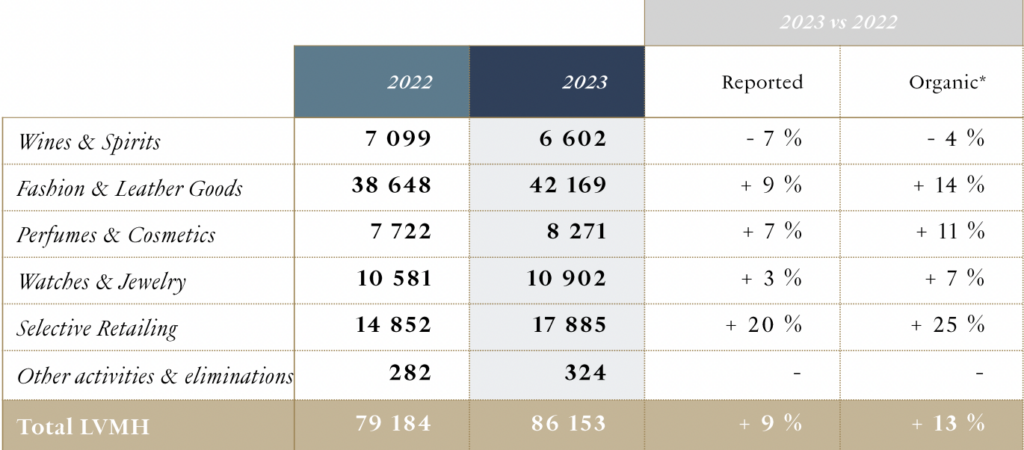

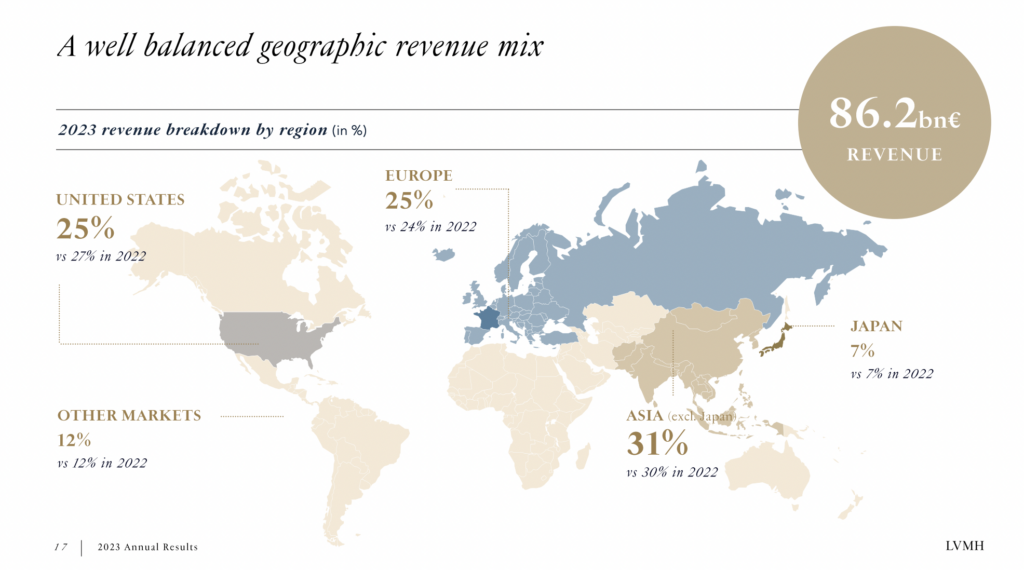

FRANCE/INTERNATIONAL. Leading luxury goods group LVMH Moët Hennessy Louis Vuitton posted record results in 2023, with revenue climbing +9% (+13% in organic terms) to €86.2 billion and group share of net profit up +8% to €15.2 billion.

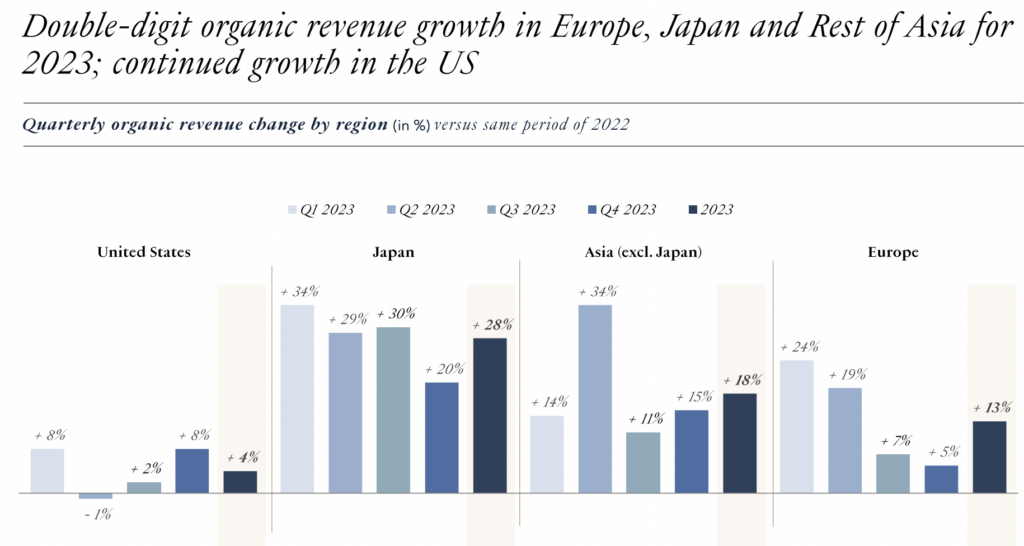

All business groups reported strong organic revenue growth, with the exception of Wines & Spirits, which was faced with a high basis of comparison and high inventory levels. By region, Europe, Japan and the rest of Asia achieved double-digit organic growth.

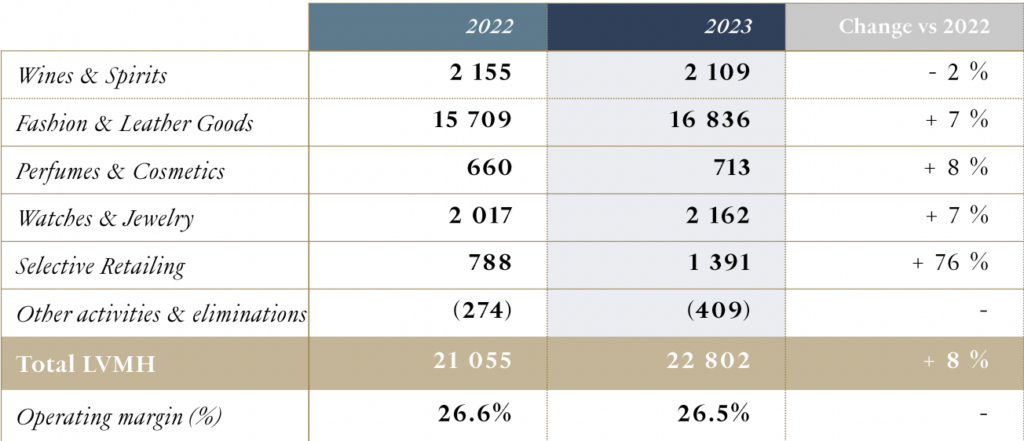

The Selective Retailing division, which includes DFS Group (co-owned with Robert Miller), posted organic revenue growth of +25% with profit from recurring operations soaring +76%.

LVMH said that while DFS revenue had risen, it remained behind 2019 levels. The return of tourists to flagship destinations Hong Kong and Macau was encouraging, it added, with more gradual recovery elsewhere. LVMH also noted DFS plans for a “transformational” project in Yalong Bay, Sanya on Hainan island by 2026 and its landmark store openings at Chongqing Jiangbei International Airport last year.

The Wines & Spirits business group saw a revenue decline (-4% organic) in 2023, faced with a high basis of comparison. Profit from recurring operations was down -2%. Driven by its value strategy, said LVMH the Champagne business posted growth, with “a good performance in Europe and Japan offsetting the effects of an unfavourable macroeconomic environment in the US”.

Hennessy Cognac was affected by a mixed recovery in China and by the post-Covid normalization of demand in the US, while efforts continued to maintain optimal inventory levels among retailers. In Provence rosé wines, LVMH acquired the prestigious Minuty estate, the second-largest market player after Château d’Esclans, which also continued its international development.

The Fashion & Leather Goods business group achieved organic revenue growth of +14% in 2023. Profit from recurring operations was up +7%. Louis Vuitton had an “excellent year, once again buoyed by the creativity and quality of its products, and by its strong ties to art and culture”, said the group.

The Fashion & Leather Goods business group achieved organic revenue growth of +14% in 2023. Profit from recurring operations was up +7%. Louis Vuitton had an “excellent year, once again buoyed by the creativity and quality of its products, and by its strong ties to art and culture”, said the group.

Christian Dior continued to deliver “remarkable growth” in all its product lines, while LVMH also highlighted the performances of Celine, Loewe, Loro Piana, Fendi, Rimowa, Marc Jacobs and Berluti.

The Perfumes & Cosmetics business group posted organic revenue growth of +11% in 2023, leaning on a “highly selective retail policy and dynamic innovation strategy”, backed by LVMH’s research centre. Profit from recurring operations was up +8%.

Christian Dior achieved “a remarkable performance”, led by its fragrances portfolio, with contributions too from makeup and skincare.

Guerlain continued to grow, driven by the popularity of its Aqua Allegoria line and its L’Art et la Matière high-end fragrance collection, as well as a strong response to its Terracotta Le Teint makeup. Parfums Givenchy, Benefit and Fenty Beauty posted robust growth.

The Watches & Jewelry business group recorded organic revenue growth of +7% with profit from recurring operations up +7%. LVMH said that Tiffany & Co. embarked on a new chapter with the reopening of its flagship store ‘The Landmark’ in New York, “raising the bar for jewellery retail worldwide”. Bulgari, Chaumet, Fred, Tag Heuer and Hublot also performed well.

Profit from recurring operations stood at €22.8 billion for 2023, up +8%. The current operating margin remained stable with respect to 2022.

LVMH Chairman and CEO Bernard Arnault said: “Our performance in 2023 illustrates the exceptional appeal of our Maisons and their ability to spark desire, despite a year affected by economic and geopolitical challenges. The group once again recorded significant growth in revenue and profits.

“Our growth strategy, based on the complementary nature of our businesses, as well as their geographic diversity, encourages innovation, high-quality design and retail excellence, and adds a cultural and historical dimension thanks to the heritage of our Maisons.

“This was reflected in Louis Vuitton and Christian Dior’s spectacular fashion shows, Tiffany’s reopening of The Landmark in New York and the ever-growing popularity of Sephora’s store concept worldwide.

“While remaining vigilant in the current context, we enter 2024 with confidence, backed by our highly desirable brands and our agile teams. It promises to be an inspiring, exceptional year for us all, featuring our partnership with the Paris 2024 Olympic and Paralympic Games, whose core values of passion, inclusion and surpassing oneself are shared by our Group. For LVMH, it provides a new opportunity to reinforce our global leadership position in luxury goods and promote France’s reputation for excellence around the world.” ✈