Tax Free World Association (TFWA) hosted its latest webinar session on 19 July, which gave an overview of the recovery of international travel.

The session, moderated by TFWA Managing Director John Rimmer, featured insightful presentations from International Air Transport Association (IATA) Economist and Policy Analyst Martina Bednarikova, m1nd-set Head of Business Development Anna Marchesini and European Travel Retail Confederation Secretary General Julie Lassaigne.

IATA on the tailwinds and headwinds influencing travel recovery

Martina Bednarikova gave an overview on the tailwinds and headwinds impacting the recovery of air travel. “The easing of travel restrictions, the willingness to travel, the acceleration of cargo and the transformation of old business models are driving the recovery of international travel,” she said.

“However, geopolitical conflicts like the Russia/Ukraine war, debt burden and costs caused by rising inflation and the pandemic crisis, and energy and climate change costs are slowing that recovery.”

According to Bednarikova, Europe and North America are leading the recovery due to open borders and strong pent-up demand. “May bookings in Europe are almost at pre-crisis levels especially in more touristic countries,” she said. “The Americas are estimated to recover in 2023, while Asia Pacific and Africa are only projected to reach 2019 levels in 2025. While the recovery in Asia Pacific is slower, with countries like Australia, New Zealand and Thailand opening up, we see this bouncing back in the mid-term.”

She also noted that premium and economy travel were recovering at the same pace, showing that travellers are willing to spend more for more premium experiences. Aircraft deliveries are also reaching pre-crisis levels in some regions.

While IATA’s overall outlook is positive, its financial forecast is still negative for this year. This is due to rising fuel, energy and staffing costs for airlines.

Commenting on the geo-political challenges that will impact the travel industry in the future, she said: “Further increases in inflation will keep consumer prices high. Russia and Ukraine are important commodity exporters and the continued war will have ripple effects globally. Also, increased military spending will have a negative impact on the sustainability agenda. This too will have an impact on labour shortages which will continue to cause flight delays and cancellations.”

m1nd-set an on the changing travel retail landscape

m1nd-set Head of Business Development Anna Marchesini presented the latest m1nd-set data on passenger traffic figures, spend and consumer trends. She said, “Globally, footfall in stores has increased to 44% of pre-crisis levels, but purchase rate and conversion have decreased to 22% and 50% of pre-crisis levels respectively.

“This growth is not uniform across the regions,” Marchesini explains. “Footfall has increased in Europe in the Americas, but is either remaining stagnant or decreasing in Asia Pacific, Africa and the Middle East. Purchase levels and conversion differs per region too.”

According to Marchesini, the consumer behaviours and purchase occasions have shifted since the crisis. M1nd-set data revealed that own consumption or self-indulgence purchases have increased from to 54% in 2022 versus 46% during pre-crisis times. This comes at the expense of gifting and on request purchase occasions. Marchesini also highlighted the growing importance of sales staff interaction in driving conversion.

European travel recovery is robust, says ETRC

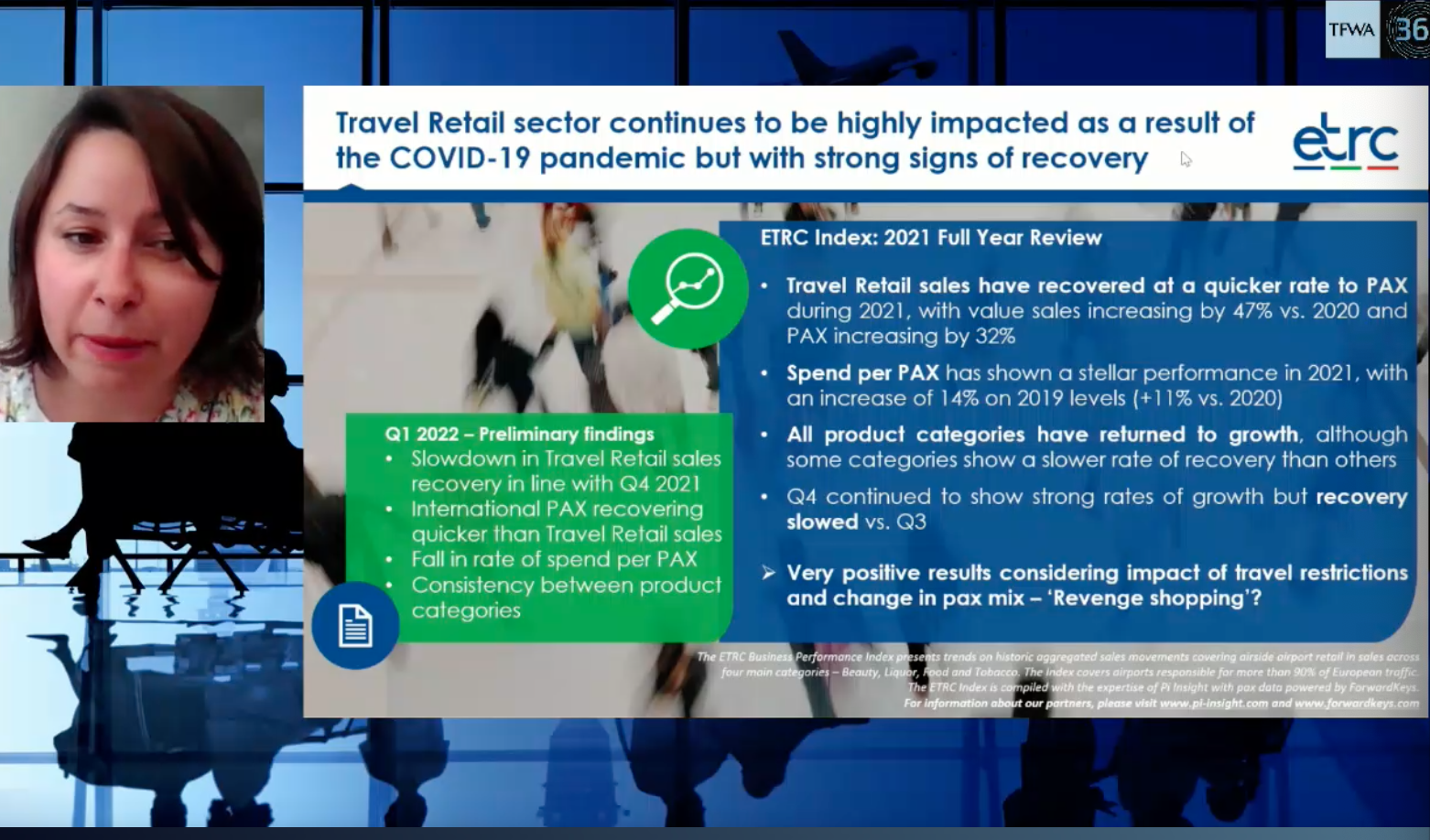

European travel is experiencing a robust comeback in the post-pandemic era due to the easing of travel restrictions in the region. European Travel Retail Confederation Secretary General Julie Lassaigne discussed the factors influencing this recovery. She said, “Strong pent up demand and ‘revenge travel’ means that estimated airport passenger traffic in Europe will reach -14% of 2019 levels this year.

“The recovery of European travel retail in 2021 was extraordinary. Travel retail sales recovered at a faster rate than passenger numbers. Travel retail sales values increased by +47% versus 2020 while pax numbers only increased by +32%. Spend per passenger increased +14% versus 2019 and all categories returned to growth, though not all at the same pace. These are very positive results considering the impact of travel restrictions and the change in passenger mix.

“However, in Q1 of 2022, we saw some changes,” she added. “There has been a slowdown in travel retail sales recovery. Now, international pax numbers are recovering quicker than sales and we also noticed a fall in the spend per passenger.

“One of the biggest challenges facing the European travel industry in the second half of 2022 is aviation capacity issues,” Lassaigne said. “We’ve all heard of the travel chaos wreaking havoc across the region. Airlines across the board are cancelling or delaying flights due to staff shortages and strikes – and this problem won’t be resolved any time soon.”

Other challenges include supply chain bottle necks, travel restrictions, economic turmoil and global peace – with the Russia/Ukraine crisis looming over stability in Europe.