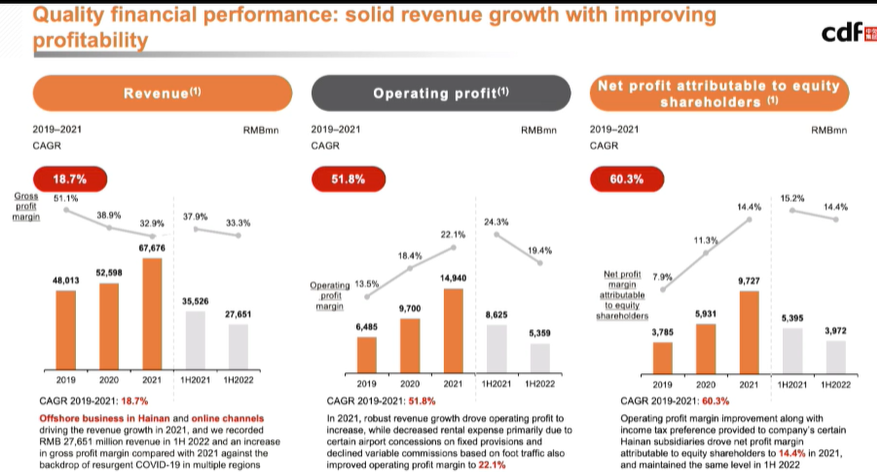

CHINA. At an invitation-only press conference conducted online from Beijing this afternoon, China Tourism Group Duty Free Corp (China Tourism Group/CTG) and China Duty Free Group (CDFG) senior executives spelled out the benefits of CTG’s secondary listing on The Stock Exchange of Hong Kong, which kick-started today.

As reported, CTG hopes to raise at least US$2.17 billion from the listing, which complements its existing presence on the Shanghai Stock Exchange.

The high-level conference was led by CTG Chairman of the Board and Executive Director Peng Hui; Executive Director and General Manager Chen Guoqiang (Charles Chen, President of CDFG); CTG Executive Director and Standing Deputy General Manager Wang Xuan; CTG Deputy General Manager, Secretary to the Board and Joint Company Secretary Chang Zhujun; and General Accountant Yu Hui.

The Moodie Davitt Report attended from the international travel retail media. We will bring you a full report on Monday once certain embargoes clear.

In a question and answer session that followed the main presentations (to be reported next week), CTG was asked about the positive impact of the listing. CTG Chairman and Party Secretary Peng Hui said: “This listing is primarily serving our strategy. We’re trying to become a more internationalised company. Internationalisation is a very important long-term goal of ours. So we highly value this Hong Kong listing, which is very important for us.

“We believe that it will further boost our global recognition and brand influence and will consolidate our leadership in the travel retail landscape.”

He added: “Secondly, this will help us access international capital. So we will have access to international capital markets and a domestic capital platform [Shanghai Stock Exchange -Ed], which will provide a lot of funding for future development. Thirdly, it will further expand and increase our financial moat. So the funds could be partially used on our Haikou project [the Haikou International Duty Free Complex, set to open later this year], downtown duty free developments and other projects.

“Fourthly, it will facilitate our overseas expansion and internationalisation.”

The Moodie Davitt Report Chairman Martin Moodie asked whether CDFG believed it had the opportunity to create a Chinese traveller-led version of DFS Group’s success story from the early 1960s through to the 90s when it built a retail empire everywhere that Japanese people travelled.

CTG Executive Director and Standing Deputy General Manager Wang Xuan replied: “Since our founding in 1984 we have always closely followed our consumers’ evolution. So as more and more Chinese consumers travel abroad and become the most important spenders in the global duty free industry, we are also following wherever they are going by opening new stores overseas.

“So for the next step, we will continue to go to top destinations for Chinese consumers in order to create more business and also more returns for us.”

Asked by powerful state media China Daily what were the key reasons for having achieved world number one travel retail status [according to the industry benchmark – The Moodie Davitt Report Top Travel Retailers ranking] Charles Chen said: “The first thing is the breadth of our channels – we are present in all of them. We run 193 stores, including 184 in the Mainland and out of ten international airports we have the concessions to run duty free stores in nine and we have signed a long-term contract with all of them.”

Chen also spelled out the company’s strong presence in Hainan where it operates in Sanya, Haikou and Bo’ao.

“The second reason is our relationship with the brand owners,” he said. “We do direct purchasing with 430 of them and we offer more than 300,000 SKUs. We have established long-term relationships with these suppliers and this was very pronounced during the COVID period, where we expressed mutual understanding and mutual support.

“Another fact is our understanding of the Chinese consumers. The mainstay of duty free shopping in the world [over recent years] has been the Chinese and we have a great understanding of them in terms of their preferences. For example, with Generation Z there have been a lot of changes in their consumption behaviours and patterns. We have a lot of insights into those consumers which other duty free or travel retail operators have no comparison with.”

Chen also cited the strong support CDFG receives from parent company CTG. “They provide us with a lot of travel resources and a lot of travellers. So there’s a strong synergy between us and a lot of sharing of resources. This is a great advantage that other duty free players cannot enjoy – we have access to the largest travel agency in China, and the hospitality system related to it.”

Experienced management is another big plus, Chen said. “I’ve been in this space for 35 years and my boss [Peng Hui] has also been in this sector for decades. And we have a lot of professional buyers, as well as employees from all over the world – from Hong Kong, Malaysia and Singapore. They are very experienced when it comes to sourcing goods.

“So all of these things contribute to our leadership as does the strength of our partnerships with suppliers. So with these advantages, it is really very hard for other players to surmount us.”

“For our sales revenue in Q3 and Q4 we expect a significant increase. So we maintain our original sales target for the entire year.”

Several reporters asked CTG about the impact of the current COVID-19 outbreak in Hainan which has seen CDFG’s stores in Haikou and Sanya closed over recent days with some limited negative impact on the company’s stock price.

Chang Zhujun replied: “As we all know, we are seeing a resurgence of the COVID pandemic in Hainan recently and our stores have also been closed as a response. But we believe that this is going to be a short-term impact. In the medium to long term, we don’t think there will be any further impact.

“Last year there were also some sporadic outbreaks. And in March to May this year we also closed stores temporarily in Hainan and in Shanghai due to the pandemic. However, at CDF, we are running a business that’s both online and offline. We embrace challenges and we are ensuring a steady growth for our business despite the pandemic.

“Last year we achieved 97.4% of traveller volume for the entire Hainan Island but our revenue actually grew by +250% compared to 2019. We also saw a very quick recovery in June this year. We achieved a margin increase year-on-year and we have also made a lot of preparations to ensure that once the ports are open again, our stores in Hainan and elsewhere will be ready to receive customers.

“We also have a number of new projects in Hainan, including the New Harbour complex in Haikou, the second site in Sanya and some additional projects. In the medium and long term they will be the growth drivers for CDFG and will also create an even better experience for our customers.

“In the near term, we actually saw a similar impact in Hainan last August, which was actually the lowest month in terms of revenue for the entire 2021. So we made adjustments.

“And from January to now our gross margin has actually been quite stable. And with the ongoing outbreak in Hainan we are also seeing that the city government in Sanya has been very proactive, and the provincial government is also very proactive in containing the pandemic.

“Because most of the people in Hainan are travellers, we are seeing the government putting a lot of efforts into COVID tests and ensuring that the recovery can happen in an orderly fashion. We therefore have reason to believe that in August and September, which are our traditional low seasons, we’ll be able to make sure that once the recovery happens we are ready for it.

“And at the same time we continue to offer our online platform so that our customers can make pre-orders and retrieve their products and their purchases at the airports. We will also open a new French-style space occupying an area of 3,000sq m in Sanya Phoenix International Airport.

“And therefore, for our sales revenue in Q3 and Q4 we expect a significant increase. So we maintain our original sales target for the entire year.”

In June The Moodie Davitt Report launched a new quarterly eZine called The Moodie Davitt China Travel Retail Report. The cover story is dedicated to China Tourism Group and CDFG. Click on the image to read the bi-lingual title. The next edition will be published in October. Please email Kristyn@MoodieDavittReport.com for a free first year subscription.