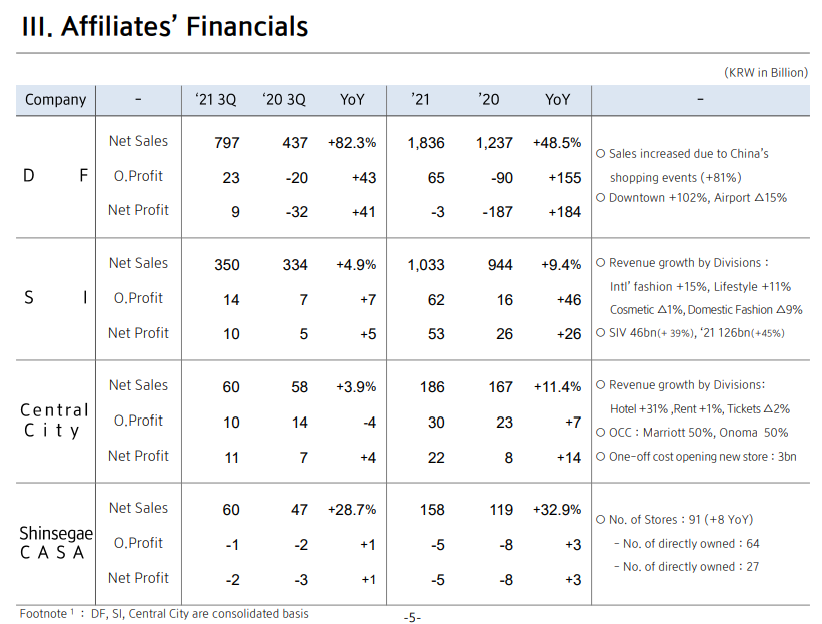

SOUTH KOREA. Shinsegae Duty Free, the Republic’s third-biggest travel retailer by sales, posted an +82.3% year-on-year increase from a very low base in Q3 net sales to KW797 billion (US$67.7 million).

Operating profit turned from a loss of KRW20 billion (US$17 million) in the same period last year to a gain of KRW23 million (US$19.5 million). Net profit moved from a KRW32 billion (US$27.2 million) loss in Q3 2020 to a profit of KRW9 billion (US$7.6 million) this quarter. Q3 sales were buoyed by China’s shopping events.

Downtown duty free sales rose +102% year-on-year while airport sales, hit hard by the country’s tough travel restrictions, moved up +15%.

For the first nine months, the duty free division of the department store giant generated a +48.5% lift in sales year-on-year to KRW1,836 billion. Operating profit reached KRW65 billion (US$55.2 million) compared with a KRW90 billion (-US$76.4 million) loss in the same period a year earlier.

Net profit for the first nine months improved from a thumping KRW187 billion (-US$158.7 million) shortfall to a small loss of KRW3 billion (US$2.5 million).

In a note, BofA Global Research reported that duty free sales grew +10% month-on-month in November on solid imported cosmetics sales with daily revenue at KRW11 billion/US$9.3 million (vs. KRW10 billion/US$8.5 million in October 2021). With Singles Day (11.11) over, the company estimates December daily average sales will come in at the KRWW9-10 billion range.

BofA noted that duty free sales will likely remain range bound in the near term due to limited travel recovery and will remain dependent on daigou demand.The company maintained its Buy rating, reasoning there would be sequential improvements in Shinsegae’s two key businesses – department store and duty free retail.

DFS sales will recover each quarter, BofA said, with daigou activities supporting downtown operations, and a more full-fledged recovery likely in 2H21.