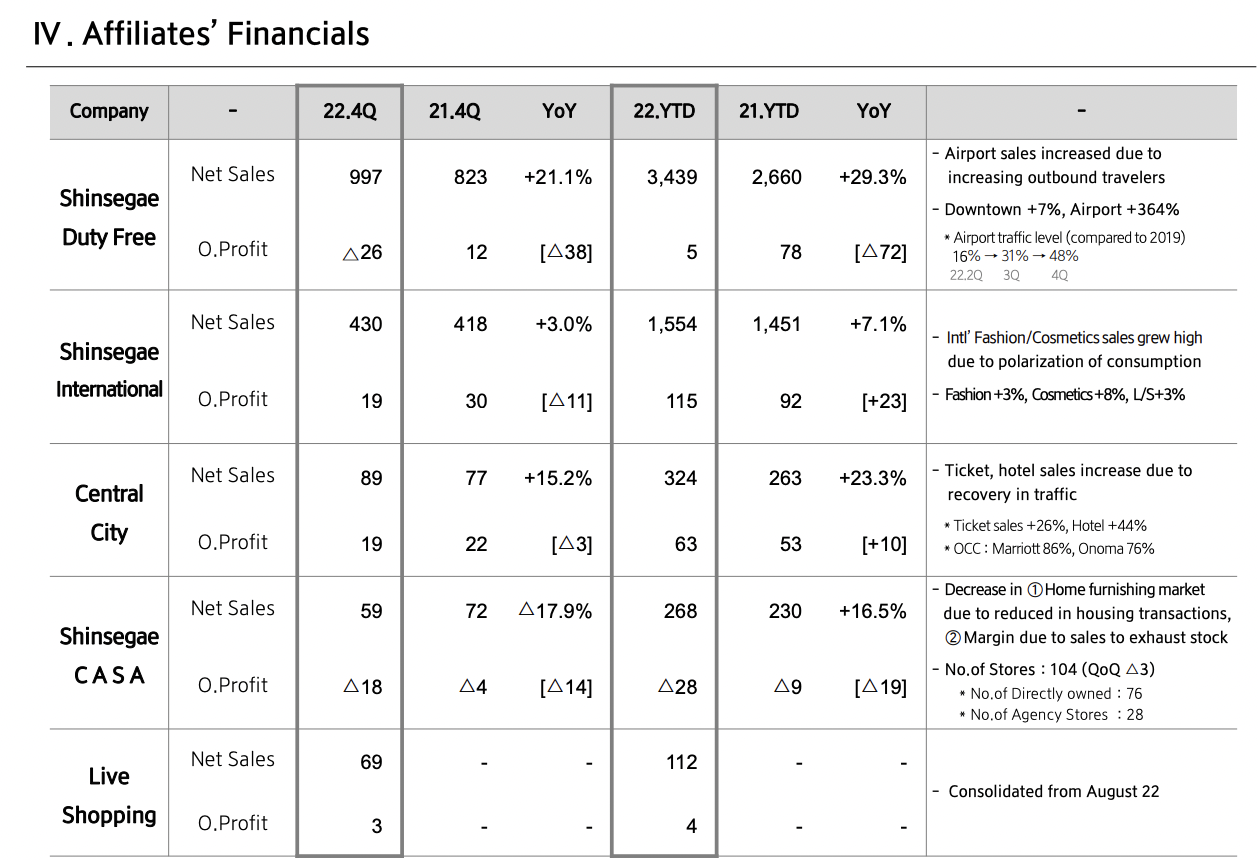

SOUTH KOREA. Shinsegae Duty Free, Korea’s third-biggest travel retailer by sales, posted net sales of KRW997 billion (US$781 million) in Q4 2022, a rise of +21.1% year-on-year. Strong airport sales (from a low base in Q4 2021) buoyed the figures.

Operating profit of KRW26 billion (US$20.4 million) was higher than market expectations and more than double last year’s figure of KRW12 billion.

For the full year, Shinsegae Duty Free sales hit KRW3,439 billion (US$2.69 billion), up by +29.3% on a year earlier, though operating profit fell from KRW78 billion (US$61.1 million) a year ago to KRW5 billion (US$3.9 billion).

Increased airport sales were a key contributor to volumes, with sales in the channel leaping by +364% over the year compared to COVID-hit 2021. Downtown duty free sales climbed by +7%.

In a note, BofA Global Research said: “Q4 duty free revenue was stronger, +11% YoY from a sharp recovery at the airport business. Profitability was in-line, adjusting for FX related loss and KRW16 billion duty free licence fee, part of which should be reversed and added to Q1 23E operating profit. On Q1-to-date operation that is likely to be affected by the cutback on the reseller business, the company guided around 30% month-on-month decline in revenue in Jan, but that the industry is likely to balance top line growth and a normalised commission rate from Q2.”

Click here for the latest results from The Shilla Duty Free, where weak demand in China and high commission rates to resellers weighed on profitability.