latest data from Hainan Airlines shows an average load factor of 62% on 254 flights on 21 March.

“With the coronavirus coming under control, airlines are gradually resuming their traffic. That is what we are seeing in China. Consumer confidence hasn’t fully come back yet and will take a while to get back to normal. But airlines have done a great job to reassure travellers with regular cleaning of aircraft, for example.”

On the wider picture, Zheng added: “The economy was hit badly in February and March. The Chinese airlines lost around US$5 billion in February and March is also difficult. But many businesses have now returned to normal, people are back to work, and that is quite encouraging. The Chinese government forecast is still for positive GDP growth in 2020.”

Speakers agreed that domestic travel was likely to bounce back first, followed by short-haul regional travel.

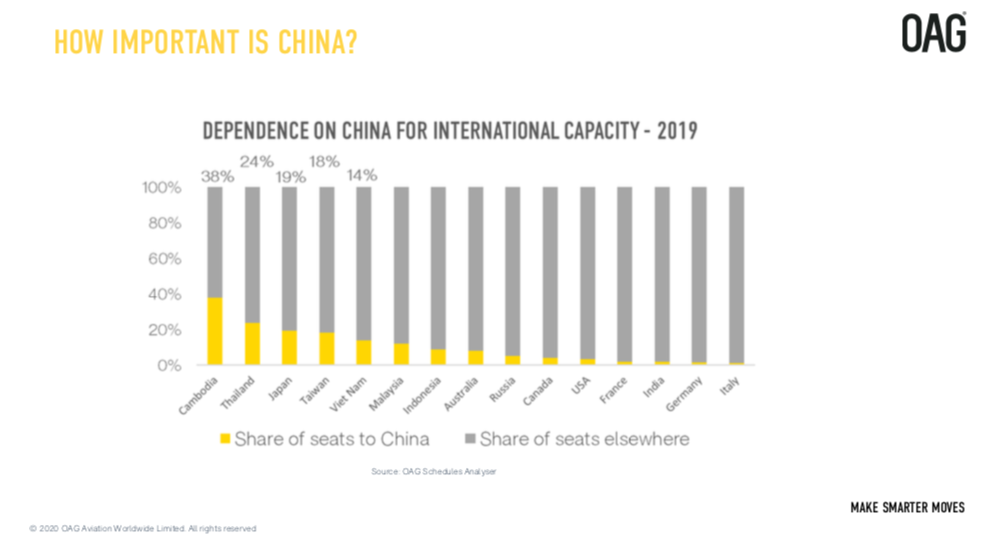

Zheng said: “Chinese tourists are important to Korea, Vietnam, Thailand and Japan so the crisis has hurt tourism overseas. But once the situation recovers we will likely see a bounce back. Demand is there but it is just being suppressed.”

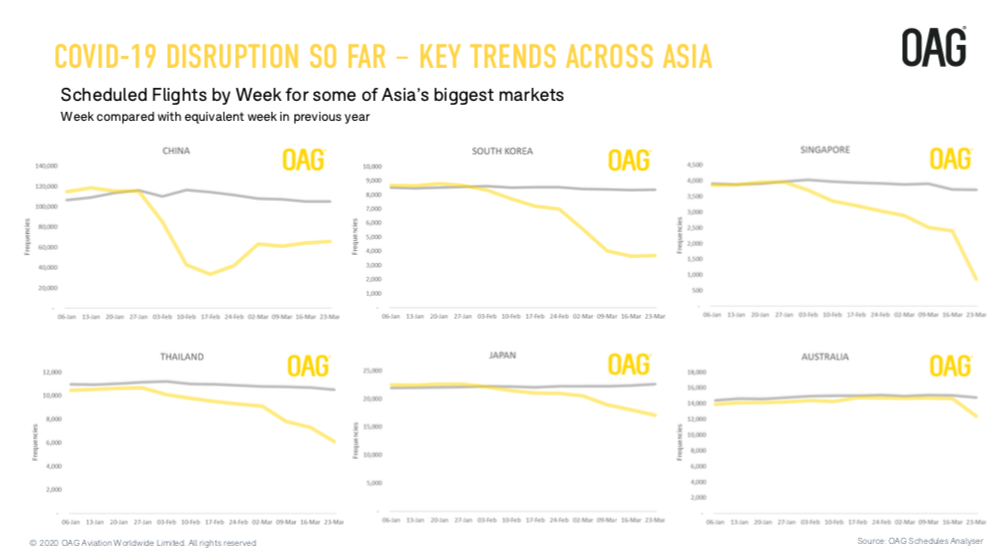

On a gradual recovery in South Korea, Sobie Aviation consultant Brendan Sobie said: “Recovery in South Korea is not as advanced as in China, but there is hope that will follow next, given that the situation is coming under control. Jeju Island is the busiest flight route in the world, and initially we’ll see that return, with international taking longer.”

On other regional markets, he added: “Japan has been quite resilient. Domestic passenger numbers are down around -50%, nowhere near as sharp as the reduction elsewhere. That should pick up if things don’t worsen. So overall North Asia looks brighter than elsewhere.

“Southeast Asia is varied. Some markets have shut down domestic, the Philippines for example, while others like Indonesia have remained relatively resilient so far though we don’t know what comes next.”

OAG Senior Analyst John Grant added: “You can see just how inter-dependent these countries are for trade and for travel, whether it’s China-South Korea; South Korea-Japan; China-Thailand; China-Singapore. Therefore as China begins to lead the way out of crisis it will impact these markets before other international markets. Then it will ripple out to south-east Asia. The inter-dependency is vital.”

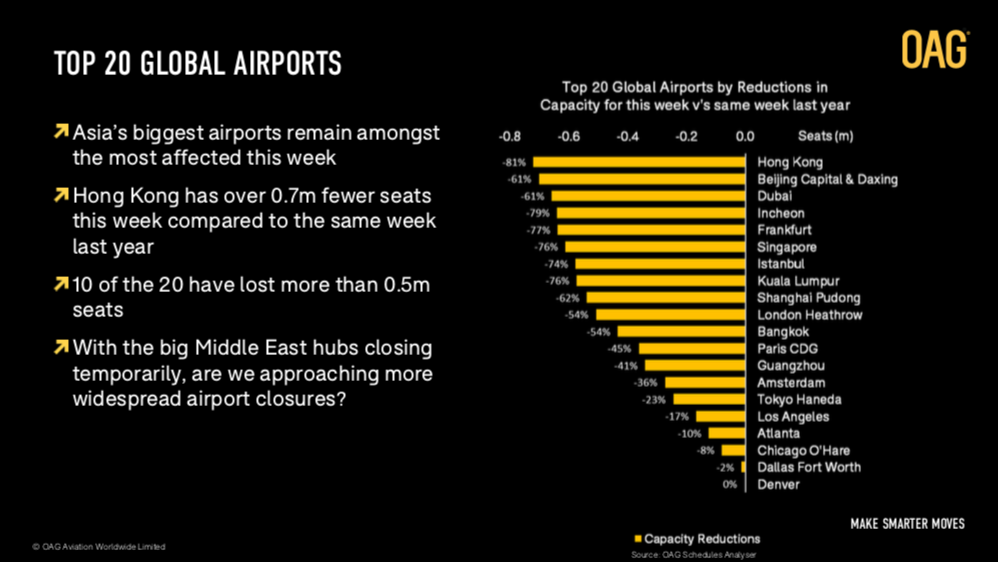

On the outlook for airports, Grant said: “It is worrying times if you have big infrastructure projects, Hong Kong with a third runway, opening at Daxing, expansion at Haneda. Airports require huge investment that drives other parts of the economy. Many airports are so far down on capacity that we are seeing dramatic steps taken, such as closing altogether. Many are being creative too, operating satellite terminals so operations are consolidated and that they can stay open.”

Commenting on how the future for aviation might look, Grant said: “It is just staggering to see the reduction in capacity just this week, and many airlines have taken capacity out at least through April and into May.

“It will hit airlines’ cash reserves… the fittest will survive. There will be casualties, not necessarily among the biggest, but those in middle of the market, without scale and mass. The size, shape and structure of airline industry will be different once we come out of this. Do airlines need to put 747s in the sky after this if capacity doesn’t demand it? Many have smaller aircraft that are more efficient.

Sobie said: “We will see some airlines use the opportunity to restructure – their 747 fleets, even the A380. Nobody can survive this for more than a few months, with all those fixed costs. You can sell some assets, drawn down cash reserves, but at some point you run out of money. You then also sacrifice your future as you will have used up your ability to respond later. Some governments have responded, Singapore and the US this week, but we need not ten countries but 100 to respond. It will not be a level playing field.”

On how close the market is to its lowest point, Grant said: “The bottom [for capacity levels] will probably happen in early April. Domestic markets are down by 50-100%, international is at -95% now. The question then is when recovery can start region by region? It will be domestic probably first, then international, led by China domestic and short-haul Asia, but that may be some months away.”

On the big picture, he said: “The industry has shown remarkable resilience to bounce back quickly though this time we may have a more shallow response. The past ten years has seen a rapid surge. You could say that has even been too fast. This event is a re-set, which may make sense for an industry that wants to be profitable and sustainable. We see so much infrastructure investment now so perhaps this is the time.”